On May 13, S&P Dow Jones Indices announced that Coinbase will officially replace Discover Financial Services in the S&P 500 index on May 19. Although companies like Block and MicroStrategy, which are strongly correlated with Bitcoin, have been included in the S&P 500, Coinbase is the first cryptocurrency exchange to join the index, indicating that cryptocurrency is gradually moving from a fringe industry to a mainstream one in the U.S.

On the day of the announcement, Coinbase's stock price surged by 23%, breaking the $250 mark. However, just three days later, Coinbase was hit by news of a hacker bribing its employees to steal customer data and demanding a ransom of $20 million. Additionally, the U.S. Securities and Exchange Commission (SEC) is investigating the authenticity of data claiming over 100 million "verified users" in its securities filings and promotional materials from its 2021 listing. These two incidents acted like mini-bombs, and as of the time of writing, Coinbase's stock has already dropped by more than 7.3%.

Coincidentally, Discover Financial Services, which is being replaced by Coinbase, can also be referred to as the "Coinbase" of the previous payment era. Discover is a digital bank and payment service company headquartered in Illinois, USA, founded in 1960. Its payment network, Discover Network, is the fourth largest payment network after Visa, Mastercard, and American Express.

In April, after the sixth-largest bank in the U.S., Capital One, was approved to acquire Discover, this long-established digital banking company smoothly passed its S&P 500 "seat" to the emerging cryptocurrency "bank." This unexpected coincidence gives a sense of a generational handover as Coinbase enters the S&P 500. However, this baton also brings Coinbase to a critical point of accumulating "external and internal troubles."

The Side Effects of ETFs

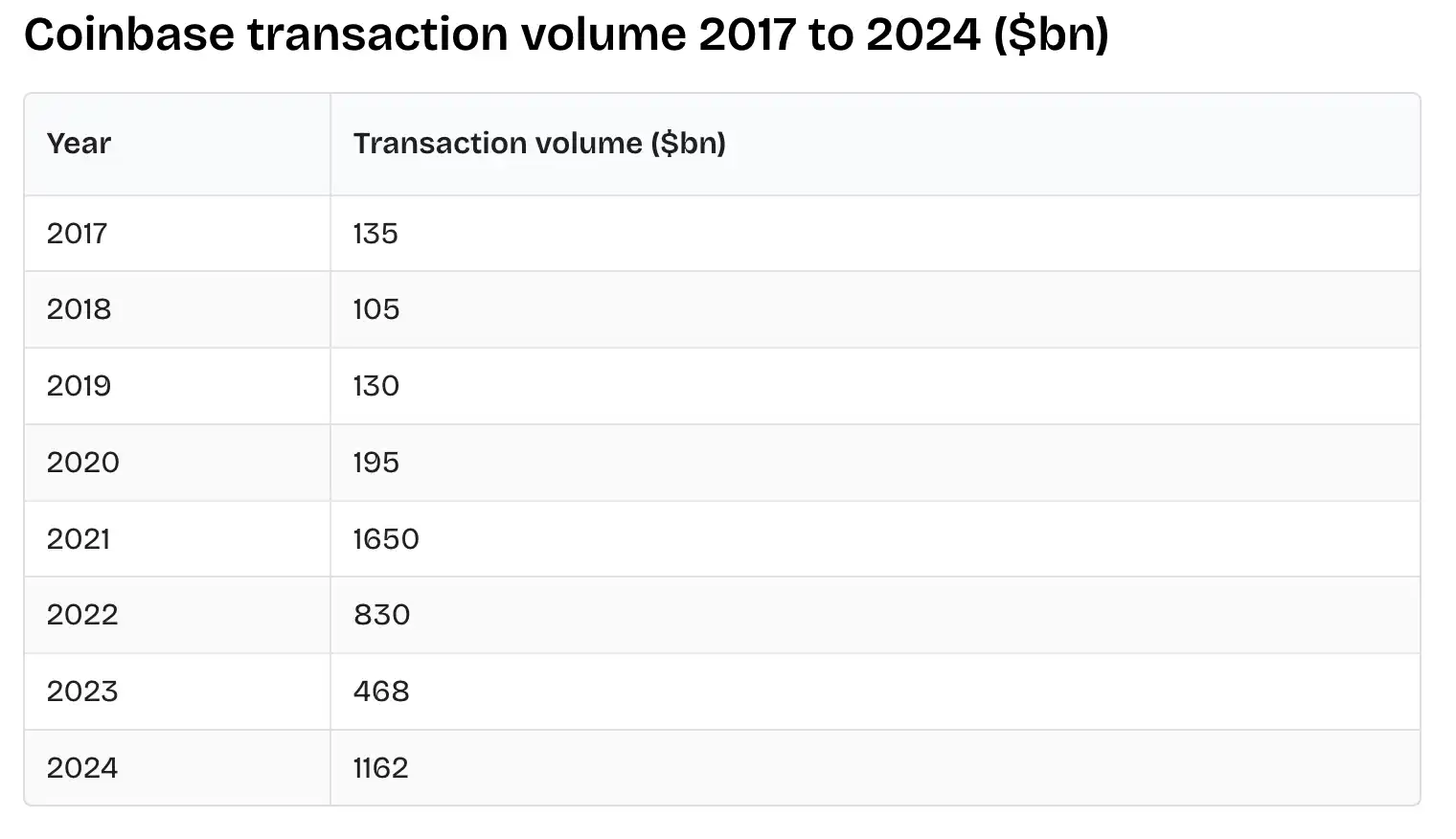

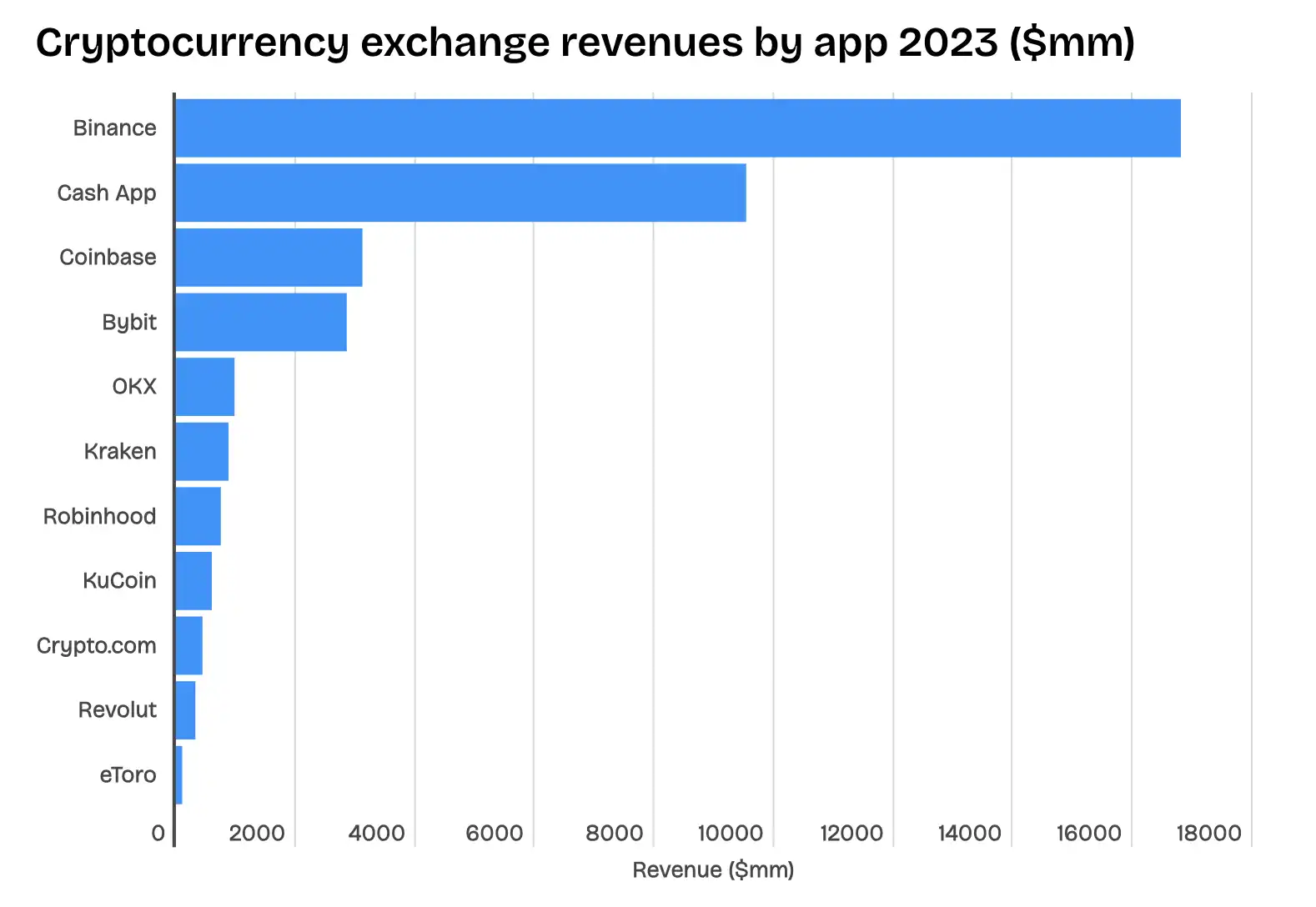

Over the past decade, cryptocurrency trading platforms have been the most stable "profit machines." They play a role in providing liquidity for the entire industry and rely on transaction fees to maintain operations. However, with the widespread rollout of ETF products in the U.S. market, this profit model is facing unprecedented challenges. As the leading exchange in the U.S., Coinbase is most affected, with over 80% of its business coming from the domestic market.

Since the approval of Bitcoin and Ethereum spot ETFs, traditional financial capital has begun to massively take over users and funds that originally belonged to exchanges, in a more cost-effective and compliant manner. The trading fee income for cryptocurrency trading platforms has started to decline, and this trend may further intensify in the coming months.

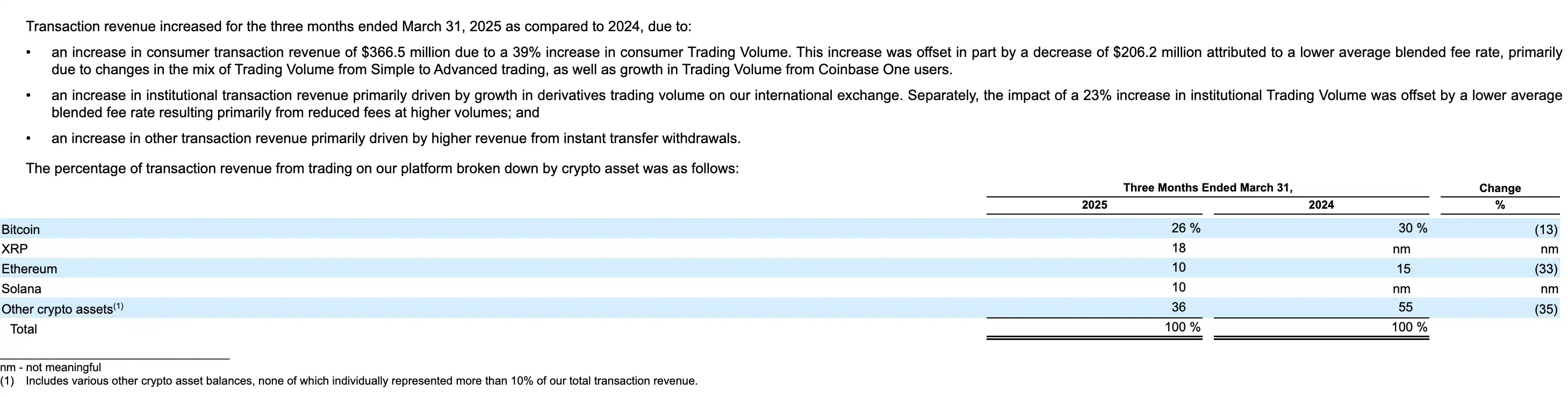

According to Coinbase's Q4 2024 financial report, the platform's total trading revenue was $417 million, a year-on-year decrease of 45%. The contribution of trading revenue from BTC and ETH fell from 65% in the same period last year to less than 50%.

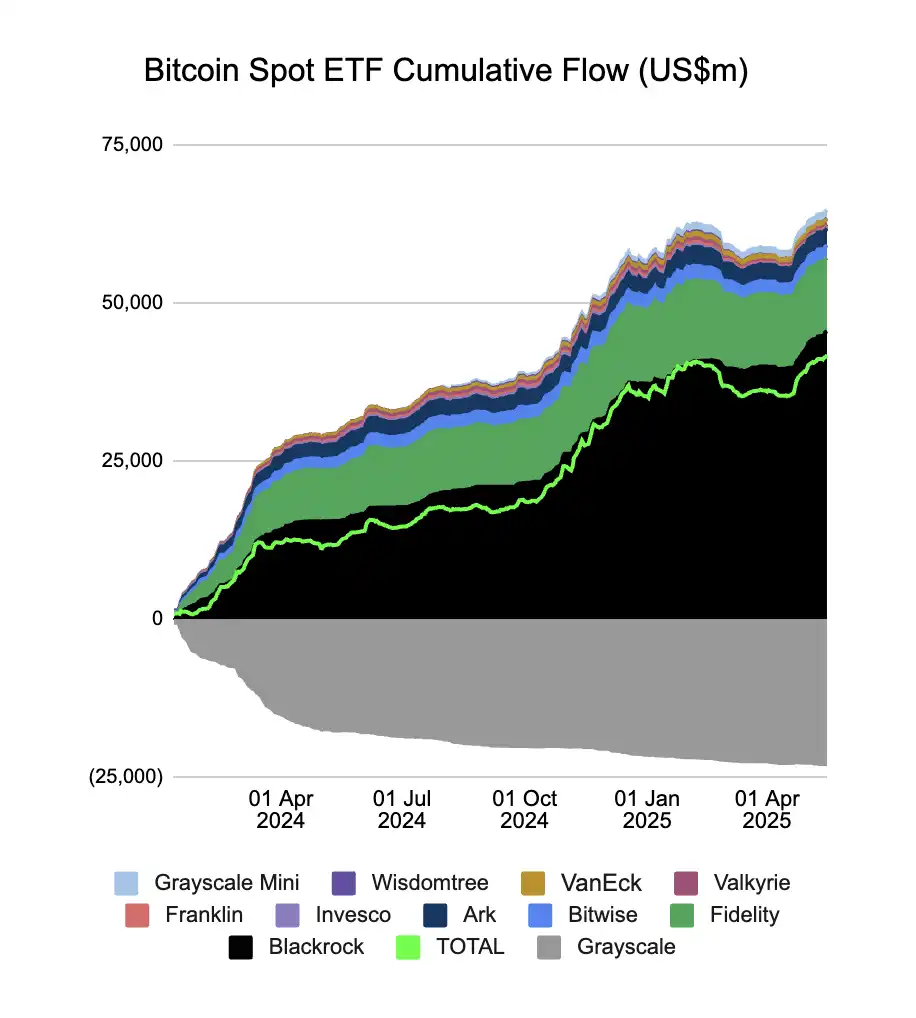

This is not a result of decreased market enthusiasm. In fact, since the approval of the Bitcoin ETF in January 2024, the inflow of BTC into the U.S. market has continued to reach new highs, with the asset management scale of funds like BlackRock and Fidelity rapidly expanding. Data shows that BlackRock's iShares Bitcoin ETF (IBIT) has already surpassed $17 billion in assets under management. As of mid-May 2025, the cumulative net inflow of 11 major institutional Bitcoin spot ETFs has exceeded $41.5 billion, with total net assets reaching $121.469 billion, accounting for about 5.91% of Bitcoin's total market value.

In the chart, only Grayscale shows a trend of net outflow.

Institutional investors and some retail investors are beginning to shift towards ETF products, partly due to compliance and tax considerations, and partly because the trading costs of ETFs are much lower than those of cryptocurrency trading platforms. Coinbase's spot trading fee rate varies in a tiered manner but averages around 1.49%, while the management fee for the IBIT ETF is only 0.25%, and most ETF institutional fees fluctuate around 0.15% to 0.25%.

In other words, the more rational users are, the more likely they are to shift from exchanges to ETF products, especially for investors aiming for long-term holdings.

According to multiple sources, several institutions, including VanEck and Grayscale, have submitted applications for Solana (SOL) ETFs to the SEC, and some institutions also have plans to submit XRP ETF applications. If approved, this could trigger a new wave of capital migration. According to the report submitted by Coinbase to the SEC, as of April, trading revenue from XRP and Solana accounted for 18% and 10% of Coinbase's platform trading revenue, respectively, nearly constituting one-third of the platform's fee income.

The approval of Bitcoin and Ethereum ETFs in 2024 has also reduced the trading fees for these two tokens on Coinbase from 30% and 15% to 26% and 10%, respectively. If SOL and XRP ETFs are approved, it will further weaken the core fee income sources for trading platforms like Coinbase.

The expansion of ETF products is gradually diminishing the financial intermediary status of cryptocurrency trading platforms. From their initial roles as matchmakers and clearinghouses, exchanges are now gradually becoming mere "entry and exit points" for funds, and their marginal value is being squeezed by ETFs.

Robinhood's Bold Moves, Traditional Brokers Also Competing

On May 12, 2025, SEC Chairman Paul S. Atkins delivered a keynote speech at the Tokenized Assets Working Group roundtable. The entire speech revolved around one theme: "It is a new day at the SEC." He stated that the SEC would not take an enforcement regulatory approach as before but would pave the way for crypto assets in the U.S. market.

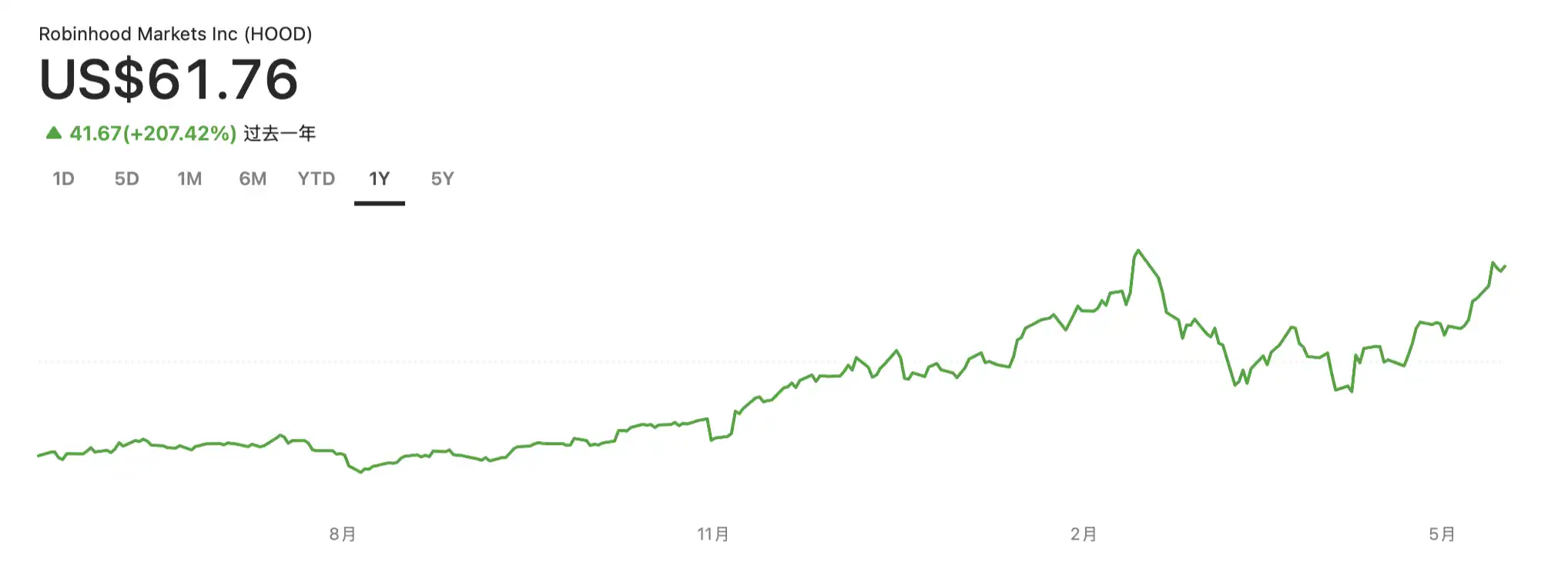

With the SEC's "NEW DAY" declaration and other signs of cryptocurrency compliance, more and more traditional brokers are attempting to enter the cryptocurrency industry. The well-known U.S. securities market player Robinhood is one of the most representative cases, having expanded its crypto business since 2018. By the time of its IPO in 2021, Robinhood's crypto business revenue accounted for over 50% of the company, largely thanks to the promotion of Dogecoin by Elon Musk.

Robinhood's Q1 2025 financial report showcased strong growth momentum, particularly in cryptocurrency and options trading, likely benefiting from Trump's Memecoin, with cryptocurrency-related revenue reaching $250 million, a nearly 100% year-on-year increase. Consequently, Robinhood Gold subscription users also reached 3.5 million, a 90% year-on-year increase, and the rapid growth of Robinhood Gold has provided the company with a stable source of income.

At the same time, Robinhood is actively pursuing reverse acquisitions of crypto assets, announcing in 2024 that it would acquire the European veteran crypto exchange Bitstamp for $200 million. Recently, Canada's largest cryptocurrency CEX, WonderFi, which listed on the Toronto Stock Exchange, also announced its integration with Robinhood Crypto. After obtaining virtual asset licenses in markets such as the UK, Canada, and Singapore, Robinhood has already gained a first-mover advantage in compliant cryptocurrency trading.

Moreover, an increasing number of securities firms are attempting similar paths, with firms like Futu Securities and Tiger Brokers testing the waters in crypto trading, some of which have applied for or obtained the Hong Kong SFC's VA license. Although the current user base is small, traditional brokers have inherent advantages in user trust, compliance licenses, and low fee structures, which may pose a threat to native crypto platforms.

Is Coinbase Still Safe After User Data Theft?

In April 2025, security researchers discovered that some user data from Coinbase had been leaked on the dark web. Although the platform initially responded that it was a "technical miscommunication," it still raised concerns among users about its security and privacy protection. Just two days before S&P Dow Jones Indices announced Coinbase's inclusion in the S&P 500 index, on May 11, 2025, Coinbase received an email from an unknown threat actor claiming to possess customer account information and internal documents, demanding a ransom of $20 million to avoid public disclosure. Coinbase later confirmed the data breach during its investigation.

Cybercriminals obtained data by bribing overseas customer service agents and support staff, primarily in non-U.S. regions like India. These agents abused their access to Coinbase's internal customer support system to steal customer data. Earlier, in February of this year, on-chain detective ZachXBT disclosed on X platform that between December 2024 and January 2025, Coinbase users lost over $65 million due to social engineering scams, with the actual amount likely being higher.

Among the victims was Ed Suman, a 67-year-old well-known artist who has worked in the art world for nearly two decades and participated in the production of artworks like Jeff Koons' "Balloon Dog." Earlier this year, he fell victim to a fake Coinbase customer service scam, losing over $2 million in cryptocurrency. ZachXBT criticized Coinbase for failing to adequately address such scams, pointing out that other major trading platforms do not face similar issues, and suggested that Coinbase strengthen its security measures.

The continuous incidents of social engineering, while not yet affecting user assets at a technical level, have raised concerns among many retail and institutional investors, especially those holding large amounts of assets on Coinbase. As of mid-May 2025, U.S. BTC ETF institutions held nearly 840,000 BTC, with 75% of that being custodied by Coinbase. If BTC is valued at $100,000, this amounts to an astonishing $63 billion, equivalent to the nominal GDP of two Icelandic nations in 2024.

Created by: ChatGPT, Source: Farside

In addition, Coinbase Custody serves over 300 institutional clients, including hedge funds, family offices, pension funds, and endowments. As of the Q1 2025 financial report, Coinbase managed total assets (including institutional and retail clients) amounting to $404 billion, although the specific amount of institutional custodial assets was not disclosed in the latest report, it should still exceed 50% according to the Q4 2024 report.

Created by: ChatGPT

Once the barrier of security is breached, not only could the rate of user loss exceed expectations, but more importantly, institutional trust in the company could be destroyed, undermining its corporate foundation. Consequently, after the hacking incident, Coinbase's stock price plummeted.

CEXs Are Self-Rescuing

In the face of declining spot trading fee income, Coinbase is accelerating its transformation, seeking growth opportunities in derivatives and emerging assets. At the end of 2024, Coinbase acquired a stake in the options platform Deribit and announced that it would officially launch perpetual contract products in 2025. This acquisition fills a gap for Coinbase in options trading and its relatively small global market share.

Deribit has a strong influence in non-U.S. markets, particularly in Asia and Europe. The acquisition allows Coinbase to gain Deribit's dominant position in Bitcoin and Ethereum options trading, which accounts for approximately 80% of global options trading volume, with daily trading volumes exceeding $2 billion.

Moreover, 80-90% of Deribit's client base consists of institutional investors, and its expertise and liquidity in the Bitcoin and Ethereum options market are highly favored by institutions. Coinbase's compliance advantages, combined with its already well-established institutional ecosystem, make it more compatible, allowing it to face pressure from giants like Binance and OKX in the derivatives market.

Kraken is also facing similar challenges, attempting to replicate Binance Futures' model in non-U.S. markets. Since the derivatives market relies more on professional users, the fee rates are relatively higher and more sticky, making it an important source of profit for exchanges. In the first half of 2025, Kraken completed the acquisition of TradeStation Crypto and a futures exchange, aiming to build a complete derivatives trading ecosystem to hedge against the risk of declining spot trading fee income.

With the surge of Memecoins in 2024, Binance, OKX, and various CEX platforms began to launch smaller, more volatile tokens on a large scale to activate active trading users. Due to the wealth effects and trading activity of Memecoins, Coinbase was also forced to join the fray, gradually listing popular Solana ecosystem tokens like BOOK OF MEME and Dogwifhat. Although these tokens are controversial, they are frequently traded and have fees several times higher than mainstream tokens, serving as a "blood replenishment" method for spot trading.

However, due to its status as a publicly traded company, this approach poses greater risks for Coinbase. Even in the currently crypto-friendly environment, the SEC is still investigating whether tokens like SOL, ADA, and SAND qualify as securities.

In addition to the forced transformation strategies mentioned above, CEXs are also beginning to explore RWA and the most discussed areas like stablecoin payments, such as the PYUSD launched in collaboration with PayPal, Coinbase's support for Circle's euro stablecoin EURC compliant with EU MiCA regulations, or Binance's collaboration with WIFL on USD1. In the increasingly crowded trading space, many CEXs have shifted their focus from purely trading markets to application areas.

The golden age of trading fees has quietly ended, and the second half for cryptocurrency trading platforms has quietly begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。