We have been discussing the market trends, and now with data and technology becoming increasingly distant, more market changes are still driven by monetary policy and Trump's statements. As expected, tariffs that were previously considered non-threatening have resurfaced today. On one hand, Trump is demanding that Apple and Samsung build factories in the U.S. or face a 25% tariff; on the other hand, he has decided to impose a 50% tariff on the EU starting June 1.

This has led to a direct drop in market capitalization, which had just begun to recover. Just a few days ago, Trump publicly suggested buying stocks, and those who listened to him might now be stuck. This once again highlights the uncertainty surrounding Trump, and perhaps the best way to predict the market now is through metaphysics.

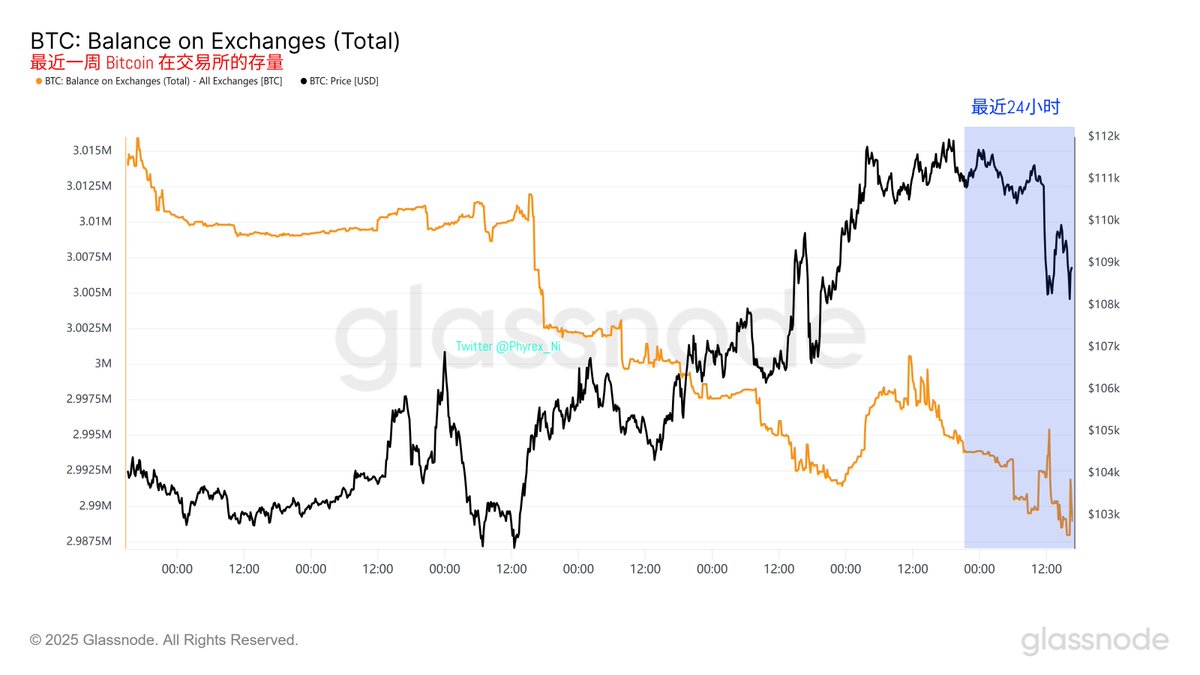

Not only is the sentiment in the U.S. stock market sluggish, but even $BTC has been knocked down, and the price drop has caused some panic among friends. The trading volume on exchanges has seen two significant increases today, but this volume is still being consumed. For the market, tariffs may not be completely desensitized, but I do not believe they will become a major obstacle.

Next, we will see if this weekend can ease investor sentiment, or whether Trump will hit the market again and then offer some relief.

PS: There have also been issues with Twitter in the past two days, often failing to send out content and not being able to see friends' replies, which is quite puzzling.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。