Key Points

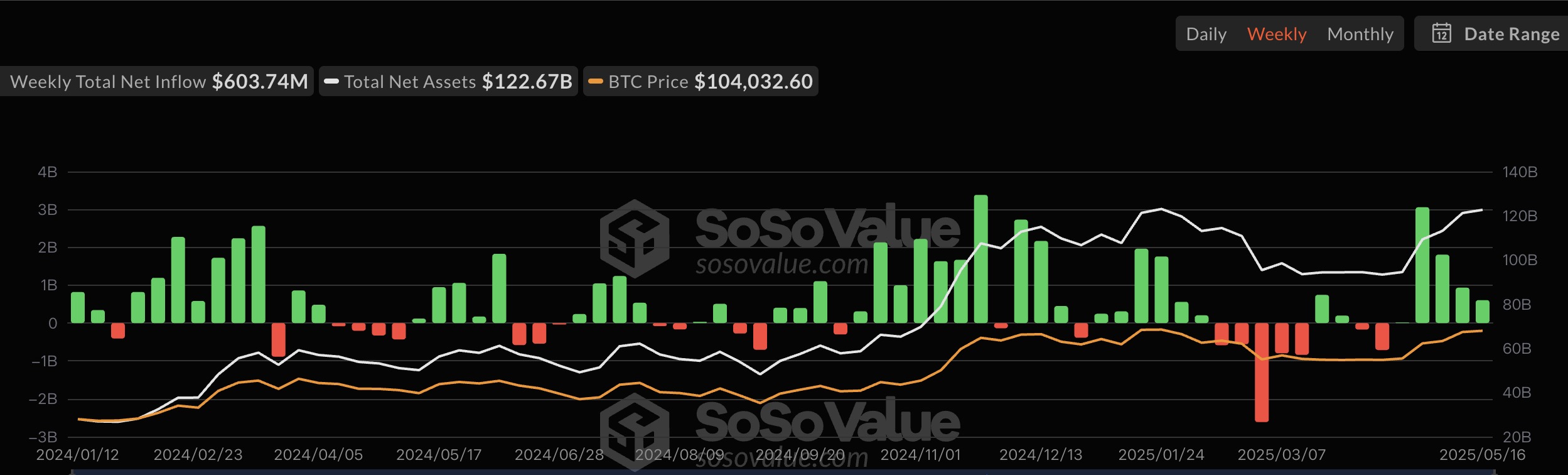

● The total market capitalization of global cryptocurrencies is $3.48 trillion, up from $3.45 trillion last week, representing a 0.87% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $41.77 billion, with a net inflow of $603 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.51 billion, with a net inflow of $41.59 million this week.

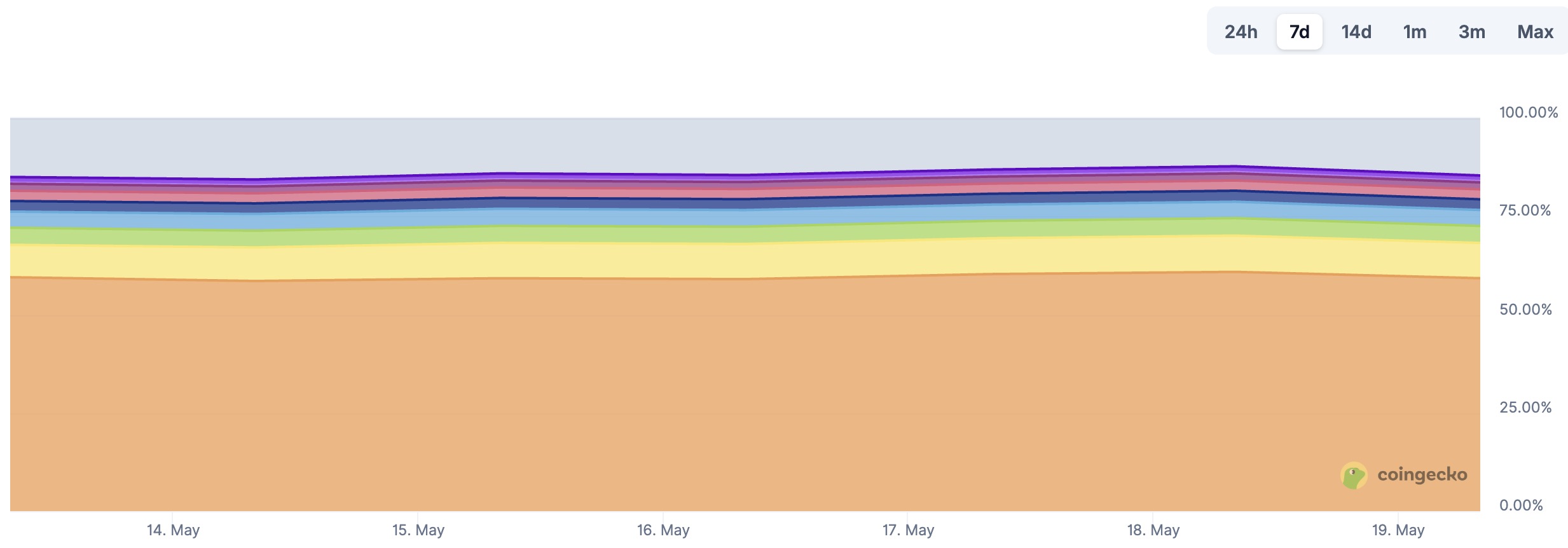

● The total market capitalization of stablecoins is $245 billion, with USDT having a market capitalization of $151.3 billion, accounting for 61.75% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $60.8 billion, accounting for 24.82%; and DAI with a market capitalization of $3.66 billion, accounting for 1.49%.

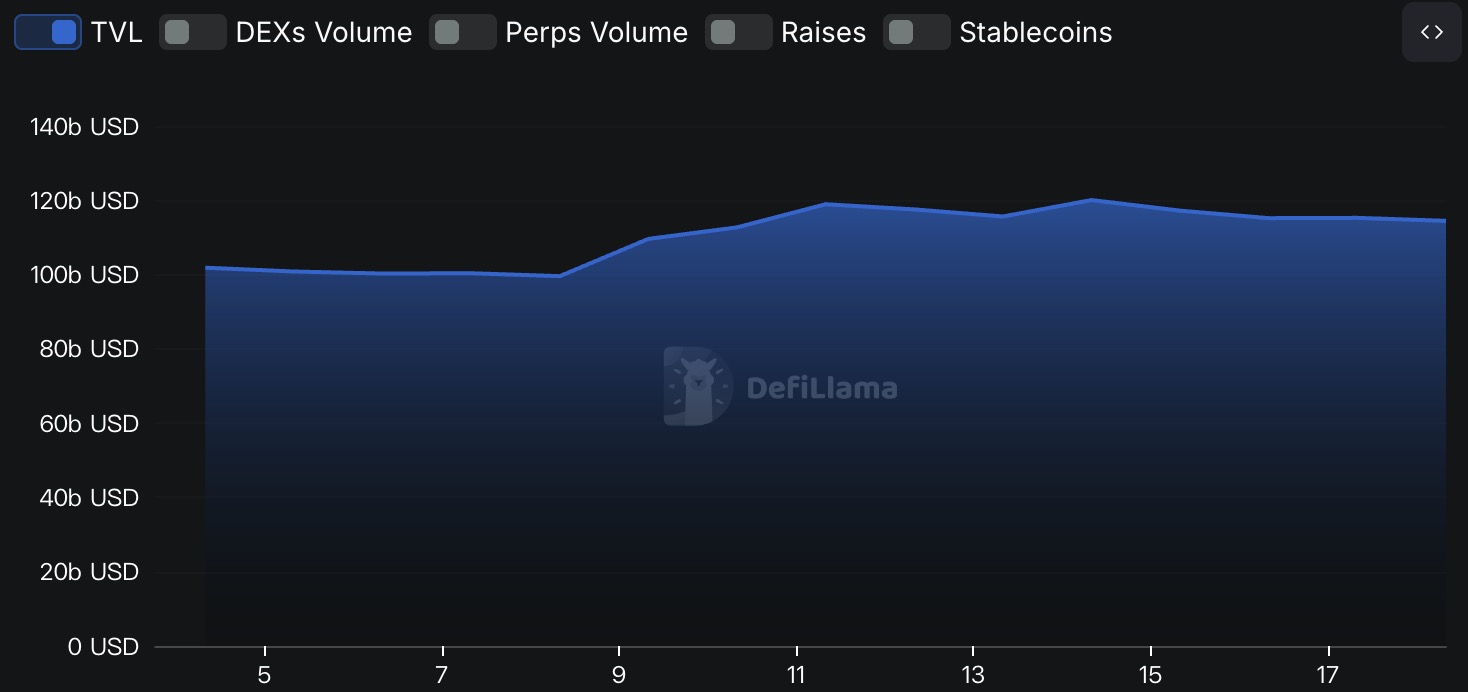

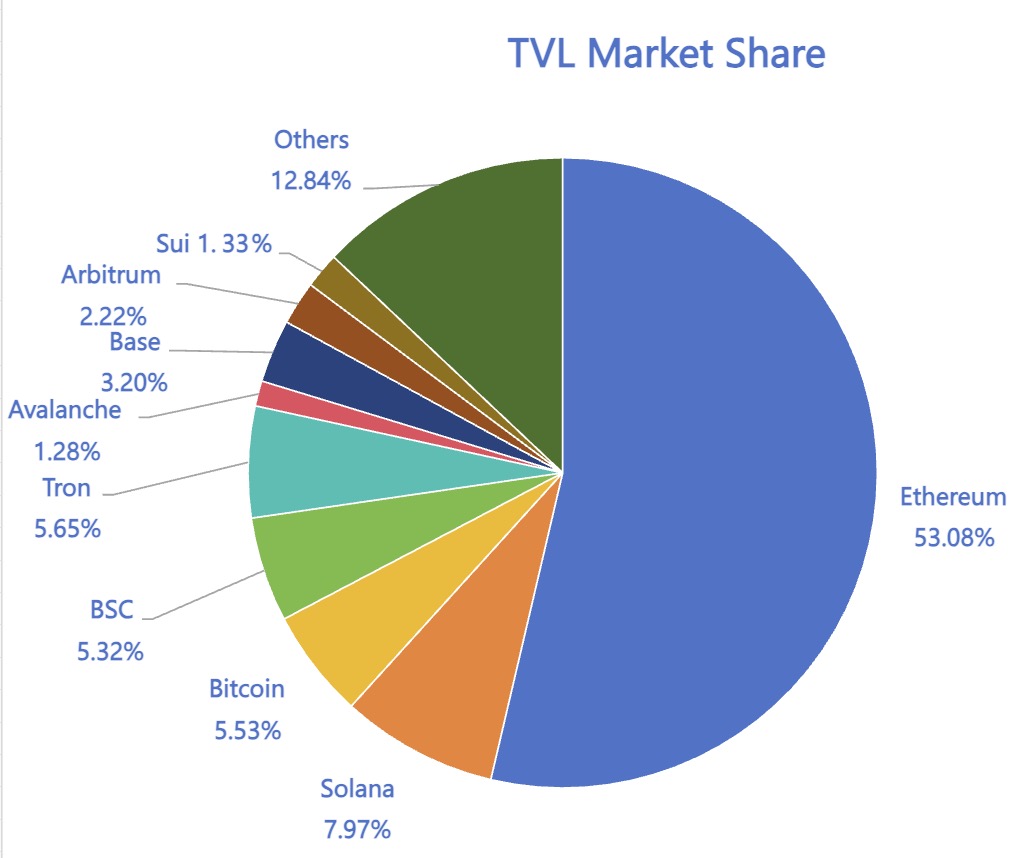

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $114.469 billion, down approximately 2.25% from last week ($117.1 billion). By public chain, the top three chains by TVL are Ethereum, accounting for 53.08%; Solana, accounting for 7.97%; and Tron, accounting for 5.65%.

● On-chain data shows a clear differentiation in activity and user experience among major public chains this week. In terms of daily trading volume and transaction fees, BNB and SUI chains performed well, with trading volumes increasing by 86.37% and 19.4%, respectively; other chains saw declines, with TON experiencing the largest drop at 55.71%, followed by ETH (-34.34%) and Aptos (-19.79%). In terms of transaction fees, Ethereum saw a significant decrease of 86.67%, and Ton also decreased; BNB chain remained relatively stable. In terms of daily active addresses and TVL, active addresses for ETH and Solana grew by 13.59% and 60.47%, respectively, while other chains generally declined, with SUI chain seeing the most significant drop (-91.44%), and BNB and TON also declining by 15.97% and 12.26%, respectively. Overall, TVL showed little change, with most chains remaining stable compared to last week, with slight declines.

● New project focus: XSY is a DeFi capital management platform focused on providing transparent, efficient, and scalable liquidity solutions for protocols, vaults, and investors, dedicated to unlocking complex on-chain structured strategies. SpaceComputer is a satellite-based blockchain validation layer project aimed at building an Orbital Root of Trust through the deployment of space infrastructure, providing secure and reliable transaction validation and threat protection for interstellar finance. Perpl is a native pricing engine in the Monad ecosystem, designed for efficiency and composability, aiming to provide an excellent trading experience on the Monad parallel EVM.

Table of Contents

Key Points………………………………………………………………………………………. 1

Table of Contents……………………………………………………………………………… 2

1. Market Overview…………………………………………………………………………… 2

2. Fear Index…………………………………………………………………………………. 3

3. ETF Inflow and Outflow Data………………………………………………………… 4

4. ETH/BTC and ETH/USD Exchange Rates…………………………………………………….. 4

5. Decentralized Finance (DeFi)………………………………………………………… 5

6. On-Chain Data………………………………………………………………………………… 7

7. Stablecoin Market Capitalization and Issuance Situation……………………………………………………………… 9

2. Hot Money Trends This Week…………………………………………………………………………… 10

1. Top Five VC Coins and Meme Coins by Growth This Week……………………………………………….. 11

2. New Project Insights…………………………………………………………………………….. 11

3. New Industry Dynamics……………………………………………………………………………… 12

1. Major Industry Events This Week………………………………………………………………………. 12

2. Major Upcoming Events Next Week…………………………………………………………………… 13

3. Important Financing and Investment from Last Week………………………………………………………………………. 14

4. Reference Links…………………………………………………………………………………. 15

1. Market Overview

1. Total Cryptocurrency Market Capitalization/Bitcoin Market Capitalization Ratio

The total market capitalization of global cryptocurrencies is $3.48 trillion, up from $3.45 trillion last week, representing a 0.87% increase this week.

Data source: cryptorank

Data as of May 18, 2025

As of the time of writing, Bitcoin's market capitalization is $2.09 trillion, accounting for 60.1% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $245 billion, accounting for 7.04% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of May 18, 2025

2. Fear Index

The cryptocurrency fear index is at 71, indicating fear.

Data source: coinglass

Data as of May 18, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $41.77 billion, with a net inflow of $603 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.51 billion, with a net inflow of $41.59 million this week.

Data source: sosovalue

Data as of May 18, 2025

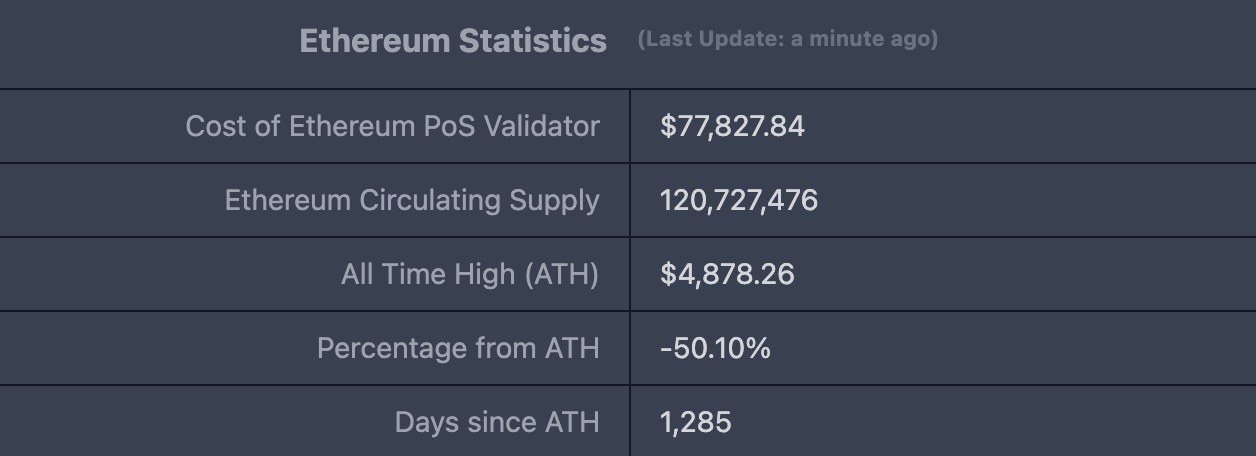

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $2,430.38, historical highest price $4,878, down approximately 50.18% from the highest price.

ETHBTC: Currently at 0.023147, historical highest at 0.1238.

Data source: ratiogang

Data as of May 18, 2025

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $114.469 billion, down approximately 2.25% from last week ($117.1 billion).

Data source: defillama

Data as of May 18, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 53.08%; Solana, accounting for 7.97%; and Tron, accounting for 5.65%.

Data source: CoinW Research Institute, defillama

Data as of May 18, 2025

6. On-Chain Data

Layer 1 Related Data

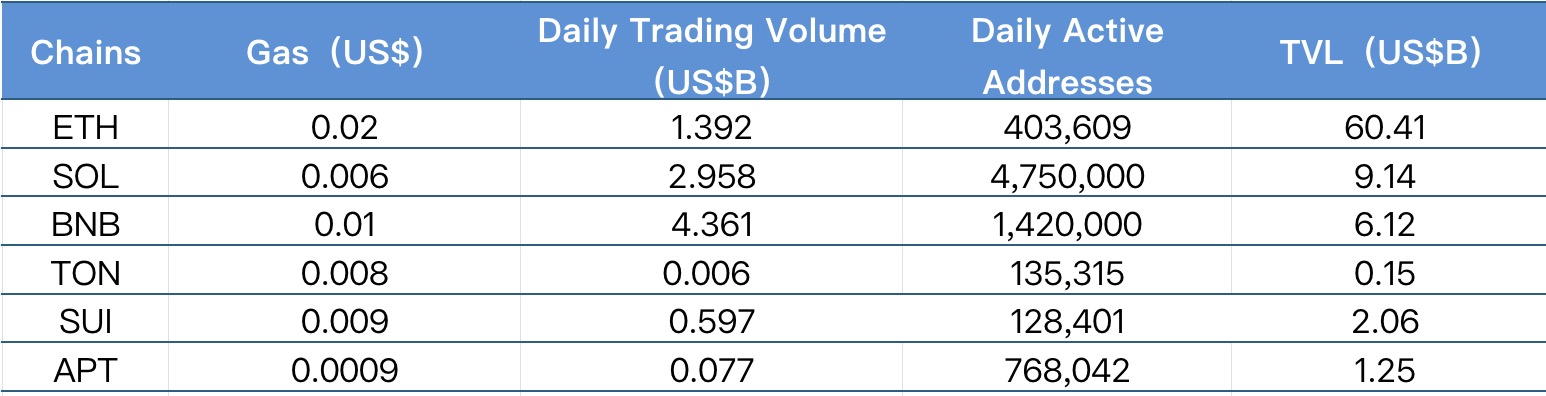

This section analyzes the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of May 18, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, BNB and SUI chains increased by 86.37% and 19.4%, respectively. Other chains saw declines, with TON experiencing the most significant drop at 55.71%, followed by ETH (-34.34%) and Aptos (-19.79%), while BNB chain remained relatively stable. Regarding transaction fees, BNB chain remained flat compared to last week, while Ton and ETH chains saw declines, and other chains experienced increases. Ethereum chain saw a decrease of 86.67%; Solana increased by 110%, and Aptos increased by 124 times, while other chains showed little change.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, active addresses for ETH and Solana increased by 13.59% and 60.47%, respectively, while other chains generally declined, with SUI chain seeing a significant drop of 91.44%, BNB down 15.97%, and Ton down 12.26%, with Aptos showing a slight decline. This week, the TVL of each chain showed a slight decrease compared to last week, remaining almost flat with little change.

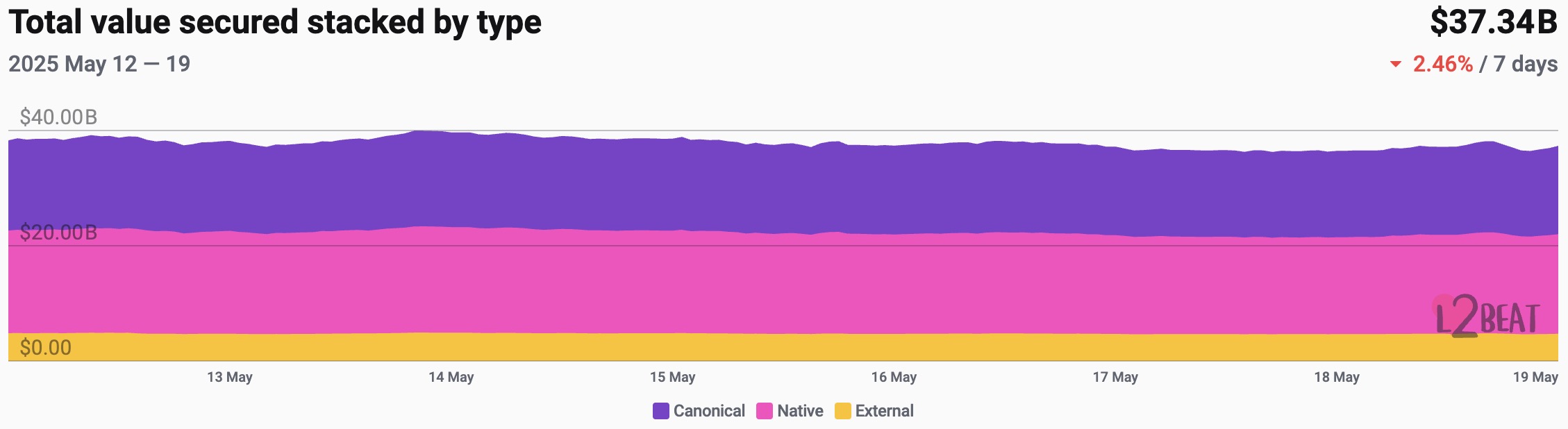

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $37.34 billion, down 2.4% from last week ($38.26 billion).

Data source: L2Beat

Data as of May 18, 2025

Base and Arbitrum occupy the top positions with market shares of 38.86% and 33.28%, respectively, with an overall increase in their share.

Data source: footprint

Data as of May 18, 2025

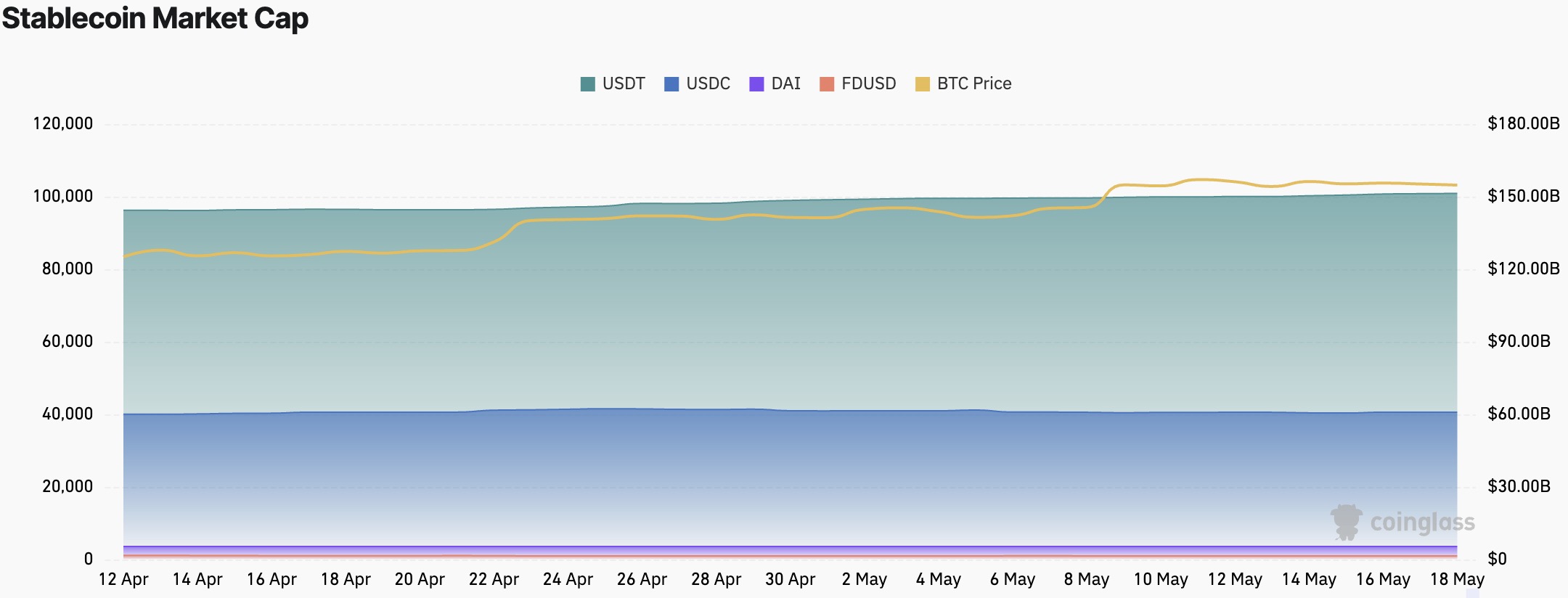

7. Stablecoin Market Capitalization and Issuance Situation

According to Coinglass, the total market capitalization of stablecoins is $245 billion, with USDT having a market capitalization of $151.3 billion, accounting for 61.75% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $60.8 billion, accounting for 24.82%; and DAI with a market capitalization of $3.66 billion, accounting for 1.49%.

Data source: CoinW Research Institute, Coinglass

Data as of May 18, 2025

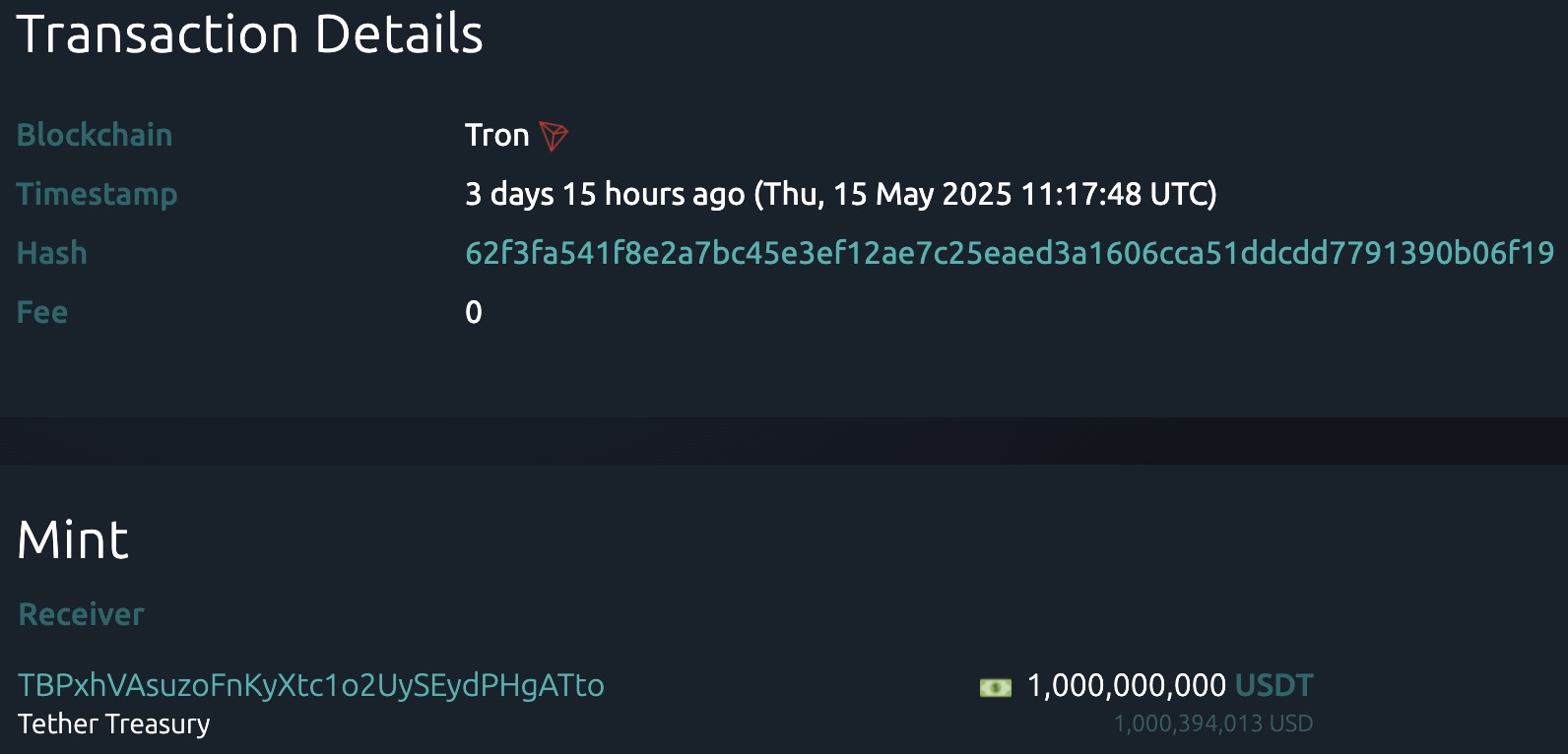

According to Whale Alert, this week the USDC Treasury issued a total of 9.2 million USDC, and the Tether Treasury issued a total of 2 billion USDT this week. The total issuance of stablecoins this week was 2.092 billion, down approximately 41.88% from last week's total issuance of 3.6 billion.

Data source: Whale Alert

Data as of May 18, 2025

2. Hot Money Trends This Week

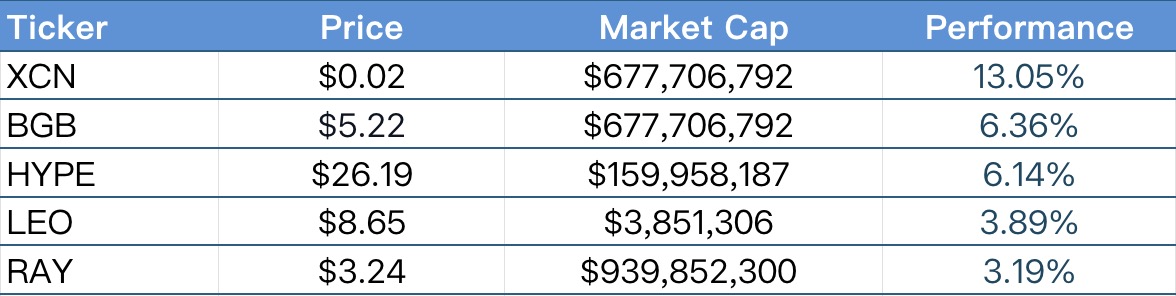

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of May 18, 2025

The top five Meme coins by growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of May 18, 2025

2. New Project Insights

XSY is a DeFi capital management platform founded by former teams from Algorand, Paxos, and FPG, focusing on providing transparent, efficient, and scalable liquidity solutions for protocols, vaults, and investors, dedicated to unlocking complex on-chain structured strategies. The project has received support from top institutions such as Protagonist, Borderless Capital, and Avalanche Fund.

SpaceComputer is a satellite-based blockchain validation layer project aimed at building an "Orbital Root of Trust" through the deployment of space infrastructure, providing secure and reliable transaction validation and threat protection for interstellar finance.

Perpl is a native pricing engine in the Monad ecosystem, designed for efficiency and composability, aiming to provide an excellent trading experience on the Monad parallel EVM. The project has secured $9.25 million in funding led by Dragonfly to further expand its development and deployment on Monad.

3. New Industry Dynamics

1. Major Industry Events This Week

On May 17, the REX project launched an airdrop event open to users with at least 196 Binance Alpha points. Eligible users can redeem 3,935 REX tokens by consuming 15 Alpha points starting from 7:00 UTC on May 17. The redemption period is 24 hours, and failure to confirm will be considered an automatic forfeiture of the airdrop eligibility.

On May 16, Alaya AI (AGT) launched the 17th phase of its TGE event on Binance Wallet. Users holding 186 or more Binance Alpha points can participate through the Alpha event page, with the subscription time from 3 PM to 5 PM (UTC+8) that afternoon.

On May 15, Binance opened the NXPC airdrop, allowing users with Alpha points ≥187, or points between 143-186 with a UID ending in "9" to claim 198 NXPC tokens. Claiming will consume 15 Alpha points and must be confirmed within 24 hours on the Alpha event page, or it will be considered a forfeiture.

On May 16, Farcaster officially announced that it has distributed WCT token airdrop rewards to some users. This airdrop covered a very small number of users, with each address receiving about 14.5 WCT, valued at approximately $7.

On May 14, the AI project Privasea AI announced its PRAI token economics, with a total supply of 1 billion tokens, where early contributors account for 9.04%, investors for 13.45%, treasury for 10.05%, and the team for 8%. On the same day, Binance Wallet launched the TGE for Privasea AI from 6 PM to 8 PM (UTC+8), and eligible users must use Alpha points to participate in the subscription.

2. Major Upcoming Events Next Week

The Solana ecosystem DePIN project CUDIS will launch its TGE in June and will distribute airdrops to community users during this period. Users must register their Solana main wallet on the official website by May 25, or it may affect their eligibility for the airdrop. CUDIS is a DePIN project in the Solana ecosystem, focusing on on-chain recording and incentive mechanisms for health data through wearable devices (such as smart rings).

Bombie officially announced that its native token BOMB will soon launch its TGE. Unlike traditional GameFi projects that view TGE as a short-term monetization node, Bombie positions this TGE as the starting point for long-term value release in the ecosystem, based on a sustainable development model and user stickiness. The project has completed user accumulation and content layout before the TGE and strengthened the binding of user behavior and token value through the IAS mechanism and the new game CapyBomb, laying the foundation for sustained growth after the TGE.

The modular blockchain project Sophon announced that its native token SOPH will officially conduct its TGE in May 2025 and will become fully transferable in Q2. The total supply of SOPH is 10 billion tokens, with allocations covering node incentives, ecological reserves, investors, and advisors. Prior to the TGE, the project has accumulated over $450 million in TVL through node sales and point activities, laying a solid community and funding foundation for the token launch.

On May 15, Cardano founder Charles Hoskinson announced that the privacy sidechain Midnight will launch an airdrop event called Glacier Drop, distributing governance token NIGHT and privacy transaction token DUST for free to approximately 37 million retail users across 8 mainstream blockchains. The project focuses on user rights, does not allocate shares to institutions, and aims to promote community participation, with the mainnet expected to launch by the end of 2025.

3. Important Investments and Financing Last Week

Openverse Network announced the completion of a $11 million strategic financing round, with participation from well-known institutions such as Castrum Capital, TB Ventures, DuckDAO, and Asva Capital. Openverse is a blockchain-based Layer 0 hub network that proposes the concept of "fully open protocol cross-chain," dedicated to achieving the free transfer of value (Token/NFT/message) between chains, the metaverse, and the traditional internet, promoting the construction of global value internet infrastructure. (May 12, 2025)

The Blockchain Group (ALTBG), as Europe's first publicly listed Bitcoin vault company, announced the issuance of convertible bonds in Luxembourg through its subsidiary, successfully raising approximately €12.1 million. The exclusive investor for this financing round is Bitcoin pioneer and Blockstream co-founder Adam Back, which will be used to accelerate its "Bitcoin vault company" strategic layout. This financing allows Adam Back to convert the bonds into up to 17.17 million shares of ALTBG under specific market conditions, reflecting his confidence in the project's long-term growth potential. (May 12, 2025)

Gnosis acquired the on-chain financial operation platform HQ.xyz for $14.95 million. This investment includes $8.95 million from the GnosisDAO treasury, which was approved through a DAO vote in January 2025, and $6 million from Gnosis Ltd. for operational expenses over the next two years. This acquisition is one of the largest investments in the Gnosis ecosystem. HQ.xyz will be renamed Gnosis HQ and integrated into Gnosis's ecosystem, which includes Gnosis Chain, Gnosis Pay, and related projects such as Safe and CoW Swap. (May 14, 2025)

4. Reference Links

Openverse Global: https://www.openverse.network/

The Blockchain Group: https://www.theblockchain-group.com/

Headquarters: https://www.hq.xyz/

XSY: https://xsy.fi/

KYD Labs: https://www.kydlabs.com/

Space Computer: https://www.spacecomputer.io/

Perpl: https://perpl.xyz/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。