On May 22, 2025, the market trend continued to rise, with Bitcoin breaking its historical high and reaching $110,000. Against the backdrop of the passage of the "GENIUS Act," an "unexpected" stablecoin, USD1, quietly became the market focus.

According to official news, Binance has announced that it will launch the stablecoin World Liberty Financial USD (USD1) today at 8 PM, becoming the third mainstream exchange to support USD1 after HTX and MEXC. With the strong emergence of USD1, the market has also welcomed a wave of "hot money in dollars + Trump label" linked trading.

Today, the B (BUILDon) token on the Binance Alpha platform surged 192% in a single day, and tokens like LISTA and STO also showed significant increases on Binance's gainers list, boosting community confidence in the "WLFI concept" and "Binance ecosystem" projects.

WLFI officially announced its support for BUILDon and purchased B tokens, leading the community to generally believe that it will replace FDUSD as Binance's main stablecoin.

Now, the wave of "USD1 heat" surrounding BUILDon has investors sensing Alpha opportunities. What other concepts related to USD1 and WLFI exist within the Binance ecosystem? BlockBeats has conducted a brief overview.

USD1 Unleashes Its Power: Analyzing the "Ecosystem Binding" of WLFI and Binance

USD1 is a dollar-pegged stablecoin issued by World Liberty Financial (WLFI) in March 2025, targeting a 1:1 exchange rate with the dollar, fully backed by short-term U.S. Treasury bonds, dollar deposits, and other assets, with BitGo Trust Company as the custodian. With strong backing from the Trump family, including co-founder Eric Trump, USD1 has carried its own traffic since its launch.

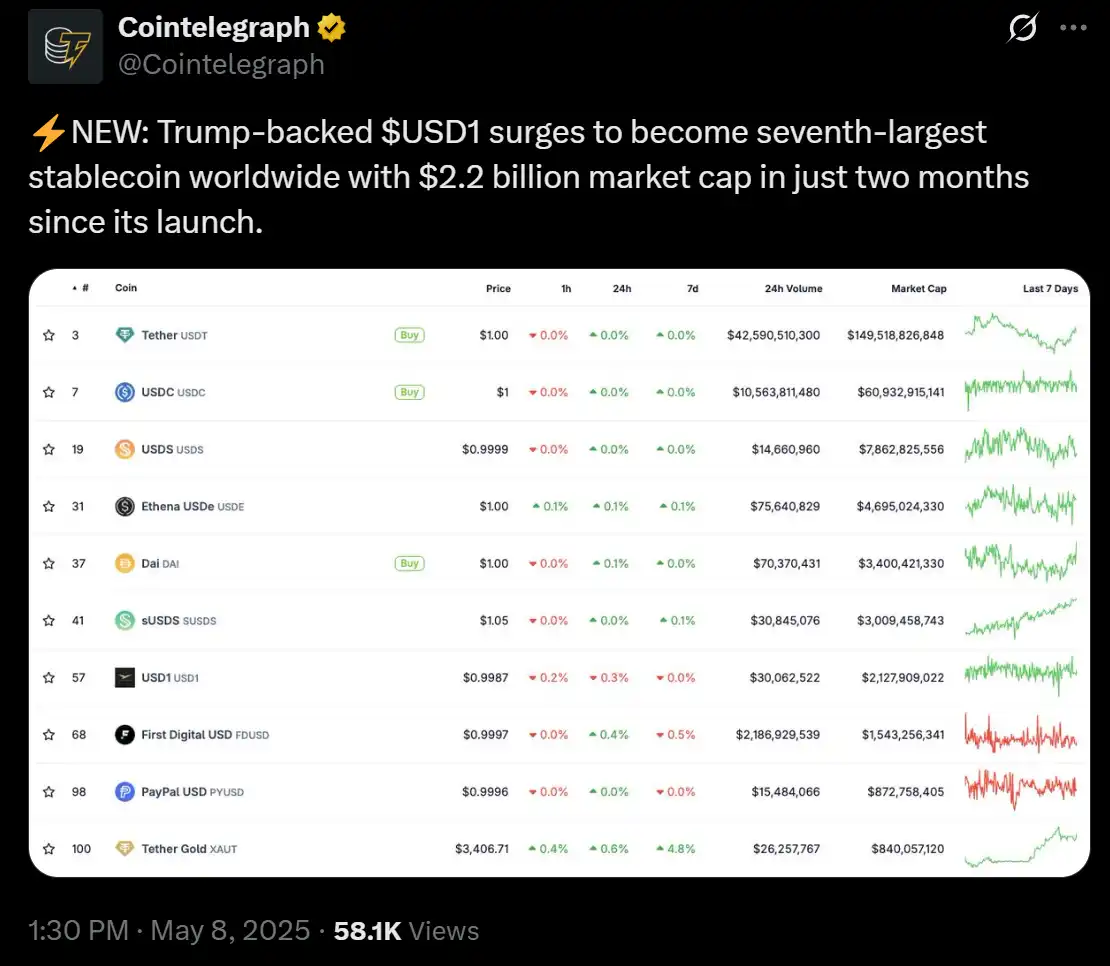

In just two months, USD1's market capitalization skyrocketed from $128 million to $2.1 billion, making it one of the top seven stablecoins globally. Its circulation on the BNB Chain accounts for as much as 90%, and it was the first to launch on mainstream exchanges like HTX.

At the same time, it has completed multi-chain deployment through Chainlink's CCIP protocol, currently supporting Ethereum and BNB Chain. In May, the popularity of USD1 continued to rise, with Abu Dhabi's MGX injecting $2 billion into Binance via USD1.

Related reading: "Behind the 40x Surge of BUILDon: Trump and CZ Unfold a $2 Billion 'Conspiracy' in Crypto Trading"

Some users even speculate that Binance is "testing the waters" with USD1 through the Alpha platform, intending to establish it as the core stablecoin of the BNB Chain.

Overview of the Hottest Trump Concept Tokens

Next, let's take a look at some of the currently hottest "Trump concept" tokens in the market.

USD1 Concept

BUILDon (480% Surge in 6 Hours)

Token B was launched on Binance Alpha on May 21, with BUILDon's market capitalization surpassing $220 million, setting a new historical high, and surging 480% in 6 hours. Coupled with WLFI's official announcement of support, B is widely regarded as a representative of the USD1 concept, and this purchase of token B marks WLFI's first acquisition of a meme coin.

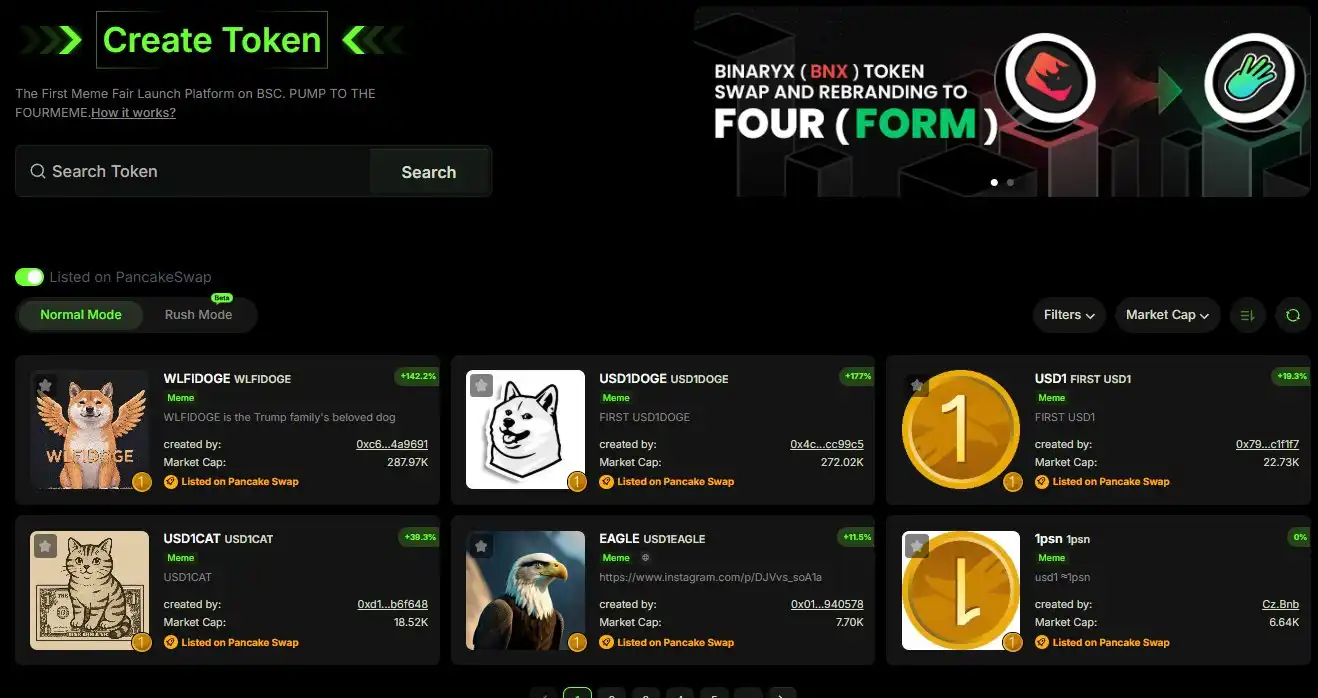

BUILDon is a token fairly launched through the Four.meme platform, with its core being a mascot promoting BSC construction culture. It will soon officially launch the USD1 construction plan to further promote the development of the stablecoin USD1.

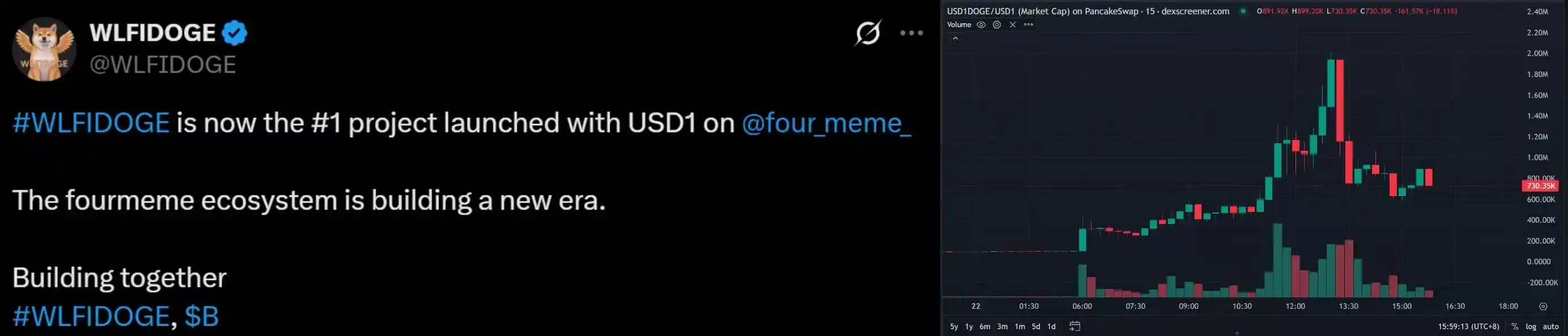

usd1doge (10x Surge) & wlfidoge (4x Surge)

On May 22, 2025, usd1doge achieved a tenfold surge within 24 hours, with its market capitalization rising from $130,000 to $2 million, before quickly retreating to around $730,000, failing to generate sufficient market momentum.

EAGLE (1067% Intraday Surge)

EAGLE is the first token related to USD1 on the Ethereum chain, but similarly, this meme token's market cap quickly rose to a peak of $3.74 million before dropping to $1.79 million, with a current price of $0.018.

The following tokens are all projects launched on the Four.Meme platform and are part of the USD1 ecosystem, but those that have not gained meme traction have relatively low market caps and have not generated market heat.

WLFI Officially Announces Cooperation Concepts

LISTA (46.62% Increase)

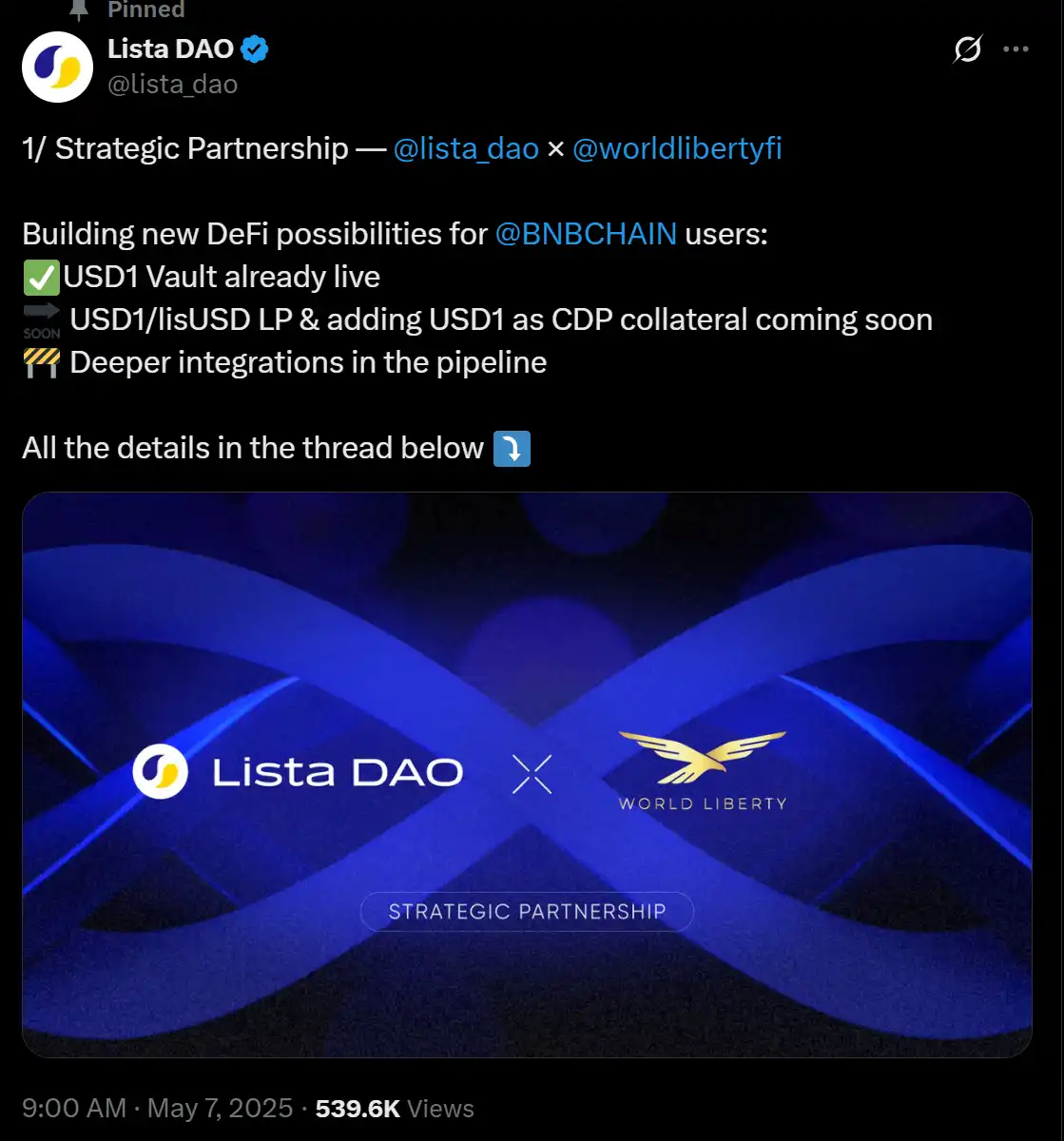

On May 22, LISTA rose by 46.62%, and as early as May 7, official news announced that WLFI had reached a strategic cooperation with Lista DAO. USD1 has officially entered the Lista DAO ecosystem, and USD1 is now live in the ListaDAO treasury.

LISTA focuses on decentralized lending, and if the WLFI ecosystem expands, its liquidity will significantly increase. The Lista DAO lending product, Lista Lending, has launched USD1Vault, marking the first application of USD1 on the BNB Chain.

STO (20% Intraday Increase)

STO officially released plans to create a more flexible cross-chain yield experience based on STONE and USD1. As an infrastructure focused on full-chain liquidity, StakeStone has integrated over 20 chains and 100 protocols, and its yield-bearing token STONE can enhance asset utilization for USD1 users while retaining liquidity. Currently, it has only officially announced cooperation and has not made large-scale purchases.

StakeStone announced on May 9 that it had completed integration with the Trump crypto project WLFI, and its deployer address received a test transfer of 10,000 USD1 from the official USD1 custody address on May 6.

"WLFI Purchase" Concept

World Liberty Financial began aggressively purchasing crypto assets in December last year. Here are some of the main assets it has acquired:

Related reading: "Spending $45 million on crypto: Who is behind the Trump project WLFI?"

TRX

- On January 21, 2025, WLFI purchased $4.7 million worth of TRX, approximately 19.58 million TRX.

- On January 22, it made an additional purchase of approximately $2.62 million worth of TRX, about 10.8 million, bringing its total TRX holdings to 30.1 million TRX.

- On January 24, 2025, WLFI purchased another 10.61 million TRX, worth $2.65 million.

The total purchase quantity is approximately 40.99 million TRX.

On March 18, WLFI officially announced the inclusion of BTC, ETH, TRX, LINK, SUI, and ONDO in their strategic reserve assets. By May 1, co-founder Zack Witkoff revealed in an interview with Cointelegraph that USD1 would also be natively deployed on the Tron chain, further expanding its multi-chain layout.

Vaulta (A)

On May 14, the original EOS was renamed to EOS, with the token supporting 1:1 wear-free exchanges and no changes to token economics. The Trump family crypto project WLFI purchased $3 million worth of EOS through the BSC ecosystem DEX protocol Pancake, and also bought $3 million worth of Vaulta (A) through the exSat ecosystem DEX protocol 1DEX.

WLFI purchased approximately 7.386 million Vaulta (A) (including 3.636 million EOS and 3.75 million Vaulta A), with a total value of approximately $6 million USDT (about $6 million).

LINK

- On December 12, 2024, WLFI purchased 41,335 LINK for $1 million USDC.

- On December 13, 2024, WLFI made an additional purchase of 37,052 LINK for $1 million USDC.

- On January 21, 2025, it purchased LINK worth $4.7 million USDC.

The total purchase quantity is approximately 256,314 LINK, with a total value of about $6.7 million USDC.

AAVE

On December 12, 2024, WLFI purchased 3,357 AAVE for $1 million USDC.

On January 21, 2025, WLFI purchased AAVE worth $4.7 million USDC.

WLFI has purchased approximately 17,730 AAVE in total, with a total value of $5.7 million USDC.

SEI

- On February 20, 2025, spent $125,000 USDC to purchase 547,990 SEI.

- On March 15, 2025, spent $100,000 USDC to purchase 541,242 SEI.

- On April 13, 2025, purchased $775,000 worth of SEI.

In the past three months, WLFI has spent approximately 1 million USDC to purchase 5.983 million SEI through three transactions, with an average price of $0.167.

AVAX

On March 16, 2025, WLFI spent $2 million USDT to purchase 103,911 AVAX.

MNT

MNT was purchased twice in March 2025, on the 16th for $2 million and on the 23rd for $3 million, totaling approximately 5.99 million MNT, with a total value of $5 million U.

ENA

On January 21, 2025, spent $2 million USDC to purchase ENA.

ONDO

On January 21, 2025, WLFI spent $2 million USDC to purchase ONDO.

MOVE

On January 29, 2025, WLFI spent $1.9 million USDC to purchase MOVE, and in February 2025, purchased MOVE for $286,000 USDC.

Market sentiment is high. USD1 ecosystem tokens such as BUILDon, usd1doge, and wlfidoge have attracted significant market attention with several-fold increases in a short period. At the same time, projects like LISTA and STO, which cooperate with or integrate USD1 applications, are also beginning to gain attention.

Currently, a new narrative surrounding USD1 and WLFI is gradually forming, positioning itself to seize potential Alpha opportunities and become a pioneer in the next round of hot market rotations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。