Original Title: "Analyst Interprets BTC's 'Stepwise' Rising Pattern, Is $160,000 Within Reach?"

Original Source: BitpushNews

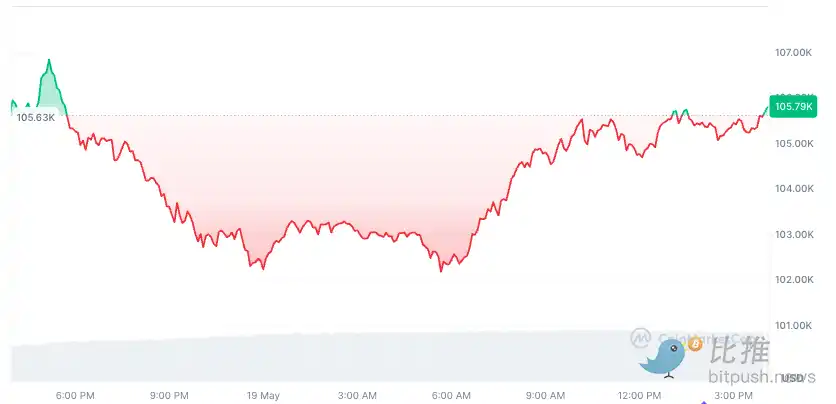

On Monday, the cryptocurrency market continued to rebound slightly, with Bitcoin briefly reaching an intraday high of $107,068 before retreating to around $102,105. According to data from CoinMarketCap, as of the time of writing, Bitcoin was trading at $105,850, with a 24-hour volatility of less than 1% and a 24-hour trading volume up 40% to $64.63 billion.

"Ten Thousand Dollar Stepwise Rising" Model

Some market observers have pointed out an interesting "stepwise" pattern in Bitcoin's recent rise.

Analyst Trader Tardigrade discovered that BTC's price increase follows a phased pattern, with each upward wave approximately $10,000, followed by a brief pause after each rise. He mentioned the movements from $75,000 to $85,000, then to $95,000, and most recently to $105,000. After each jump, there is usually a period of relative calm horizontal consolidation lasting seven to ten days.

For traders, this pattern provides predictable opportunities for profit-taking or establishing new positions. These consolidations can serve as new support levels, indicating buyers' willingness to re-enter the market. If this pattern continues, the next logical target could be $115,000, which is about 11% higher than the current price.

Tardigrade believes that the significance of the $100,000 mark is self-evident. This round number is not only an important psychological barrier but also forms strong technical support. Notably, after a significant 11% surge in early May, Bitcoin still maintained a slight increase of 0.5% last week, a "slow bull" characteristic that appears healthier and more sustainable compared to extreme volatility.

$160,000 Target

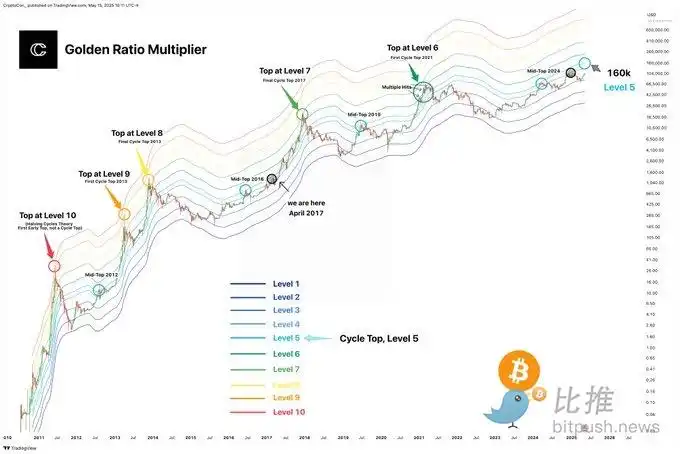

Looking further ahead, chart analyst CryptoCon provided a more optimistic outlook through the "Golden Ratio Multiplier" model.

CryptoCon stated that the Golden Ratio Multiplier model is one of the few technical indicators that accurately predicted the peak of the Bitcoin cycle in April 2021.

According to the model's analysis, by March 2024, the market will have reached the mid-cycle peak of this round, indicating that the market is likely to test the peak again. Currently, the model shows that the fifth-level target points to $160,000 and continues to rise, a trend reminiscent of the 2015-2017 bull market cycle—this current stage is comparable to the position in April 2017, just before the main upward wave of the bull market. Historical experience suggests that this slow accumulation phase often foreshadows a subsequent acceleration in price.

It is important to note that while this technical analysis has certain reference value, the $160,000 target is based on specific model calculations, and actual movements may be influenced by various factors. For ordinary investors, understanding this cyclical characteristic can help grasp market rhythms, but more importantly, it is essential to manage risks effectively.

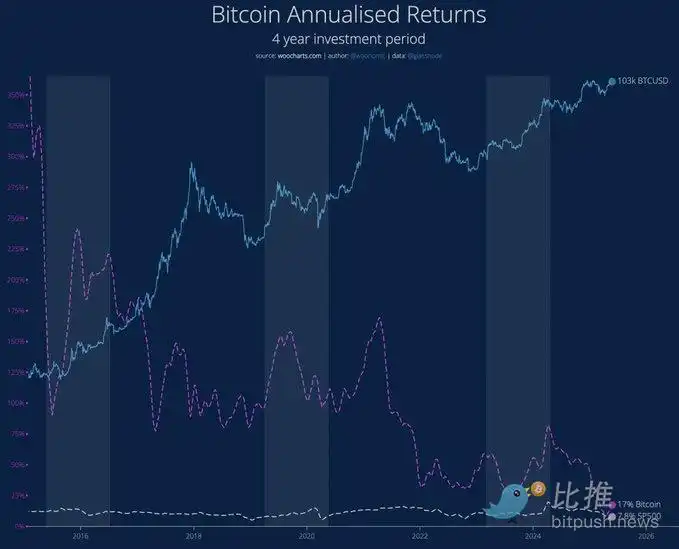

Willy Woo: BTC's Compound Annual Growth Rate Will Stabilize at 8%

Analyst Willy Woo provided another perspective. He believes that Bitcoin has evolved from a highly volatile, explosive growth asset into a more mature financial tool. Although many still view Bitcoin as a continuously soaring "magical unicorn," Woo pointed out that the era of over 100% annual growth rates, like in 2017, is largely over. He marked 2020 as a key turning point when Bitcoin achieved "institutionalization," as companies and sovereign entities began to accumulate it.

With more institutional capital entering, Bitcoin's compound annual growth rate (CAGR) has naturally declined from triple digits to around 30%-40% and continues to trend towards moderation. Woo attributes this to Bitcoin's increasing maturity and its growing role as a store of value. He emphasized Bitcoin's status as a global financial asset, stating that it "will continue to absorb capital until it reaches its equilibrium point."

Looking further into the future, Woo predicts that Bitcoin's compound annual growth rate will eventually stabilize at a level consistent with broader economic trends, potentially around 8% per year (combining 5% long-term monetary expansion and 3% GDP growth). Although this growth rate may seem insignificant compared to earlier periods, he remains confident in its long-term performance, summarizing: "Before that (perhaps in 15-20 years), enjoy the journey, because there are very few publicly investable products that can match Bitcoin's performance over the long term, even if Bitcoin's compound annual growth rate continues to decline."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。