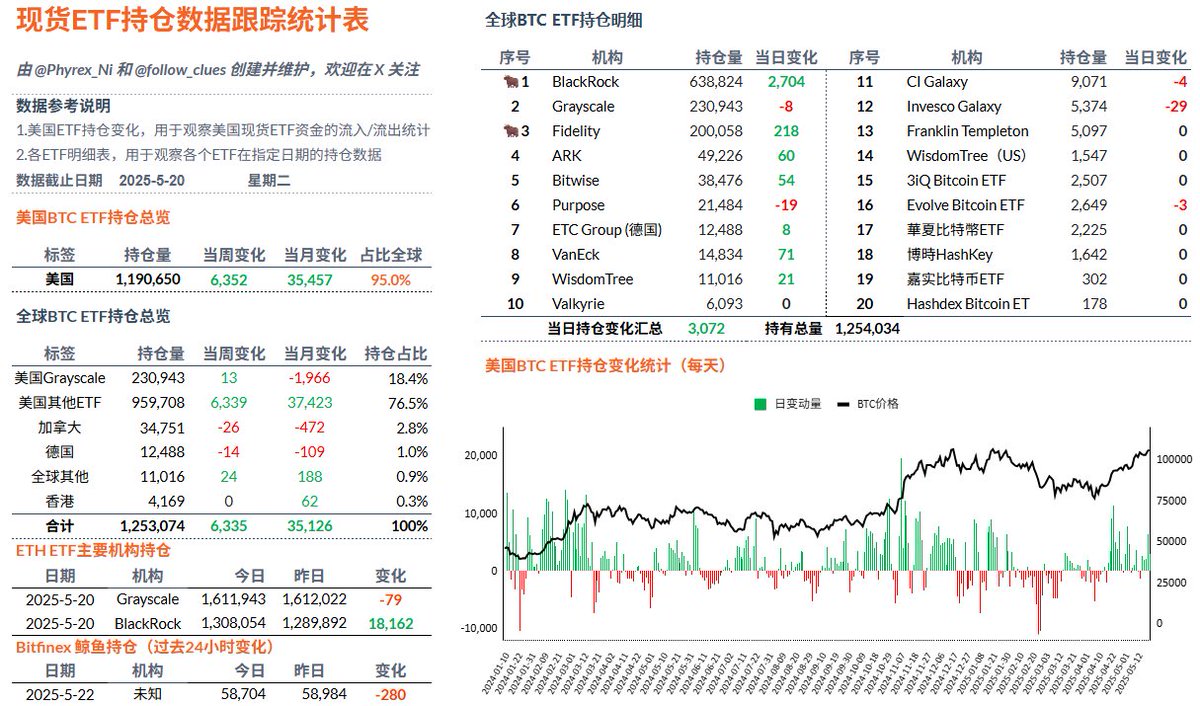

In the past two days, the rise of $BTC has been quite impressive. Although the spot ETF did not continue the strong buying power from Monday yesterday, the gap for BlackRock's investors is not significant. The buying volume from Fidelity and ARK has decreased, and among the 12 ETF institutions in the U.S., 5 have shown no change, while two have reduced their holdings by a total of 37 units. Overall, investors still seem to be in a wait-and-see state.

It's uncertain whether this is related to the recent bond purchases, but ETF investors do not appear to be in a rush for Bitcoin to break new highs, which is a stark contrast to the situation before and after last year's election. Even from a bird's-eye view, the increase in $MSTR does not keep pace with BTC, suggesting that the sentiment among U.S. stocks and traditional investors may not be very positive.

However, the buying situation among cryptocurrency investors is quite good. Yesterday, BTC surged to $107,000, but neither ETF nor MSTR investors showed any signs of FOMO.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。