Key Points

● The total market capitalization of global cryptocurrencies is $3.54 trillion, up from $3.48 trillion last week, with a weekly increase of 1.72%. As of the time of writing, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $44.53 billion, with a net inflow of $2.75 billion this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $2.76 billion, with a net inflow of $248 million this week.

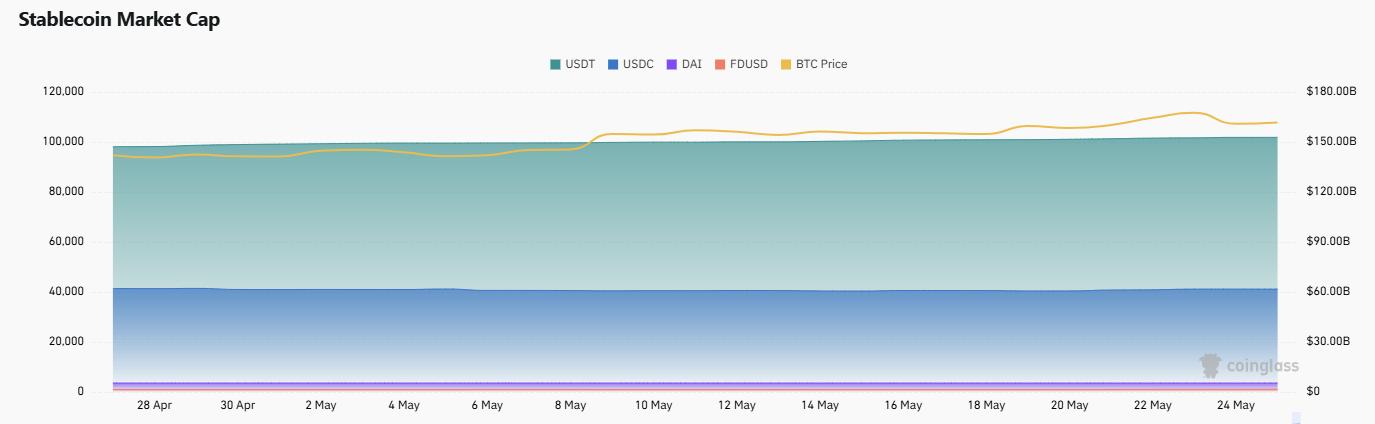

● The total market capitalization of stablecoins is $249 billion, with USDT having a market capitalization of $15.28 billion, accounting for 61.4% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $61.7 billion, accounting for 24.8%; and DAI with a market capitalization of $5.36 billion, accounting for 2.2%.

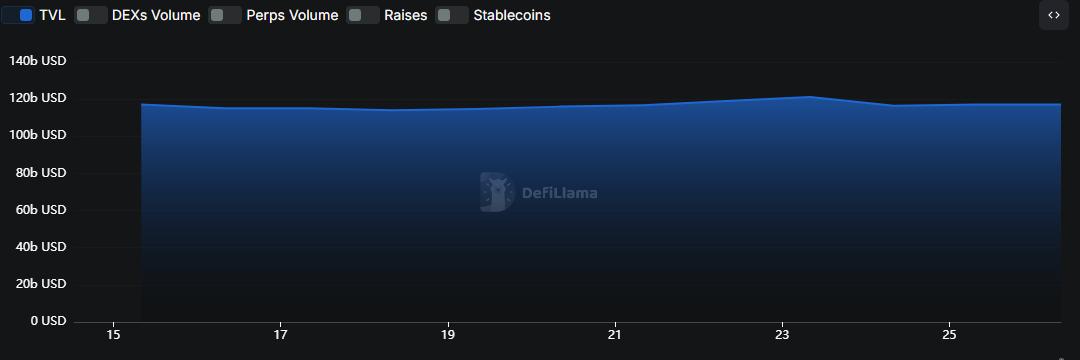

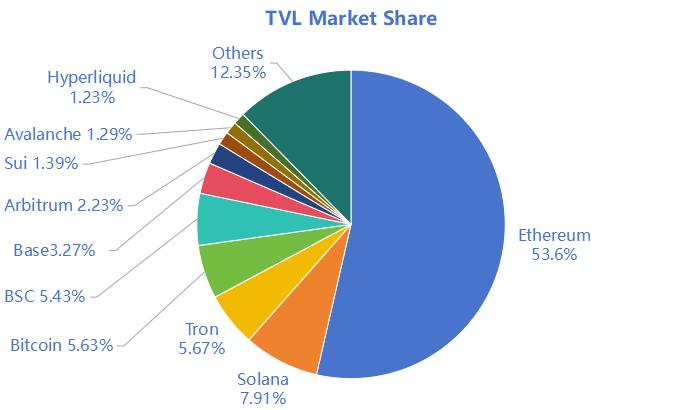

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $117.1 billion, up from $114.5 billion last week, with a weekly increase of 2.3%. By public chain, the top three chains by TVL are Ethereum with a share of 53.6%; Solana with a share of 7.91%; and Tron with a share of 5.67%.

● From on-chain data, this week, except for Solana, Toncoin, and Sui which saw a decline in transaction volume, other public chains showed an upward trend, with BNBChain increasing by 138% compared to last week; in terms of transaction fees, Ethereum, BNBChain, and Sui's transaction fees remained stable compared to last week, while some public chains showed a downward trend, with Solana down 100% and Aptos down 99.3% compared to last week. In terms of daily active addresses, most public chains saw a decline, but BNBChain showed significant growth, increasing by 23.24% compared to last week; in terms of TVL, most public chains, except for Sui and Aptos, experienced slight growth.

● Innovative projects to watch: xStocks is a tokenized stock issuance platform where all xStocks tokens can be freely transferred. They can be used in lending protocols, DEX, or any DeFi application; aiva is a platform that generates dynamic UIs for Web3 interactions based on user intent; Gavel, based on the Solana chain, is a token distribution and liquidity guidance platform, which has completed its initial public sale, raising 30,747 SOL.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Capitalization Ratio

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Ratios

5. Decentralized Finance (DeFi)

7. Stablecoin Market Capitalization and Issuance Situation

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Events Coming Next Week

3. Important Investments and Financing from Last Week

I. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Share

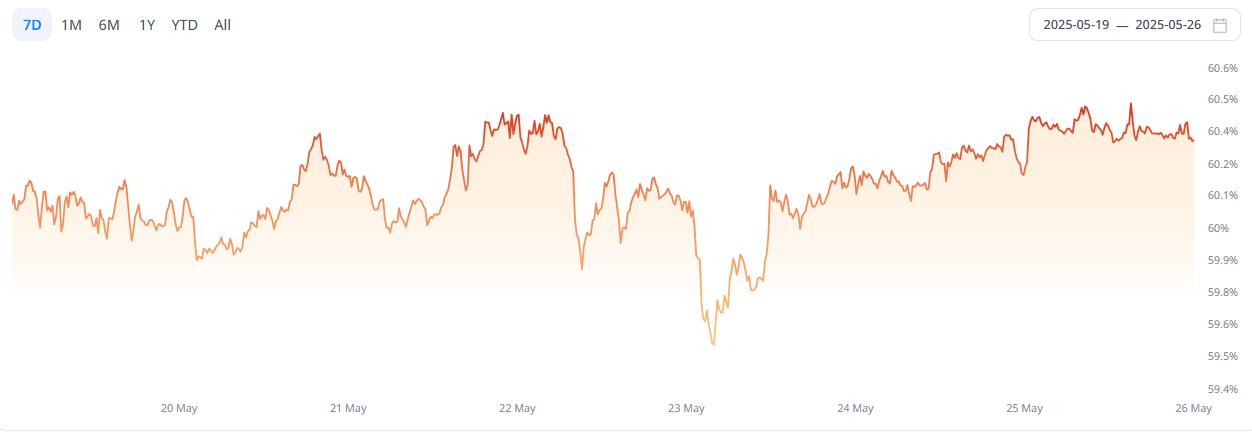

The total market capitalization of cryptocurrencies is $3.54 trillion, up from $3.48 trillion last week, with a weekly increase of 1.72%.

Figure 1 Data Source: cryptorank

As of the time of publication, Bitcoin's market capitalization is $2.17 trillion, accounting for 61.12% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $249 billion, representing 7.02% of the total cryptocurrency market capitalization.

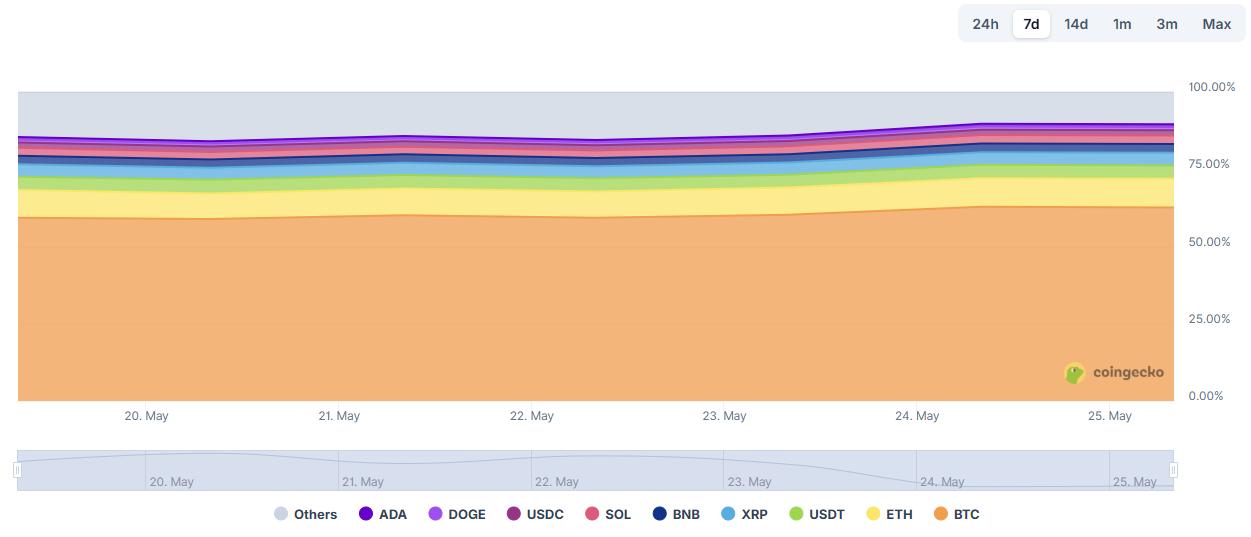

Figure 2 Data Source: coingeck

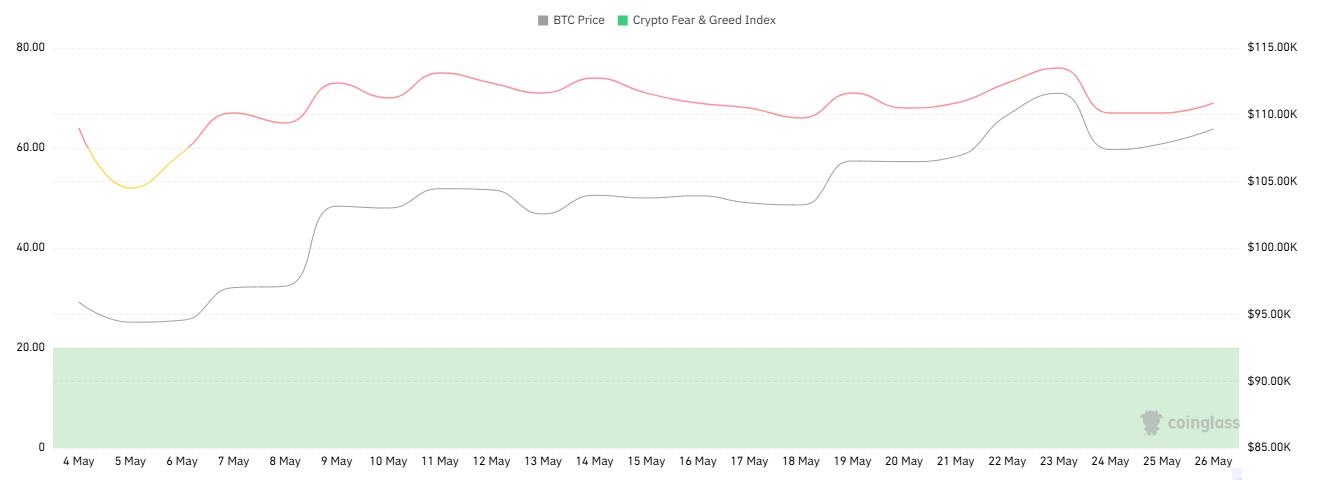

2. Fear Index

The cryptocurrency fear index is at 69, indicating greed.

Figure 3 Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of publication, the total net inflow of Bitcoin spot ETFs in the U.S. is approximately $44.53 billion, with a net inflow of $2.75 billion this week; the total net inflow of Ethereum spot ETFs in the U.S. is approximately $2.76 billion, with a net inflow of $248 million this week.

Figure 4 Data Source: sosovalue

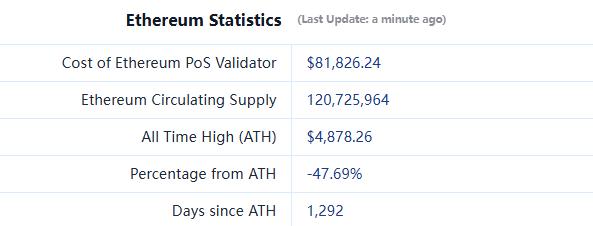

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price is $2,556, with a historical high of $4,878, a decline of approximately 47.69% from the peak.

ETHBTC: Currently at 0.023411, with a historical high of 0.1238.

Figure 5 Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $117.1 billion, up from $114.5 billion last week, with a weekly increase of 2.3%.

Figure 6 Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum chain at 53.6%; Solana chain at 7.91%; and Tron chain at 5.67%.

Figure 7 Data Source: CoinW Research Institute, defillama

Data as of May 25, 2025

6. On-chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Figure 8 Data Source: CoinW Research Institute, defillama, Nansen

Data as of May 25, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, except for Solana, Toncoin, and Sui, which saw declines, other public chains showed an upward trend, with BNBChain increasing by 138% compared to last week; regarding transaction fees, Ethereum, BNBChain, and Sui's transaction fees remained stable compared to last week, while some public chains showed a downward trend, with Solana down 100% and Aptos down 99.3% compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. From the perspective of daily active addresses, most public chains saw declines, but BNBChain showed significant growth, increasing by 23.24% compared to last week; regarding TVL, most public chains showed slight increases except for Sui and Aptos.

Layer 2 Related Data

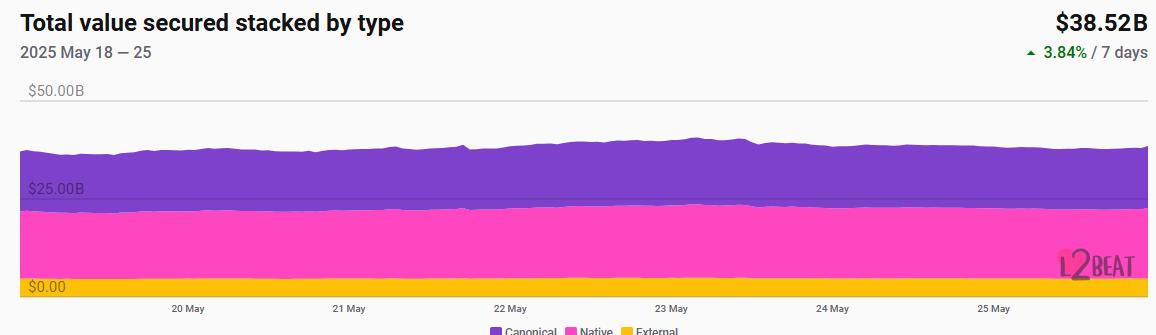

● According to L2Beat, the total TVL of Ethereum Layer 2 is $38.52 billion, up from $37.34 billion last week, with an overall increase of 3.84%.

Figure 9 Data Source: L2Beat

Data as of May 25, 2025

Base and Arbitrum hold the top positions with market shares of 39.01% and 32.78%, respectively, with Base still ranking first in Ethereum Layer 2 TVL this week.

Figure 10 Data Source: footprint

Data as of May 25, 2025

7. Stablecoin Market Capitalization and Issuance

According to Coinglass, the total market capitalization of stablecoins is $249 billion. Among them, USDT has a market capitalization of $152.8 billion, accounting for 61.4% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $61.7 billion, accounting for 24.8%; and DAI with a market capitalization of $5.36 billion, accounting for 2.2%.

Figure 11 Data Source: CoinW Research Institute, Coinglass

Data as of May 25, 2025

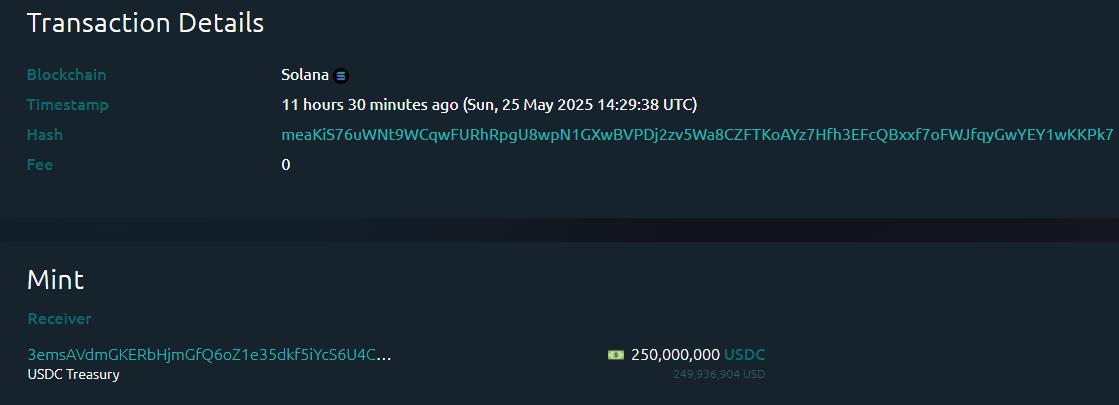

According to Whale Alert, this week, USDC Treasury issued 1.2 billion USDC, and Tether Treasury issued 1 billion USDT, with a total issuance of stablecoins this week amounting to 2.2 billion, up from 2.092 billion last week, representing an increase of approximately 8.6%.

Figure 12 Data Source: Whale Alert

Data as of May 25, 2025

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins by Increase This Week

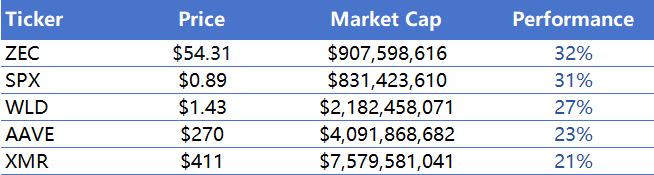

The top five VC coins by increase over the past week

Figure 13 Data Source: CoinW Research Institute, coinmarketcap

Data as of May 25, 2025

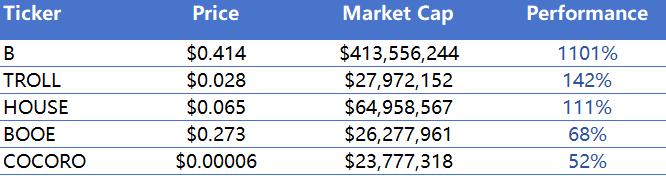

The top five Meme coins by increase over the past week

Figure 14 Data Source: CoinW Research Institute, coinmarketcap

Data as of May 25, 2025

2. New Project Insights

● xStocks (X: [https://x.com/xStocksFi]): Backed by support, it is a tokenized stock issuance platform where all xStocks tokens are freely transferable and can be used in lending protocols, DEX, or any DeFi application.

● aiva (X: [https://x.com/aivai_xyz]): AIVA is a platform that generates dynamic UIs for Web3 interactions based on user intent. It integrates smart contracts, DEX, and DeFi protocols, utilizing neural task orchestration and model-context-protocol (MCP) to execute transactions and analyze tasks across blockchains.

● Gavel (X: [https://x.com/gavelxyz]): Based on the Solana chain, it is a token distribution and liquidity guidance platform aimed at moving the token distribution process on-chain to avoid paying centralized exchange rents while achieving anti-sniping transactions. The project has completed its initial public sale, raising 30,747 SOL.

III. Industry News Updates

1. Major Industry Events This Week

● The WCT token of WalletConnect has launched on Solana, marking its third chain after Optimism's OP mainnet and Ethereum. The WalletConnect Foundation will airdrop 5 million WCT to active Solana users through partners Phantom, Jupiter, Backpack, and Solflare.

● Huma Finance has launched its first quarter airdrop plan, with 5% of the total supply of tokens allocated for the airdrop. This round of airdrops targets three groups: liquidity providers (65%), ecological partners (25%), and community participants (10%). The airdrop will be available for claiming after the TGE and will last for one month. The second round of airdrop snapshots is expected to take place about three months after the TGE, with a total supply of 2.1% of tokens allocated for the airdrop.

● Based on the ZKsync modular blockchain, Sophon announced that its second quarter Yapper leaderboard event has concluded, and the snapshot has been completed. Winners will be announced after the TGE. The third quarter has now started and will run until June 21.

● CeFi lending platform Ledn announced that it will stop supporting Ethereum collateral loans starting July 1 and will cease lending customer assets to third parties for profit, shifting to only offering fully managed Bitcoin collateral loan products. This move aims to eliminate third-party credit risks and enhance platform transparency and customer asset security.

● Regulated on-chain reinsurance company OnRe will launch its ONe token and funding pool, supported by Ethena Labs, the Solana Foundation, and RockawayX. The ONe token is built on the synthetic dollar protocol Ethena, generating returns from the Solana-based reinsurance pool, which combines returns from sUSDe collateral and ONRE protocol incentives.

2. Major Events Happening Next Week

● Sophon announced that SOPH will have its TGE on May 28 and will disclose its tokenomics, with 57% allocated to the community (including 20% for node rewards, 26% for ecological reserves, 9% for airdrops, and 2% for L2 liquidity mining), 25% allocated to core contributors (released over 4 years), and 18% allocated to seed round investors (released over 3 years). The airdrop plan allocates 6% to L1 Farmer users and an additional 3% airdrop to early supporters. Users can check their eligibility at claim.sophon.xyz.

● The decentralized AI data liquidity network Vana is launching an Academy program, with applications due by May 26, and the program set to start on June 2. This 9-week program is aimed at Web3 developers, data scientists, AI developers, and founders, offering 1:1 mentoring, technical support, funding rewards, and venture capital showcase opportunities.

● The Ethereum re-staking protocol ether.fi will run its fifth season from February 1, 2025, to May 31, 2025, with rewards including ETHFI tokens (at least 10 million), partner tokens, and King Protocol rewards.

● The eUSDe Pendle pool launched by Ethena Labs (in collaboration with Ethereal) will expire on May 29, offering 50 times Ethena rewards and Ethereal points.

● Soneium's 100 million ASTR incentive campaign will run until May 30, where users can earn ACS points by interacting with dApps in games, consumer applications, and Web3 social platforms, as well as providing liquidity. At the end of the campaign, ACS points will be converted to ASTR at a fixed rate of 1 ACS = 0.1 ASTR, rewarding real users who drive ecosystem development.

3. Important Financing Events from Last Week

● True Markets raised $12 million, with investors including RRE Ventures, Accomplice, Variant Fund, and PayPal Ventures. True Markets is a non-custodial, native stablecoin exchange dedicated to providing market and liquidity services globally through reliable and innovative trading technology. True Markets features a proprietary matching engine that efficiently matches trade orders, ensuring secure separation between trade execution and asset custody while guaranteeing seamless completion of trades using stablecoins. (May 20, 2025)

● Catena Labs raised $18 million, with investors including Andreessen Horowitz, Coinbase Ventures, Breyer Capital, and Circle Ventures. Catena Labs is a Web3 product development company focused on incubating independent products covering identity verification, communication, artificial intelligence, and business sectors. Currently launched products include the developer API and component suite DecentKit, the decentralized social network Duffle, and the custom AI agent solution Friday. (May 20, 2025)

● Roxom raised $17.9 million, with investors including Borderless Capital, Draper Associates, and Kingsway Capital. Roxom is an exchange for stocks, commodities, and futures priced and quoted in Bitcoin, allowing users to view and trade global markets using Bitcoin. (May 22, 2025)

Reference Links:

xStocks

https://x.com/xStocksFiGavel

https://x.com/gavelxyz

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。