Macroeconomic Interpretation: The global financial market is undergoing an unprecedented wave of capital reallocation. While the U.S. stock market faces an outflow of $1.8 billion and the gold market experiences its largest single-week net outflow of $2.9 billion in nearly a decade, the Bitcoin market is performing a contrasting "ice and fire" trend. The astonishing data of a net inflow of $934 million into spot Bitcoin ETFs in a single day not only sets a new four-month high but also sharply contrasts with Grayscale's outflow of $856 million worth of 7,700 BTC in a single day, revealing the complex position adjustments being made by institutional investors. This dramatic divergence in capital flow coincides with a critical moment when U.S.-EU trade negotiations are at a standstill—U.S. trade representatives are demanding unilateral tariff reductions from the EU, only to face strong resistance from Europe on the digital tax issue. This struggle in the traditional economic sphere unexpectedly becomes a catalyst for the rise of crypto assets.

Geopolitical games are injecting new momentum into the cryptocurrency market. Trump's remarks at a crypto dinner in Virginia, while not breaking existing policy frameworks, elevate the dominance of cryptocurrencies to the level of "national strategic security," which is quite significant. Particularly, the phrase "we must not let China take the lead" suggests that crypto assets may become a new battleground in the tech competition among major powers. This political endorsement effect is immediately reflected in the derivatives market, where the Hyperliquid trading platform saw four investors accumulate a total of $1.188 billion in long positions, with the largest single position reaching 7,225 BTC, showcasing aggressive operations with leverage as high as 40 times, which not only demonstrates market confidence but also plants the seeds of volatility risk. Interestingly, during the same period, 43% of TRUMP token holders experienced losses, exposing the complex ecology of speculation and value investment coexisting in the crypto market.

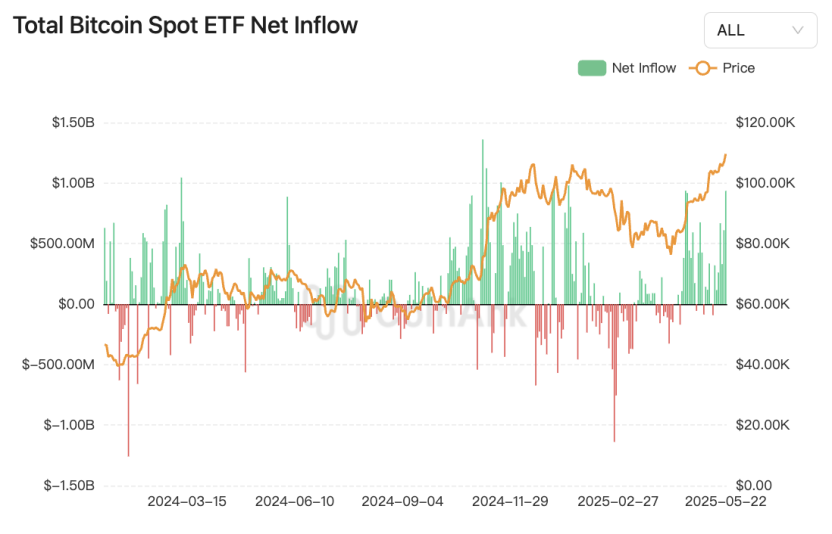

Observing the evolution of market structure, this round of Bitcoin's rise exhibits characteristics markedly different from historical cycles. During the process of breaking through $111,000 to set a new historical high, the daily average inflow into spot ETFs stabilized at several hundred million dollars, which fundamentally differs from the leverage-driven nature dominated by futures during the bull market of 2021. A capital research report reveals institutional behavior patterns that are indicative: a potential allocation demand for $2.1 billion in perpetual preferred stock financing, combined with a massive sweep of 130K call options in September, has constructed a multi-layered long mechanism. This shift is corroborated by technical analysis—Bitcoin's V-shaped rebound during Asian trading hours coincides with a traditional asset sell-off triggered by weak U.S. Treasury auctions, showcasing characteristics independent of traditional risk assets.

The marginal improvement in the regulatory environment is reshaping market expectations. Although the EU maintains an independent stance in digital tax negotiations, the U.S. Securities and Exchange Commission's continued approval of spot ETFs objectively opens a compliant channel for institutional funds. The frequent large transfers by Grayscale suggest that market makers are building a more efficient liquidity network. This improvement in infrastructure contrasts interestingly with the moderate rise in implied volatility in the options market, indicating that investors recognize the medium to long-term upward trend while managing risks through derivative tools. This rational game may become a stabilizer for the healthy development of the market.

Looking ahead, three major forces will dominate Bitcoin's trajectory. First is the safe-haven demand brought about by geopolitical economic fractures; the escalation of U.S.-EU trade frictions may accelerate the diversification of global reserve assets. Second is the structural shift in institutional allocation; the continued inflow of long-term capital such as pensions through ETF channels will solidify the price foundation. Finally, the practical implementation of technological innovations, such as the commercial proliferation of second-layer solutions like the Lightning Network, may trigger a true value storage revolution. However, caution is warranted regarding the chain reaction triggered by concentrated high-leverage positions being liquidated, as well as the potential for regulatory policies to fluctuate during Trump's term. When Bitcoin's market capitalization surpasses silver to become one of the top six asset classes globally, the contest between traditional finance and the crypto economic model may just be beginning.

BTC Data Analysis:

According to CoinAnk data, the U.S. spot Bitcoin ETF market experienced a surge in capital inflow yesterday, with a single-day fundraising scale exceeding $930 million, setting the highest single-day record since January 2025. Among them, BlackRock's IBIT fund dominated with a net inflow of $877 million, accounting for 93.8% of the total, while Fidelity's FBTC and Ark's ARKB contributed $48.66 million and $8.9 million, respectively. This phenomenon continues the strong performance of the IBIT fund since the beginning of the year, with its assets under management occupying nearly half of the market, indicating institutional investors' concentrated preference for leading ETF products.

From a market impact perspective, the large-scale capital inflow reinforces Bitcoin's asset allocation attributes, with the total amount of Bitcoin held by ETFs continuously approaching the scale of Satoshi Nakamoto's wallet, highlighting the accelerated institutionalization of cryptocurrencies. Currently, the total net asset value of ETFs has surpassed $121 billion, accounting for nearly 6% of Bitcoin's total market capitalization, and this structural change provides incremental liquidity to the market. Historical data shows that ETF fund flows exhibit a significant positive correlation with Bitcoin prices, with sustained inflows often pushing prices to break through key resistance levels. For example, in May 2024, when ETFs saw continuous inflows for 18 days, Bitcoin's price broke through the $71,000 mark. It is worth noting that the Bitcoin reserves on exchanges have recently dropped to a seven-year low, combined with the continuous accumulation by ETFs, which may exacerbate the supply-demand imbalance in the market, creating favorable conditions for price increases. However, caution is needed regarding the risks of excessive market concentration, as fund movements in leading funds may trigger short-term volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。