Original Title: "Bitcoin Hits New All-Time High, Progress of the 'GENIUS Act' and Dual Growth of Stablecoins Lead Market Recovery | Frontier Lab Crypto Market Weekly Report"

Original Source: Frontier Lab

Market Overview

Market Situation

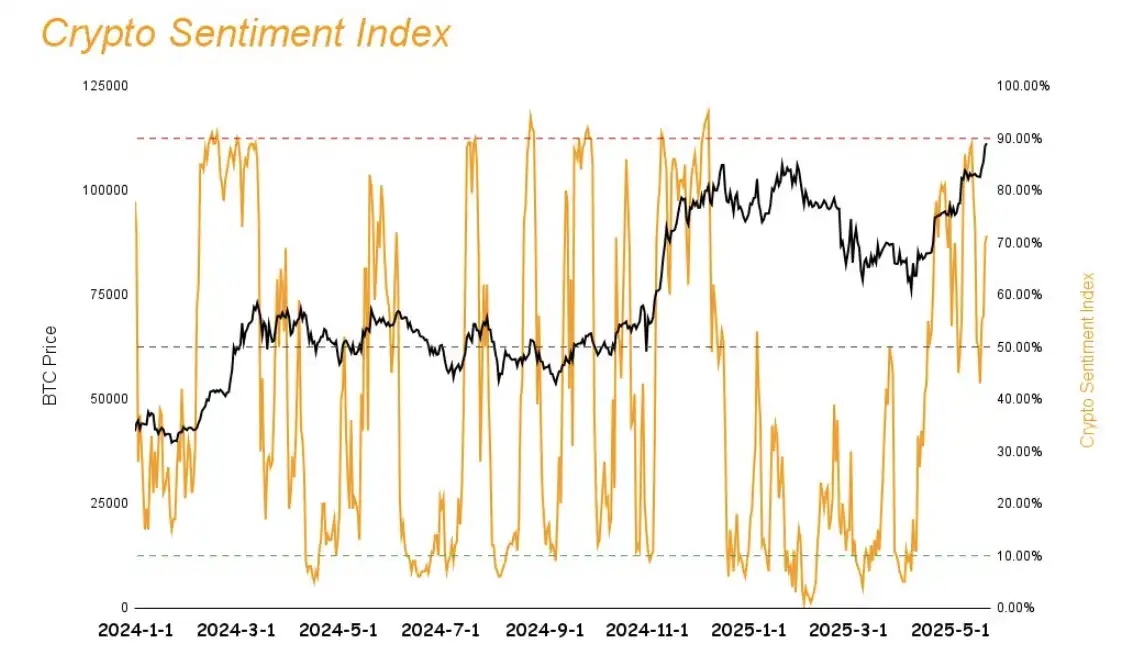

This week, the cryptocurrency market showed an upward trend, with Bitcoin (BTC) reaching a new high, and altcoins generally following suit. The market sentiment index slightly decreased from last week's 73% to 71%. Although it has declined compared to last week, it remains in the bullish range overall.

Stablecoin Market Dynamics

In the past month, the stablecoin market has shown a synchronized upward trend for USDT and USDC for the first time:

USDT: Market capitalization reached $151.9 billion, with a week-on-week growth of 0.79%. The weekly increase has exceeded $1 billion for three consecutive weeks, continuing its upward trend.

USDC: Market capitalization is $61 billion, with a week-on-week growth of 0.83%, ending a three-week downward trend and beginning to show an upward trend.

This phenomenon is noteworthy for investors: the continuous growth of USDT indicates that institutional funds, primarily from non-U.S. users, are increasing their entry into the market; the end of USDC's three-week decline reflects that U.S. users may be accelerating their entry due to favorable crypto policies introduced by the U.S. government and the new highs in BTC. The synchronized rise of USDT and USDC indicates that market funds are actively entering at this stage, but investors should be cautious of potential FOMO sentiment.

Policy Benefits Boost Market Sentiment

This week, the cryptocurrency market showed an overall positive trend, mainly benefiting from two major policy advantages:

· Significant progress on the 'GENIUS Act' amendment

· The bill has made breakthrough progress in the U.S. Senate

· Core Impact: Promotes the compliance of stablecoins and provides a clear regulatory framework for the industry

· Market Expectation: After the bill is passed, it will introduce substantial incremental funds, significantly boosting investor confidence.

· Texas Bitcoin Strategic Reserve Bill Passed

· As an important state in the U.S., Texas's move signifies further recognition of Bitcoin by mainstream society

· Demonstration Effect: Expected to encourage other states to follow suit with similar policies

· Market Impact: Strengthens Bitcoin's position as a reserve asset and significantly enhances market sentiment.

Macroeconomic Risks Still Need Attention

Despite the clear policy benefits, there remains uncertainty in the macroeconomic environment:

· The Federal Reserve's monetary policy stance remains unchanged

· Several Federal Reserve officials have clearly stated that there will be no interest rate cuts in the near term

· The high-interest-rate environment will continue to affect market liquidity and risk asset valuations.

· U.S. tariff issues remain unresolved

· Tariff negotiations between the U.S. and multiple countries are still ongoing

· The outcome is unclear and may cause fluctuations in the global economy and market sentiment.

Risk Warnings and Outlook

In an environment where policy benefits and macro caution coexist:

· Avoid FOMO sentiment: Although short-term benefits are evident, one should not blindly follow the trend to enter the market.

· Balanced allocation strategy: While seizing policy dividends, reasonably control positions to guard against macro risks.

Clarifying policy regulation is a necessary path for the cryptocurrency market to mature. The 'GENIUS Act' and various states' acceptance of Bitcoin signify that crypto assets are gradually integrating into the traditional financial system. However, investors still need to maintain rationality amid optimistic sentiment and closely monitor the potential impact of macroeconomic variables on the market.

Next Week's Predictions

Bullish Target: DRIFT

DRIFT: Strategic Transformation of Institutional-Level DeFi

This Thursday, Drift, the largest perpetual contract decentralized exchange (Perp DEX) in the Solana ecosystem, announced the launch of its institutional version. This collaboration with traditional financial giant Apollo marks Drift's official entry into the development strategy of institutional-level DeFi. Through this partnership, Drift not only expands its layout in real-world assets (RWA) and private credit business but also brings new opportunities for collaborative development with traditional financial institutions. This move is expected to help Drift significantly increase its market share and revenue scale.

Bridge for Integration of Traditional Finance and Blockchain

The Solana ecosystem, with its on-chain performance advantages and the recently proposed Alpenglow upgrade, signifies a strategic upgrade to introduce institutional-level financial services. The launch of Drift's institutional version marks the beginning of this transformation, addressing the pain points of traditional financial institutions through on-chain technology, injecting institutional-level liquidity and trust into the entire ecosystem.

· Market Transformation Timing: Blockchain development has transitioned from the infrastructure construction phase to the application landing phase, with institutional capital seeking entry. Drift accurately seizes this time window, becoming a key bridge connecting traditional finance and DeFi.

· Precise Pain Point Solutions: Addressing the three core pain points of the traditional private credit market (high entry barriers, limited liquidity, low capital efficiency), Drift provides on-chain solutions, bringing over $20 trillion of market value into the blockchain world.

· Building Technical Barriers: By partnering with Securitize to implement sToken vault technology, Drift successfully tokenized Apollo-managed $1 billion multi-asset credit fund ACRED and achieved its application as on-chain collateral for the first time, establishing a hard-to-replicate technical barrier.

Capital Efficiency-Driven Institutional Service Ecosystem

Drift's institutional version is no longer a simple DeFi product but has transformed into a complete institutional-level financial service ecosystem. Through capital efficiency optimization and compliance-first strategies, it not only meets the requirements of institutional investors but also maintains the innovative advantages of blockchain.

· White-Glove Service: Provides professional service channels for institutional assets such as credit funds, real estate, and commodities, achieving Solana's native trading speed and capital efficiency while ensuring compliance and transparency.

· Complete Product System: Constructs a comprehensive service system including Drift Borrow/Lend and Drift Earn, supporting ACRED token holders in on-chain lending, automated strategy management, and liquidity interaction, forming a closed-loop ecosystem.

· Innovative Leverage Strategies: Provides leverage strategies for tokenized private credit, creating enhanced yield opportunities that are unattainable in traditional finance, while ensuring system security through risk management, balancing innovation and stability.

Network Effect Catalyzed by Institutional Capital Introduction

As the first institutional-level DeFi product on Solana, Drift's institutional version not only brings growth momentum to itself but also creates network effects for the entire Solana ecosystem. By introducing high-quality institutional capital, it enhances the overall ecosystem's value and attractiveness.

· Top Institutional Endorsement: Collaboration with Apollo, which manages $750 billion in assets, brings institutional-level trust endorsement to the Solana ecosystem, enhancing the market recognition and perceived security of the entire network.

· Liquidity Depth Enhancement: The entry of institutional funds will significantly increase the total locked value (TVL) on Solana, improving liquidity depth and reducing volatility, creating a better trading environment for more institutions and retail users.

· Standard Setting Leadership: As the first institutional-level product, Drift sets standards for compliance, risk management, and institutional services for the entire Solana DeFi ecosystem, promoting the entire ecosystem's development towards a more mature and regulated direction.

Paradigm Shift from Speculative Narrative to Value Capture

Drift's institutional version represents a key step in the Solana ecosystem's transformation from speculation-driven to value capture. By tokenizing real assets and integrating them into the DeFi ecosystem, it establishes a sustainable growth model based on real value.

· Real Asset Anchoring: Unlike purely speculative meme coins, the ACRED introduced by Drift represents a real asset portfolio managed by Apollo, providing value support from the real economy for on-chain activities.

· Compliance-First Strategy: In the context of increasingly stringent regulatory environments, Drift adopts a "compliance-first" approach, ensuring that institutional services meet regulatory requirements, laying the foundation for long-term sustainable development.

· Value Capture Mechanism: By providing value-added services for tokenized assets, Drift can capture value from the massive capital flow migrating from traditional finance to blockchain, establishing a profit model based on actual services rather than solely relying on token speculation.

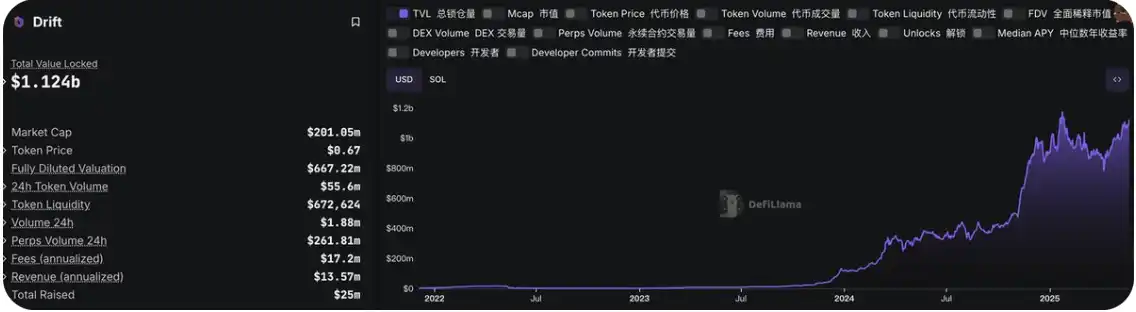

Drift On-Chain Data

Drift's TVL (Data Source: https://defillama.com/protocol/drift?dexVolume=false&perpsVolume=false&tokenVolume=false)

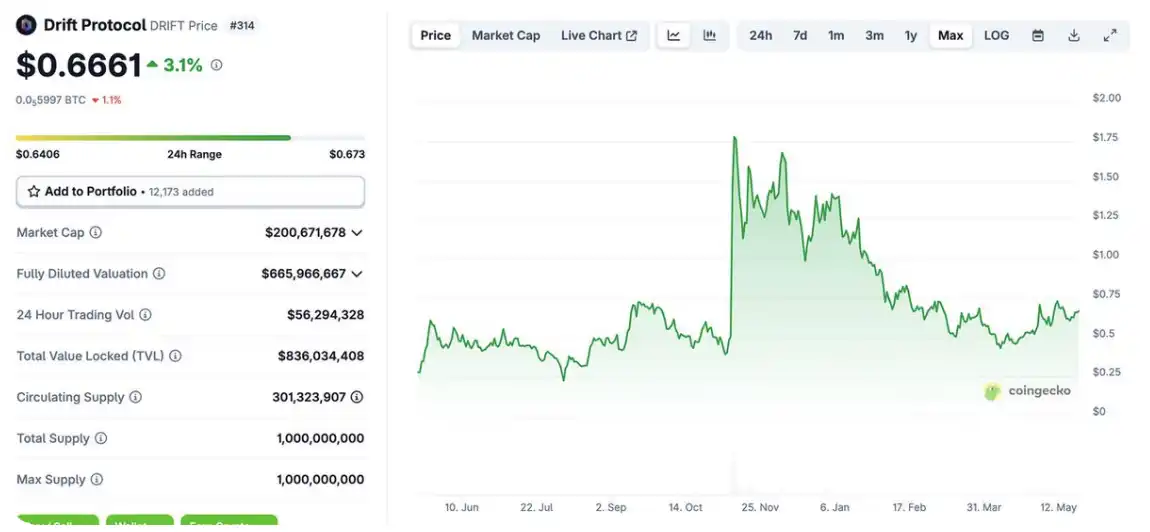

Drift's Price Trend (Data Source: https://www.coingecko.com/en/coins/drift-protocol)

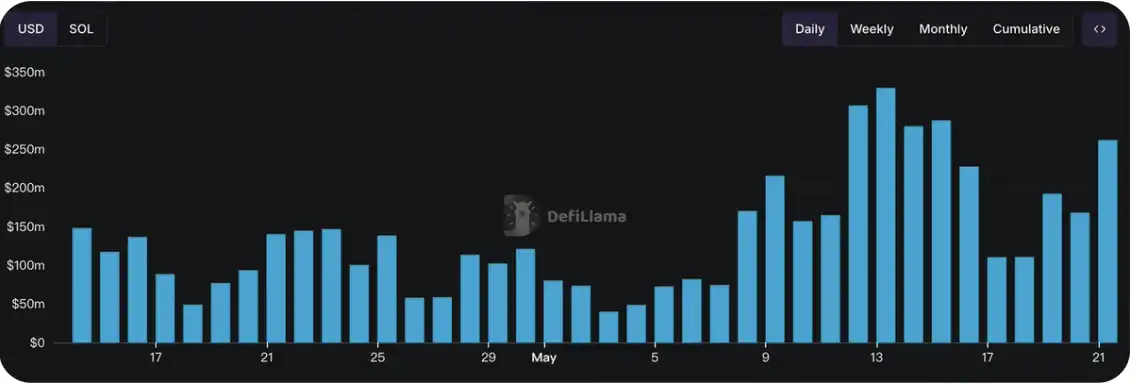

Drift's Trading Volume Changes (Data Source: https://defillama.com/protocol/drift?dexVolume=false&perpsVolume=false&tokenVolume=false)

From the above charts, we can see that Drift's trading volume has been on an upward trend this week, and compared to the previous month, Drift's overall trading volume is at a high level this month.

Therefore, based on the above data, we can analyze that Drift's TVL has rapidly grown recently, reaching a historical high of $1.124 billion, about to hit the historical peak of $1.177 billion. Additionally, Drift's daily trading volume is at a high level this month and has shown a rapid upward trend this week. However, the price of the DRIFT token still has nearly double the space compared to its historical high of $1.78. As a DEX project with practical applications, its business volume and capital often represent its current development status. We can see that the price of the DRIFT token is currently clearly undervalued.

Bearish Targets: CETUS, REZ

CETUS: $223 Million Security Breach Triggers Trust Crisis and Survival Challenges

Cetus Protocol, the largest decentralized exchange in the Sui blockchain ecosystem, has suffered a severe security breach, with hackers exploiting a computational precision issue to steal over $223 million in assets (after the incident, $162 million in assets were urgently frozen), leading to near-exhaustion of the platform's liquidity, with the Total Value Locked (TVL) plummeting to just $37.84 million.

Direct Economic Losses

· Fund Losses: $223 million in assets were stolen, with $162 million frozen urgently after the incident, resulting in an actual loss of $61 million, far exceeding the project's total revenue of $19 million.

· TVL Collapse: The liquidity pool has been emptied, with the Total Value Locked (TVL) sharply declining to just $37.84 million.

· Token Value Plummets: The CETUS token has seen a significant price drop due to panic selling.

TVL of Cetus Protocol (Data Source: https://defillama.com/protocol/cetus)

Technical Trust Crisis

· Design Flaws Exposed: The computational precision issue has been identified as a fundamental design flaw, raising questions about the technical capabilities of the project team.

· Inadequate Security Audits: Such a significant vulnerability was not detected beforehand, indicating serious flaws in the security audit process.

· Lack of Clear Vulnerability Disclosure: Following the attack, there was a failure to promptly release a detailed technical analysis, increasing user uncertainty.

User Behavior Chain Reaction

· Trust Collapse: Users have developed extreme distrust towards the platform.

· Fund Withdrawals: Remaining users may accelerate their withdrawals, further reducing platform liquidity.

· User Attrition: The lack of compensation expectations leads to permanent user loss.

Long-Term Survival Threats

· Liquidity Death Spiral: User withdrawals → liquidity decline → worsened trading experience → more user withdrawals.

· Revenue Source Dwindling: Decreased trading volume leads to reduced fee income.

· Development Fund Shortage: Inability to raise new funds for product development and market expansion.

This multi-layered negative impact creates a self-reinforcing vicious cycle. If not addressed quickly and effectively, the prospects for Cetus Protocol as a sustainable DeFi project will be extremely bleak.

REZ: Large-Scale Token Unlock on May 29 May Intensify the Doldrums in the Re-Staking Sector

Renzo is a re-staking protocol based on EigenLayer. Renzo abstracts the complex process of re-staking for end users, allowing stakers to avoid concerns about operator and reward strategy selection and management.

Deteriorating Industry Environment

· Overall Ethereum Ecosystem Slump: The Ethereum ecosystem has faced challenges over the past six months, continuously suffering from market FUD.

· Severe Shrinkage in the Re-Staking Sector: As a niche area, re-staking projects have generally seen a decline in attention.

· Insufficient User Confidence: Market skepticism towards the Ethereum ecosystem has affected user willingness to participate in re-staking protocols.

Poor Project Performance

· TVL Plummets 75%: Compared to its peak, the locked value has decreased by three-quarters, indicating severe user withdrawals.

· Market Capitalization Shrinks: The current market capitalization is only $41.1 million, at a low level.

· Insufficient Liquidity: The average daily trading volume is only $9 million, with inadequate market depth.

· Lack of Product Differentiation: Although the staking process has been simplified, it has failed to establish a sufficient moat in competition.

Upcoming Token Unlock Pressure

· Large-Scale Unlock Approaches: On May 29, 423.7 million REZ tokens will be unlocked, accounting for 4.24% of the total locked amount.

· High Risk of Unlocking Entities: The unlocking subjects are mainly investment institutions and project teams, with strong motives to sell.

· Weak Market Absorption Capacity: The value of unlocked tokens is disproportionate to daily trading volume, making it difficult for the market to absorb effectively.

These three adverse factors overlap and reinforce each other, creating a negative cycle: a deteriorating industry environment leads to poor project performance, poor project performance puts pressure on token prices, and the upcoming large-scale unlock may further exacerbate downward price pressure, potentially leading the project into deeper trouble.

TVL of Renzo (Data Source: https://defillama.com/protocol/renzo)

Market Sentiment Index Analysis

The market sentiment index has decreased from 73% last week to 71%. Although it has declined, it remains in the bullish range overall.

Hot Tracks

Passage of the 'GENIUS Act' Amendment: Clarification of Stablecoin Regulation Will Lead to New Growth in the DeFi Sector

Overview

The revised 'GENIUS Act' has made significant progress in the U.S. Senate, providing a clear legal framework for the stablecoin market through measures such as establishing a tiered regulatory system, requiring dollar asset backing, and restricting participation from tech giants. Although it introduces strict regulations, the act effectively ends long-standing regulatory uncertainty, attracting traditional financial institutions and Wall Street capital into the market, bringing considerable incremental funds to the crypto ecosystem. Among various sub-sectors, the DeFi sector, particularly projects like Aave and Pendle that are deeply integrated with stablecoins, will become the biggest beneficiaries, as their arbitrage mechanisms align closely with the professional capabilities of traditional financial institutions, and they have established mature stablecoin application scenarios, likely to see greater growth opportunities under the new regulatory environment.

Interpretation of the Revised 'GENIUS Act'

Last week, the 'Guiding and Promoting U.S. Stablecoin National Innovation Act' faced obstacles in the U.S. Senate but has been revised and reintroduced by Republican senators, achieving significant progress. On Tuesday morning Beijing time, the procedural motion for the revised 'GENIUS Act' was passed with 66 votes in favor and 32 against, clearing the way for final legislation.

Tiered Design of the Regulatory System

The revised bill adopts a market capitalization-based tiered regulatory strategy:

· Large Stablecoins (> $10 billion): Directly regulated by the Federal Reserve (FED).

· Small Stablecoins ($10 billion): Regulated by state regulatory agencies.

This tiered regulatory model effectively maintains federal control over significant stablecoins while avoiding the excessive dispersion of regulatory resources. It can effectively prevent "regulatory arbitrage" caused by inconsistent regulatory standards across states while ensuring that systemically important stablecoins are subject to strict oversight.

Asset Backing Requirements and U.S. Treasury Financing

The bill requires all stablecoins to be fully backed by highly liquid assets such as U.S. dollars or U.S. Treasury bonds:

· Anchoring in the U.S. Dollar Financial System: Tying stablecoins to the U.S. dollar ecosystem, continuing to maintain market demand for the dollar.

· U.S. Treasury Financing Tool: Due to current pressures on U.S. Treasuries, the declining demand for Treasuries within the old financial system creates a new demand channel for U.S. government bonds, helping to alleviate financing pressures on the U.S. government.

· Continuation of Dollar Hegemony: In the context of declining dollar influence, expanding the impact of dollar-based stablecoins aims to sustain the dollar's influence.

The bill effectively transforms the stablecoin market into a new indirect purchaser and channel for U.S. Treasuries, alleviating the pressures faced by Treasuries and forming a virtuous cycle of "stablecoin issuance → purchasing Treasuries → supporting U.S. government financing," while forcibly linking new innovative economies with the dollar to increase market demand for the dollar, thereby maintaining dollar hegemony.

Restrictions on Tech Giants and Balancing Financial Power

The bill restricts large non-financial tech companies, such as Tesla, META, Amazon, Google, and Microsoft, from issuing stablecoins, imposing higher requirements if such companies wish to issue stablecoins.

· Preventing Financial Power Transfer: Limiting tech giants from leveraging their vast user bases and technological advantages to enter the currency issuance field.

· Maintaining Traditional Financial Dominance: Ensuring that the right to issue currency remains primarily in the hands of regulated financial institutions.

· Avoiding "Supranational" Risks: Preventing multinational tech companies from creating payment networks that could challenge national monetary sovereignty.

This provision in the bill can be understood as a power struggle between the traditional financial system and emerging economies, strictly limiting the issuance rights of emerging tech companies and ensuring that the right to issue currency must be held by national financial institutions.

Credit Isolation and Responsibility Boundaries

The bill explicitly prohibits stablecoin issuers from falsely claiming that their products are insured by the Federal Deposit Insurance Corporation (FDIC) or backed by the U.S. government, which has significant risk management implications:

· Preventing Moral Hazard: Clearly stating that the government does not provide implicit guarantees for stablecoins, reducing issuers' risk-taking motives.

· Protecting Government Credit: Safeguarding the credit ratings of the U.S. government and FDIC during potential market turmoil in the stablecoin sector.

· Risk Isolation Mechanism: Establishing a firewall between the stablecoin market and the traditional financial system to prevent risk contagion.

· Crisis Prevention: Avoiding a stablecoin crisis from evolving into a systemic financial crisis requiring government bailouts.

This credit isolation strategy reflects regulators' efforts to prevent potential systemic risks by clearly defining responsibility boundaries.

New Protection Mechanisms and Ethical Standards

The latest revisions add three key aspects:

· Consumer Protection Mechanisms: Enhancing protective measures for stablecoin users to ensure transparency and fairness.

· Bankruptcy Protection Mechanisms: Establishing clear bankruptcy handling processes to prevent the impact of stablecoin collapses on the broader financial system.

· Expanding Ethical Standards: Specifically targeting regulations for government officials and prominent business figures, explicitly mentioning individuals like the Trump family and Elon Musk.

These supplementary provisions aim to enhance overall safety through strengthened industry regulation while boosting investor confidence. These measures include consumer protection laws and bankruptcy protection mechanisms, designed to provide more comprehensive safeguards for investors and consumers.

Benefits of the Revised 'GENIUS Act' for the Crypto Market

Through the interpretation of the revised 'GENIUS Act', it is evident that while the act introduces various regulatory provisions, it overall promotes the compliance of the stablecoin market, providing a clear and defined legal framework that ends long-standing regulatory uncertainty.

The implementation of this act will attract more institutional investors and traditional financial institutions into the crypto market. Traditional U.S. banking giants and Wall Street firms will accelerate their involvement in the stablecoin business, expected to bring in billions or even trillions of dollars in capital. For the crypto market, stablecoins are a key infrastructure of the crypto economy and the foundation for its development. The number of stablecoins can also reflect the liquidity of the market to some extent. Although not all stablecoin funds will flow into the crypto industry after the implementation of the 'GENIUS Act', a portion of incremental funds will inevitably be attracted. Currently, the crypto market is only $3 trillion in size, which is still relatively small for traditional capital. Therefore, even a partial inflow of traditional funds into the crypto market will drive rapid development in the crypto industry.

For the crypto industry, the DeFi sector is likely to be the most affected by the influx of new funds. Most projects in the DeFi sector offer opportunities for capital arbitrage, which is an area where traditional capital excels. As a large amount of traditional capital begins to enter stablecoins, it will inevitably seek new use cases, and DeFi projects present an excellent opportunity.

In the DeFi sector, the projects that utilize stablecoins the most are Aave and Pendle. Aave is the largest on-chain lending project.

Market Transformation Driven by Regulatory Clarity

Although the revised 'GENIUS Act' introduces strict regulatory provisions, its main role is to provide a clear legal framework for the stablecoin market, ending long-term regulatory uncertainty:

· Compliance Certainty: The act provides clear compliance guidelines for market participants through a tiered regulatory structure, asset backing requirements, and credit isolation mechanisms. Stablecoin issuers no longer need to navigate a vague environment but have clear rules to follow, enabling businesses to formulate long-term development strategies and reduce regulatory risks.

· Attracting More Institutions: Traditional financial institutions are highly sensitive to legal risks. The 'GENIUS Act' provides a reliable compliance path for these institutions by clarifying the legal status and operational requirements of stablecoins. Particularly for institutions that manage client assets in a fiduciary capacity, the implementation of the act means they can begin exploring stablecoin business without violating fiduciary duties.

· Enhanced Investor Confidence: The regulatory framework not only provides certainty for issuers but also offers security for investors. By requiring stablecoins to be 100% backed by U.S. dollars or U.S. Treasury bonds and prohibiting misleading advertising, the act reduces default risks and information asymmetry. Institutional investors, in particular, value these protective measures and will be more willing to include stablecoins in their portfolios.

Catalytic Role of Traditional Financial Capital Inflow

Accelerated Institutional Capital Deployment

· Participation of Banking Giants: Traditional U.S. banks will gain a clear path to participate in stablecoin business. Financial giants like JPMorgan and Citibank may enter the market by directly issuing compliant stablecoins, providing custody services, or developing payment solutions based on stablecoins, bringing significant capital and market credibility.

· Wall Street Capital Injection: Asset management giants like BlackRock and Vanguard will seek strategic positions in the stablecoin space, not only directly investing in projects but also developing investment products based on stablecoins. The involvement of Wall Street means more complex financial instruments and larger capital flows.

· Scale Expectations: Considering that the total assets of the U.S. banking industry exceed $23 trillion, even a small percentage flowing into the stablecoin market will bring in billions or even hundreds of billions of dollars in incremental capital, fundamentally changing market depth and liquidity.

Strengthening Stablecoins as Infrastructure of the Crypto Economy

Stablecoins play a critical role in the crypto ecosystem:

· Medium of Exchange and Store of Value: They address the volatility issues of cryptocurrencies, supporting the daily operations of the entire ecosystem.

· Bridge Between Traditional Finance and Crypto Finance: They connect the fiat world and the crypto world, providing efficient channels for capital circulation between the two systems.

· Market Liquidity Indicators and Providers: The market capitalization and circulation of stablecoins are important indicators for measuring market liquidity and sentiment.

While not all new stablecoin funds will flow directly into the crypto market, a portion of the inflow will have a significant impact on the currently $3 trillion-sized crypto market. Compared to the vast scale of traditional financial markets, the growth potential of the crypto market remains enormous.

Strategic Advantages of the DeFi Sector

Among various sub-sectors in crypto, the DeFi sector may become the biggest beneficiary:

· Alignment of Arbitrage Mechanisms: The yield arbitrage opportunities provided by DeFi projects align closely with the professional capabilities of traditional financial institutions. These institutions possess advanced quantitative trading systems and risk management models, enabling them to efficiently identify and exploit yield differences in the DeFi ecosystem, such as interest rate arbitrage and liquidity mining optimization.

· Clear Capital Usage Scenarios: Compared to other crypto areas, DeFi offers clearer paths for capital application. Traditional institutions can easily understand core functions like lending, trading, and market-making, as these concepts closely resemble traditional financial operations. The transparency of DeFi platforms also makes the flow of funds and risks more visible.

· Familiarity with Risk-Return Structures: Many DeFi products are designed based on traditional financial instruments, lowering the threshold for institutions to understand and assess them. DeFi protocols typically offer customizable risk exposure options, allowing institutions to choose strategies that fit their risk preferences.

Projects Likely to Yield the Most Returns

In the DeFi sector, the leading projects most closely tied to stablecoins are Aave and Pendle.

Aave

Aave is the largest decentralized lending project in the crypto market. As lending projects provide liquidity to the market, most users in lending projects use staked token assets to obtain stablecoins. Aave operates on a lending pool model, so the more funds in the pool and the better the depth, the lower the loan interest rates, which helps users borrow more assets.

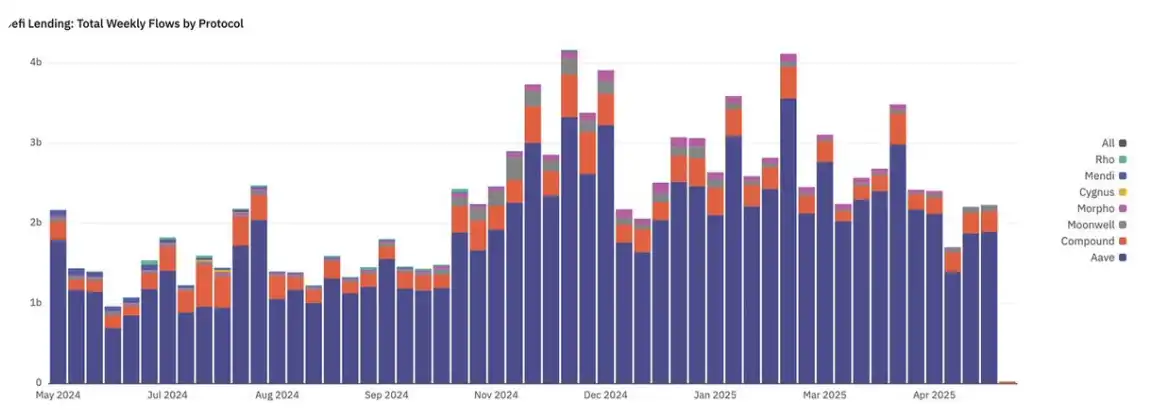

Total lending volume and share in the crypto market (Data Source: https://dune.com/green_team/defi-lending-and-borrowing)

From the chart, it can be seen that Aave holds an absolute dominant position in the lending market, accounting for 85.75% of all loans.

Aave's TVL (Data Source: https://defillama.com/protocol/aave?tokenLiquidity=false&borrowed=false&revenue=true)

From the chart, Aave's TVL has surpassed $24.384 billion, reaching a historical high, indicating that Aave's business development is on a healthy and rapid upward trend.

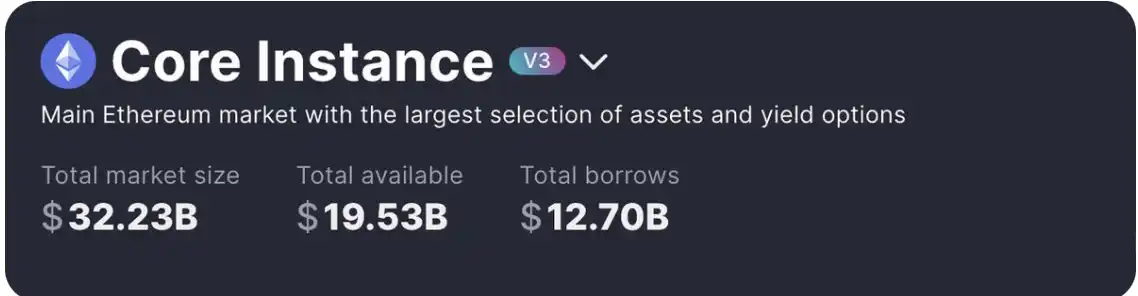

Total loan amount of Aave (Data Source: https://app.aave.com/markets/)

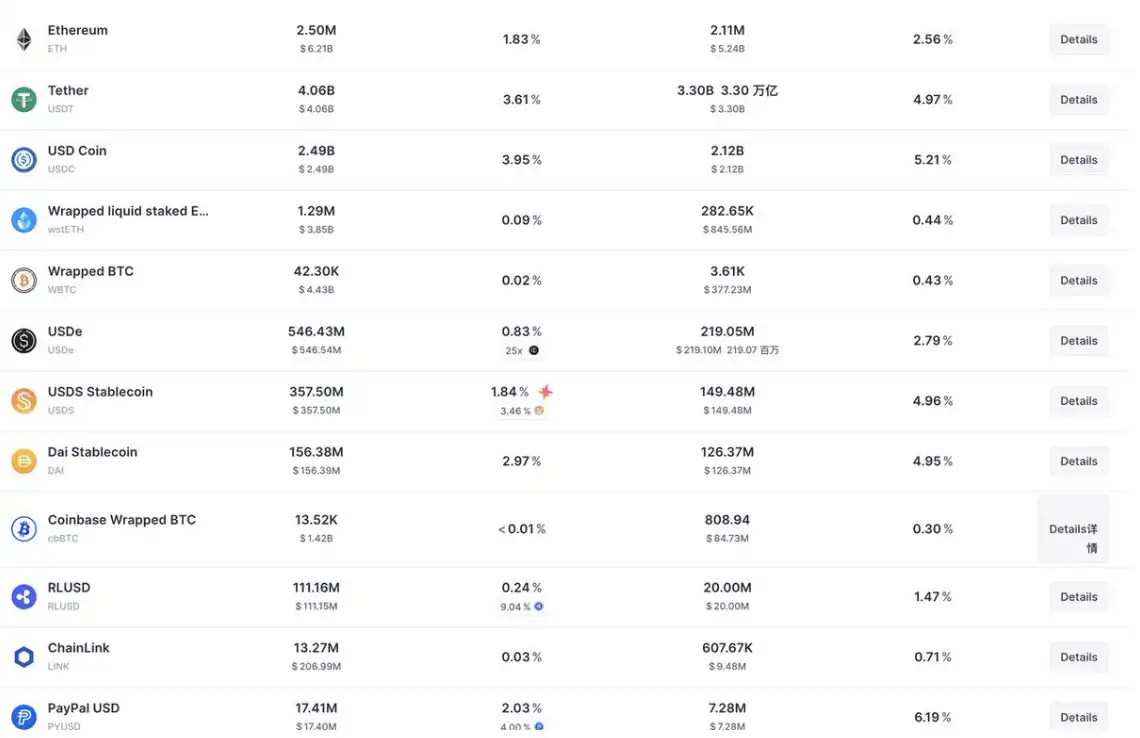

Various lending pool conditions of Aave (Data Source: https://app.aave.com/markets/)

According to data from Aave's official website, Aave's lending business has a total loan amount of $12.7 billion, with stablecoins accounting for $6.114 billion, making up the majority of the lending.

In summary, based on Aave's industry position in the lending sector and the scale of its internal business, it can be seen that Aave's project support still relies on the lending business of various stablecoins. Therefore, if the stablecoin bill is passed and a large amount of stablecoins enter the crypto market, Aave will undoubtedly be the best ideal project for generating returns from these stablecoins.

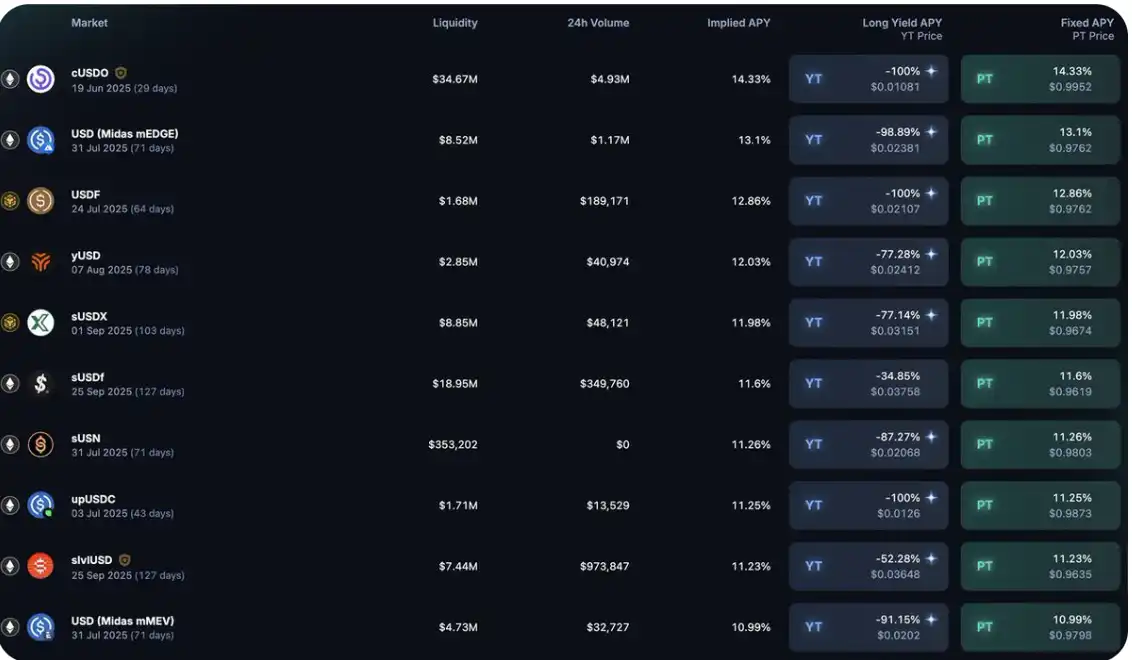

Pendle

Pendle is the largest and most liquid interest rate trading project in the crypto market, situated in the sub-sector of DeFi—interest rate derivatives. For institutional participants, earning stable arbitrage returns is one of their main sources of income, and Pendle's products include specialized offerings that involve the separation of principal and interest for stablecoins, allowing users to trade various stablecoins' YT and gain greater returns through derivatives.

Pendle's TVL (Data Source: https://defillama.com/protocol/pendle)

From the chart, it can be seen that Pendle's TVL has reached a scale of $4.198 billion. Although it is not at its peak, the upward curve of its TVL indicates that Pendle's business scale is in a rapid recovery phase.

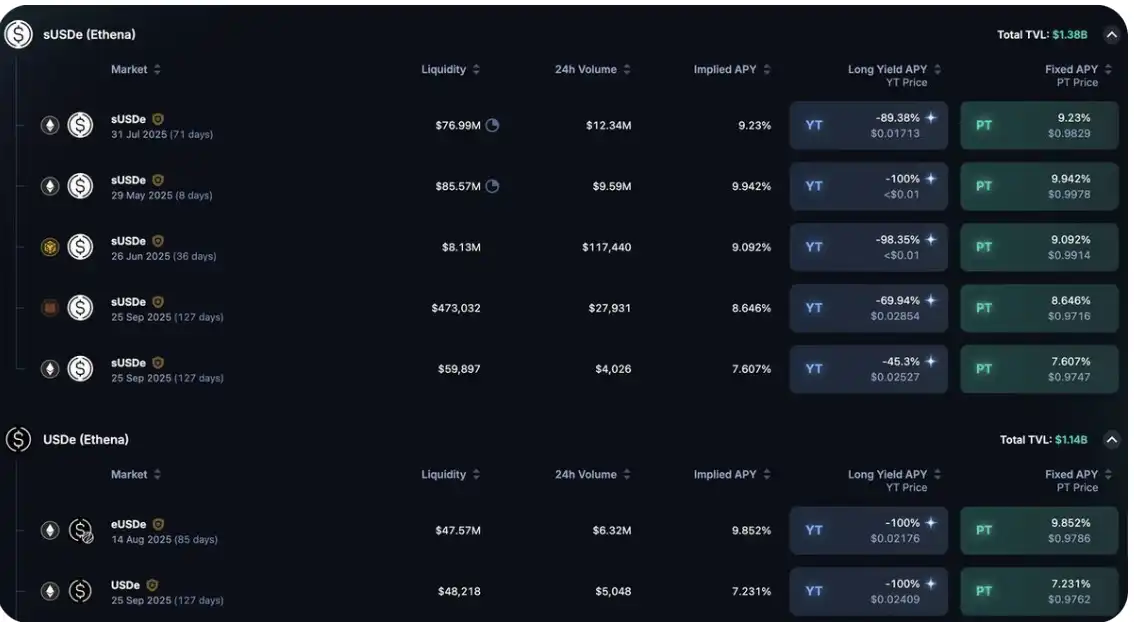

Illustration of Pendle's stablecoin TVL (Data Source: https://app.pendle.finance/trade/markets)

According to data from Pendle's official website, Pendle's total stablecoin TVL can reach over $3.7 billion, accounting for more than 88% of Pendle's overall TVL, indicating that the interest rate market of Pendle is primarily focused on stablecoins.

Pendle's stablecoin market (Data Source: https://app.pendle.finance/trade/markets)

As shown in the figure, Pendle's stablecoin yields generally exceed 10%, which is a very high return for traditional capital. If traditional funds can enter the crypto market in a compliant manner, stablecoin yields above 10% will undoubtedly attract a large influx of traditional capital.

In summary, based on Pendle's scale in the stablecoin interest rate sub-sector, it can be seen that Pendle's business support lies in the stablecoin interest rate market. Therefore, if the stablecoin bill is passed and a large amount of stablecoins enter the crypto market, Pendle will be the main market for institutions participating in stablecoin interest rate trading.

Overall Market Overview

Data Source: SoSoValue

According to weekly return statistics, the AI sector performed the best, while the PayFi sector performed the worst.

AI Sector: In the AI sector, TAO, RENDER, FET, and WLD have a significant share, totaling 75.26%. This week, their price changes were 9.31%, 7.12%, 12.28%, and 25.71%, respectively. It can be seen that the main projects in the AI sector all experienced upward trends this week, with most tokens showing significant increases, making the AI sector the best performer.

PayFi Sector: In the PayFi sector, XRP, XLM, and BCH have a significant share, totaling 94.17%. This week, their price changes were -1.46%, 1.76%, and 10.13%, respectively, with average increases lower than those of projects in other sectors. Even the largest share, XRP (accounting for 83.25%), experienced a decline, resulting in the PayFi sector being the worst performer.

Upcoming Major Crypto Events

· Thursday (May 29): U.S. initial jobless claims for the week

· Friday (May 30): U.S. final consumer confidence index for May from the University of Michigan; U.S. April core PCE price index year-on-year; second round of compensation for FTX users

Summary

This week, the cryptocurrency market showed a clear upward trend, with Bitcoin reaching new highs, driving a general rise in altcoins. However, the market sentiment index slightly decreased to 71%, still maintaining a bullish range. On the policy front, the revised 'GENIUS Act' made significant progress in the U.S. Senate, and the passage of the Texas Bitcoin Strategic Reserve Act injected strong confidence into the market. The stablecoin market showed positive signals with USDT and USDC growing in sync, indicating that global investors are accelerating their entry.

However, investors should remain cautious and be alert to potential FOMO sentiment and macroeconomic uncertainties. The Federal Reserve's stance on maintaining high interest rates and unresolved U.S. tariff issues could cause market volatility. Additionally, security risks cannot be ignored, as highlighted by the $223 million vulnerability attack on the Cetus Protocol, which serves as a wake-up call for security awareness. It is recommended that investors grasp policy dividends while reasonably controlling their positions, balancing allocation strategies, and closely monitoring the potential impact of the U.S. economic data releases on May 29 and 30, as well as important events like the second round of compensation for FTX users.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。