In the past two days, I haven't been looking at complex data much, as it's all just a matter of what Trump says. Instead, I've been focusing more on user sentiment. Especially after comparing the data of $BTC, $MSTR, and ETFs over the past week, my personal view is that the recent surge is not closely related to traditional American users, including ETF investors and MSTR investors.

In fact, this group of investors is more closely related to U.S. stock investors. Particularly, after Bitcoin reached a new high, MSTR not only did not follow BTC's trend but also moved closer to the U.S. stock market. Although BTC, MSTR, and U.S. stocks are generally aligned in the big picture, the details still reflect the priorities of traditional investors.

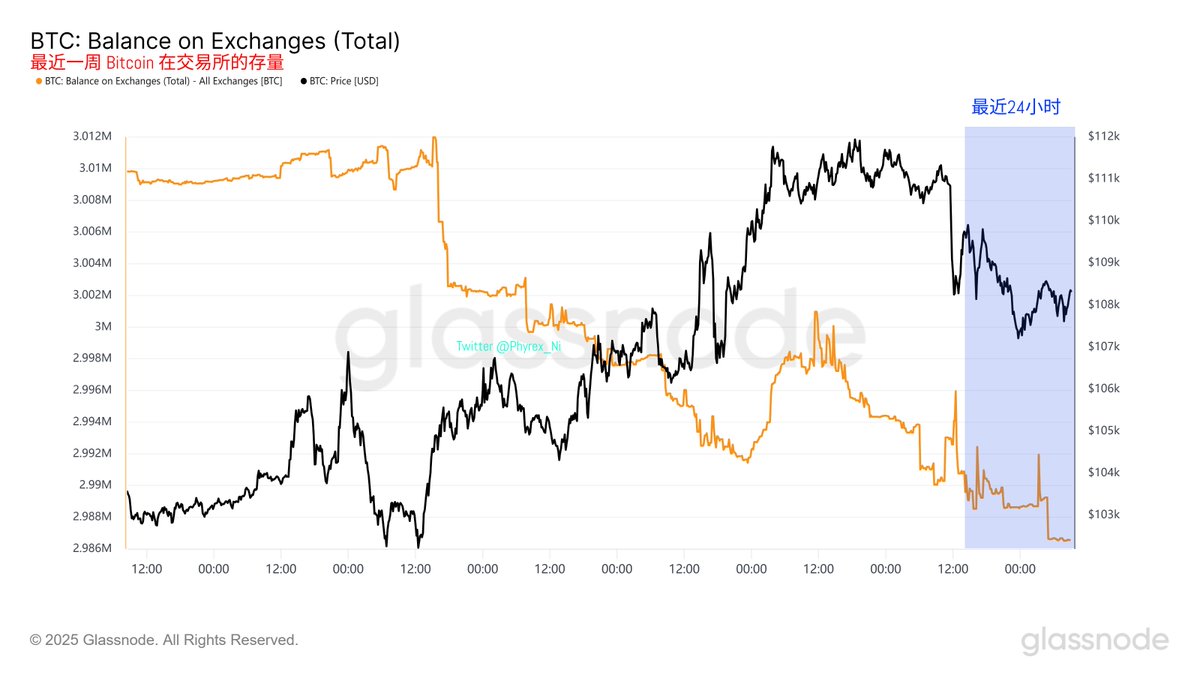

Therefore, I am more concerned about the BTC inventory data from exchanges. It can be seen that after Trump's market intimidation, Bitcoin did experience three noticeable inflows, but by now, they have all been consumed, and even more BTC has been transferred out of exchanges. So personally, I still feel that, at least for now, the market sentiment is not panic.

The market's perception of tariffs should be a gradual process of disillusionment, as everyone has already gotten used to the situation with China. Next up is the European Union, and it seems that the only unresolved issues are with China and the EU.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。