Preface: Investment carries risks, and operations should be conducted with caution.

Article review takes time, and there may be delays in publication. The article is for reference only, and you are welcome to read!

Article writing time: May 21, 12:44 PM Beijing Time

Market Information

- The U.S. spot BTC ETF has seen a net inflow for four consecutive trading days, reaching $1.372 billion;

- The Texas House of Representatives passed a second reading to establish a strategic Bitcoin reserve;

- Michael Saylor stated, "Bitcoin represents the greatest digital transformation of the 21st century";

- "Fed mouthpiece" Nick Timiraos: Core PCE is expected to rise by about 0.13% in April;

- Musk: There is no conflict of interest between the Efficiency Department and my business;

Market Review

Previously, we mentioned that Bitcoin faced pressure around 105,000. The short positions we had previously notified offline have exited, and those who did not exit in time online have basically hit their stop losses. After this wave of high-pressure fluctuations, the market is slowly standing above the pressure level, with the current highest point at 107,292. There are no signs of a downturn in the large-scale closing, and Bitcoin is expected to continue to rise; the short position layout around 2,700 for Ethereum has still yielded a profit of 250, reaching the target near 2,450, with the lowest point for Ethereum at 2,312, followed by a rebound. The current price is fluctuating around 2,534;

Market Analysis

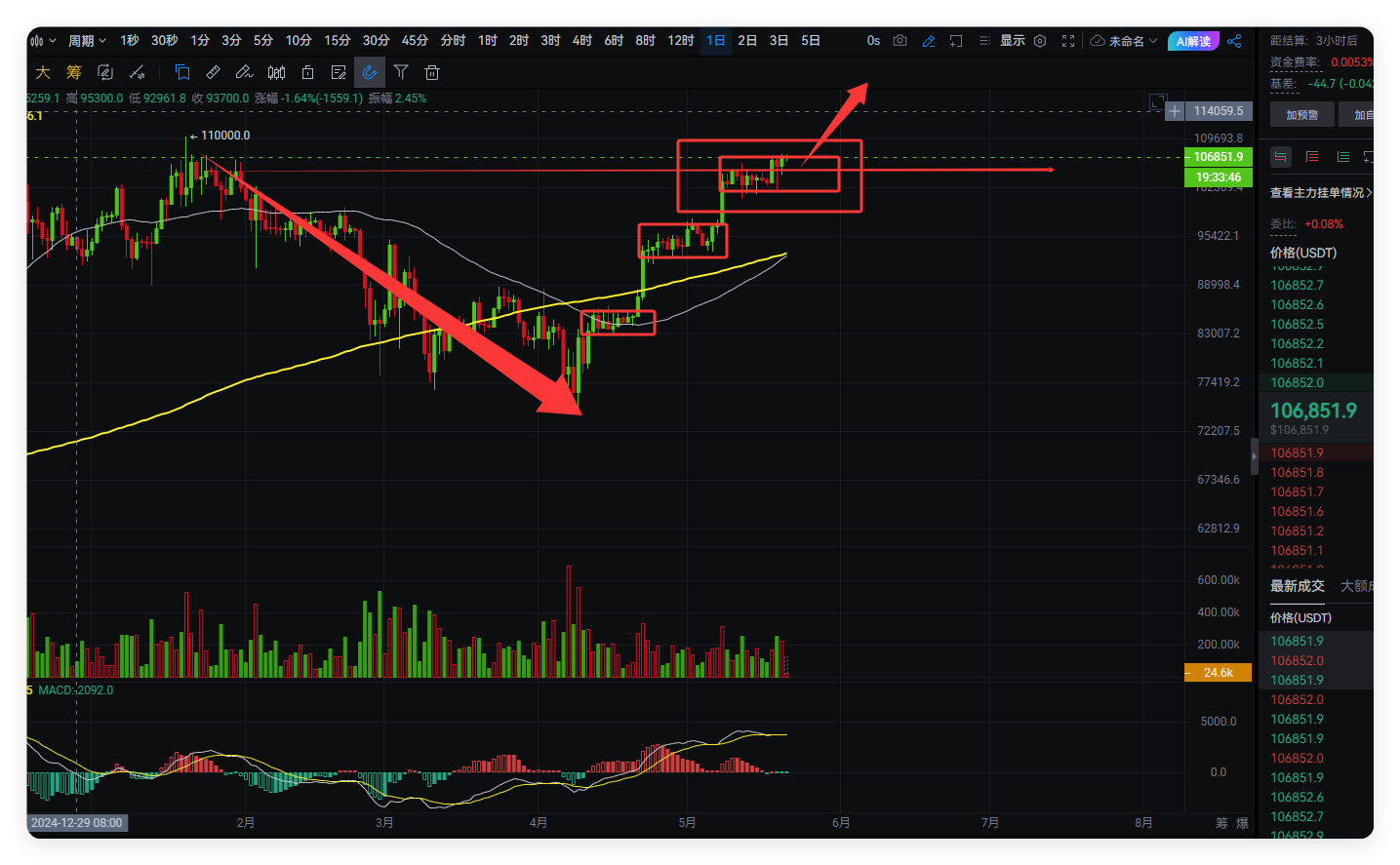

Bitcoin:

Bitcoin has been fluctuating at high levels and has stabilized above the pressure level of 105,000. The daily closing in recent days has shown strong bullish momentum. This wave of Bitcoin's rise has basically not provided any pullback opportunities, only high-level fluctuations after rebounds, continuing to rise in a stair-step manner. Currently, Bitcoin's trend is also showing high-level fluctuations, with daily closing indicating bullishness. With the stabilization above 105,000, the opportunity for a rebound is imminent. The main trading strategy is to go long, and entering directly can yield profits. It is recommended to enter around 106,800, with a stop loss at 105,000, and the target is to look for new highs. Please manage your entry opportunities; for short-term trading, control risks and manage your own profits and losses;

Ethereum:

Ethereum's trend is slightly weaker. After facing pressure around 2,745, a small pullback occurred, and our short position also exited with profit. Subsequently, Ethereum rebounded and returned above the support level of 2,425. Currently, the daily trend has formed two bottoming candles, and a rebound is expected to follow. The trading strategy for Ethereum is also to go long, and entering at the current price of 2,550 is feasible, with a stop loss at 2,480. The initial target is to look for a breakout at 2,750, and if it breaks, aim for around 3,070. Please manage your entry opportunities; for short-term trading, control risks and manage your own profits and losses;

In summary:

Both Bitcoin and Ethereum currently show bullish trends and are about to make higher rebounds. Pay attention to entry opportunities;

The article is time-sensitive, be aware of risks, and the above is only personal advice for reference!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

If you don't like it, you must have your own standards for what you like. All negativity is the opposite of positive perception. The matter itself is not important; what matters is what changes you can achieve through it and what impact it can have! Some people prefer one-sided trends, some prefer fluctuations, some excel in rising markets, while others are obsessed with falling markets. No one is absolutely right, and no one is absolutely wrong. If you don't like it, it doesn't meet your standards; what you can't do may be what others excel at.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。