Original Author: Bright, Foresight News

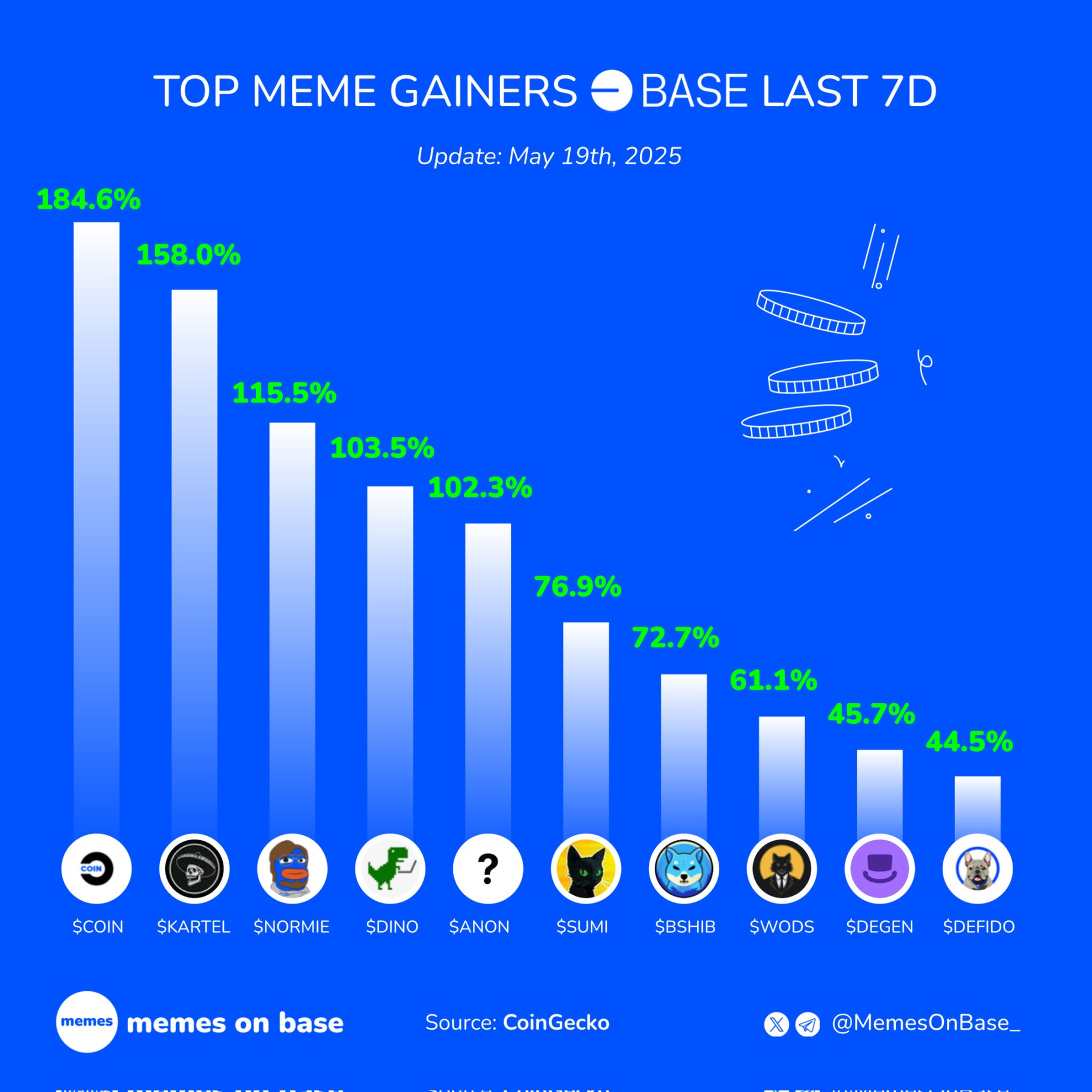

Recently, DINO on the Base chain has consistently ranked high on the growth list, reaching a new high on May 19, strongly breaking through a market cap of 40 million USD. However, the first half of this journey, which started in April 2024, reflects the reality of most projects in the crypto space.

Assuming you bought DINO at its peak in April 2024, you would only need to endure 15 weeks of decline and 36 weeks of sideways movement, while suppressing the urge to cut losses during 5 weeks of slight increases, to eventually reap 6 weeks of violent surges, achieving over 70% profit.

And if you were exceptionally lucky, you would have ample time to build your position without exceeding a market cap of 1 million, enjoying a "push-back feeling" of over 40 times.

Rebellious Little Dinosaur

DINO (CODING DINO) held a presale in March 2024 and had its TGE in April. DINO is an ERC50 smart contract asset issuance protocol. During the asset issuance phase, users can deposit ETH into the contract to exchange for DINO tokens, and can withdraw their ETH by exchanging DINO at any time before reaching the hard cap. Once the hard cap is reached, the smart contract automatically adds liquidity and begins trading.

According to a retweet from DINO's official Twitter, people bought DINO because in April 2024, there were too many large liquidations (VT, machi) issuing tokens through presale forms like Bome and Slerf, leading to significant financial losses due to blind trust in these large liquidations. Therefore, DINO's concept is to distrust centralized entities (project teams/KOLs) and instead trust decentralized code. It echoed the narrative consistent with Ethereum:

don’t trust, just verify

don’t trust people, trust code

At that time, DINO's official posed the question: "Can this narrative continue to expand? For example, could future asset issuances no longer use the method of sending money to private addresses, but instead use DINO's smart contract? In the short term, this may be somewhat difficult, as most project issuers are not technical experts. However, as long as retail investors unite and demand that project teams use smart contracts to issue tokens, project teams may ultimately have to adopt smart contract issuance."

Unexpectedly, the early form of Bonding Curve had already appeared at that time.

DINO's logo is also quite interesting. Combining DINO's core narrative—only trust code, resist project teams/KOLs from harvesting—DINO chose a small dinosaur game that appears when the Chrome browser is offline. This classic dinosaur image is linked to the early spirit of code developers: independence, open-source, and a focus on technology.

Silent Coin Price and Vacuum Community

However, like all unsuccessful meme projects, the lack of enthusiasm led DINO's price to free fall a month later, continuing its trend towards zero.

At the same time, DINO's social media and community became increasingly silent as the price declined. The last update on the official Twitter was a mention of Binance, dated September 7, 2024.

The last update on the official Telegram introduced the Safeguard bot, dated September 6, 2024.

In other words, the original DINO token team has likely (probability > 99%) run away, leaving holders wandering.

Behind the Violent Surge

The "soft rug" in the first half of DINO's lifecycle is all too familiar to crypto players, while the large bullish candles in the second half are indeed a rare sight.

From May 12 to 18, DINO's weekly trading volume exceeded 15.6 million USD, with both volume and price rising. According to rumors, some big players and promoters entered DINO.

However, despite the fierce upward momentum, DINO's on-chain situation is not "healthy." The top ten holding addresses mostly show token inflows, with the top holder accumulating 53.4% of the total circulating supply. Moreover, on-chain data indicates that DINO has been continuously flowing into the top ten holding addresses. All of this indicates a high degree of control over DINO's entire market, so entering DINO at the current price requires careful consideration of risks.

In other words, DINO, which thrives on decentralization, code independence, and retail resistance narratives, has long lost all its supporters, replaced by premeditated manipulators and Degen chasing the price surge. The artificially awakened dinosaur may have a shorter life span.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。