Original | Odaily Planet Daily (@OdailyChina)

Early this morning, according to OKX Market, the price of BTC briefly broke through $110,000, with a 24-hour increase of nearly 3%. This means that Bitcoin has lived up to expectations, reaching a new all-time high after four months.

At the same time, Ethereum briefly surpassed $2,600, currently reported at $2,580, with a 24-hour increase of 5.04%; SOL broke through $175, currently reported at $174.8, with a 24-hour increase of 3.60%.

According to the latest data from MarketCap, Bitcoin's market capitalization has returned above $2.1 trillion, currently reaching $2.166 trillion, surpassing e-commerce giant Amazon and rising to fifth place in the global asset market capitalization ranking.

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the total liquidation across the network was $402 million, with long positions liquidated at $189 million and short positions at $213 million. In terms of cryptocurrencies, BTC saw liquidations of $147 million, and ETH saw liquidations of $111 million.

In the process of Bitcoin reaching a new all-time high, the most notable figures are two whale traders, James Wynn and the "50x Insider Whale," who opened opposing positions on Hyperliquid. Below, Odaily Planet Daily will review the high-energy operations of these two whales.

James Wynn and the "50x Insider Whale" Engage in Exciting Long and Short Battles

James Wynn: Long BTC, Long Position Exceeds $1.1 Billion

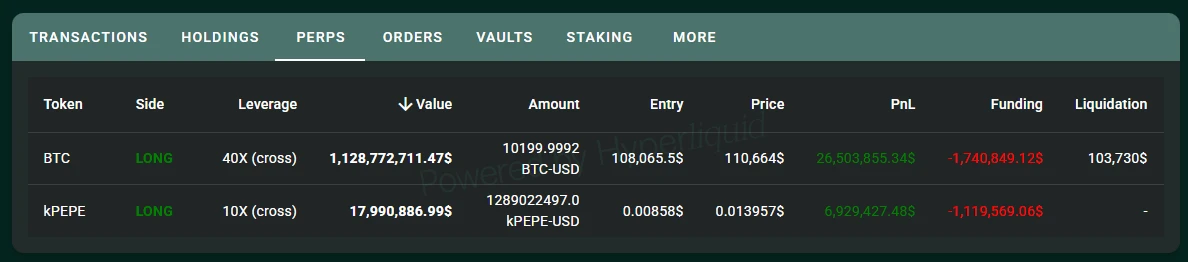

In recent days, as the price of BTC has risen, James Wynn has continuously increased his 40x leveraged BTC long position to 10,199 BTC, with the current position valued at a staggering $1.11 billion, potentially setting a record for the maximum value of a single position on Hyperliquid.

During the early morning, as BTC retraced from its peak to $106,000, his position briefly showed a floating loss of over $10 million. Currently, the opening cost of this long position is $108,065.5, with a liquidation price of $103,780, and a floating profit of up to $26 million.

James Wynn Position Information

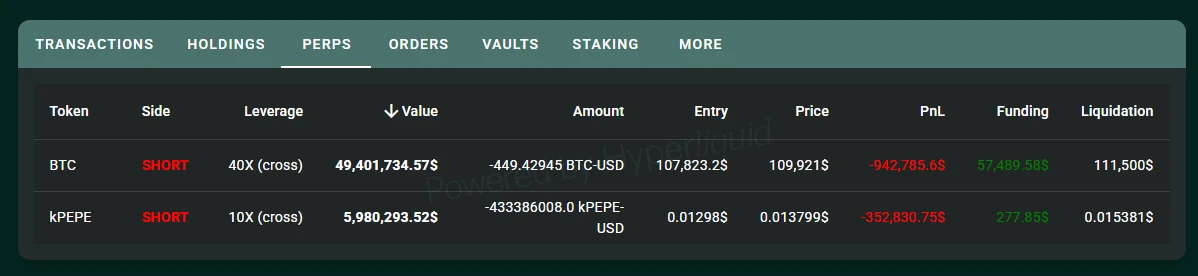

"50x Insider Whale": Short BTC, Reduced Position to Increase Liquidation Price

The "50x Insider Whale" transferred 2.3 million USDC to Hyperliquid as margin at 4 AM yesterday to open a short position of 826 BTC with 40x leverage. As the price of BTC continued to rise, the whale reduced his position by half due to the price increase, but he did not stop shorting; instead, he added another 5 million USDC as margin and increased his short position to 1,097 BTC.

After BTC broke through $110,000, his position was again reduced to 449 BTC. Currently, the average opening price of this short position is $107,823.2, with the liquidation price raised to $111,500, and a current floating loss of nearly $1 million.

"50x Insider Whale" Position Information

This morning, although BTC experienced a retracement, both "whales" did not close their positions but continued to increase their favored direction. Currently, James Wynn has a floating profit of $26 million, while the "50x Insider Whale" has a floating loss of nearly $1 million.

With the "GENIUS Stablecoin Act" entering the final voting stage in the Senate, a new channel that could guide hundreds of billions of dollars into the crypto market is about to open. Meanwhile, the U.S. SEC has also initiated a new round of cryptocurrency regulation formulation, sending unprecedented positive policy signals. Against the backdrop of continuous policy benefits, market confidence has rapidly heated up, further supporting Bitcoin's strong breakout in price.

Bullish Sentiment Prevails, $110,000 May Just Be a New Starting Point

Early this morning, U.S. President Trump posted on Truth Social, stating: "BITCOIN ALL TIME HIGHS, ENJOY!!" to celebrate Bitcoin's new all-time high. Additionally, many notable figures are confident about its future development.

Michael Saylor: Not Buying at Bitcoin's Historical High is a Missed Opportunity

As BTC broke through its historical high, Strategy Executive Chairman Michael Saylor posted on X, stating, "If you are not buying at Bitcoin's historical high, you are missing a great opportunity."

Arthur Hayes: Bitcoin Could Rise to $200,000, U.S. Treasury Policy is the Key Driver

In a recent interview, Arthur Hayes stated that Bitcoin could rise to $200,000, emphasizing that the main driving force behind the current bull market may be U.S. Treasury policy rather than the Federal Reserve. Arthur Hayes analyzed that when the Federal Reserve reduces its purchases of U.S. Treasury bonds, although rising yields lead to tighter market liquidity, the Treasury's debt management and issuance plans could create new market dynamics.

Standard Chartered: U.S. SEC Data Disclosure Supports Bitcoin Reaching $500,000 by 2028

Geoff Kendrick from Standard Chartered stated that the recent 13F filings submitted to the U.S. Securities and Exchange Commission (SEC) support the possibility of Bitcoin's price reaching $500,000 by the end of 2028. Although direct ETF holdings decreased in the first quarter, government agencies increased their holdings in Strategy (formerly MicroStrategy), which is viewed as an alternative asset to Bitcoin. This may reflect that government agencies are still striving to increase Bitcoin holdings despite regulatory restrictions.

PlanB: If the S&P Index Rises to 7,000 Points, Bitcoin Could Reach $300,000

Crypto analyst PlanB released a chart indicating that based on his logarithmic regression model, if the S&P 500 index (SPX) rises to 7,000 points, the corresponding Bitcoin price could reach $300,000. The fitted curve in the chart shows a strong correlation (R²=0.873) between Bitcoin and the S&P index, suggesting that in a scenario where traditional markets strengthen, there is further upward potential for Bitcoin's price. This view is based on historical fitting data and model extrapolation, not investment advice.

CryptoQuant Analyst: No Signs of Overheating in Bitcoin, Still in a Healthy Bull Market

CryptoQuant analyst Avocado stated that there are no signs of overheating during Bitcoin's rebound, which is a clear signal that the market is still in a healthy bull market. "This indicates that market buying sentiment is still favorable for further increases, and now is not the time to consider exiting."

Author of "Rich Dad Poor Dad": Still Buying More Bitcoin, Predicts It Will Rise to $250,000 This Year

Robert Kiyosaki, author of "Rich Dad Poor Dad," posted on X, stating that the central banking system is collapsing, and many banks are going bankrupt, so the value of gold, silver, and Bitcoin will continue to rise. He noted that he is still continuously buying more Bitcoin and predicts that Bitcoin will rise to $250,000 this year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。