This Week's Preview (5.26-6.1), the 2025 BTC Conference** is Coming Soon, ETF Weekly Trading Volume Hits a Record $25 Billion!**

Table of Contents:

Large Token Unlock Data for This Week;

Overview of the Crypto Market, Quick Read on Weekly Popular Tokens' Price Changes/Fund Flows;

Bitcoin Spot ETF Dynamics;

BTC Liquidation Map Data Interpretation;

Key Macroeconomic Events and Crypto Market Highlights and Interpretations for This Week.

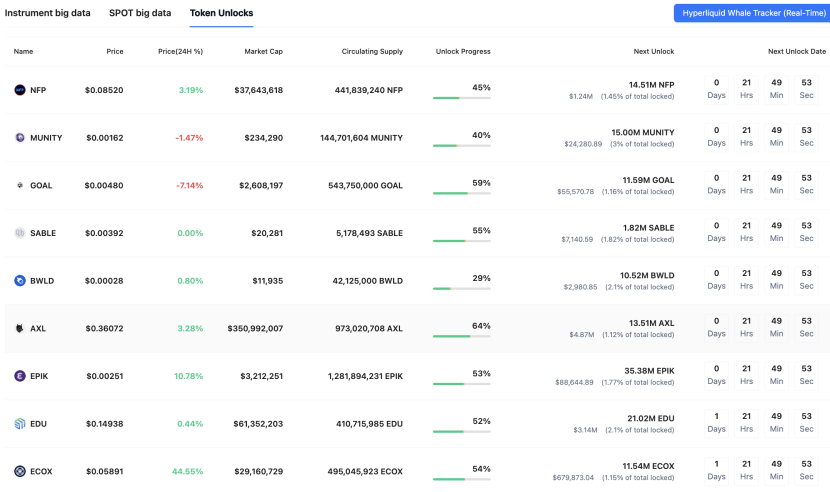

1. Large Token Unlock Data for This Week;

Coinank data shows that this week SUI, OP, ZETA, and others will experience significant token unlocks, including:

Optimism (OP) will unlock approximately 31.34 million tokens at 8 AM on May 31, accounting for 1.83% of the current circulating supply, valued at about $23.33 million;

Sui (SUI) will unlock approximately 44 million tokens at 8 AM on June 1, accounting for 1.32% of the current circulating supply, valued at about $158 million;

ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8 AM on June 1, accounting for 5.34% of the current circulating supply, valued at about $11.34 million;

dydx (DYDX) will unlock approximately 8.33 million tokens at 8 AM on June 1, accounting for 1.07% of the current circulating supply, valued at about $5.06 million.

We believe that the large unlock events of several mainstream tokens this week will bring short-term disruptions to the market supply-demand relationship. Among them, Sui (SUI) has the highest unlock amount at $158 million, but its proportion of circulating supply is only 1.32%, indicating that SUI has a large circulating base, which may dilute the marginal impact of a single unlock. In contrast, ZETA's unlock amount accounts for 5.34% of its circulating supply, significantly higher than other projects, and combined with its smaller market capitalization, the token may face greater selling pressure after release.

Historically, such unlocks are often accompanied by price volatility. For example, when OP unlocked in February 2024, it accounted for 1.93% of the circulating supply, with a higher market cap ratio, while this time the ratio has decreased to 1.83%, reflecting that the expansion of its circulating supply has diluted the impact of a single unlock. Additionally, project teams may counter market sentiment with positive developments, such as OP being a leading Layer 2 project, its increased on-chain activity may attract funds to absorb selling pressure. DYDX, as a decentralized derivatives protocol, may alleviate liquidity pressure from the unlock due to recent growth in trading volume.

It is worth noting that high-value unlock tokens (like SUI) may have a higher probability of short-term price corrections if there is insufficient market buying support, but the long-term trend still depends on the project's fundamentals. Investors are advised to comprehensively assess risks considering project ecological developments, market liquidity, and the nature of the unlock recipients (team/institution/community).

2. Overview of the Crypto Market, Quick Read on Weekly Popular Tokens' Price Changes/Fund Flows

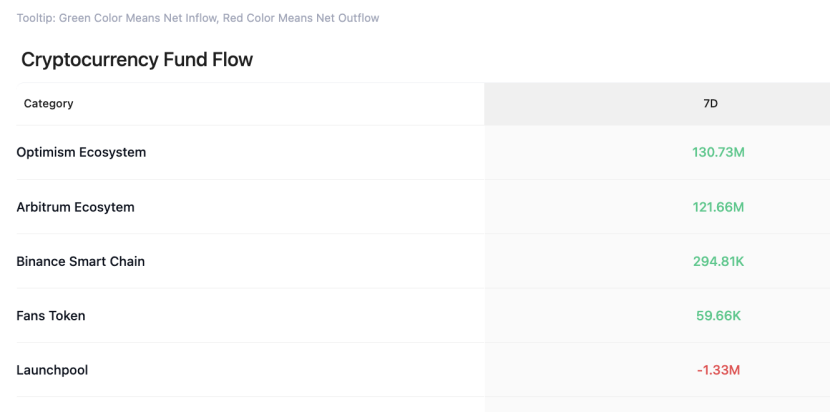

CoinAnk data shows that over the past week, the crypto market, categorized by concept sectors, saw net inflows in sectors such as the Optimism ecosystem, Arbitrum ecosystem, Binance Smart Chain, and fan tokens.

In the past 7 days, the top gainers among tokens (selected from the top 500 by market cap) include LISTA, DOG, HYPE, ZEC, and SPX, which have shown relatively strong gains, and this week, strong tokens should continue to be prioritized for trading opportunities.

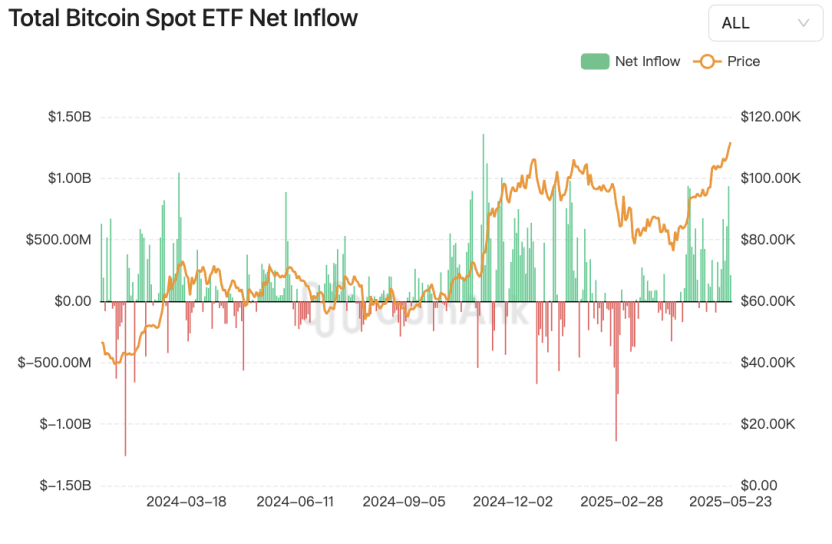

3. Bitcoin Spot ETF Fund Dynamics.

CoinAnk data shows that last week, the net inflow into U.S. Bitcoin spot ETFs was $2.75 billion, including: BlackRock IBIT: +$2.432 billion; Fidelity FBTC: +$209.9 million; Bitwise BITB: +$42.3 million; ARK ARKB: +$101 million; Invesco BTCO: -$5.3 million; VanEck HODL: +$31.2 million; Grayscale GBTC: -$89.2 million; Grayscale Mini BTC: +$28.3 million.

Last week, U.S. spot Bitcoin ETFs recorded the highest weekly trading volume since 2025, with a total trading amount of $25 billion and a net inflow of $2.75 billion, marking the second-highest single-week net inflow since these products were launched in early 2024. BlackRock's IBIT currently holds 3.3% of the global Bitcoin supply, with net assets exceeding $71 billion, about three times that of the second-ranked Fidelity FBTC. During the same period, the net inflow into Ethereum spot ETFs was approximately $250 million, the highest level since early February, although trading volume slightly declined.

The cumulative net inflow into U.S. Bitcoin spot ETFs has reached $44.499 billion, setting a new historical high.

We believe that last week's net inflow of $2.75 billion into U.S. Bitcoin spot ETFs, marking the second-highest single-week net inflow since their launch in early 2024, and the cumulative net inflow exceeding $44.499 billion reflects investors' continued favor for cryptocurrency assets.

The weekly trading volume of Bitcoin ETFs reached $25 billion, the highest level in 2025, and the increase in liquidity further solidifies its status as a mainstream financial product. Meanwhile, the net inflow of $250 million into Ethereum spot ETFs, reaching a new high since early February, indicates that funds are spreading from Bitcoin to other crypto assets, but the decline in Ethereum trading volume may reflect that the market still anchors on Bitcoin.

Despite strong ETF demand (with purchase volumes reaching six times miners' output), new accounting standards require companies to adjust Bitcoin asset valuations at market prices, which may pose financial reporting risks if prices fluctuate significantly. Additionally, the monopoly of giants like BlackRock may squeeze the survival space of smaller institutions, necessitating attention to potential regulatory interventions regarding market concentration. Current data confirms the deepening of cryptocurrency as an asset class, but structural differentiation and external risks still require vigilance.

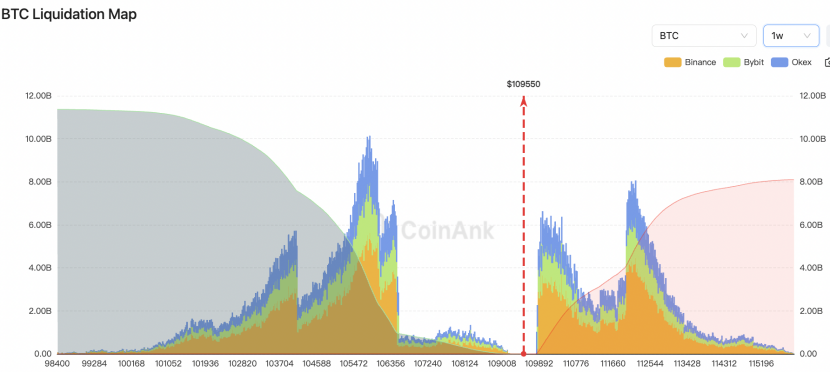

4. BTC Liquidation Map Data.

CoinAnk liquidation map data shows that if BTC breaks $115,000, the cumulative short liquidation intensity on mainstream CEXs will reach $7.978 billion. Conversely, if Bitcoin falls below $102,000, the cumulative long liquidation intensity on mainstream CEXs will reach $10.576 billion.

We believe that the current liquidation threshold in the Bitcoin market has significantly increased, reflecting a simultaneous rise in market leverage and price volatility. Compared to earlier data (e.g., in January 2025, when it broke $104,000 corresponding to short liquidations of $538 million, and in March 2025, when it broke $88,000 corresponding to short liquidations of $842 million), the current liquidation scale shows exponential growth, indicating that market risk exposure continues to expand.

Liquidation intensity does not represent the actual amount to be liquidated but reflects the potential severity of liquidity shocks when prices reach critical levels. High-intensity short liquidations may trigger a "short squeeze," driving prices up rapidly; conversely, long liquidations may trigger panic selling, creating a negative feedback loop. Notably, the current long liquidation intensity ($10.576 billion) far exceeds that of shorts ($7.978 billion), suggesting that there is a dense accumulation of long positions in the $102,000-$115,000 range, concentrating the risk of price declines.

This market structure may stem from institutional investors' strong expectations for breaking historical highs, but high-leverage operations have also exacerbated systemic risks. Researchers suggest paying attention to the risk of liquidity exhaustion after price breaches thresholds, as well as the amplifying effect of cross-exchange position distribution on liquidation waves. Current data highlights that Bitcoin is transitioning from an asset volatility phase to a high-leverage speculative phase, and market participants should be wary of nonlinear volatility under extreme market conditions.

5. Key Macroeconomic Events and Crypto Market Highlights and Interpretations for This Week.

CoinAnk data shows that on May 26: Binance Alpha will launch the Huma Finance (HUMA) airdrop;

On May 27: The 2025 Bitcoin Conference will be held from May 27 to 29 in Las Vegas;

On May 28: U.S. Vice President Vance will speak at the "Bitcoin 2025" conference;

Sophon: TGE on May 28, with 57% of tokens allocated to the community, of which 9% is for airdrops;

On May 30: FTX will begin distributing over $5 billion to creditors according to its bankruptcy plan;

On June 1: Trump originally suggested imposing a 50% tariff on the EU starting June 1; (the latest news is that Trump agreed to extend the deadline for imposing tariffs on the EU to July 9).

Numerous Federal Reserve officials will also speak from Monday to Friday.

We believe that this week's macro events in the crypto market mainly revolve around policy dynamics, industry conferences, and project developments, which may have multidimensional impacts on market sentiment and fund flows.

The Bitcoin 2025 Conference and Policy Signals: The attendance and speech of U.S. Vice President Vance marks the first time a senior U.S. official has spoken at a mainstream crypto conference, potentially releasing a policy-friendly signal. Combined with the recent passage of the U.S. "GENIUS Stablecoin Act" and the regulatory improvements in Hong Kong, the trend towards policy compliance may further boost market confidence. However, caution is warranted if the speech content does not meet expectations, as it may trigger short-term volatility.

FTX Compensation and Liquidity Pressure: On May 30, FTX will initiate the distribution of $5 billion, but the dispute over creditors' demands for compensation in cryptocurrency rather than cash remains unresolved. Although the compensation amount exceeds expectations (119% of debt value), if creditors choose to convert cash into crypto assets, it may exacerbate market selling pressure, similar to the risks observed from small compensation payouts in February 2025.

Project Developments: The launch of the HUMA airdrop (5% token allocation) and Sophon's TGE (9% airdrop) on Binance Alpha will attract short-term speculative funds, but attention should be paid to the selling pressure after concentrated token releases. Additionally, platforms like Binance may enhance user stickiness and indirectly support market activity through point mechanisms.

In terms of market impact, positive factors include the policy expectations from the Bitcoin conference, continued institutional accumulation (with corporate purchases exceeding three times the new supply), and compliance progress, which may support Bitcoin's price in a high-level consolidation.

Risk points include potential selling pressure from FTX's large compensation, lingering uncertainties following the extension of Trump's tariff policy, and the possibility that hawkish comments from Federal Reserve officials may suppress risk appetite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。