🧐 Is the reason we can't make money because we need a completely new way of thinking in the crypto space? | The cycle hasn't disappeared; it has just become more like quantum superposition——

In the past, I also firmly believed in the "four-year major cycle."

Halving, bull and bear markets, cycles, altcoin seasons, getting rich by buying the dip: this is the collective memory of early crypto believers.

Haotian @tmel0211, I found this perspective very interesting after reading it this morning; it aligns so well with my logic. It represents a significant structural cognitive upgrade in the crypto space during this cycle.

Many of my friends and I share a similar feeling: are we too fixated on a rhythm that has already become outdated?

This feeling has led us to re-examine the market, our position allocation, and the selling price of Bitcoin, which will likely not reference previous bull and bear cycles;

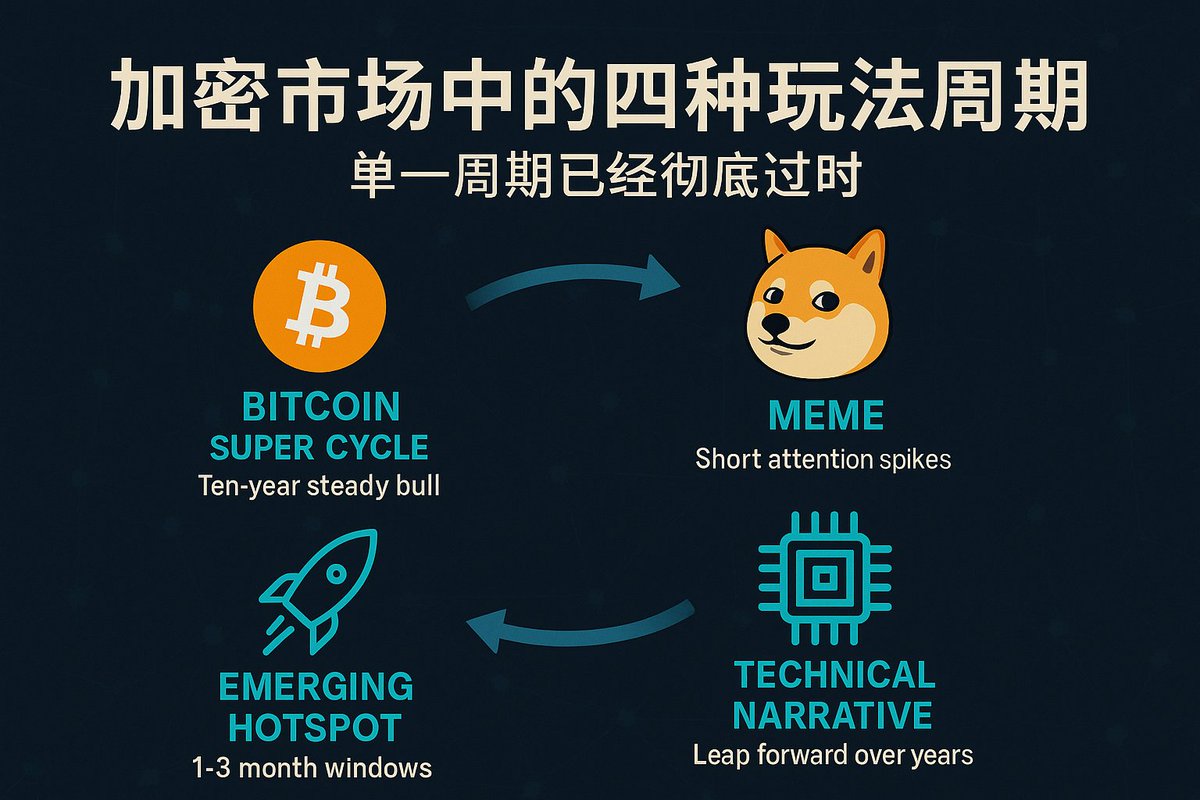

This theory accurately reveals: a bull market ≠ a single main line, but rather four sub-lines launching simultaneously, each with its own rhythm and strategy.

First, I want to clarify: this is not a "denial of the bull market" argument, but a diversified narrative analysis framework that better aligns with the current structural reality—

“It’s not that the bull market isn’t coming; it’s that the logic, gameplay, and rotation methods of the bull market are becoming more complex and professional.”

1️⃣ Why retail investors should carefully read this content:

1) Break the linear bull and bear market thinking, proposing a "multi-cycle parallel" perspective, breaking the market down from one major cycle into four concurrent local structures.

2) Each line has a clear "funding logic + market characteristics + investor adaptation type," which has strong reference value.

3) Suitable for the current market phase of "high volatility, low consensus, fragmented narratives," helping retail investors extract "threads" from the "chaos."

2️⃣ The first sub-line | Bitcoin: Super Slow Bull Cycle

Institution-led pricing, restructuring of chip structures, and reduced intraday volatility—this judgment is very accurate and aligns with the current reality of ETF + MSTR + macro fund allocation trends.

In simple terms, $BTC is no longer a "retail speculation tool," but rather an "institutional allocation asset."

The funding structure led by MicroStrategy, ETFs, and Wall Street is flattening volatility and extending the cycle.

What you see is sideways movement; institutions see it as a dollar-cost averaging opportunity.

BTC resembles tech stocks more, potentially following a slow bull curve over ten years or more.

3️⃣ The second sub-line | MEME: Short Wave of Attention Cycle

MEME is a barometer of market sentiment, always having a stage, but please note: it has transformed from a "grassroots paradise" into a "professional arena."

Retail investors who do not understand this and are eager to engage in PVP will suffer greatly because they don’t even know who they are up against;

MEME ≠ everyone can profit, but rather "ordinary people play probabilities, studios play win rates." Hot money is cycling through MEME: high frequency, short-term, quick in and out.

If you are a retail investor, I recommend shifting from "following the trend" to "observing the emotional rhythm," avoiding chasing highs, and aiming to catch the "symbol recognition" before an explosion.

Want to feast? It’s not about faith, but about timing the "emotional trigger point."

4️⃣ The third sub-line | Technical Narrative: Leapfrogging Long Cycle

The most interesting point in Haotian's article is:

It fundamentally points out the misalignment between the technical cycle and the emotional cycle—so damn accurate!

In the future, we will see that the vast majority of technical projects are misjudged during the "valley of death" phase.

Projects with real technical content (L2, ZK, AI Infra) never follow the rhythm of market sentiment.

Their breakthroughs often come after enduring the "valley of death," doubling overnight.

The returns of these projects do not rely on hype but on time traversal.

They are suitable for patient and discerning investors.

So what we need is not to wait for narratives while losing money, but to leverage position management + information advantage to seek leapfrogging value.

5️⃣ The fourth sub-line | Small Hotspots: Short Rotation Cycle

AI Agent, DePIN, RWA, MemeFi;

Various narratives take turns on stage, each with only a 1-3 month window.

Haotian @tmel0211 breaks down a six-stage model: "Concept Validation → Funding Testing → Public Opinion Amplification → FOMO Entry → Valuation Overdraft → Capital Withdrawal." Want to profit in this model?

The key is to enter during the "Concept Validation" to "Funding Testing" phase and exit at the peak of "FOMO Entry."

What I see is four words: do not cling to battles, secure profits!

6️⃣ Conclusion——

In the past, relying on luck and buying in to lie flat worked; now it has become ineffective, requiring more strategic effort.

If you are still using the old logic of "the bull is coming = get on board and get rich" to make judgments, you may miss all the rhythm points.

The truly suitable strategy is never to ask "what is the current market," but to assess "which cycle you are currently in."

Following the BTC long slope and thick snow route requires time and structural cognition;

Riding the MEME emotional wave requires rhythm and intuition;

Betting on technological leapfrogging is a path only the lonely can walk;

Grabbing hot rotation is a physical job, a fast-paced game.

Adapting to the market structure of "multi-cycle parallel" is the biggest alpha moving forward. Which path will you choose? And how long can you walk it?

The market will answer us, but first, we must ask ourselves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。