On the evening of May 21, the day before Trump's dinner, Bitcoin once again broke its historical high after 121 days, reaching a price of $109,432, a cumulative increase of 46.35% since it bottomed out at $74,508 on April 9.

Recently, Bitcoin's price has repeatedly surpassed $107,000, just a step away from the historical high of $109,114 set at the beginning of the year. Since entering May, Bitcoin has frequently crossed the $100,000 mark, with prices oscillating at high levels, ultimately breaking the historical high under the resonance of favorable global policies and capital flows.

Unlike the rollercoaster market of 2021, this round of price increase shows stronger resilience and structural characteristics—dominated not only by spot funds but also with the open interest rising to a historical high of $34 billion, while the funding rate has remained close to zero, indicating that the market has not been excessively leveraged.

The low leverage and high trading volume pattern means limited speculative bubbles and more solid price support, making this round of market activity relatively mild in volatility. An increasing number of analysts point out that the BTC market structure is quietly changing: short-term speculation is retreating, and institutions and long-term holders are becoming the dominant forces, gradually establishing a new buying logic.

Against the backdrop of Moody's downgrade of the U.S. sovereign rating and rising global market risk aversion, Bitcoin's ability to rise against the trend further reinforces its "digital gold" attribute—the narrative as an anti-inflation and safe-haven asset is gaining more consensus and may become the main bullish line in the coming months.

Favorable Policies Combined with Improved Trade Environment

On May 12, a joint statement was released following the China-U.S. Geneva trade talks, temporarily pressing down the most significant uncertainty affecting financial markets this year.

The talks significantly reduced the bilateral tariff levels, with the U.S. canceling a total of 91% of the additional tariffs, while China correspondingly canceled 91% of its counter-tariffs; the U.S. also suspended the implementation of a 24% "reciprocal tariff," and China similarly suspended its 24% counter-tariff.

The market reacted positively as soon as the joint statement was released: the Nasdaq 100 index futures rose over 3%, the Hong Kong Hang Seng Index surged during trading, with technology and consumer stocks leading the way, while gold prices fell sharply. This translated into the crypto market, where Bitcoin has stabilized above the $100,000 mark since May 12, continuously building momentum for this new high.

In addition to the improvement in the trade environment, several favorable policies have also emerged recently in the U.S.

On May 20, the U.S. Senate voted to pass a "cloture motion" to formally review the "GENIUS Act," with at least 15 Democratic senators changing their stance to vote in favor, including Cortez Masto, Adam Schiff, and Mark Warner. The bill will now enter a comprehensive review process, having only passed the "cloture motion" so far; the bill itself has not yet been approved. The "GENIUS Act" will next enter the debate and amendment phase in the Senate.

Arthur Hayes, co-founder of BitMEX, stated at this year's Token2049 conference that investors should thank the U.S. monetary authorities. He believes inflation may continue, and the market generally sees this as favorable for assets like Bitcoin. In an interview, he also pointed out, "I think the current market environment is very suitable for the rise of risk assets, just as we saw from the third quarter of 2022 to early 2025."

Analysis shows that the current market presents a complex game: on one hand, the high-interest-rate environment continues to suppress investors' interest in high-risk assets like cryptocurrencies; on the other hand, geopolitical risks combined with inflation expectations are driving some funds to use Bitcoin as a "digital gold" hedge.

Notably, the Federal Reserve's policy statement for the first time mentioned that it "will consider a wide range of economic data rather than a single indicator," which the market interprets as a potential shift towards easing when clear signs of economic slowdown emerge. Currently, CME interest rate futures show that the probability of a rate cut in September has risen to 68%, an increase of 12 percentage points since the decision. The correlation between the crypto market and traditional financial markets continues to strengthen, with macro policy changes becoming a key variable influencing digital asset prices.

In addition to the Fed's rate cut expectations, the market has also welcomed a certain favorable outcome, namely the initial success of tariff negotiations. On May 8, the UK and the U.S. reached an agreement on tariff trade agreement terms, with the UK government agreeing to make concessions on imports of U.S. food and agricultural products in exchange for the U.S. reducing tariffs on UK car exports.

According to CNBC, U.S. Treasury Secretary Yellen stated in an interview on Monday that he expects progress in U.S.-China trade negotiations in the coming weeks and pointed out that Trump's 145% tariffs on China cannot be maintained long-term. This indicates that the Trump administration has some room for easing in tariff policy, which is beneficial for the stable development of the crypto market.

Bitcoin ETF Funds Reach Historical Highs

Bitcoin ETF funds have seen continuous net inflows since mid-April, with a total net inflow of over $1.34 billion in the past four trading days alone. Over the past five weeks, the total net inflow into Bitcoin ETFs has reached $6.63 billion. Historical data shows that this is usually a strong bullish signal for future Bitcoin price increases.

On May 20, the cumulative net inflow into Bitcoin spot ETFs surpassed $42.416 billion, setting a new historical high. Previously, the total net inflow into Bitcoin spot ETFs reached a phase historical high of $40.78 billion on February 7, and the net outflow during the market's low period over the past three months has been completely recovered.

According to Bloomberg analyst James Seyffart's post on platform X, Bitwise plans to launch a yield-generating ETF based on crypto options, with related applications submitted, including Ethereum and Bitcoin options ETFs, as well as an ETF targeting thematic cryptocurrency stocks.

Public Companies and Bitcoin Reserve Plans in U.S. States

Bitcoin has welcomed a continuous "big buyer."

MicroStrategy has been a steadfast buyer of Bitcoin, announcing on May 2 that it plans to launch an ambitious "42/42 plan," aiming to raise $84 billion over two years to purchase Bitcoin, following last year's implementation of the $42 billion "21/21 plan." As of May 18, 2025, MicroStrategy holds 576,230 Bitcoins, with a total purchase price of approximately $40.18 billion, averaging about $69,726 per Bitcoin.

Additionally, Japanese listed company Metaplanet recently announced an investment of $53.4 million to acquire an additional 555 BTC. It also issued ordinary bonds worth $25 million to fund additional Bitcoin purchases. On May 19, Metaplanet purchased an additional 1,004 Bitcoins, totaling 15.195 billion yen, with an average price of about 15.13 million yen per Bitcoin. To date, the company has accumulated 7,800 Bitcoins, with a historical average purchase price of 13.51 million yen per Bitcoin, surpassing El Salvador's holdings of 6,714 Bitcoins.

Furthermore, Harsh Bharwani, CEO of Indian listed company Jetking, stated that it is raising billions of dollars to purchase 18,000 BTC. The CEO of Jetking said, "In the next six months, we plan to raise funds and scale up to about 180 Bitcoins. In the coming year, we will reach a scale of about 1,800 Bitcoins. Ultimately, around 2030, using various tools and resources at our disposal, we will reach a scale of about 18,000 Bitcoins."

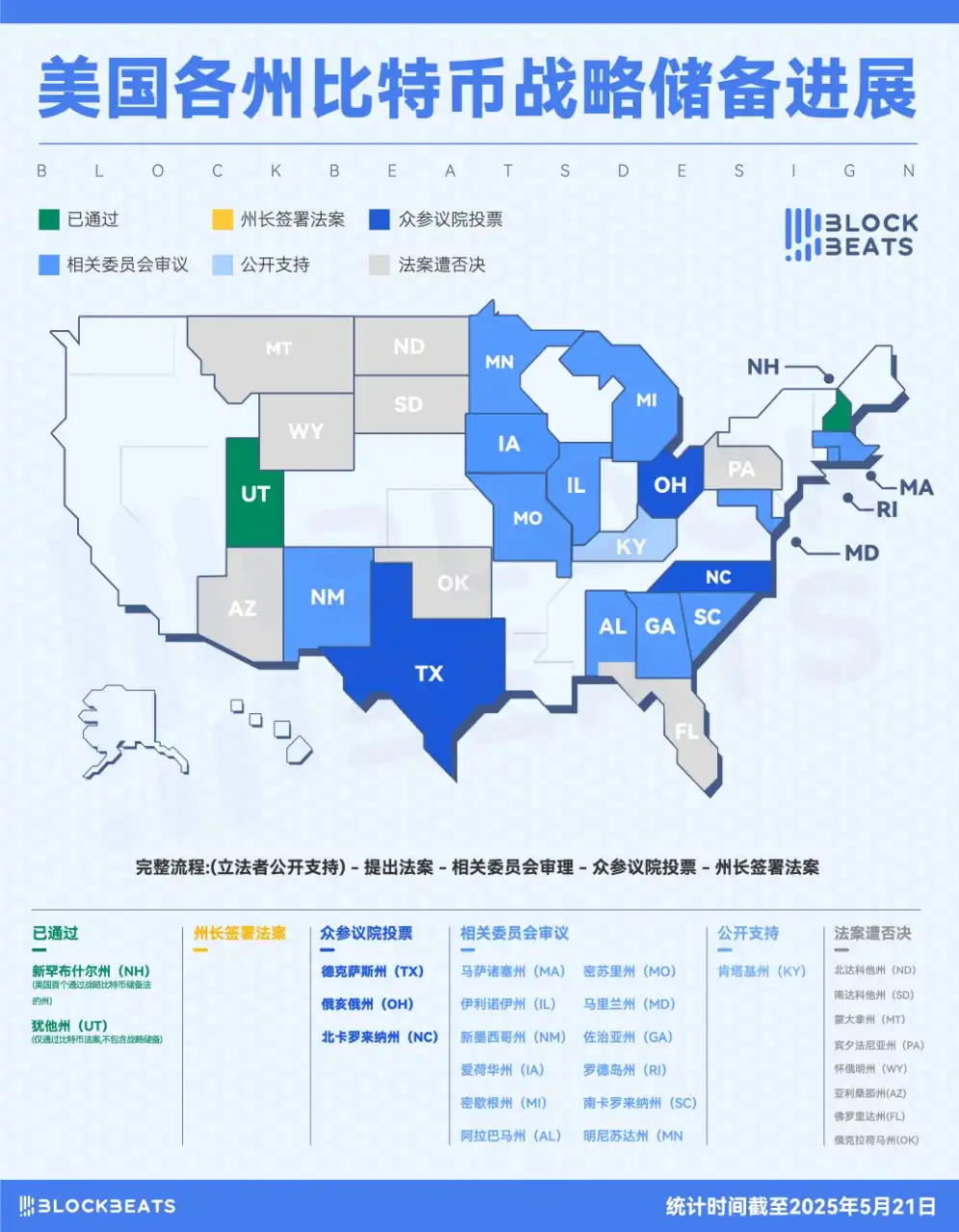

In addition to the continuously buying MicroStrategy and other listed companies, various U.S. states are also advancing Bitcoin strategic reserve laws. At the federal level, Trump signed an executive order in March requiring the establishment of a strategic Bitcoin reserve and digital asset inventory.

On May 7, New Hampshire became the first state in the U.S. to pass a strategic Bitcoin reserve law, authorizing state financial officials to purchase the world's largest digital asset directly or through exchange-traded products (ETPs).

Today, Texas's strategic Bitcoin reserve bill SB 21 passed its second reading in the House. The process after the second reading is: third reading vote (final approval by the House) → sent to the Senate (third reading process repeats) → if the versions of both houses are inconsistent, mediation and revision will occur → finally sent to the governor for signature and enactment.

This bill is an important legislative measure for Texas to establish a strategic Bitcoin reserve, having completed all committee review procedures and is just one step away from final approval.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。