The funding rates are severely differentiated, and the long and short sentiments are in confrontation: this is a good thing!

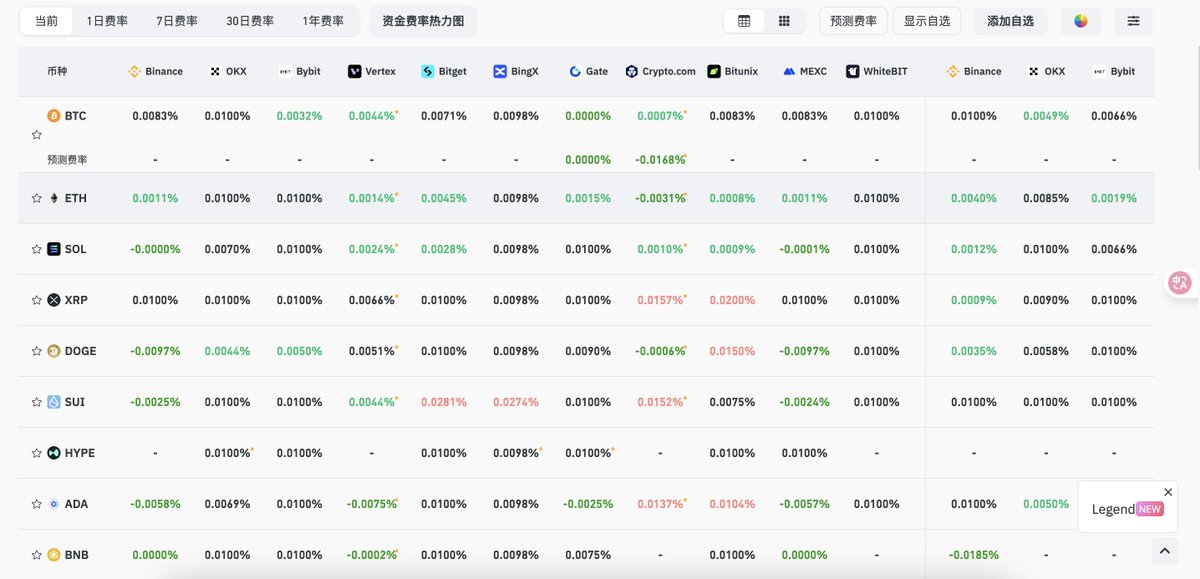

I took a look at the current funding rate data for mainstream cryptocurrencies on CEX & DEX—

The funding rates for BTC and ETH mostly fluctuate around the baseline, indicating a neutral market sentiment;

However, the rates for $SUI and $DOGE are polarized, while $LINK and $SOL show negative rates on multiple platforms, indicating a clear short position.

The gap between long and short positions is widening, suggesting significant market divergence and a lack of consensus expectations, which usually means that a real big market movement has not yet arrived.

In this phase, blindly chasing long positions or shorting can easily turn one into a "high-position buyer." Smart money chooses to "patiently wait" and "reverse test positions."

I say this is a good thing because:

👉 No consensus expectations = No high bubble;

👉 Long and short confrontation = Room for speculation;

👉 Emotional tearing = Opportunities against the trend.

Don't be misled by localized emotions; differentiation itself is a signal. The market does not rise in a straight line but rather spirals upward, requiring self-adjustment and correction;

When everyone in the market stands on the same side, that is when it is truly dangerous;

Now that the divergence is at its peak, it is precisely the moment to build momentum for the next real market movement.

Uncertainty is not risk; it is an opportunity for value to be mispriced.

As long as you have patience, positions, and strategies—you can earn money that others cannot understand from this "incomprehensible market."

📊 Data source: @coinglass_com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。