Key Points

● The total market capitalization of cryptocurrencies worldwide is $3.45 trillion, up from $3.07 trillion last week, representing a 12.4% increase this week. As of the time of writing, the cumulative net inflow of the Bitcoin spot ETF in the U.S. is approximately $41.16 billion, with a net inflow of $600 million this week; the cumulative net inflow of the Ethereum spot ETF in the U.S. is approximately $2.4 billion, with a net inflow of $157 million this week.

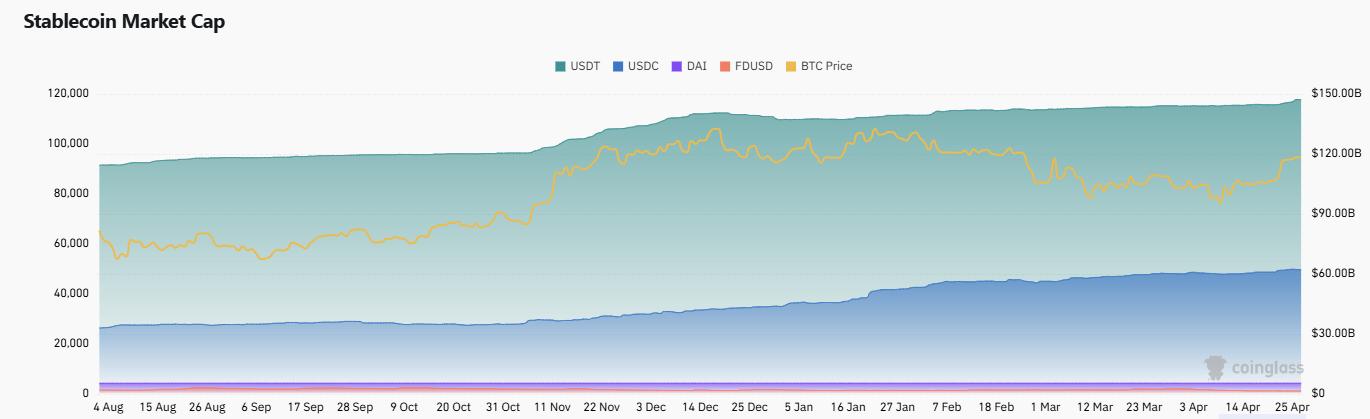

● The total market capitalization of stablecoins is $246 billion, with USDT having a market capitalization of $144.8 billion, accounting for 58.9% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $61.7 billion, accounting for 25% of the total; and DAI with a market capitalization of $5.37 billion, accounting for 2.2% of the total stablecoin market capitalization.

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $117.1 billion, up from $101.5 billion last week, representing a 15.4% increase this week. By public chain, the top three chains by TVL are Ethereum with a share of 53.41%; Solana with a share of 7.94%; and Bitcoin with a share of 5.53%.

● On-chain data shows that with the market warming up this week, daily trading volumes have increased, with Ethereum showing significant growth, up 11.6% from last week; in terms of transaction fees, most public chains have seen an increase this week, except for Aptos, which saw a decrease, with Ethereum experiencing the most significant increase of 93% compared to last week, while BNBChain's transaction fees remained relatively stable. In terms of daily active addresses, overall public chain activity is on the rise, with BNBChain increasing by 34% compared to last week; Solana increased by 10% compared to last week. In terms of TVL, all public chains have seen growth, with Ethereum and Solana showing the most significant upward trends, increasing by 17.7% and 19.5% respectively compared to last week.

● Innovative projects to watch: SPLAT is an intelligent AI trading terminal that adapts to user needs, providing real-time, objective market insights; BentoBatch is a streamlined trading layer aimed at enhancing blockchain efficiency; Lume is a non-custodial wallet designed for ordinary users, allowing them to create, stake, and earn using Lume.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Capitalization Ratio

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Ratios

5. Decentralized Finance (DeFi)

7. Stablecoin Market Capitalization and Issuance

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Events Happening Next Week

3. Important Financing and Investment from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Capitalization Ratio

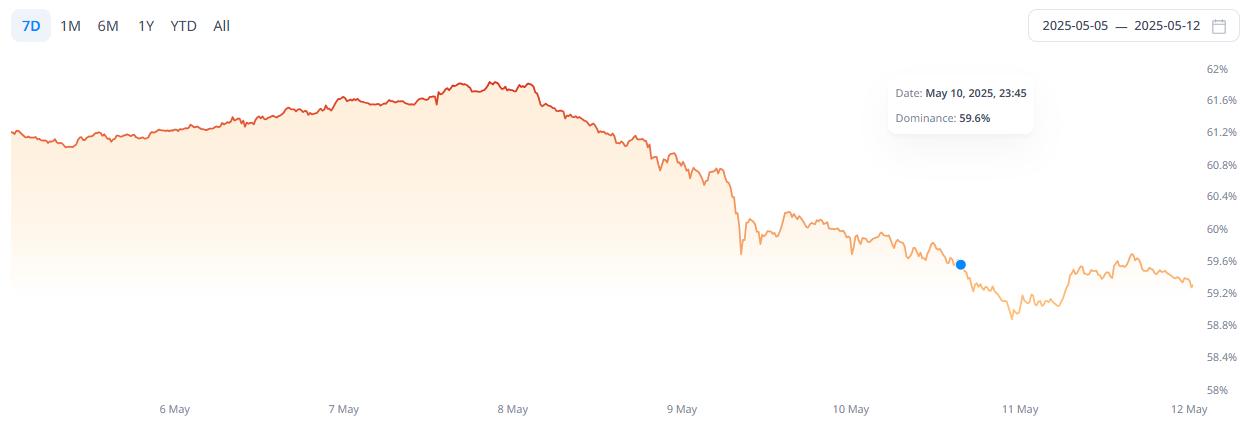

The total market capitalization of cryptocurrencies worldwide is $3.45 trillion, up from $3.07 trillion last week, representing a 12.4% increase this week.

_Figure 1 Data Source: cryptorank_

As of the time of writing, the market capitalization of Bitcoin is $2.07 trillion, accounting for 59.96% of the total cryptocurrency market capitalization. Meanwhile, the market capitalization of stablecoins is $246 billion, accounting for 7.13% of the total cryptocurrency market capitalization.

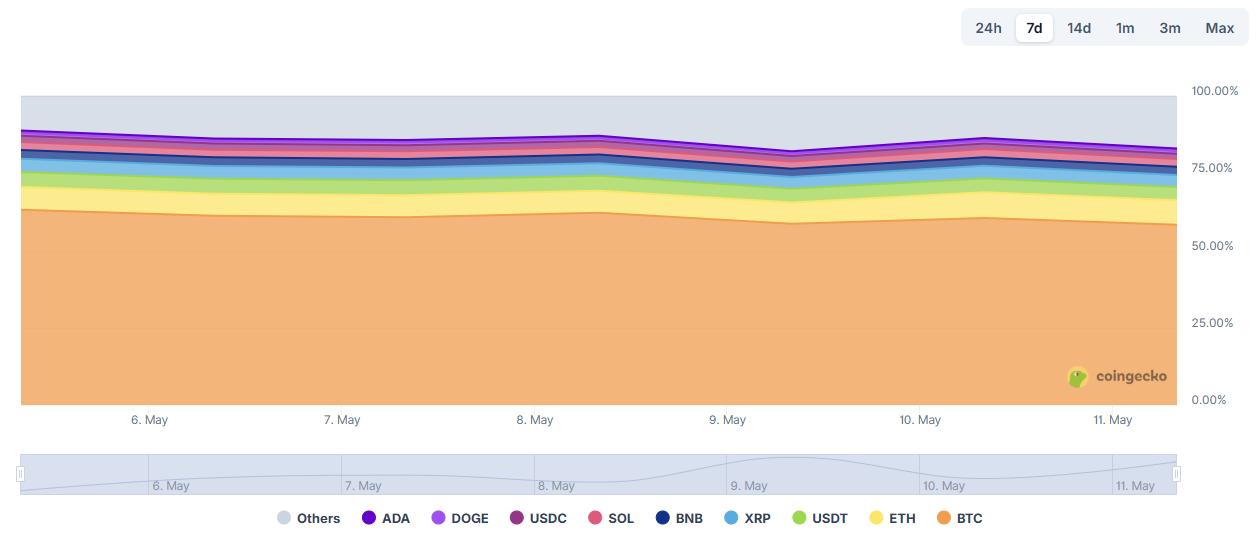

Figure 2 Data Source: coingecko

2. Fear Index

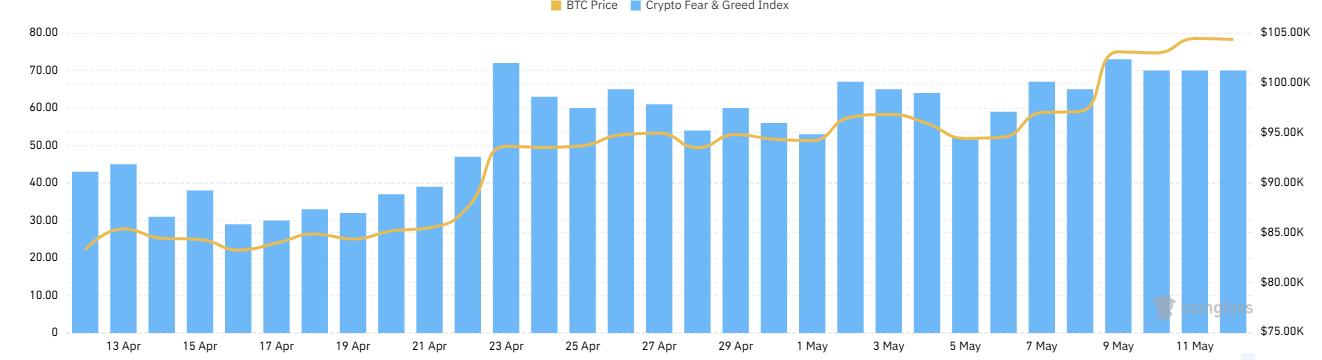

The cryptocurrency fear index is at 70, indicating greed.

Figure 3 Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the Bitcoin spot ETF in the U.S. is approximately $41.16 billion, with a net inflow of $600 million this week; the cumulative net inflow of the Ethereum spot ETF in the U.S. is approximately $2.4 billion, with a net inflow of $157 million this week.

Figure 4 Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Ratios

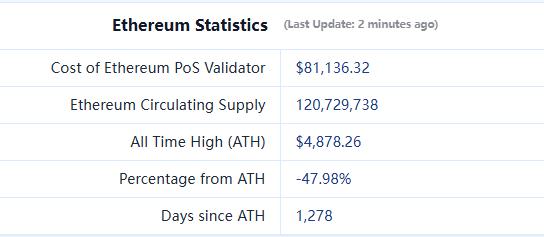

ETHUSD: Current price is $2,530, with a historical high of $4,878, down approximately 47.98% from the highest price.

ETHBTC: Currently at 0.024208, with a historical high of 0.1238.

Figure 5 Data Source: ratiogang

5. Decentralized Finance (DeFi)

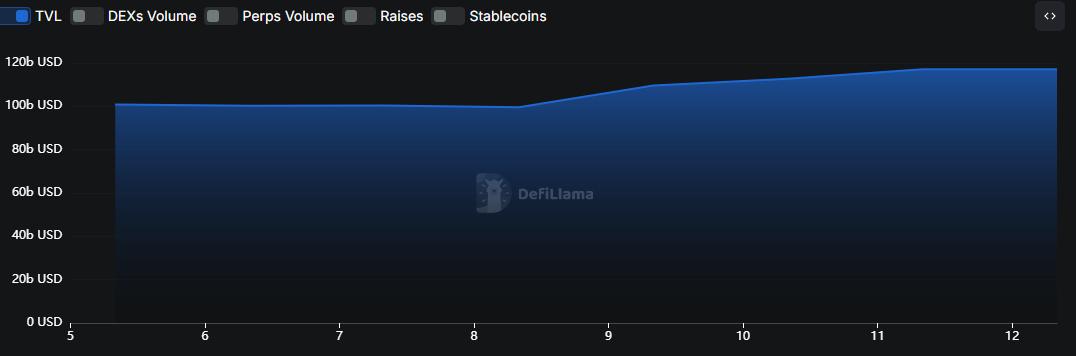

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $117.1 billion, up from $101.5 billion last week, representing a 15.4% increase this week.

Figure 6 Data Source: defillama

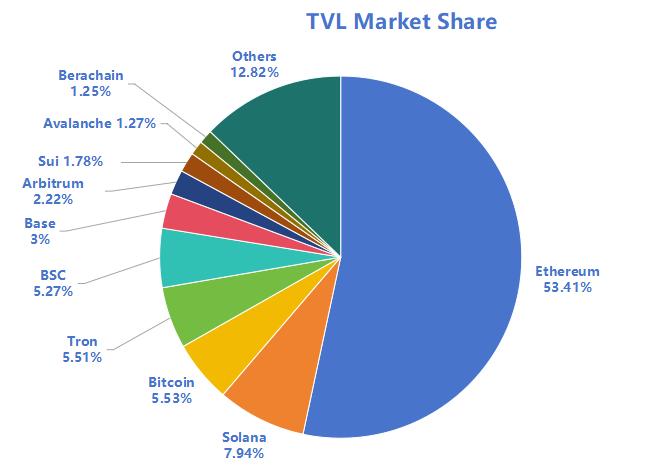

By public chain, the top three chains by TVL are Ethereum with a share of 53.41%; Solana with a share of 7.94%; and Bitcoin with a share of 5.53%.

Figure 7 Data Source: CoinW Research Institute, defillama

Data as of May 11, 2025

6. On-Chain Data

Layer 1 Related Data

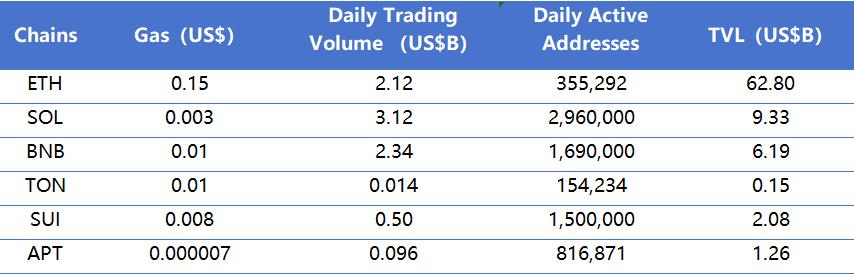

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Figure 8 Data Source: CoinW Research Institute, defillama, Nansen

Data as of May 11, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, with the market warming up, daily trading volumes have increased, with Ethereum showing significant growth, up 11.6% from last week; in terms of transaction fees, most public chains have seen an increase this week, except for Aptos, which saw a decrease, with Ethereum experiencing the most significant increase of 93% compared to last week. Additionally, BNBChain's transaction fees remained relatively stable.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. From the perspective of daily active addresses, overall public chain activity is on the rise, with BNBChain increasing by 34% compared to last week; Solana increased by 10% compared to last week. In terms of TVL, all public chains have seen growth, with Ethereum and Solana showing the most significant upward trends, increasing by 17.7% and 19.5% respectively compared to last week.

Layer 2 Related Data

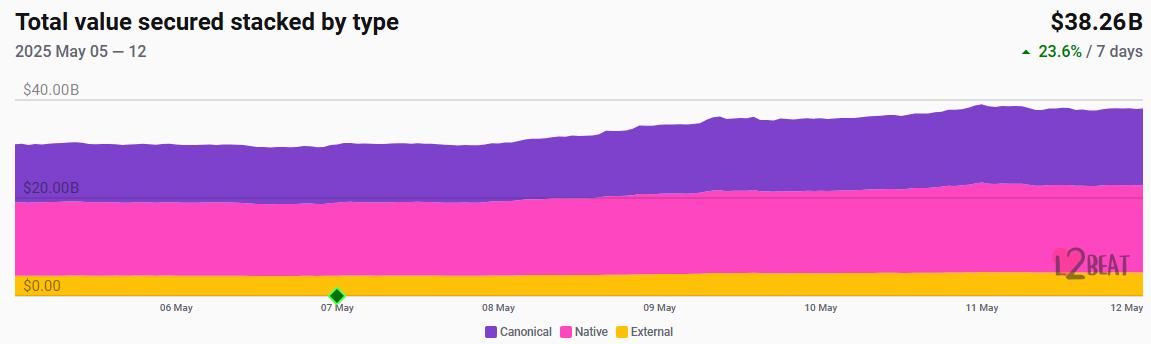

● According to L2Beat, the total TVL of Ethereum Layer 2 is $38.26 billion, up from $30.94 billion last week, representing an overall increase of 23.7%.

Figure 9 Data Source: L2Beat

Data as of May 11, 2025

● Base and Arbitrum occupy the top positions with market shares of 38.31% and 32.63% respectively, with Base still ranking first in Ethereum Layer 2 TVL this week.

Figure 10 Data Source: footprint

Data as of May 11, 2025

7. Stablecoin Market Capitalization and Issuance

According to Coinglass, the total market capitalization of stablecoins is $246 billion. Among them, USDT has a market capitalization of $144.8 billion, accounting for 58.9% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $61.7 billion, accounting for 25% of the total; and DAI with a market capitalization of $5.37 billion, accounting for 2.2% of the total stablecoin market capitalization.

Figure 11 Data Source: CoinW Research Institute, Coinglass

Data as of May 11, 2025

According to Whale Alert, this week the USDC Treasury has issued a total of 3.6 billion USDC, with a total stablecoin issuance of 3.6 billion this week, compared to 3.322 billion last week, representing an increase of approximately 8.7% in stablecoin issuance this week.

Figure 12 Data Source: Whale Alert

Data as of May 11, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Figure 13 Data Source: CoinW Research Institute, coinmarketcap

Data as of May 11, 2025

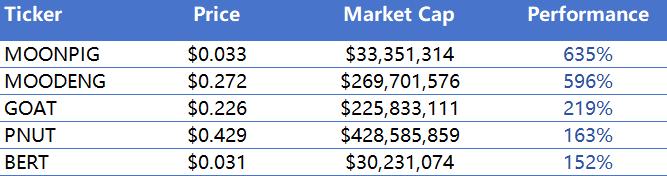

The top five Meme coins by growth in the past week

Figure 14 Data Source: CoinW Research Institute, coinmarketcap

Data as of May 11, 2025

2. New Project Insights

● SPLAT: An intelligent AI trading terminal that adapts to user needs, providing real-time, objective market insights. SPLAT focuses on speed, accuracy, and user-driven content exploration. (Official X: https://x.com/asksplat)

● Bento Batch: A streamlined trading layer aimed at enhancing blockchain efficiency. The Streamlined Trading Layer (STL) redefines the interaction between wallets and dApps, where transactions are simplified to the expected outcomes of various operations. Users only need to define their goals, and STL can efficiently meet their needs. (Official X: https://x.com/Bento_Labs)

● Lume: A non-custodial wallet designed for ordinary users, allowing them to create, stake, and earn using Lume. (Official X: https://x.com/lumefiapp)

III. Industry News

1. Major Industry Events This Week

The blockchain gaming ecosystem Treasure DAO launched Agent Social Pilot, with the first 1,000 spots open to NFT agents on the support list (including SMOL, Azuki, BAYC, Meebits, Milady Maker). Users can pay 0.005 ETH to activate the X connection feature, allowing agents to post independently. A few participants have the chance to win rare 1/1 animated collectibles, and the most active agents during the event will receive a special Smol Brain.

The NFT project Doodles has launched a token airdrop on May 9. The airdrop is divided into two phases, with the first phase prioritizing registered Doodles Collectibles holders, expected to take 3 to 5 minutes; the second phase will airdrop to members of the partner community New Blood, expected to take 15 minutes. Registered users and partner community members will automatically receive the airdrop without manual operation.

The multi-party computation (MPC) network Ika announced its token economics. The initial supply of IKA is 10 billion, with over 50% allocated to the community, including 6% (600 million) distributed through the first community airdrop at the mainnet launch. The complete distribution and mechanism of the IKA token, including the remaining community and internal allocations, are planned to be announced closer to the Ika launch.

The decentralized social protocol Farcaster announced that it has distributed Monad testnet airdrops (MON test tokens) to over 75,000 accounts. Users can check their eligibility by opening the wallet in the mobile application.

XOCIETY, an action game on Sui, is collaborating with Adidas to launch a digital collectible, consisting of 2,600 Adidas x XOCIETY mystery box NFTs. Each NFT contains an Adidas-themed skin, categorized into four rarity levels. Additionally, each NFT box includes a certificate of authenticity and the ecosystem token XO from XOCIETY.

2. Major Events Coming Next Week

sns.sol announced that the SNS airdrop claim will begin on May 13. Currently, the SNS token airdrop allocation query is open, allowing a 90-day window for eligible wallets to claim their token allocation. The claim window will officially close on August 11, and any unclaimed tokens will be returned for ecosystem development.

The distributed validation infrastructure Obol Collective will have its TGE on May 15. Obol Collective is a decentralized operational ecosystem aimed at expanding Layer 1 and decentralized infrastructure.

The proposal solicitation for NEAR's chain-abstract relayer is open for applications until May 15. This RFP aims to build a chain-abstract relayer infrastructure, a self-service platform that will enable developers to seamlessly sponsor gas fees or allow users to pay transaction fees across multiple blockchains, accepting base tokens (such as ETH, SOL) and mainstream stablecoins (USDT/USDC) as gas deposits.

CoinList will launch the Acurast (ACU) token sale on May 16. The official announcement states that 100% of the tokens will be unlocked at TGE. The price per token is $0.09, with a total of 60,000,000 tokens available for purchase, and a purchase limit of a minimum of $100 and a maximum of $2 million.

3. Important Financing from Last Week

● Sentora raised $25 million, with investors including New Form Capital, Ripple, Tribe Capital, UDHC, Curved Ventures, and others. Sentora is a DeFi asset management service platform that integrates institutional-grade DeFi analytics from IntoTheBlock and structured liquidity solutions from Trident. The platform aims to bring institutional investors into the on-chain world and will develop a unified interface to address the fragmentation of multi-chain protocol interactions. (May 6, 2025)

● Deribit: Coinbase announced on May 8 that it would acquire Deribit for $2.9 billion, making it the largest single acquisition deal in the crypto space. Deribit is currently the largest cryptocurrency options exchange, with over 80% of the market's total trading volume in Bitcoin options and over 90% in Ethereum options. (May 8, 2025)

● Metaplanet secured $21.25 million in debt financing, with the investing institutions undisclosed. Metaplanet is a publicly listed company on the Tokyo Stock Exchange (stock code: 3350) and has initiated a strategic transformation. Metaplanet will utilize Bitcoin (BTC) as its primary reserve asset, leverage excess cash flow, and implement value-added corporate governance, including financial management strategies such as debt and equity financing. (May 9, 2025)

Reference Links:

SPLAT

https://x.com/asksplatBento Batch

https://x.com/Bento_Labs

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。