Today is May 19th. Many partners may still be struggling to get past the past gloom. Historically, there was a "519 Kill R" event.

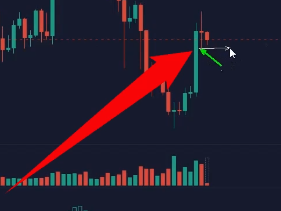

Today, as expected, there was another wave of significant decline on May 19th. We made a short position at 107,000, and this wave was very satisfying.

Essentially, the take-profit position was aimed at 104,500, but we didn't reach that low. Overall, we did manage to profit from this wave.

At the current position, the top structure has already formed.

From the daily chart perspective, although it hasn't closed yet, a temporary top structure has appeared from the 6-hour and 4-hour charts. Therefore, overall, we should primarily focus on shorting at high positions.

Currently, we can see where the rebound position is above. The Fibonacci retracement shows two levels: the first level at 103,980 and the second level at 104,500. These are the two upper levels.

We can see that after the main decline, the rebound of the second wave is a good position to short.

Below, we must first pay attention to the support at 101,300 and the support level at 100,700. Looking at the entire long-term cycle, it seems to be moving towards a high retracement. The first level below is 99,100. We can only take it step by step, starting from this first level.

High retracement.

The small structure of the second coin is identical to that of the large coin, and a temporary small top has already formed. Pay attention to the weekly chart's closing. The lowest price of this weekly candle is 2,312, which means this price cannot be broken.

If this price is broken, the probability of returning to 2,100 becomes very high. If this price is not broken, it will oscillate here for a while.

In this wave of oscillation, there are two scenarios.

Currently, at this position, we still take it step by step. This position is still in a temporary swing and oscillation phase, so we need to wait. It is still advisable to short in accordance with the direction of the large coin.

If you are unsure about the direction and can't grasp the levels, follow our public account: KK Strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。