Another day has passed without surprises, and today the difficulty of the assignments has dropped sharply. Yesterday, I was discussing the shorting space of $BTC with @Cato_CryptoM. In fact, I was repeatedly trading long and short around $104,200 to $103,100, but I felt the efficiency was low. I planned to narrow the range to around $104,100 to $103,500, but unexpectedly, after closing my position, it never returned to $104. Uncle Cat made a good profit this time.

He opened his position at $104,500. When I closed mine, he said he would hold it until next week. As a result, I only made a small profit, and since then, I have had no position. This is mainly due to Moody's downgrade of the U.S. credit rating. I believe this won't have a significant impact on $BTC, but it has indeed affected Bitcoin's ceiling. However, I don't plan to adjust my strategy for now; I'll wait to see if it comes back on Sunday.

Today, the macro environment was again stirred up by Trump. On one hand, he called for Powell to lower interest rates quickly, while on the other hand, he demanded that Walmart should not raise prices and should actively bear the tariffs. It's worth noting that by mid-2024, Walmart's net profit margin is about 2.5%. If they have to absorb all the tariffs, especially from China, I roughly calculated that if they bear 1% of the tariffs, it would consume about 6% of their total net profit.

In simpler terms, if Walmart absorbs 10% of the tariffs, their profit margin would drop by 60%. This would not only compress shareholder returns but also affect Walmart's reinvestment capacity and pricing power in the supply chain, ultimately forcing them to either raise prices, lay off employees, or outsource production.

In this policy contradiction, the market is caught in a paradox of wanting low inflation while not allowing companies to adjust prices.

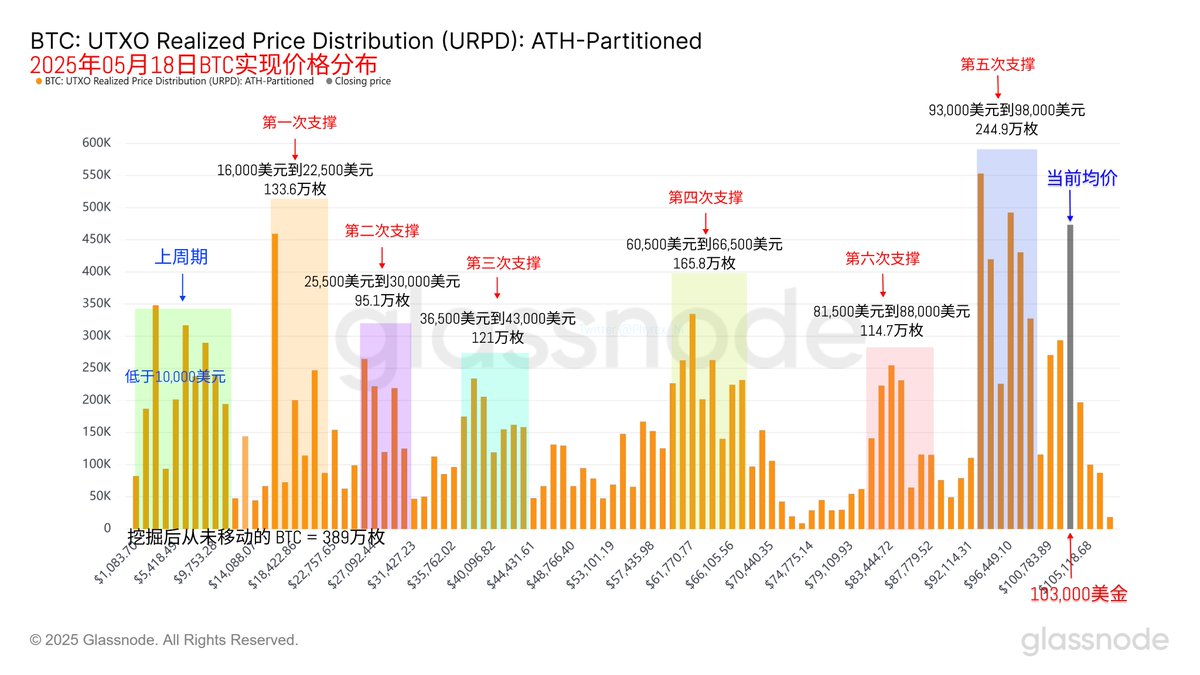

Looking back at Bitcoin's data, it has already been so quiet by Saturday, and it is expected to be even quieter by Sunday. The trading volume has been decreasing throughout the week, and the turnover rate has also dropped significantly. Investor sentiment towards trading is now very low. Although the price is holding up well, liquidity is a complete mess.

The decrease in turnover rate means less support. Recently, short-term investors have not been active in the last 24 hours. Now, it seems that trading volume has decreased significantly every weekend.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。