One thing that surprises me the most is that there is no single common opinion about AMMs, LP profitability, LVR, arbitrage, and other things.

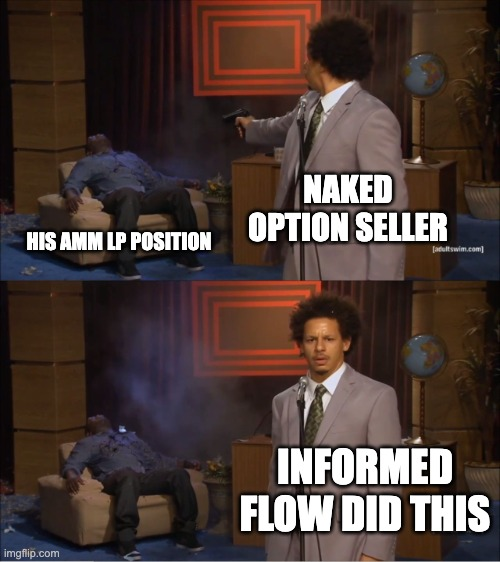

IMO, there's a misconception that LPs are competing against traders, or that AMMs lose because traders win. This isn't how LPing works. LPs aren’t betting against traders - they’re selling volatility. The key risk they take is not trader skill but asset movement, and they're compensated with fees for providing that exposure.

LPing is conceptually similar to options selling: in options, you receive a premium upfront based on implied volatility, whereas LPs earn fees continuously based on realized volatility. LPs earn yield (fees) in exchange for taking on the risk that prices will move away from their position.

Arbitrage does not imply LP loss. It’s a necessary part of the mechanism. LPs do not care if they are selling to informed or uninformed flow, they care about their liquidity staying in range and earning fees. And while LPs could theoretically capture some arbitrage profit via MEV recapture, it's not the core design intent. The fact that billions of dollars remain deployed in Uniswap, even when some analyses show LP losses, suggests that the LPs understand they’re being paid for volatility exposure, not for making directional bets, and they are successfully hedging this exposure.

As the DEX infrastructure matures, LPs will have better tools to manage/hedge their exposure. Also, considering that options are one of the most traded financial instruments in the real world, the future of decentralized LPing remains strong, despite the timeline is doomposting on LPing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。