Original Author: TVBee (X: @blockTVBee)

DePin is a type of project that appears relatively abstract, unlike public chains, DeFi, or MEME, which have more intuitive feelings. However, DePin may actually be an application with broader scenarios…

The Unignorable DePin Track and Data

The uniqueness of DePin is reflected in two aspects:

First, the business areas and service targets of DePin.

DePin is developing in areas such as cloud computing, cloud rendering, file storage, network hotspots, and even meteorology, with its service targets not limited to the Web3 field.

For example, Aethir, as a decentralized cloud computing platform for AI training and inference, as well as game computing, has already provided a large amount of cloud computing services for Web2 enterprises. GEODNET, based on GNSS satellite reference station geographic and meteorological data information platform, is committed to providing services for agriculture, engineering, transportation, geology, and more.

Second, the data of DePin is relatively difficult to obtain. Although the working principles of public chains are not entirely the same, there are many similarities, and DeFi products and MEME data are even more homogenized, making this data relatively easy to obtain. In contrast, the differences between DePin projects are significant, and their main work may not be executed on the blockchain, so the data in this track is often overlooked.

Defillama is a very powerful data platform, but it mainly focuses on DeFi projects. @tokenterminal is a comprehensive data platform that focuses on a wider range of project types and data.

Recently, @AethirCloud established a deep cooperation with Token Terminal.

How deep is the cooperation? The two parties have collaborated to establish a #Aethir smart contract tagging registry on-chain, which is a data tool exclusive to Token Terminal, used to identify various behaviors and data of Aethir applications on-chain, allowing for standardized calculations of Aethir's on-chain data.

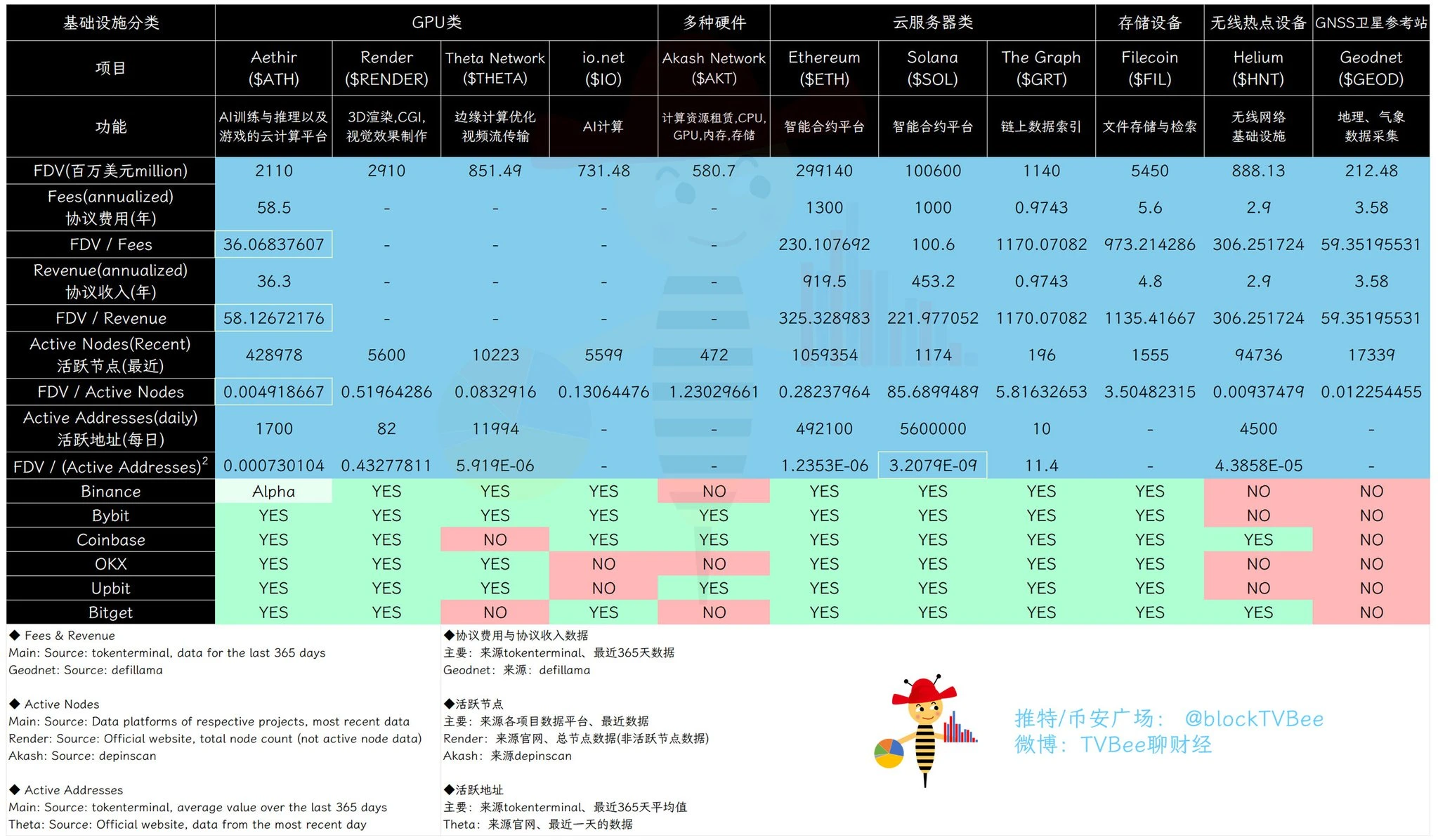

On this basis, Aethir has been included in the infrastructure category, making it comparable to other similar projects. Below, we will compare several major DePin projects.

DePin Data Comparison

Demand Side

Using protocol fees and protocol revenue as two indicators to measure the demand situation of DePin projects.

Protocol Fees

Protocol fees are calculated as the total amount of fees paid by all users over a period of time, reflecting the ability of DePin projects to create economic value.

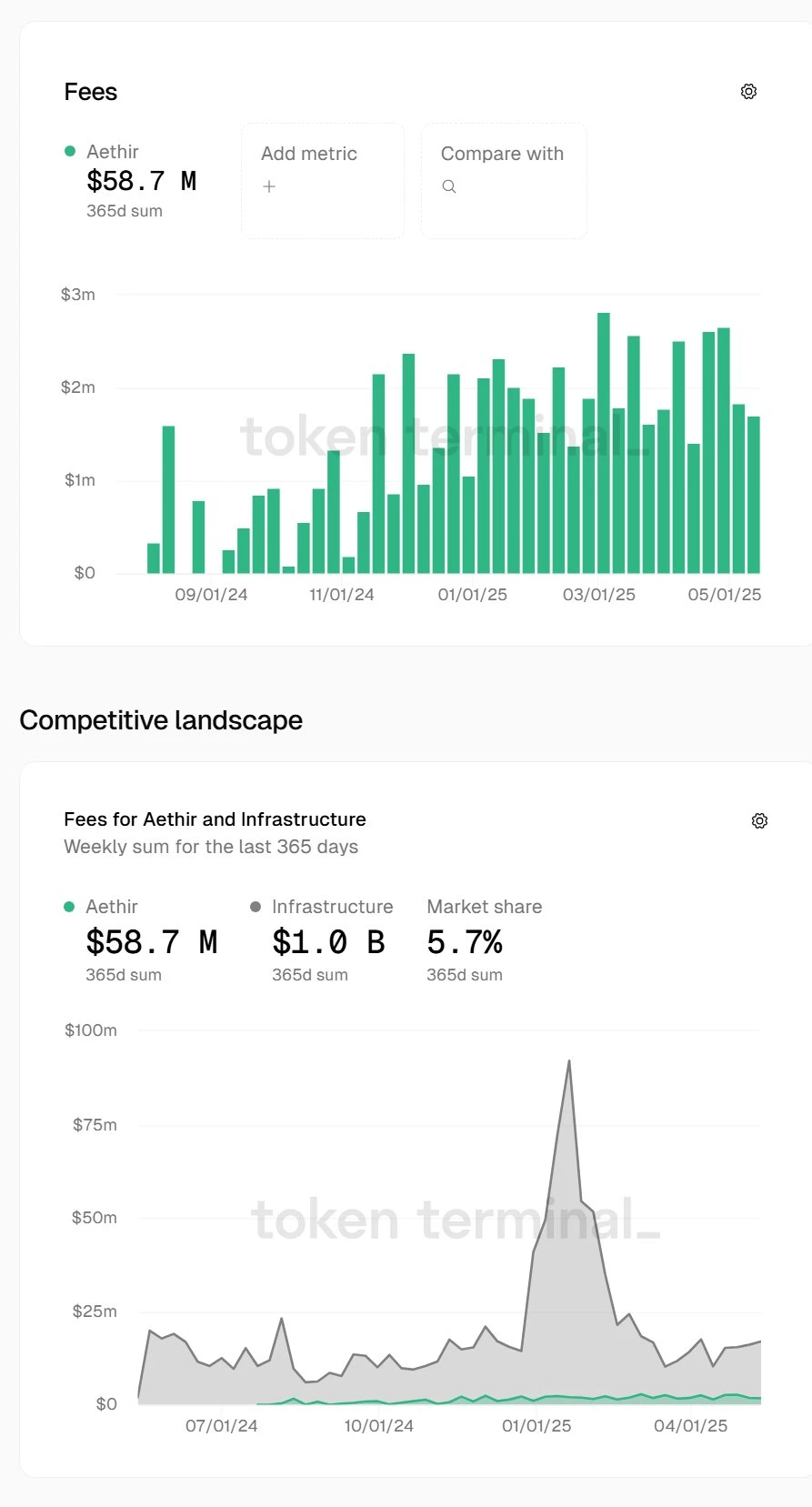

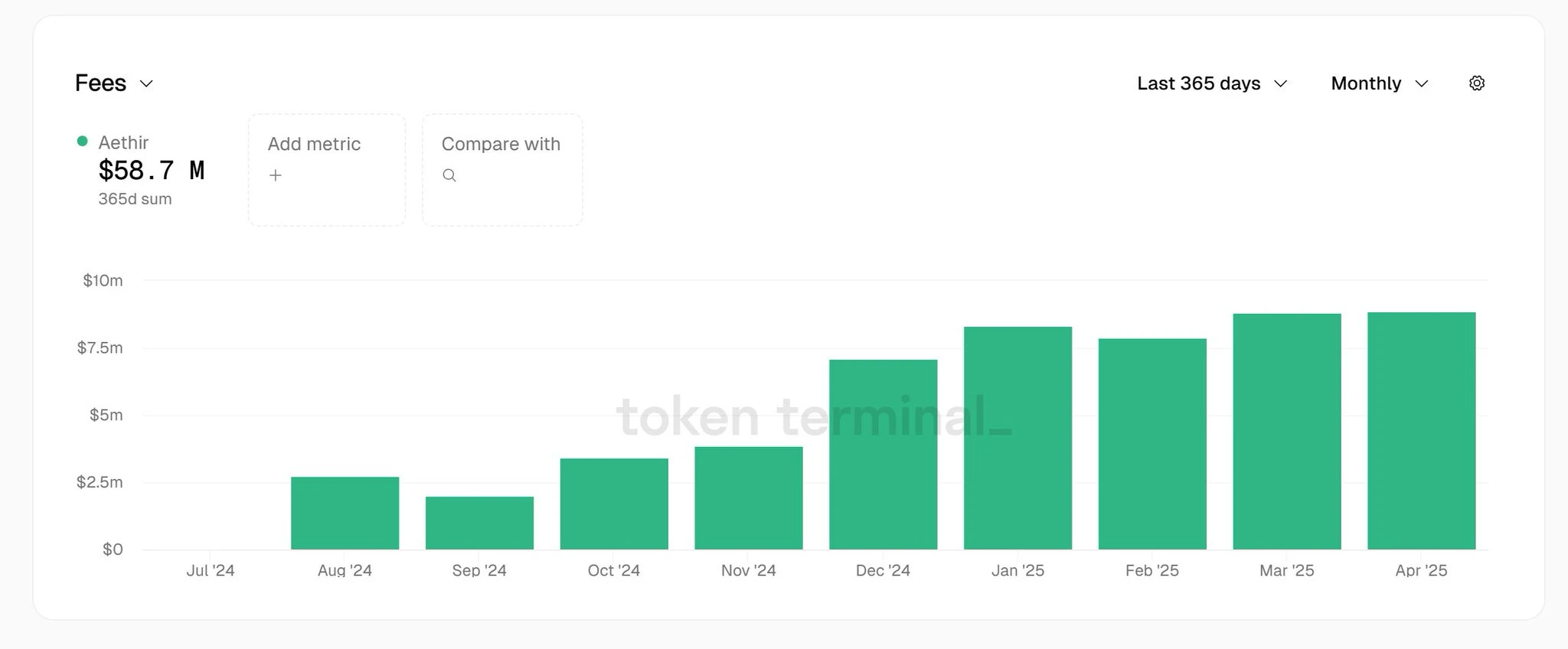

For example, in the past year, Aethir has generated a total of $58.7 million in protocol fees, holding a 5.7% market share in the infrastructure market as per Token Terminal statistics.

Aethir's protocol fees have a significant characteristic: they show an overall upward trend, unrelated to the bull and bear markets of Web3. The months of March and April saw a significant decline in the cryptocurrency market; however, Aethir's protocol fees did not decline at all during this period.

This is because Aethir is an enterprise-level cloud computing platform, with its service targets and revenue sources primarily from Web2 sectors such as gaming companies and AI enterprises.

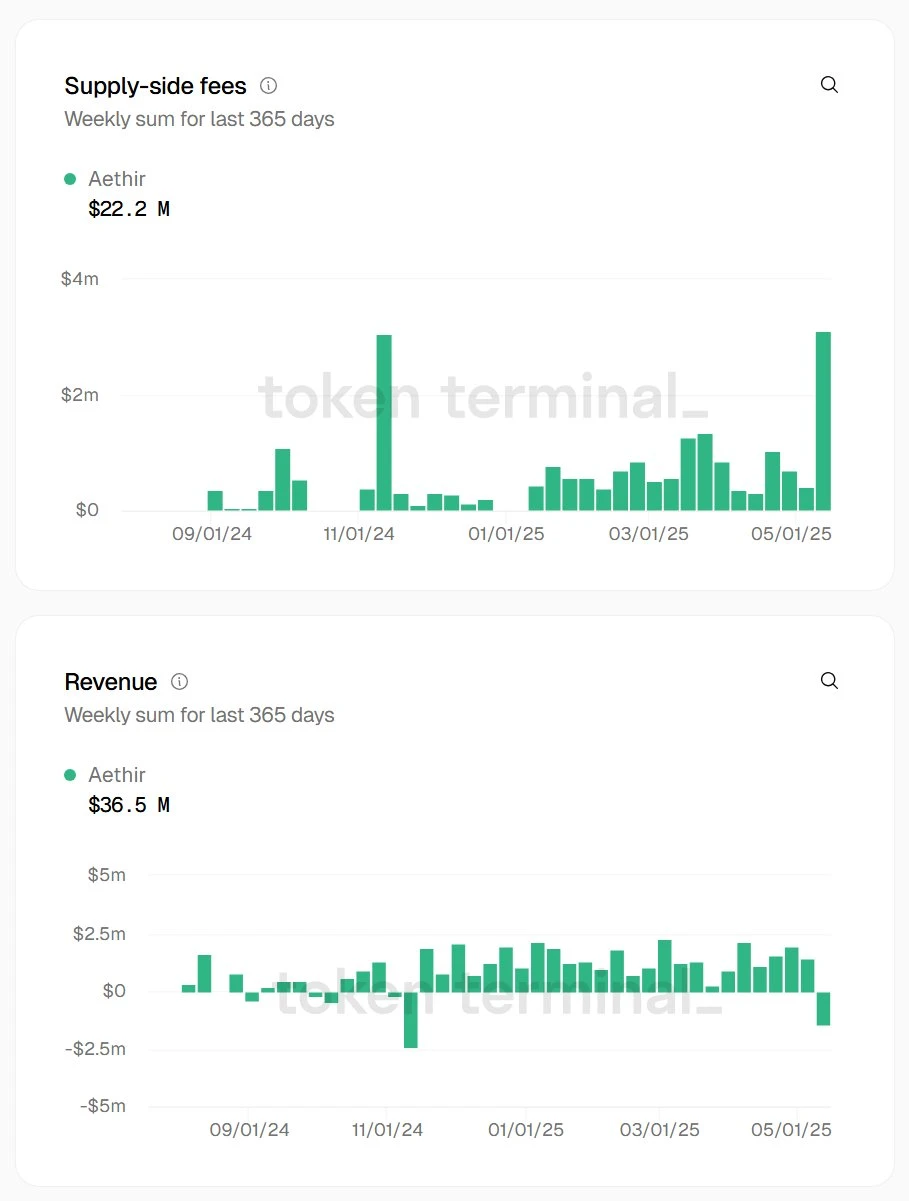

Protocol Revenue

Protocol revenue is the retained portion after deducting dividends from protocol fees, reflecting the net capital inflow of DePin projects and their income distribution system.

For example, in the past year, Aethir has distributed a total of $22.2 million in dividends, leaving a retained protocol revenue of $36.5 million ($58.7 million - $22.2 million = $36.5 million).

The protocol fee and protocol revenue data in the table mainly come from Token Terminal, while Geodnet's data comes from Defillama.

Data Comparison

In comparison, public chains generate the highest protocol fees. Yes, public chains, as a decentralized accounting system or database, are essentially a type of DePin. However, public chains serve as the main carrier of the Web3 ecosystem and are not labeled as DePin.

Apart from public chains, Aethir is the DePin project with the highest protocol fees and protocol revenue. The once-popular Filecoin has protocol fees that are less than one-tenth of Aethir's.

Value Comparison

Using FDV divided by protocol fees and protocol revenue, this ratio is similar to the calculation logic of price-to-earnings ratios, which can be used to assess and compare the value of projects.

After comparison, it is found that Aethir has the lowest FDV/Fees and FDV/Revenue ratios, indicating that Aethir may be the most undervalued relative to the projects in the table.

Interestingly, this is not because Aethir has not launched on Binance's spot trading. Another project, $GEOD, has launched on fewer exchanges, yet its two ratios are also higher than Aethir's.

Supply Side

Active Nodes

DePin nodes refer to the physical infrastructure that truly provides services in a decentralized physical infrastructure network. This includes GPUs, CPUs, cloud servers, storage devices, wireless hotspots, etc.

The more active nodes there are, the stronger the service capacity of the DePin network and the higher the total service cost.

The active node data mainly comes from the official websites of various projects, while Akash's data comes from the depinscan platform developed by IOTX (a DePin data platform that provides information on social data, token market data, and the global distribution of nodes for each DePin).

Data Comparison

Due to the significant cost differences among different types of infrastructure nodes, active node data comparisons should be made within the same category.

In the GPU category, Aethir clearly has the highest number of nodes. Among these projects, Render has the highest market capitalization; however, its official website does not provide active node data, only the total number of nodes since the project's inception, which is 5,600, a mere 1.3% of Aethir's active nodes.

In the cloud service category, Ethereum has the highest number of nodes.

Value Comparison

Still using FDV divided by the number of active nodes as a multiplier to measure the value of DePin projects.

Although the costs of different types of nodes vary, the cost of GPUs is likely to be higher than that of cloud servers, storage devices, and other hardware. Therefore, Aethir has the lowest "value/cost" multiplier, further indicating that Aethir may be undervalued.

Following Aethir, Helium also has a low multiplier, suggesting it may also be undervalued from the supply side perspective.

Ecosystem Overview

Number of Active Addresses

According to Metcalfe's Law, the value of a network is proportional to the square of the number of active users. Therefore, using the number of active addresses on-chain as an indicator for ecosystem comparison.

The number of active addresses in the table mainly comes from Token Terminal, calculating the average daily active addresses over the past year. Theta's data comes from its official website and should reflect data from the past day.

Data Comparison

Undoubtedly, the public chain with the most active addresses is Solana, followed by Ethereum. Of course, different uses of DePin networks are not comparable.

In the GPU computing category of DePin projects, Theta has the highest number of active addresses, but its data comes from the official website and is not annual average data, which may not be comparable to other similar projects. Under comparable conditions, Aethir has the highest number of active addresses among GPU computing DePin projects.

Value Comparison

Without considering data comparability, Theta may be an undervalued GPU computing DePin.

Under comparable conditions, Aethir is an undervalued GPU computing DePin.

Final Thoughts

Aethir is the first GPU computing DePin project to accept deep data acquisition from Token Terminal. Based on the ratio data of FDV to demand, supply, and the square of the number of active addresses, $ATH may be in a state of undervaluation.

Unlike other projects, Aethir and similar DePin projects primarily serve sectors outside of Web3, and their revenue is not correlated with cryptocurrency market fluctuations. Aethir's revenue shows a stable growth trend.

On the other hand, DePin projects represented by Aethir generate revenue from non-Web3 sectors, which is extremely rare. This means that the main revenue model of such projects may not be in the secondary market and could even attract capital from outside the cryptocurrency space…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。