Source: Cointelegraph

Original: “Ethereum (ETH) Price Indicator Turns Bullish, Historical Indicator Led to 90% Surge”

Key Points:

A bullish flag pattern is forming on the Ethereum daily chart, with a potential breakout above $3,600.

If Ethereum reclaims the middle line of the two-week Gaussian channel, it could trigger a strong rally of 90%.

Currently, Ethereum's price is consolidating in the range of $2,400 to $2,750 on the daily chart, forming a typical bullish flag pattern, targeting the resistance zone of $3,000 to $3,100. The bullish flag is a continuation pattern that follows a rapid rise from $1,900 to $2,730 (the black flagpole), while the current consolidation range constitutes the flag portion.

Ethereum Daily Chart. Source: Cointelegraph/TradingView

If the price successfully breaks through the $2,600 resistance level, the theoretical target price could reach $3,600 (calculated by adding the flagpole height to the breakout point), but the current market focus remains on the key resistance zone of $3,100-$3,000.

The 200-day Exponential Moving Average (EMA) provides support for the lower range. The Relative Strength Index (RSI) is still close to the overbought area but has noticeably cooled off in recent days.

A breakout in ETH accompanied by a simultaneous rise in RSI and volume would strongly confirm this bullish trend, while a drop below $2,400 could invalidate the pattern.

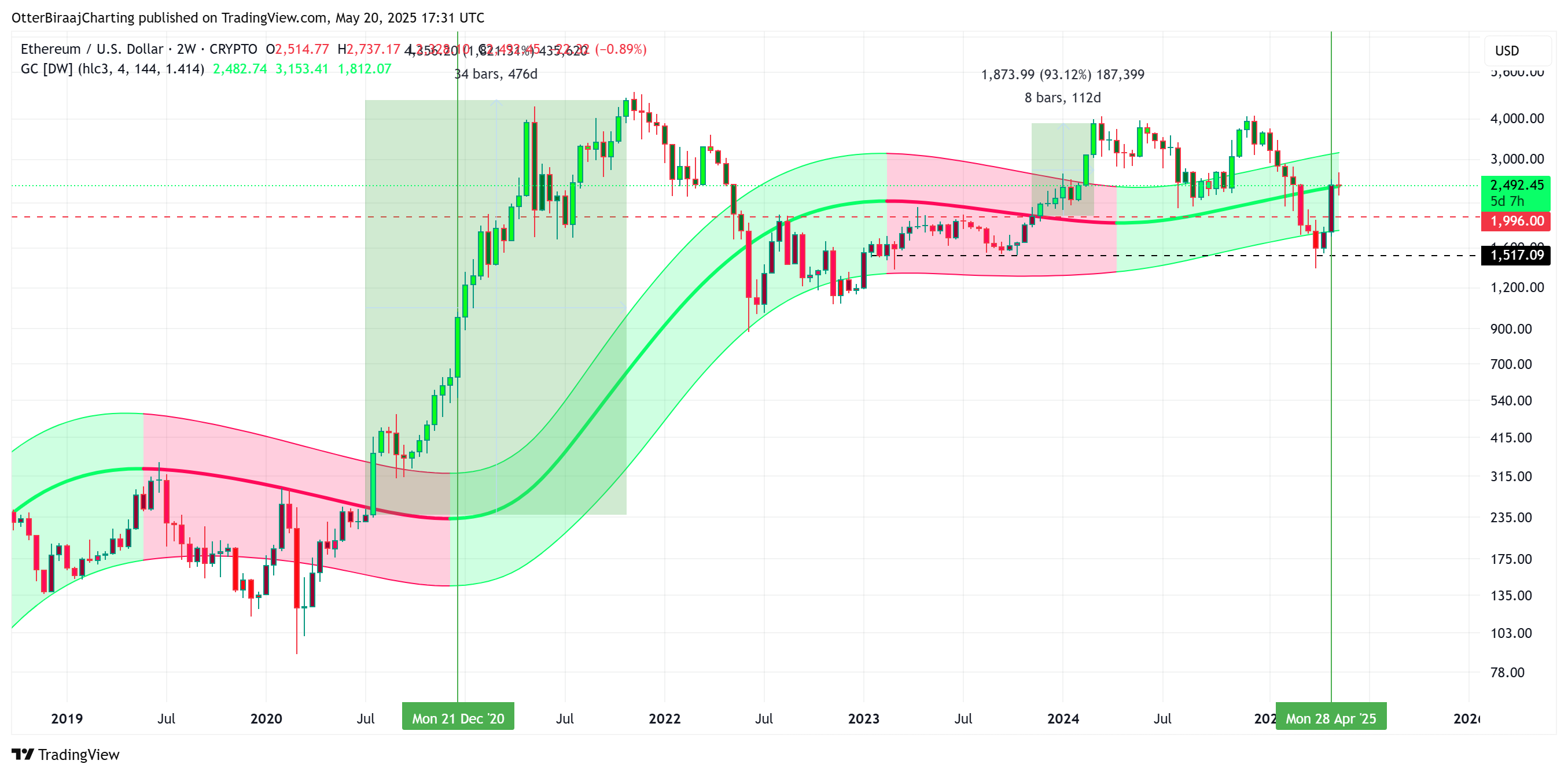

On May 20, Ethereum showed significant signs of trend reversal, attempting to reclaim the middle line of the two-week Gaussian channel—a professional technical indicator used to identify price trends. The Gaussian or normal distribution channel can plot price movements within a dynamic range, automatically adapting to market volatility.

Historically, when ETH breaks above this middle line, it often triggers significant upward movements. In 2023, ETH soared 93% to $4,000 after a similar breakout; in 2020, it recorded an astonishing 1,820% increase, sparking a massive altcoin bull market.

Ethereum Gaussian Channel Analysis. Source: Cointelegraph/TradingView

However, a similar technical pattern that appeared in August 2022 failed during a market correction, reminding investors not to overly rely on a single indicator.

Also noteworthy is that cryptocurrency analyst Merlijn observed a golden cross between the 50-day SMA and the 200-day SMA (Simple Moving Average), which may further enhance the likelihood of ETH's upcoming breakout. It is important to note that this golden cross appears on the 12-hour chart, which is less reliable than daily chart signals.

Renowned cryptocurrency trading expert XO pointed out that Ethereum is consolidating below the "important" resistance level of $2,800. The analyst expects that if ETH fails to break through $2,800 in the coming days, it will face retracement pressure. He stated, "I tend to think that the price will form a range-bound movement for at least the next few weeks or longer, at which point I will reconsider buying."

From a Fibonacci level perspective, there is also a contrary view to the bullish outlook. Cointelegraph's latest report noted that Ethereum recently retested the 0.5 to 0.618 Fibonacci levels, which could trigger a short-term adjustment in ETH.

In this scenario, the key support zones are $2,150 and $1,900, which may lead to a slowdown in bullish momentum for an extended period.

Ethereum Weekly Price Analysis. Source: Cointelegraph/TradingView

Related: Bitcoin Open Interest Hits All-Time High, Bulls Strongly Push BTC Price to New Peaks

This article does not contain any investment advice or recommendations. Any investment and trading activities involve risks, and readers should conduct their own research before making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。