This report is authored by Tiger Research and provides an in-depth analysis of the key trends from the TOKEN2049 Dubai conference, revealing that stablecoins are rising as a key infrastructure while the crypto industry gradually shifts from speculation to practical applications.

Key Takeaways

Stablecoins have become core infrastructure. Once narrative-driven, stablecoins now demonstrate clear product-market fit and are establishing their position as a core component of the digital economy.

AI expectations exceed actual developments. Although AI was a significant theme at the conference (accounting for 11% of the agenda), many attendees pointed out that the gap between industry hype and actual progress is widening.

The industry is entering a structurally mature phase. The crypto industry is transitioning from a speculative "frontier era" to a phase focused on infrastructure development and practical use cases. The market's demand for validated applications and clear value propositions is gradually surpassing expectations for conceptual innovations.

1. TOKEN2049: A Strategic Barometer for Web3 Market Direction

Source: Token2049

According to the research report, TOKEN2049 Dubai 2025 has once again solidified its status as a premier global crypto industry event, attracting over 15,000 participants from more than 160 countries. The two-day conference featured a series of high-profile speeches and discussions, reflecting the evolution of market dynamics and the rise of emerging trends.

As an important forum for the industry, TOKEN2049 is seen as a barometer for the future direction and narrative shifts of the Web3 market. This report systematically reviews the main content of TOKEN2049 Dubai 2025, categorizing and deeply analyzing key announcements by core themes while capturing changes in overall ecosystem priorities, providing strategic insights to help interpret the industry's future potential direction.

2. Emerging Trends: What Does the Agenda Reveal?

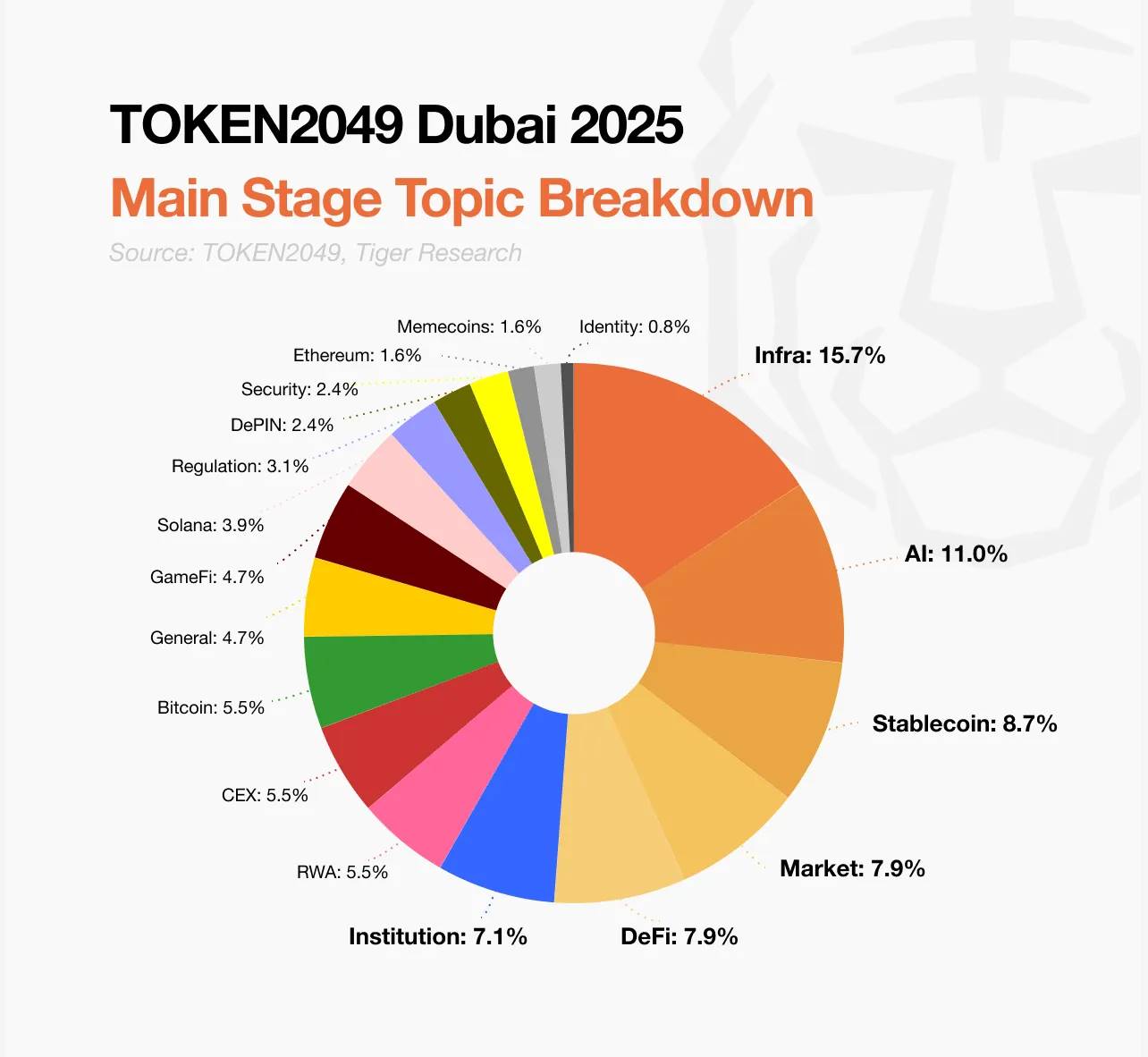

Source: TOKEN2049, Tiger Research

TOKEN2049 Dubai 2025 covered a wide range of blockchain topics, showcasing the evolution of industry priorities. Infrastructure-related themes accounted for the largest share (15.7%), followed by AI (11%). Although initial enthusiasm around AI agents has cooled, ongoing efforts to integrate AI with blockchain indicate that this theme remains structurally significant.

Notably, the combined proportion of stablecoins (8.7%) and real-world assets (RWA, 5.5%) has surpassed that of AI. This reflects a growing market interest in blockchain applications with direct utility. In particular, stablecoins are gaining attention for their practical value in payments and settlements, while RWAs are emerging as a leading category for the next generation of blockchain applications.

dYdX founder Antonio discussed hot topics: "Is DeFi swallowing CeFi? Slowly yet suddenly." Source: dYdX

In this year's DeFi discussions, industry perspectives were more mature compared to previous years. Instead of focusing on replacing traditional finance, the discussions shifted to how decentralized systems can complement existing institutions. This aligns with the broader industry trend towards regulatory engagement and institutional adoption.

A notable change is the increasing focus on the Solana ecosystem. Despite suffering significant setbacks during the FTX collapse, the Solana ecosystem has successfully rebounded, currently enjoying a presence and technical discussion intensity on stage that even surpasses Ethereum. This shift in ecosystem dynamics is worth close attention, as it could mark a turning point in the Layer 1 blockchain landscape.

Overall, the main stage of the conference showcased a more grounded and pragmatic mindset. While eye-catching elements like meme coins and celebrity appearances still existed, they were merely secondary. Core discussions revolved around long-term growth drivers, including regulation, financial integration, infrastructure development, and artificial intelligence.

3. Deep Changes Beyond the Spotlight

As in previous years, the most significant developments often occur offstage. Side events and closed-door meetings revealed deeper industry trends, strategic reshaping, and foundational directional shifts—factors that often have profound impacts on the market before they enter the public narrative.

3.1 Stablecoins Have Become Infrastructure

Stablecoins have now established themselves as core infrastructure for the digital economy and are viewed as a key opportunity in the Web3 space. An increasing number of viewpoints suggest that stablecoin trading will expand from on-chain activities into the real economy, potentially forming a market worth trillions of dollars. This prospect is attracting more participants into the stablecoin space.

As this viewpoint solidifies, the industry's focus has shifted from simple integration to control over the payment layer. The goal is not just to issue stablecoins but to extend to building end-to-end financial infrastructure. Web3 projects and institutions are ramping up efforts to secure leadership positions within the stablecoin technology stack.

Although still in the early stages, this shift has already prompted ecosystems like Solana, Tron, and TON to accelerate their establishment as foundational settlement platforms. Their strategies encompass not only the issuance of stablecoins but also wallet development, payment infrastructure construction, and institutional adoption.

3.2 AI in Crypto: Exciting but Still Experimental

In discussions about AI, a cautious tone was prevalent. Many attendees pointed out that the gap between market enthusiasm and the maturity of current technological developments is widening. In particular, some AI agent projects were criticized for lacking clear use cases, further deepening the perception that much of the activity in this field remains speculative in nature.

Despite these concerns, there is long-term confidence in Web3's potential role in the AI market. Concepts such as decentralized AI computing and open-source agent frameworks are viewed as areas with practical potential. These are seen as long-term opportunities rather than short-term trends, expected to gain attention gradually after the current market frenzy subsides.

While AI continues to attract widespread attention, most attendees agreed that a long-term perspective should be taken in this field. The current focus remains on foundational experimentation rather than immediate large-scale applications.

3.3 Node Sales Surge

A notable trend at the conference was the increasing attention on node sales related to physical devices. By opening node operations to a broader audience—previously limited to a select few—these initiatives are seen as an important step towards greater decentralization and redistributing participation opportunities.

However, some attendees expressed skepticism about this trend. They questioned whether these sales are merely retail financing strategies packaged as ecosystem participation. Criticism mainly focused on exaggerated reward structures, unclear token models, and a lack of meaningful network activity to support the sales.

Despite these doubts, several projects still attracted significant capital and attention. However, their long-term viability remains uncertain and will ultimately depend on the actual utility of the networks.

3.4 Technology Is No Longer the Sole Leverage

The gap between technological advancement and market adoption continues to widen. Even teams with strong technical capabilities acknowledge that sustained research alone is insufficient to attract market interest. Many technically mature protocols have failed to gain user attention, while some simple meme coins launched through meme platforms continue to generate stable trading volumes.

In response, industry participants are shifting their focus from research to execution. Increasing efforts are being directed towards developing strategic market entry plans, understanding liquidity flows, establishing exchange relationships, and designing user-friendly token models. While technological excellence remains important, the ability to create meaningful value will be limited without effective distribution strategies.

Market participants are increasingly concerned that short-term returns and immediate utility are taking precedence over long-term innovation. In the current environment, execution capability outweighs potential capability. The market has evolved into a competitive arena where survival cannot be ensured solely by technology.

4. Key Announcements

Tether – Launching a New Compliant USD Stablecoin Plan

Tether CEO Paolo Ardoino announced plans to launch a new USD stablecoin that complies with U.S. regulations, distinct from the existing USDT, expected to be released in 2025-2026. This plan reflects Tether's ongoing efforts in regulatory engagement and includes discussions with U.S. lawmakers.

OKX – Launching OKX Pay and Institutional Collaboration Plans

OKX launched OKX Pay, a self-custodial crypto payment application that offers zero-fee transfers and wallet recovery through split-key technology. Additionally, OKX disclosed several institutional collaborations, including a partnership with Standard Chartered Bank in Dubai's VARA regulatory sandbox, and previewed integration plans with Mastercard and Stripe.

Zodia Custody – Entering the UAE Market and Strengthening Regulatory Cooperation

Zodia announced the acquisition of Tungsten Custody to establish a regulated business base in the UAE. At the same time, Zodia unveiled a new custody partnership with Bybit and jointly released a custody framework with Abu Dhabi regulators.

Mesh – Retail Crypto Payment Integration

Mesh showcased its new integration with Apple Pay, allowing users to pay with cryptocurrencies while merchants receive stablecoins. This feature is based on Mesh's "SmartFunding" solution, set to launch in Q2 2025, aimed at simplifying crypto payment processes in retail environments.

World Liberty Financial and TRON – $2 Billion Stablecoin Investment

Abu Dhabi's MGX Fund completed a $2 billion investment in Binance through the stablecoin USD1. Following the transaction, USD1 will be natively integrated into the TRON ecosystem.

MEXC Ventures – Launching an Ecosystem Development Fund

MEXC Ventures announced the establishment of a $300 million fund, focusing on investments in modular chains, ZK-rollups, and self-custody solutions. This move reflects a renewed interest in infrastructure investment following the market downturn in 2022.

Lightspark – Bitcoin-Based Payment Infrastructure

Former PayPal executive David Marcus launched Spark, a native protocol based on the Bitcoin Lightning Network. This protocol aims to enable fast, low-cost payments, expanding Bitcoin's use cases beyond "value storage."

These announcements align closely with the themes of TOKEN2049. Stablecoins remain a core topic, with Tether's compliance plan and the $2 billion investment case based on stablecoins exemplifying this. Infrastructure development is another major focus, with companies like OKX, Zodia, and MEXC making significant efforts in scalability, custody, and modular architecture.

The functional evolution of Bitcoin is also highlighted through Lightspark's Spark protocol, further driving discussions about Bitcoin's broader application potential. While artificial intelligence held a significant position in the speaking sessions, it was relatively understated in the main announcements. Instead, the emphasis remains on the practical deployment of payments, compliance, and institutional access, marking the industry's ongoing shift from experimental phases to large-scale implementation.

5. From Frontier to Urbanization Stage

This year's conference clearly showcased the transformation of the crypto industry—from speculative enthusiasm to a focus on practicality and infrastructure development. Three key directional themes emerged:

- Stablecoins transcend narrative, becoming the infrastructure of the digital economy

Stablecoins are no longer just a concept; they have demonstrated tangible product-market fit and are gradually establishing their position as core infrastructure of the digital economy.

- AI enthusiasm is high, but market sentiment is becoming cautious

Although artificial intelligence received significant attention at the conference, many attendees pointed out that the gap between market enthusiasm and the actual maturity of AI technology development is widening.

- Dubai solidifies its position as a regulatory and capital hub for Web3

The UAE continues to play a leading role in the global expansion of Web3, with Dubai emerging as an important regulatory and capital hub in this field.

The conference did not introduce a new wave of trends but emphasized the further consolidation of existing narratives, particularly around AI, stablecoins, and real-world assets (RWA). The increase in institutional participation and the continuous improvement of regulatory frameworks indicate that the market is entering a new phase of structural transformation.

The idealistic experimental era is giving way to a phase of pragmatic execution. Just as the transition from frontier economies to urbanized economies is driven by revolutions in transportation and distribution, the Web3 ecosystem is now entering a stage reliant on infrastructure development, system integration, and delivery capabilities.

While attention economics remains an important factor, the market is no longer solely buying into conceptual innovations. Stakeholders are now more eager for practical applications and clear value propositions. This shift marks a broader maturation of the entire ecosystem, paving the way for more stable, long-term development—signifying the arrival of Web3's "urbanization" era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。