On May 22, 2025, Bitcoin (BTC) made a strong breakthrough in the Asian morning session, surging past $110,000 to reach $111,880, setting a new historical high. With institutions continuously increasing their positions, the strong inflow of capital into spot ETFs, and a warming macroeconomic outlook, Bitcoin's upward momentum seems unstoppable. However, on-chain data remains moderate, altcoins are underperforming, and high leverage risks are accumulating, signaling that the market may be at a critical juncture between the beginning of a trend and its peak.

Institutions and ETFs: A Flood of Capital Driving New Bull Market Highs

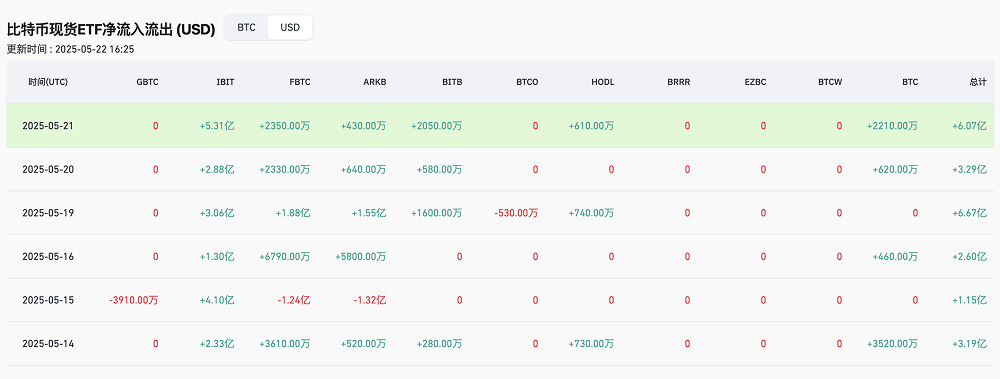

This week, Bitcoin spot ETFs have become the market focus. According to Coinglass data, as of May 21, U.S. spot Bitcoin ETFs recorded net inflows for six consecutive days, accumulating over $2 billion, which has increased their share of Bitcoin's total market capitalization to 6%. The BlackRock iShares Bitcoin ETF (IBIT) leads the market, with assets nearing $43 billion and a trading volume exceeding $750 billion since its launch in January 2024. The continuous accumulation by traditional financial giants has injected strong confidence into the market, with institutions like Strategy and Twenty One Capital frequently increasing their holdings.

The Bitcoin futures market at the Chicago Mercantile Exchange (CME) is also exceptionally active, with open interest reaching a historical high of $34 billion. Matrixport analysis indicates that the current funding rate is close to zero, suggesting that this round of price increase is primarily driven by spot buying rather than high-leverage speculation. This reduces the risk of severe pullbacks due to leverage liquidations in the short term, keeping volatility at a low level. However, on-chain analyst Yu Jin has detected that some high-leverage whales have begun to reduce their positions, with one whale closing a 40x leveraged long position of 2,139 BTC on May 21, reducing the position's value from $830 million to $600 million.

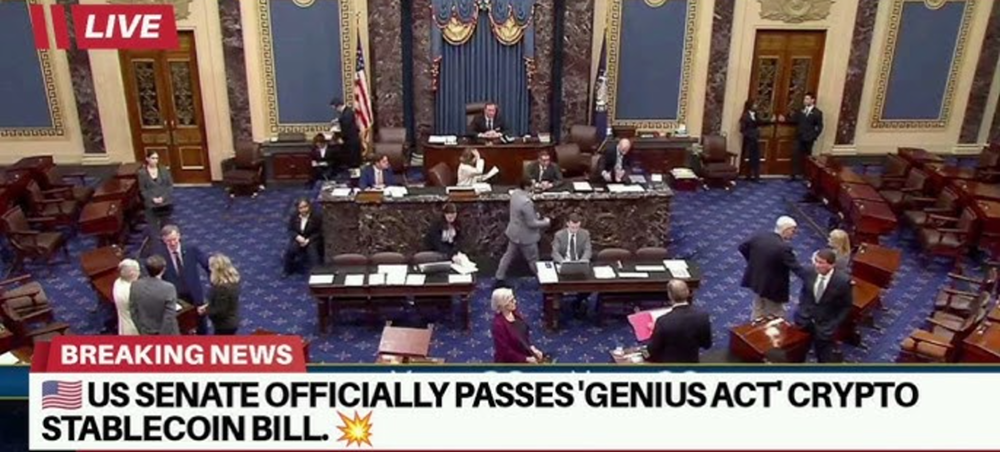

Stablecoin Bill Passed: A Potential Catalyst for Bitcoin Prices

On May 20, 2025, the U.S. Congress passed the Stablecoin Transparency and Oversight Act, introducing a clear regulatory framework for the stablecoin market, requiring issuers to have 100% reserves and to regularly disclose asset compositions. This move is seen as a milestone towards compliance in the crypto market, having a profound impact on the subsequent price movements of Bitcoin. The bill reduces systemic risks associated with stablecoins, enhances investor confidence in the crypto ecosystem, and indirectly boosts BTC's demand as "digital gold." Glassnode data shows that after the bill's passage, on-chain transfers of USDT and USDC surged by 12%, reflecting accelerated capital inflow into the crypto market, with BTC absorbing most of the incremental funds. Analysis firm Messari points out that the compliance of stablecoins may attract traditional financial institutions to participate more deeply in the BTC market, with an expected influx of new institutional funds reaching $5 billion in the second quarter of 2025.

On-Chain Data: Hidden Concerns Amid Moderate Signals

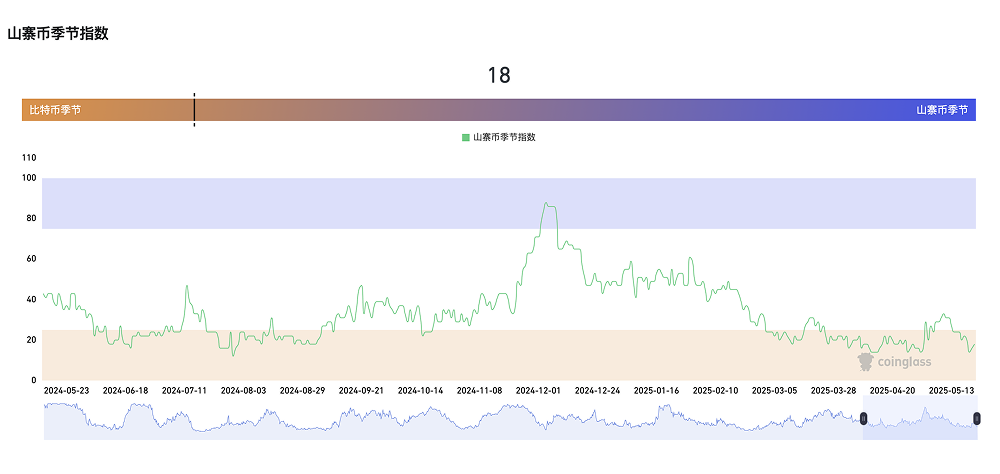

From on-chain data, the Bitcoin network is currently in a healthy but not overheated state. Sentora (formerly IntoTheBlock) data shows that 99% of BTC holders are in profit, indicating high market confidence. However, the fast confirmation times and low transaction fees suggest that on-chain transactions have not yet reached congestion levels. This contrasts with the frenzied atmosphere at the peak of the 2021 bull market, hinting that the current upward trend may still be in its early stages. CryptoQuant's CEO notes that the current market is not a traditional "altcoin season," with funds more concentrated in mainstream assets like BTC rather than spreading broadly.

It is worth noting that risks in high-leverage areas are accumulating. On-chain data shows that some whales are taking profits and reducing their positions at high levels, indicating market vigilance towards short-term pullbacks. Veteran trader Peter Brandt warns that BTC prices may pull back to $76,614 during the trend, although he maintains a bullish outlook, setting a short-term target price at $125,000.

Altcoins: A Late Party?

Despite BTC hitting new highs, the altcoin market has failed to dance in sync. Eugene Ng Ah Sio points out that altcoin holders are exhibiting "extreme anxiety," eager to sell, leading to rapid price declines back to lows. Currently, BTC's dominance is around 56%, significantly higher than levels during altcoin seasons, indicating that capital has not yet fully flowed into altcoins. Historical data shows that altcoin seasons typically start after BTC stabilizes at high levels; for example, in May 2021, the total market capitalization of the top 100 altcoins reached 1.3 times that of BTC.

However, the 2025 altcoin season may be delayed due to the ongoing capital inflow into BTC spot ETFs. Nevertheless, applications for ETFs of mainstream altcoins like XRP and ETH are accelerating. Institutions such as Grayscale, CoinShares, and ProShares have submitted applications for XRP spot ETFs to the SEC, and the first-day trading volume of CME's XRP futures contracts exceeded $19 million, indicating growing institutional interest in altcoins. Siemer analysis suggests that for altcoins to replicate the breakthroughs of 2021, they need to improve adoption and revenue generation by several orders of magnitude, a process that may take three years. In the short term, high-market-cap altcoins like ETH and SOL may rebound first, but the overall arrival of an altcoin season still requires BTC to stabilize further.

Price Predictions: A Game of Optimism and Rationality

Predictions from institutions and analysts regarding Bitcoin's future movements show divergence but are generally bullish. Standard Chartered and Bernstein expect BTC to reach $200,000 in this bull market, Tim Draper predicts $250,000, and Arthur Hayes believes it could break $150,000 within the year. More aggressive predictions come from Blockstream CEO Adam Back ($500,000 to $1 million) and BlackRock CEO Larry Fink ($700,000). Coinbase's CEO even suggested that BTC could potentially reach several million dollars in the future.

However, rational voices remind the market to stay calm. Bitfinex predicts that BTC could reach $145,000 to $200,000 by mid-2025, but short-term volatility is inevitable. Pantera Capital expects BTC to reach $117,000 by August 2025, close to the current price, indicating that a phase of consolidation may occur in the short term.

Conclusion: Beginning of a Trend or Peak?

Bitcoin's breakthrough of $110,000 marks another milestone in this bull market. The influx of institutional capital, the strong capital absorption of ETFs, and the improved policy environment have collectively built the upward momentum for BTC. However, the moderate on-chain data, the underperformance of altcoins, and the accumulation of high-leverage risks suggest that the market has not yet entered a phase of full frenzy. The 2025 crypto market may present a pattern of BTC leading the way, with quality altcoins gradually catching up, but short-term volatility and pullback risks still need to be heeded.

In this climate of high expectations, investors need to remain calm, focus on structural changes and macro variables, and adjust their strategies flexibly. Bitcoin's next targets may be $125,000, $150,000, or even higher, but the road to the top is never smooth. Only with rationality and patience can opportunities be captured amid volatility.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。