Overview

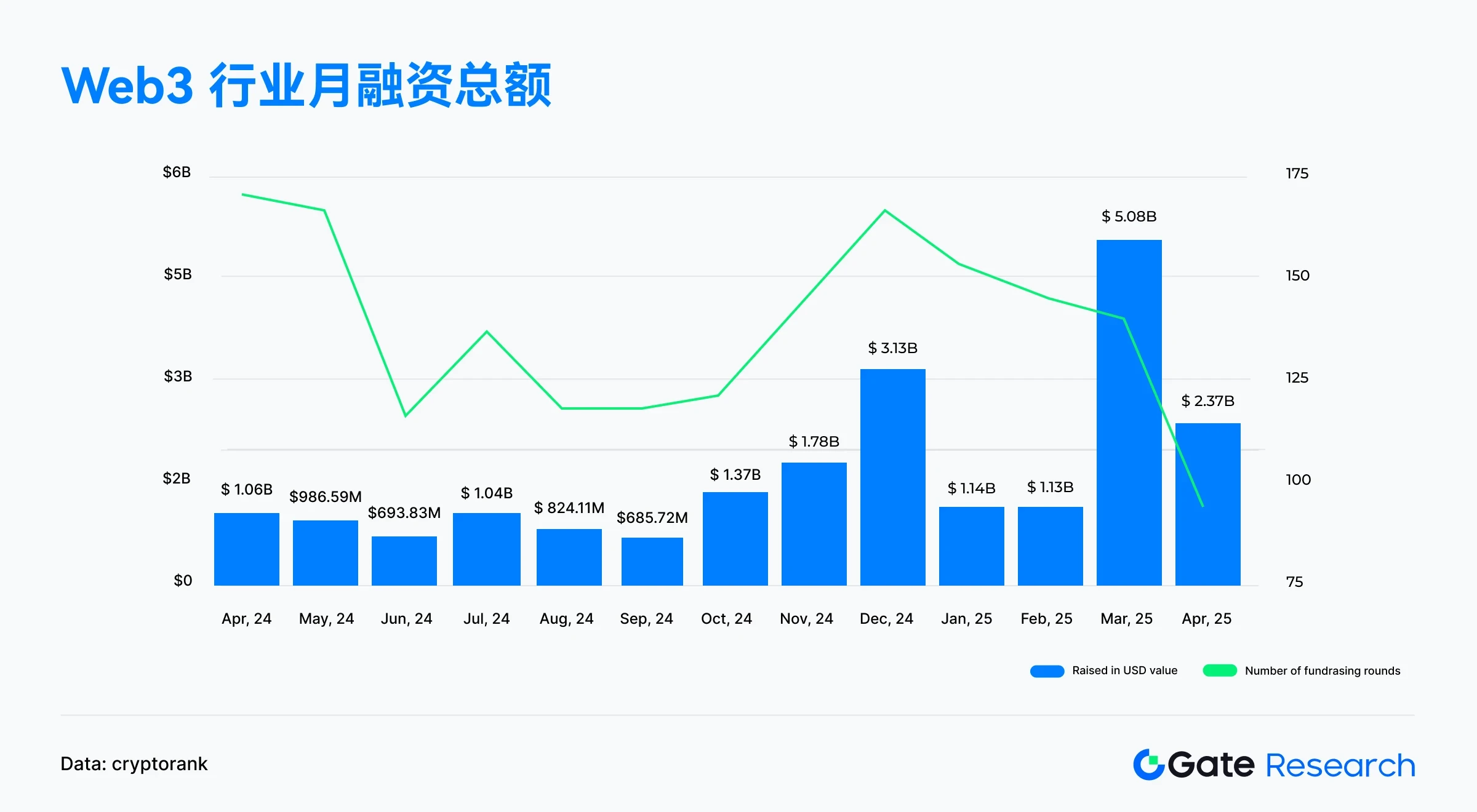

• According to the Cryptorank Dashboard data on May 7, 2025, the Web3 industry completed a total of 94 financing rounds in April 2025, amounting to $2.37 billion. Both the scale and number of financing rounds have declined, indicating a significant cooling of the market.

• Traditional financing methods are making a comeback, with mergers and acquisitions and structured financing dominating large transactions. This includes multiple cases such as Ripple's acquisition of Hidden Road for $1.25 billion, reflecting the market's preference for resource integration capabilities, risk control mechanisms, and mature development paths.

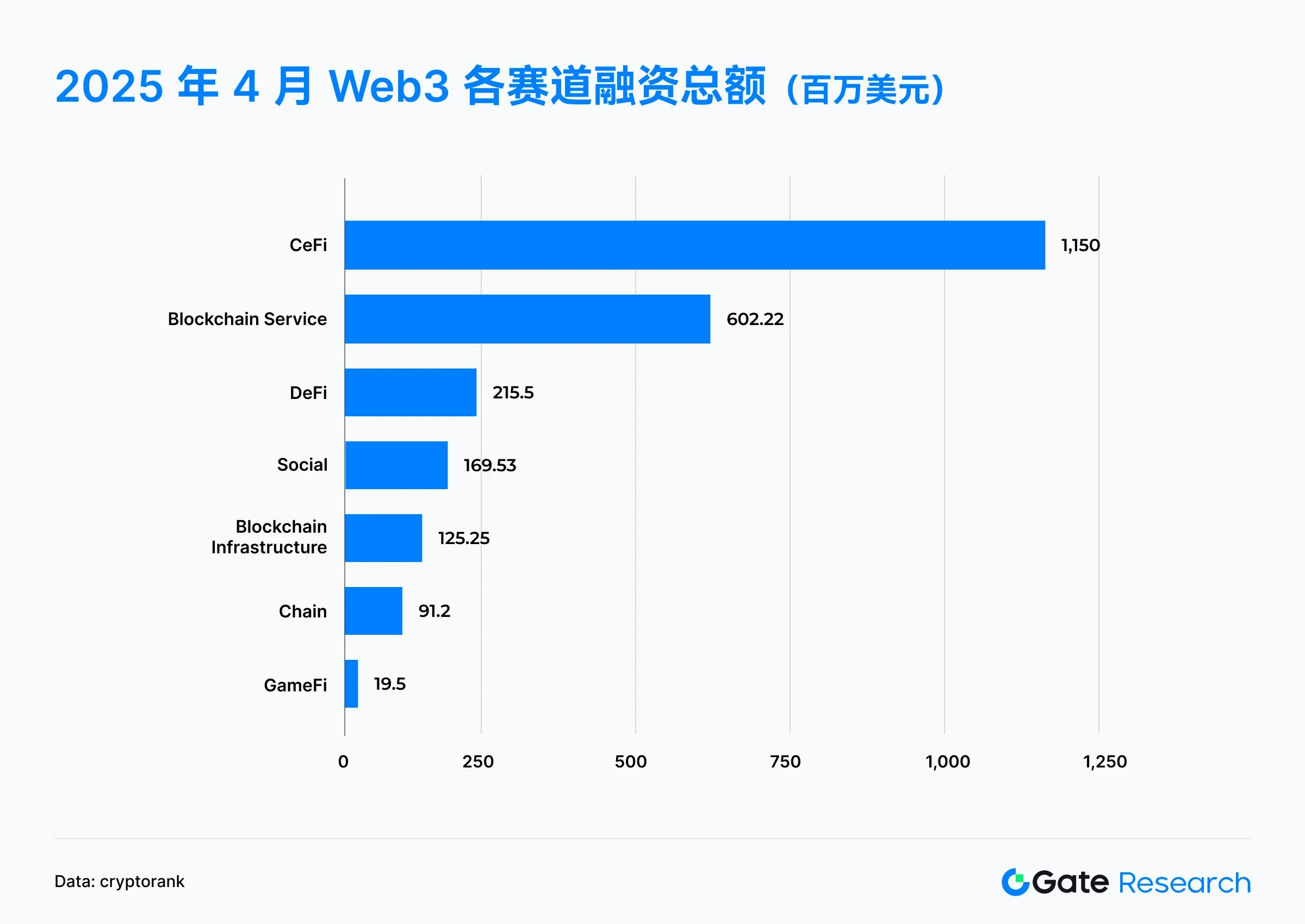

• Financing in April was primarily concentrated in CeFi ($1.15 billion) and blockchain services ($602 million), with DeFi and Social following. This indicates that capital is more inclined to bet on Web3 companies that possess traditional financial integration capabilities and clear compliance paths.

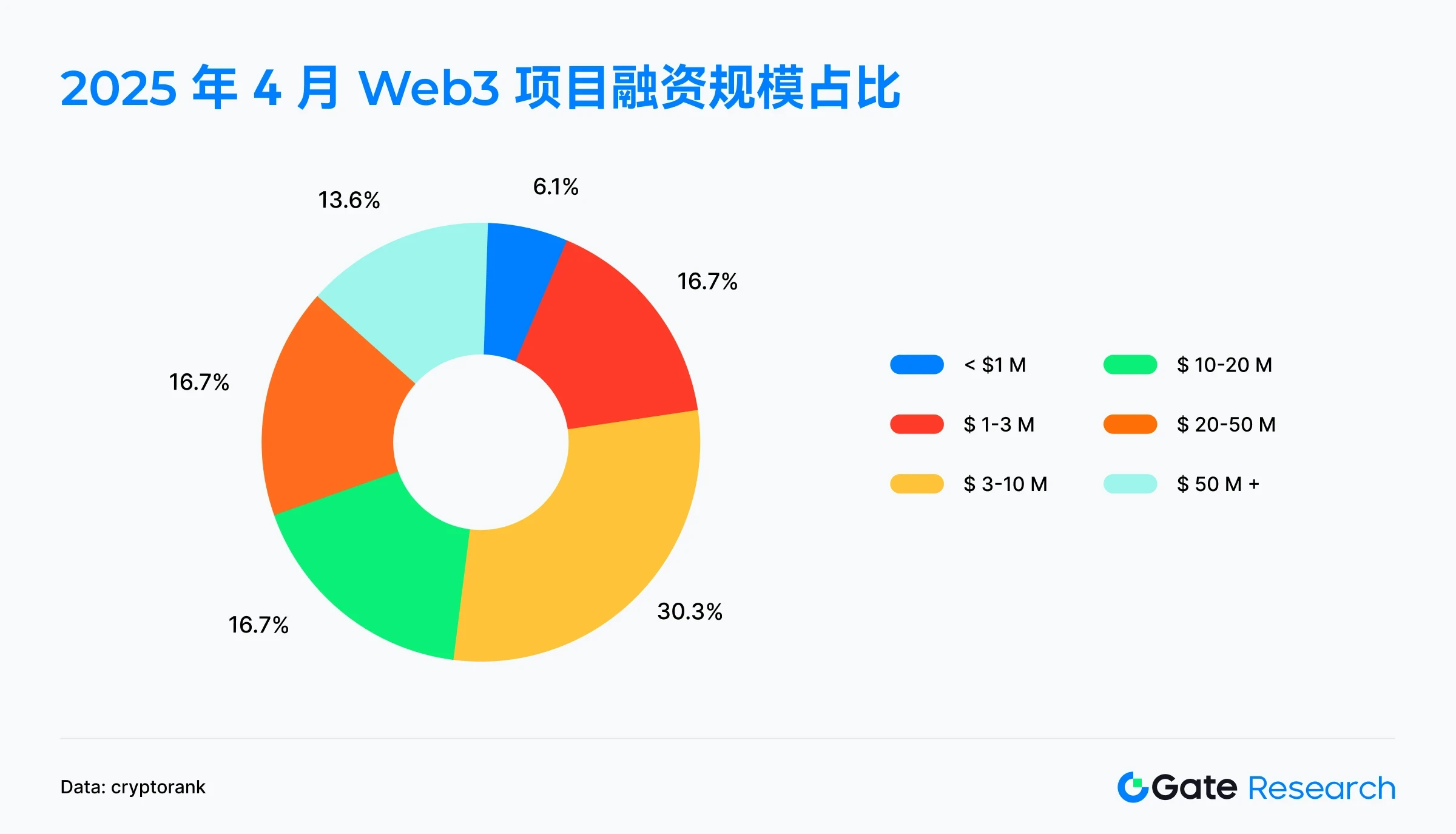

• The Web3 financing ecosystem is shifting from "scattergun support" to "structured betting," with medium and large projects dominating. Projects with financing amounts exceeding $10 million account for 47%, reflecting a preference for mid-tier projects with commercialization paths and growth validation capabilities.

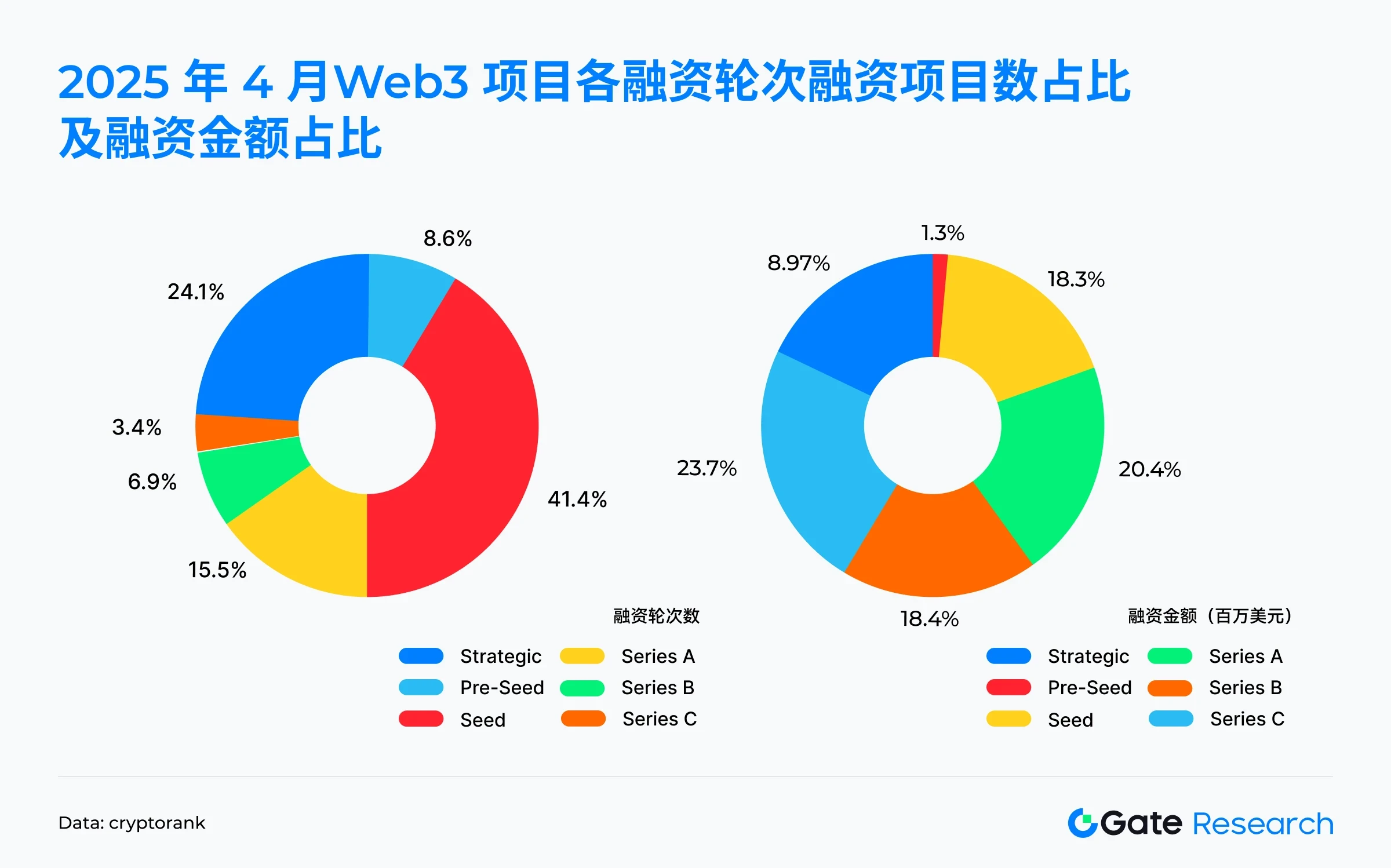

• The financing rounds exhibit a "small at both ends, large in the middle" structure, with funds clearly concentrating on later-stage projects. Although seed round projects account for the largest number (41.4%), Series C financing attracts the most funds, accounting for 23.7% of the total financing amount, indicating that capital is focusing on mature projects with scaling potential.

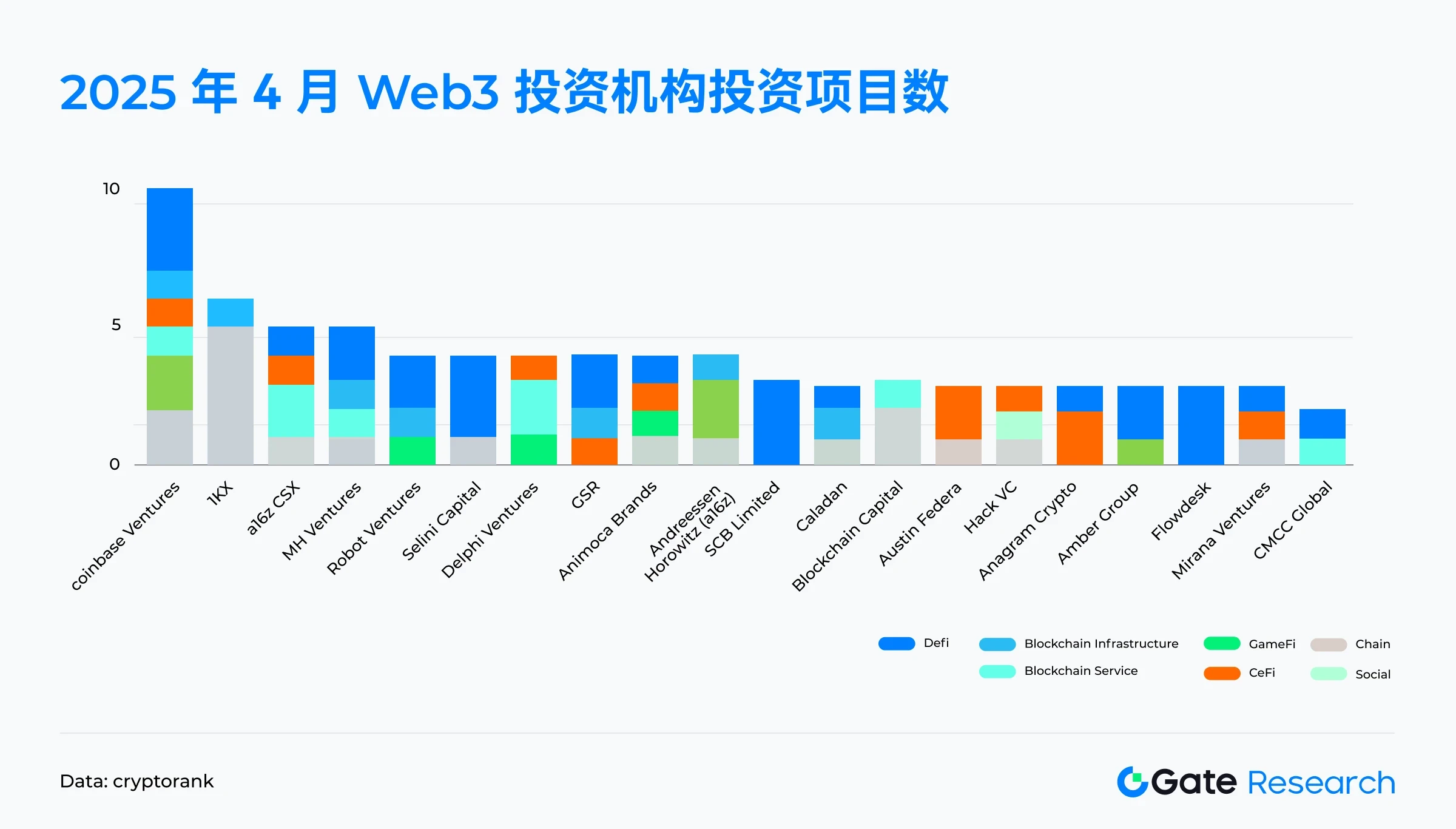

• Coinbase Ventures leads with investments in 10 projects, covering DeFi, CeFi, and blockchain infrastructure, followed closely by 1kx and a16z CSX.

Financing Overview

According to data released by Cryptorank on May 7, 2025, the Web3 industry completed a total of 94 financing rounds in April 2025, with a total financing amount of $2.37 billion. Due to Cryptorank's specific statistical treatment, this amount differs from the total obtained by summing individual financing project amounts (approximately $3.68 billion); however, to maintain consistency with the trend analysis below, this article uses the original statistical criteria provided by its Dashboard.

Compared to $5.08 billion and 140 transactions in March 2025, the total financing amount has decreased by over 53%, and the number of financing rounds has also fallen below 100, reaching a new low in nearly a year.

Previously, the Web3 financing in the first quarter of 2025 experienced explosive growth, especially in March, driven by significant transactions such as Abu Dhabi MGX's $2 billion investment in Binance and Kraken's $1.5 billion acquisition of NinjaTrader, pushing the total financing amount to a historical peak. However, the market clearly cooled in April, with a significant contraction in the number of financing rounds.

This phenomenon may be driven by the following factors: short-term wait-and-see sentiment after concentrated capital release in the first quarter; market corrections or tightening regulatory expectations; or perhaps some financing has shifted to more discreet private placements or strategic phases, leading to a reduction in publicly disclosed large financing cases. It is worth noting that although the total financing amount remains high, the number of financing rounds has shown a downward trend since March, indicating that capital is accelerating towards a few capital-intensive projects, making it more difficult for small and medium-sized projects to secure financing, and the "Matthew effect" within the industry is gradually becoming apparent.

Data analysis of the top 10 financing projects in April 2025 shows that capital is highly concentrated in a few leading projects, further confirming the trend of the "Matthew effect" intensifying in the market.

CeFi still dominates: Among the top ten projects, six belong to the centralized finance (CeFi) sector, with a total financing amount exceeding $1.9 billion, fully demonstrating that despite the continuous development of the DeFi ecosystem, centralized financial infrastructure remains the most favored area for capital. Among them, SOL Strategies and Securitize completed large fundraising through traditional financing tools such as post-IPO debt, indicating that the capital market still gives high valuations and liquidity support to Web3 companies with traditional financial integration capabilities.

Traditional financing methods are making a strong comeback: Mergers and acquisitions (M&A), post-IPO debt, and private placements have become high-frequency financing methods, reflecting the current market's preference for a "controlling acquisition + structured financing" capital path to strengthen resource integration and risk control capabilities. Notably, Hidden Road's $1.25 billion acquisition transaction ranks first, acquired by Ripple, showing that traditional blockchain giants are accelerating their strategic layout in the CeFi credit network field.

Infrastructure projects continue to attract top capital: The only blockchain infrastructure project to enter the top ten this month is LayerZero, which secured $55 million in financing with support from a16z, demonstrating that even in a tightening funding environment, basic interoperability technology still has strong appeal.

Overall, the financing landscape in April 2025 exhibits "three major characteristics": CeFi dominance, acquisition-driven, and capital centralization. This not only reflects the capital market's increasing emphasis on compliance, profit models, and integration capabilities but also indicates that the future Web3 financing landscape will further concentrate on a few projects with resource advantages and institutional endorsements.

According to the Cryptorank Dashboard data, the financing landscape of the Web3 industry in April 2025 shows a trend of "CeFi leading strongly, basic services stable, defensive technologies favored, and cautious investment in innovative tracks," with capital allocation preferences gradually shifting from high-risk experimental projects to more mature fields with stronger profitability and integration capabilities. Specific manifestations are as follows:

• CeFi (centralized finance) remains in the lead with a total financing amount of $1.15 billion, accounting for nearly half of the total financing for the month, indicating that capital still prioritizes betting on centralized projects with traditional financial attributes and clear compliance paths. Several large transactions (such as Hidden Road and SOL Strategies) have boosted the scale of this sector, highlighting the market's high recognition of CeFi infrastructure integration capabilities.

• Following closely, the blockchain services sector secured a total financing amount of $602 million, showing continued market attention to projects providing infrastructure and tools for the Web3 ecosystem. This may include development platforms, security solutions, data analysis services, etc., which are crucial for the healthy development of the entire ecosystem.

• DeFi and Social sectors attracted $215 million and $169 million in financing, respectively, although not as large as CeFi, they still maintain a certain level of activity, particularly in strategy-based MEV platforms and social payment innovations receiving capital support. Blockchain infrastructure ($125 million) has seen an overall decline in financing compared to before, but projects like LayerZero still attract top institutions due to technological innovation, maintaining a high level of trust.

• Chain projects and GameFi only secured $91.2 million and $19.5 million, respectively, placing them at the lower end of financing this month, indicating that in the current cycle, public chains and chain game innovations have not become the primary focus of capital, with funds flowing more towards "more certain" sectors.

Based on the financing scale data of 66 Web3 projects disclosed in April 2025, the financing scale that month exhibits a structural characteristic of "dominance in the middle + concentration at the top + cooling in small amounts." The overall distribution shows that medium-scale projects account for the largest number, while the proportion of larger-scale projects has significantly increased, and the proportion of small financing projects is relatively low.

Among them, projects with financing scales between $3 million and $10 million account for as much as 30.3%, making it the most significant financing range. This indicates that a large number of projects that have completed technological validation or initial implementation are receiving positive responses from the capital market regarding their growth potential.

Additionally, projects with financing scales exceeding $10 million account for a total of 47%, with projects in the $10 million to $20 million, $20 million to $50 million, and over $50 million ranges accounting for 16.7%, 16.7%, and 13.6%, respectively. This data indicates that compared to the previous phase dominated by small and medium financing, the market is giving higher attention to projects with mature business paths, clear profit models, and medium to long-term potential, with capital beginning to accelerate towards mid-tier and top projects.

In contrast, projects with financing scales below $1 million only account for 6.1%, highlighting the high difficulty of securing financing for small-scale projects, with investors' risk preferences becoming more conservative and requiring stricter fundamentals from projects.

Overall, the financing data for April 2025 reflects that the Web3 financing ecosystem has shifted from "scattergun support" to "structured betting," with capital resources accelerating towards projects with clear development paths and strong integration capabilities.

From the data on the number of financing rounds and the proportion of financing amounts, it can be seen that the current market exhibits a structural characteristic of "dominance in the number of early rounds, with funds concentrating on later rounds"; the capital market is gradually converging on a few mid to late-stage projects with scaling potential and technological realization capabilities, while being more stringent in screening early-stage projects, with investment styles becoming more rational and concentrated.

In terms of the proportion of financing rounds, seed rounds account for the highest proportion at 41.4%, indicating that the Web3 industry is still in an active early entrepreneurial stage, with a plentiful number of projects. Following are strategic rounds and Series A projects, accounting for 24.1% and 15.5%, respectively, while Pre-Seed only accounts for 8.6%. The proportions of Series B and C projects are relatively small, at 6.9% and 3.4%, respectively, indicating that the number of projects entering the mid to late stages remains limited.

However, from the perspective of financing amount distribution, funds are clearly skewed towards mid to late-stage projects: although there are fewer Series C projects, they have the strongest capital-raising ability, with a total financing amount of $205 million, accounting for 23.7% of the total financing; Series A and B financing amounts are $177 million and $159 million, respectively, each also exceeding 18%. In contrast, although seed rounds have the most projects, they only account for 18.3% of the total financing, while Pre-Seed accounts for a mere 1.3%.

This phenomenon of "light projects, heavy funding" concentrating on mid to late-stage projects reflects investors' current preference for more stable projects with commercialization capabilities and growth validation, with a relatively lower risk tolerance for early-stage projects. The financing amount for strategic rounds reached 17.8%, indicating that some mature enterprises or projects are strengthening their ecological layout or resource integration through targeted financing.

According to Cryptorank data from May 7, 2025, Coinbase Ventures ranks first by investing in 10 projects, clearly leading other institutions and demonstrating its strong participation and resource integration capabilities in the current cycle. Following closely are 1kx, a16z CSX, and MH Ventures, each investing in between 5 to 6 projects, reflecting their ability to maintain a high frequency of investments while also showcasing their clear strategic directions.

From the distribution of investment tracks among various institutions, there are certain differences in investment preferences. For example, Coinbase Ventures has significant investments in DeFi, Blockchain Infrastructure, and CeFi; 1kx is more inclined towards DeFi and Blockchain Infrastructure; while a16z CSX is active in both DeFi and Blockchain Service directions.

Key Financing Projects in April

ZAR

Introduction: ZAR is a digital dollar wallet designed to empower local merchants worldwide to become exchange points for cash and digital dollars. Users can conveniently exchange cash for digital currency through the ZAR app and use virtual and physical debit cards for transactions globally. The product was founded in 2024 by Brandon Timinsky and Sebastian Scholl, aiming to empower "corner stores" globally to participate in cash and stablecoin exchange transactions, promoting the widespread application of stablecoins in the real economy.【3】

On April 30, ZAR announced the completion of $7 million in financing, led by Dragonfly Capital and VanEck Ventures.【4】

Investors/Angel Investors: Dragonfly Capital, a16z CSX, VanEck Ventures, Coinbase Ventures, Solana Ventures, and angel investor Balaji Srinivasan, among others.

Highlights:

The platform has not officially launched yet but has attracted about 100,000 users waiting to register, with over 7,000 merchants from 20 countries, including Pakistan, Indonesia, and Nigeria, expressing willingness to cooperate, and is expected to officially launch in the summer of 2025.

Launching a stablecoin pegged to the South African Rand (ZAR), focusing on regions with unstable currencies and weak banking infrastructure, such as Sub-Saharan Africa, to reduce exchange rate fluctuations and payment costs, and enhance financial access efficiency. The ZAR wallet supports USDC and USDT, providing a stable payment channel based on the US dollar, enhancing user trust and asset stability.

Users can make payments globally using ZAR's virtual or physical debit cards, supporting Apple Pay and Google Pay, avoiding additional fees incurred by traditional international exchanges. At the same time, users can achieve two-way exchange of cash and stablecoins at partner merchants, simplifying the acquisition and use of digital assets, and promoting deep integration of local economies and digital finance.

Pencil Finance

Introduction: Pencil Finance is a decentralized lending protocol aimed at bringing real-world student loan financing on-chain. It connects investors with verified student loan originators, transforming student debt into a transparent, investable asset class.【5】

On April 30, Pencil Finance announced the completion of $10 million in liquidity pool financing. The funds have been deployed in the liquidity pool on the Open Campus EDU Chain, aimed at supporting its first on-chain education loans and educational company debt financing business.【6】

Investors: Animoca Brands, Open Campus, etc.

Highlights:

Bringing education loans on-chain, creating a new EduFi track. Pencil Finance collaborates with traditional education loan companies to bring education loans from Southeast Asia and the United States onto the blockchain, expanding a new asset class for on-chain investors. Through on-chain deployment and transparent management, it enhances fund efficiency and lowers financing thresholds.

Risk-weighted structure design to match different risk preferences. Pencil Finance introduces a student loan risk-weighted protocol, allowing whitelisted users to provide liquidity for the loan pool and freely choose to invest in senior (low-risk, low-return) or junior levels (high-risk, high-return). At the same time, the platform undertakes loan deployment and repayment management, ensuring transparency in the process and traceability of returns on-chain.

CAP

Introduction: CAP is a stablecoin engine designed to break the closed-loop dependence on endogenous incentive models, providing users with a truly sustainable yield path.

It supports the issuance of redeemable stablecoins pegged to assets such as USD, BTC, and ETH, and democratizes complex strategies traditionally reserved for a few high-level players through the integration of arbitrage, MEV, and RWA yields.【7】

On April 7, CAP announced the completion of $11 million in financing, with investors including Franklin Templeton and Triton Capital. The funds will primarily be used to develop its stablecoin engine, which is planned to officially launch later this year.【8】

Investors: Franklin Templeton, Triton Capital, GSR, etc.

Highlights:

CAP is a new stablecoin protocol built on MegaETH, aiming to create a sustainable stablecoin system driven by real yields without relying on inflation incentives. CAP does not depend on traditional DeFi incentive methods such as token issuance but instead supports itself with external yields from market making, MEV, arbitrage, and RWA (such as corporate bonds), avoiding the "incentive exhaustion → liquidity exhaustion" flywheel risk, and possesses stronger scalability and anti-cyclical capabilities.

Users can obtain a "foolproof" yield experience through CAP without needing complex financial knowledge or connections. Its stablecoin cUSD is backed 1:1 by USDC/USDT, meaning it is fully collateralized and always redeemable. Unlike other yield-stablecoins that rely on DeFi liquidity incentives, CAP shifts the risk to re-stakers (those who stake ETH through EigenLayer to protect the protocol).

CAP builds decentralized infrastructure, integrating on-chain arbitrage, MEV, and traditional bonds and other RWA yield paths to form a synergistic drive. In addition to cUSD, CAP will also launch stablecoins pegged to BTC and ETH to meet the yield needs of users with different risk preferences, expanding the entry points for diverse assets.

Camp Network

Introduction: Camp Network is an innovative Layer-1 blockchain focused on proprietary intellectual property (IP), aiming to provide a verifiable operating environment for the next generation of AI agents with user identities. It aggregates Web2 data and connects traditional platforms with the blockchain, allowing users to monetize their digital footprints while maintaining control, thus addressing issues of AI training data ownership and creator revenue.【9】

On April 29, Camp Network announced the completion of $25 million in Series A financing, led by 1kx and Blockchain Capital, with participation from OKX, Lattice, Paper Ventures, and others, reaching a valuation of up to $400 million.【10】

Investors/Angel Investors: 1kx, Blockchain Capital, OKX, Lattice, Paper Ventures, etc.

Highlights:

Camp Network's core design emphasizes two main capabilities: first, off-chain data integration capability, which can connect with Web2 platforms through APIs to verify and chain user social, behavioral, and other data, ensuring authenticity and usability; second, developer friendliness, by providing standardized toolkits to help developers quickly build DApps based on user data, such as fan tokens, social derivative protocols, etc., lowering the barriers to building Web3 applications.

Camp Network emphasizes a fully decentralized data storage and identity verification mechanism, effectively avoiding data monopolies and privacy risks associated with traditional platforms. At the same time, its integration with LayerZero provides strong cross-chain compatibility, allowing developers to easily deploy multi-chain interoperable applications. Additionally, the platform has strong social data aggregation capabilities, collecting user profiles from Web2 platforms to provide smarter personalized services for Web3 applications, enhancing user retention and interaction quality.

Camp Network has partnered with leading platforms such as Figma, CoinList, and WalletConnect, and has established an ecological fund to support developers and creators. Recently, it also collaborated with Movement Labs to promote the application of social data in Web3, accelerating ecological expansion.

Blackbird Labs

Introduction: Blackbird is a Web3 loyalty and payment company dedicated to connecting restaurants with customers, providing a fully customizable loyalty program platform and consumer application. The Blackbird app serves as a digital wallet for users, making it easy to manage memberships, view $FLY balances, track activities, and interact with restaurants.【11】

On April 8, Blackbird Labs announced the completion of $50 million in Series B financing, led by Spark Capital; the funds will be used for equity and warrants for unreleased cryptocurrencies.【12】

Investment Institutions: Spark Capital, Coinbase, a16z crypto, Union Square Ventures, Amex Ventures, etc.

Highlights:

Blackbird's core goal is to eliminate unnecessary intermediaries in the restaurant industry, such as payment processors, through its blockchain platform Flynet. These intermediaries typically take 3% to 5% of restaurant revenue without providing corresponding value. Flynet aims to establish a direct connection between restaurants and customers, significantly reducing costs and optimizing the dining experience. For example, compared to traditional credit card fees that can exceed 3.75%, Flynet only charges a fixed rate of 2%, with 1.5% of that returned instantly to the restaurant for customer acquisition and retention, thereby greatly reducing costs.

Flynet has built a tokenized points system that is universal across restaurants, supporting personalized reward programs based on on-chain behavior. Restaurants can design exclusive experiences for users, including hidden menus and interactions with celebrity chefs, to incentivize frequent consumption and brand loyalty. Users will receive platform tokens (FLY) as rewards when they participate in restaurant spending, which can be redeemed at any restaurant within the Flynet network. Currently, the network covers over 600 high-quality restaurants in New York City, San Francisco, and Charleston, South Carolina, forming a tradable Web3 dining loyalty ecosystem.

Blackbird also announced the launch of Blackbird Club, a tiered loyalty program designed to reward loyal users with surprises and exclusive experiences, replacing traditional point redemption models. Members will enjoy exclusive benefits such as reservation guarantees, priority pre-sales for exclusive events, hidden menu tastings, and special gatherings for friends and family.

Summary

In April 2025, the Web3 industry completed a total of 94 financing rounds, amounting to $2.37 billion, with both the scale and number of financings declining, indicating a clear cooling of the market. However, the flow and preferences of capital have undergone significant changes, showing a trend towards more mature, integrative, and compliant areas such as CeFi and blockchain services. Traditional financing methods such as mergers and acquisitions and structured financing have regained dominance, with larger funds flowing more towards mid to late-stage and leading projects, reflecting investors' emphasis on projects' commercialization capabilities and stable growth. Although early innovations are still occurring, capital selection for startup projects has become stricter, with risk preferences tending towards conservatism. Leading institutions represented by Coinbase Ventures remain active and are strategically positioning themselves in key tracks. Notably, star projects such as ZAR, Pencil Finance, CAP, Camp Network, and Blackbird are demonstrating innovative potential in niche areas like stablecoins, educational finance, stablecoin yield aggregation, IP infrastructure, and crypto dining applications, receiving support from both traditional financial institutions and well-known Web3 funds, indicating that the Web3 ecosystem continues to explore new growth points and application scenarios.

References:

Cryptorank, https://cryptorank.io/funding-analytics

Cryptorank, https://cryptorank.io/funding-rounds

ZAR, https://www.zar.app/

X, https://x.com/zardotapp/status/1917569020318097627

Pencil Finance, http://pencilfinance.io/

Animoca Brands, https://www.animocabrands.com/pencil-finance-announces-usd10m-for-student-loan-financing-backed-by-animoca-brands-open-campus

CAP, https://caplabs.io/

Coindesk, https://www.coindesk.com/tech/2025/04/06/cap-raises-usd11m-to-fuel-stablecoin-engine-as-industry-heats-up

Camp Network, https://www.campnetwork.xyz/

Fortune, https://fortune.com/crypto/2025/04/29/camp-network-30-million-ai-blockchain-1kx-blockchain-capital/

Blackbird Labs, https://www.blackbird.xyz/

Fortune, https://fortune.com/crypto/2025/04/08/blackbird-funding-ben-leventhal-restaurants/

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of the assets and products they are purchasing before making any investment decisions. Gate.io is not responsible for any losses or damages resulting from such investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。