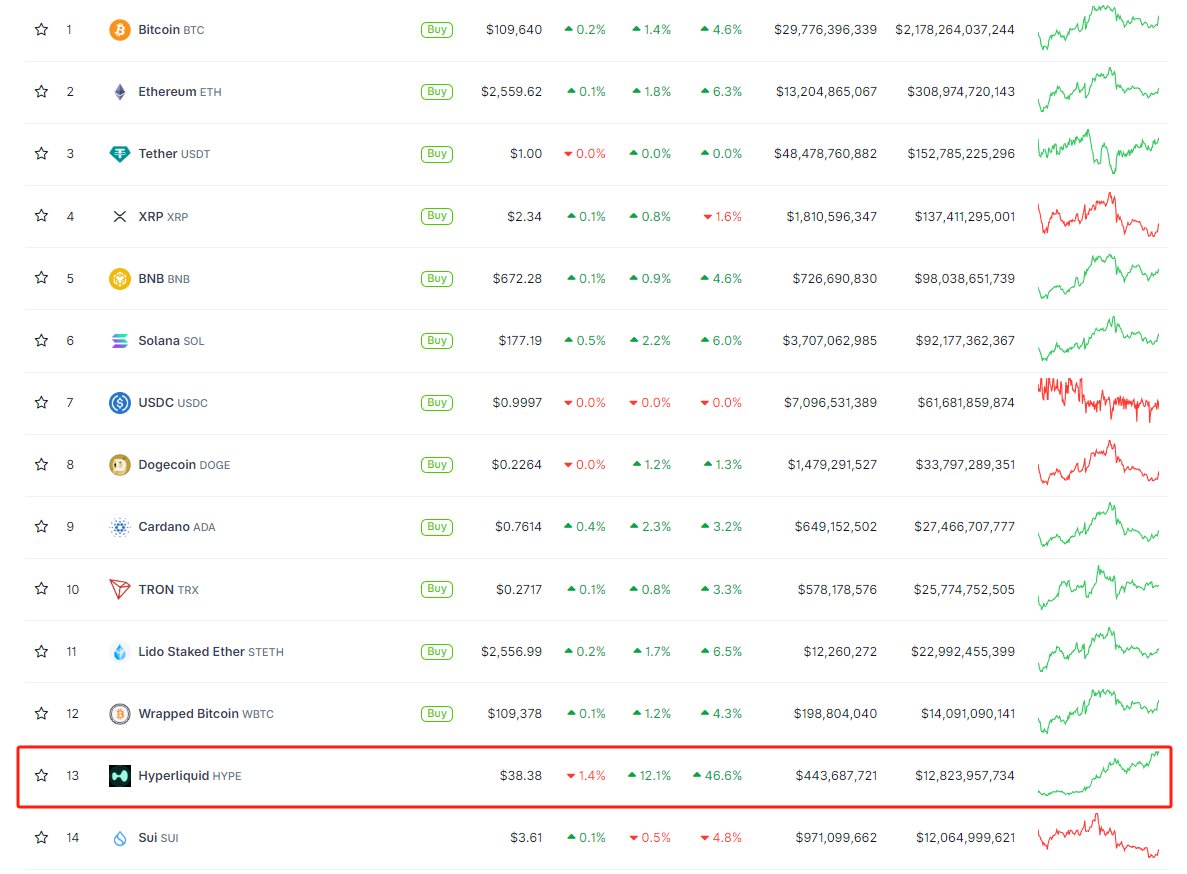

⚡️ An amazing signal: $HYPE's market cap surpasses SUI, ranking 13th in market cap——

@HyperliquidX The speed of this round of growth is truly beyond everyone's imagination. A derivatives DEX can reach this market cap in just six months, attracting various whales to open positions, and Little Black continues to be bullish…

I believe everything can be attributed to one trend:

The narrative is shifting from infrastructure to product, and the market is rewarding "few but refined" products.

In the past few years, we have been obsessed with L1, cross-chain, modularization, and new consensus mechanisms, but the fact is—only a very small number of people truly care about your underlying structure.

What can really break the market now is whether you can produce a product that has real users, makes real profits, and can truly attract on-chain capital flow.

The explosion of Hyperliquid is not because it has shouted a bigger slogan, but because it has hit several core aspects that are extremely well-polished in the derivatives market:

✅ A matching experience that is smooth to the point of being centralized

✅ Extremely high capital utilization

✅ Chain-level design optimized for quantitative players

It doesn't need to tell the story of "we can accommodate the entire ecosystem," it just needs to prove: in a single scenario, I am stronger than anyone else.

Not just Hyperliquid, this is also the cyclical law of the entire industry:

Phase one, infrastructure explosion: public chains, L2, modularization, consensus innovation, a competition where everyone strives to shine.

Phase two, application layer breakthrough: which applications can truly make good use of these infrastructures, find entry points, and achieve scale effects, who will be the core of the next narrative.

From DeFi, RWA, SocialFi, to AI×Crypto, derivatives DEX, the future narrative focus may no longer be on the chain's TPS and L1 compatibility, but rather:

Who can build a financial machine that funds, users, and strategies cannot do without.

I believe this is a structural transformation that the #Crypto industry will inevitably undergo after experiencing a public chain boom—

When the underlying tracks are oversaturated and infrastructure is saturated, the market will no longer reward universal chains, and the focus will shift from "who can carry more ecosystems and issue more subsidies" to "who can directly create perceivable value."

The next step of the revolution is not to stack more narratives, but to be few but refined, strong but precise.

So now, when looking at projects, the mindset cannot just focus on narratives; you need to see what kind of financial machine the market needs—

Funds need more efficient liquidity matching and risk management;

Users need usable products with lower thresholds and higher security;

Strategies need stronger combinability and a more predictable gaming environment.

You must learn to apply the concept and formula of capital density + clear scenarios to find financial machines like Hyperliquid.

Once you understand this logic, you will understand why @CryptoHayes has been shouting about Hyper and Pendle this round.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。