Original Title: I Don’t Think You Understand How Great Ethena Is

Original Authors: @13300RPM, @FourPillarsFP Researchers

Original Translation: Rhythm Little Deep

Editor’s Note: Ethena maintains a stablecoin (USDe) with a market value of $5 billion through a 26-person team led by founder @gdog97_. It uses delta-neutral strategies to hedge against the volatility of assets like ETH and BTC, keeping a $1 peg while providing double-digit annualized returns. Its automated risk management and multi-platform hedging create a competitive moat, successfully navigating market turbulence and the Bybit hacking incident. Ethena plans to drive USDe circulation to $25 billion through iUSDe, the Converge chain, and a Telegram application, becoming a financial hub connecting DeFi, CeFi, and TradFi.

The following is the original content (reorganized for readability):

Have you ever tried eating hot noodles while riding a roller coaster? It sounds ridiculous, but this is the best metaphor for what @ethenalabs does every day: it maintains a $5 billion stablecoin (USDe) that consistently holds a $1 peg despite the constant volatility in the crypto market. And all of this is achieved by a 26-person team led by founder @gdog97. This article will delve into Ethena's unique secrets, revealing why it is hard to replicate, and explain how Ethena plans to push USDe's circulation to $25 billion.

Hedging Billions of Volatility

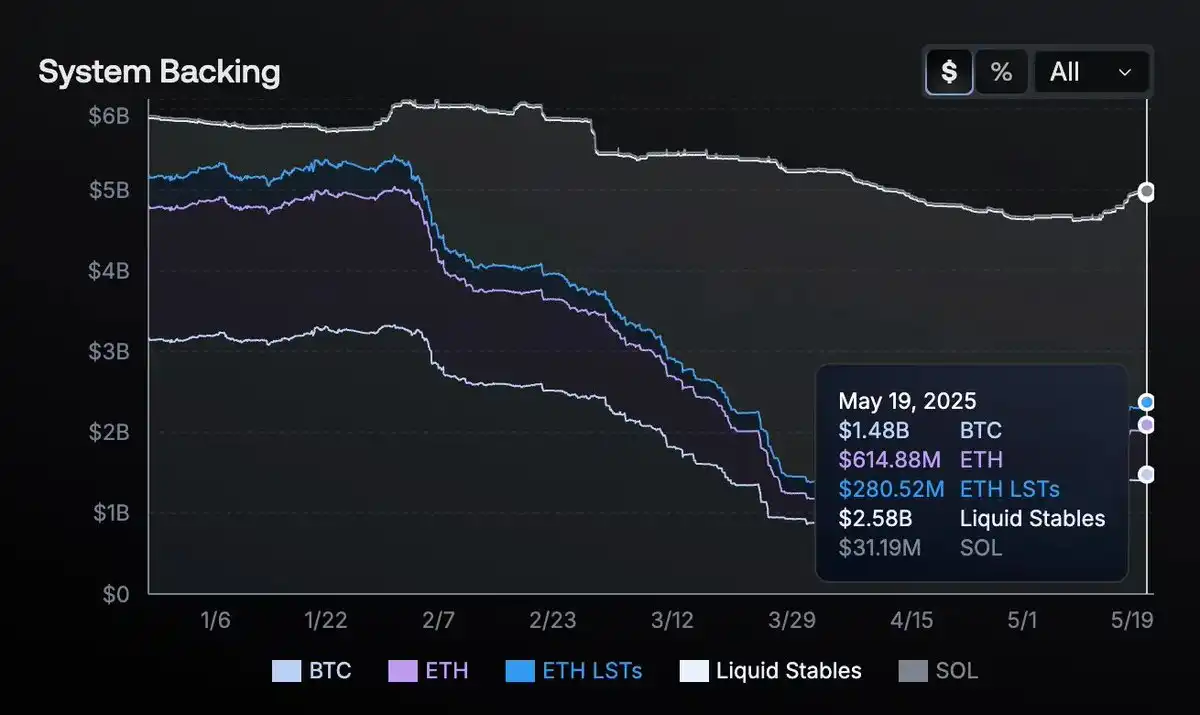

Stablecoins may seem boring on the surface: $1 is just $1, right? But dive into Ethena's internal mechanisms, and you'll find it's anything but simple. Ethena does not use dollars in a bank as the backing for its stablecoin; instead, it employs a robust asset portfolio that includes ETH, BTC, SOL, ETH LSTs (liquid staking tokens), and $1.44 billion worth of USDtb (a stable asset backed by U.S. Treasury bonds). These assets are continuously shorted in major derivatives markets to ensure that any price fluctuations in collateral can be offset by corresponding gains or losses from short positions.

Source: Ethena Transparency Dashboard

If ETH rises by 5% and your hedge ratio deviates, it could lead to tens of millions of dollars in exposure risk. If the market crashes at 3 AM, the risk engine must immediately rebalance collateral or close positions. The margin for error is minimal. However, Ethena has managed billions in daily hedging during the roller coaster market of 2023-2024 without a single crash (no decoupling, no margin calls, no liquidity shortages).

During the Bybit hacking incident, Ethena maintained its solvency without any collateral losses. Traditional hedge funds might require an entire floor of analysts and traders to handle such volatility, while Ethena achieves this with a streamlined team and zero errors.

Within months of its launch, Ethena became the largest counterparty for several centralized exchanges. Its hedging trades even impacted liquidity and order book depth, but few noticed because stablecoins "just work."

Regarding high yields: Ethena offers double-digit annualized returns during bullish market conditions. At first, this brings to mind the Terra/LUNA disaster with its 20% Anchor. But unlike that, Ethena's returns come from real market inefficiencies (staking rewards plus positive perpetual contract funding rates), not from minting tokens or unsustainable subsidies.

How Ethena's Delta-Neutral Magic Works

When users deposit $1,000 worth of ETH, they can mint about $1,000 worth of USDe. The protocol automatically opens a short futures position. If the price of ETH drops, the short profits offset collateral losses; if ETH rises, the short loses, but the collateral appreciates. The end result is that the net dollar value remains stable. Meanwhile, when the perpetual contract market is over-leveraged in the bullish direction, Ethena (holding shorts) can collect funding fees, providing double-digit APY for USDe under bullish conditions without fiscal subsidies.

Ethena spreads these hedges across Binance, Bybit, OKX, and even some decentralized perpetual contract protocols to mitigate risks and margin constraints from a single exchange. A recent governance proposal shows that Ethena plans to include Hyperliquid in its hedging portfolio to short in the deepest liquidity markets. By diversifying short positions, Ethena reduces reliance on a single platform, further enhancing stability.

Source: Ethena Transparency Dashboard

To cope with ongoing adjustments, Ethena deploys automated bots that work in tandem with trading teams (similar to high-frequency trading systems), constantly rebalancing the entire multi-platform ledger. This is why USDe can maintain its peg regardless of how violently the market fluctuates.

Finally, the protocol uses over-collateralization to handle extreme downturns and can pause minting under unsafe conditions. Custodial integrations (Copper, Fireblocks) allow Ethena to control assets in real-time rather than leaving them in the exchange's hot wallet. If an exchange goes bankrupt, Ethena can quickly withdraw collateral, protecting users from a single point of failure disaster.

A Strong Moat

Ethena's approach may seem replicable on paper (hedging some crypto assets, collecting funding fees, profiting), but in reality, the protocol has built a strong moat that deters imitators.

A key barrier is trust and credit lines: Ethena hedges billions of funds through institutional trading with custodians and major trading platforms (Binance Ceffu, OKX). Most small projects cannot easily access these institutions or negotiate the minimum collateralization requirements for millions of dollars in short positions, which requires institutional-level rigor in legal, compliance, and operations.

Equally important is multi-platform risk management. Splitting large hedges across multiple exchanges requires real-time analytical capabilities that rival Wall Street quant trading teams. Yes, anyone can replicate delta hedging on a small scale, but scaling it up to $5 billion (and rebalancing massive collateral across multiple platforms around the clock) is another level. The complexity of the required analysis, automation, and credit relationships grows exponentially with scale, making it nearly impossible for newcomers to catch up to Ethena's size overnight.

At the same time, Ethena does not rely on permanent free yields. If perpetual contract funding rates turn negative, it will reduce short positions and rely on staking or stablecoin yields. A reserve fund can buffer long-term periods of negative funding rates, while many high-yield DeFi protocols collapse when the music stops.

By not holding all collateral directly on a single exchange, Ethena further reduces counterparty risk; instead, assets are stored with custodians. If a trading platform becomes unstable, Ethena can quickly close positions and transfer collateral off-exchange, minimizing the risk of catastrophic failure.

Finally, Ethena's performance during extreme volatility solidifies its moat. USDe has not experienced a single decoupling or crash during months of severe market fluctuations. This reliability drives new user adoption, listings, and top-tier brokerage trading (from Securitize to BlackRock and Franklin Templeton), creating an unreplicable trust snowball effect. The gap between discussing delta hedging and delivering around-the-clock at a billion-dollar scale is precisely why Ethena stands out.

The Road to $25 Billion

Ethena's growth strategy relies on a self-reinforcing ecosystem where currency (USDe), network (the "Converge" chain), and exchanges/liquidity aggregation evolve simultaneously. USDe was launched first, driven by crypto-native demand from DeFi (Aave, Pendle, Morpho) and CeFi (Bybit, OKX). The next phase involves iUSDe, a compliant version suitable for banks, funds, and corporate treasuries. Even a small portion of the massive bond market in traditional finance (TradFi) flowing into USDe could push the stablecoin's circulation to $25 billion or more.

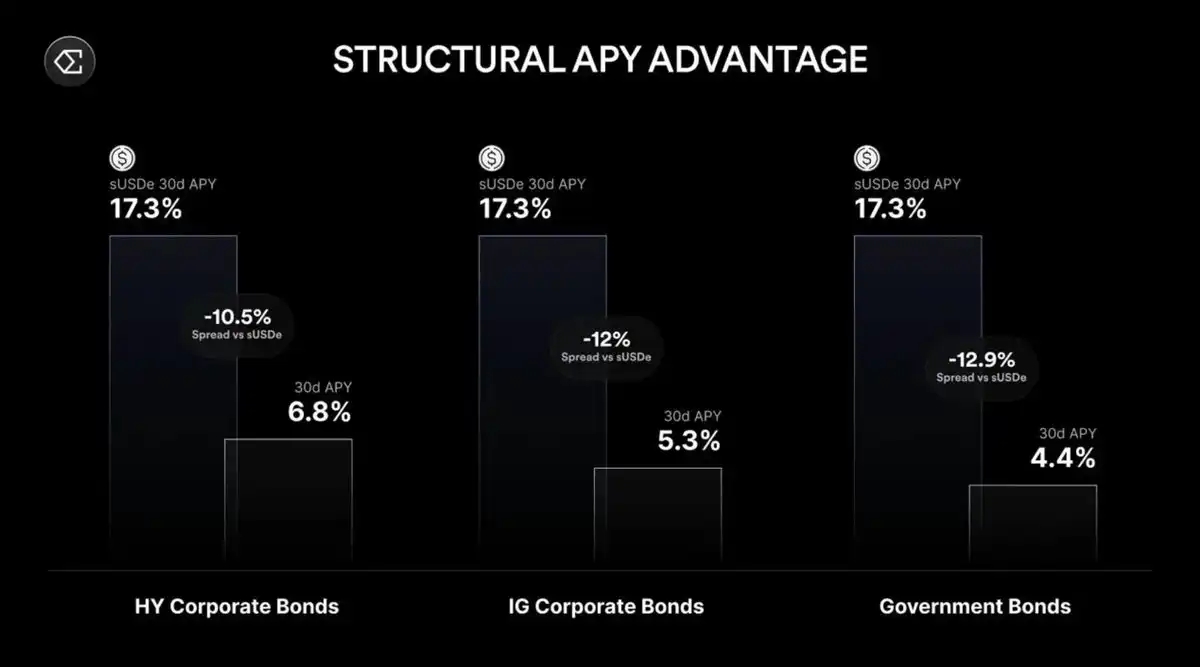

Driving this growth is the arbitrage between on-chain funding rates and traditional interest rates. As long as there is a significant yield gap, funds will flow from low-interest-rate markets to high-interest-rate markets until equilibrium is reached. Thus, USDe becomes a hub connecting crypto yields with macro benchmarks.

Source: Ethena 2025: Convergence

Meanwhile, Ethena is developing a Telegram-based application that introduces high-yield dollar savings to ordinary users through a user-friendly interface, bringing hundreds of millions of users into sUSDe. In terms of infrastructure, the Converge chain weaves together DeFi and CeFi tracks, with each new integration bringing cyclical growth to USDe's liquidity and utility.

Notably, the returns on sUSDe are negatively correlated with actual interest rates. When the Federal Reserve cuts rates by 75 basis points in Q4 2024, funding yields leap from about 8% to over 20%, highlighting how declining macro rates inject momentum into Ethena's yield potential.

This is not a slow, phased approach but a cycle of expansion: broader adoption enhances USDe's liquidity and yield potential, attracting larger institutions, driving further supply growth, and ensuring a more stable peg.

Looking Ahead

Ethena is not the first stablecoin to promise high yields or position itself as an innovative approach. What sets it apart is that it delivers on its promises, with USDe consistently pegged at $1 even under the most severe market shocks. Behind the scenes, it operates like a high-level institution, shorting perpetual futures and managing staking collateral. However, what ordinary holders experience is a stable, yield-bearing dollar that is simple and easy to use.

Expanding from $5 billion to $25 billion is no easy feat. Stricter scrutiny from regulators, larger counterparty exposures, and potential liquidity tightening could introduce new risks. However, Ethena's multi-asset collateral (including $1.44 billion in USDtb), strong automation, and robust risk management indicate it is more capable of handling these challenges than most projects.

Ultimately, Ethena demonstrates a method for navigating crypto market volatility at an astonishing scale using delta-neutral strategies. It outlines a vision for the future: USDe will become a core component in every financial domain, from the permissionless frontier of DeFi, the trading desks of CeFi, to the vast bond markets of TradFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。