Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55%, which is $2.06 trillion. The market cap of stablecoins is $242.5 billion, with a recent 7-day increase of 0.12%, of which USDT accounts for 62.4%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $103,628; ETH has shown a slight upward trend, currently priced at $2,599.

Among the top 200 projects on CoinMarketCap, a small number have risen while most have fallen, including: WIF with a 7-day increase of 44.8%, RAY with a 7-day increase of 19.4%, ETHFI with a 7-day increase of 114.52%, and NXPC with a 7-day increase of 75.9%.

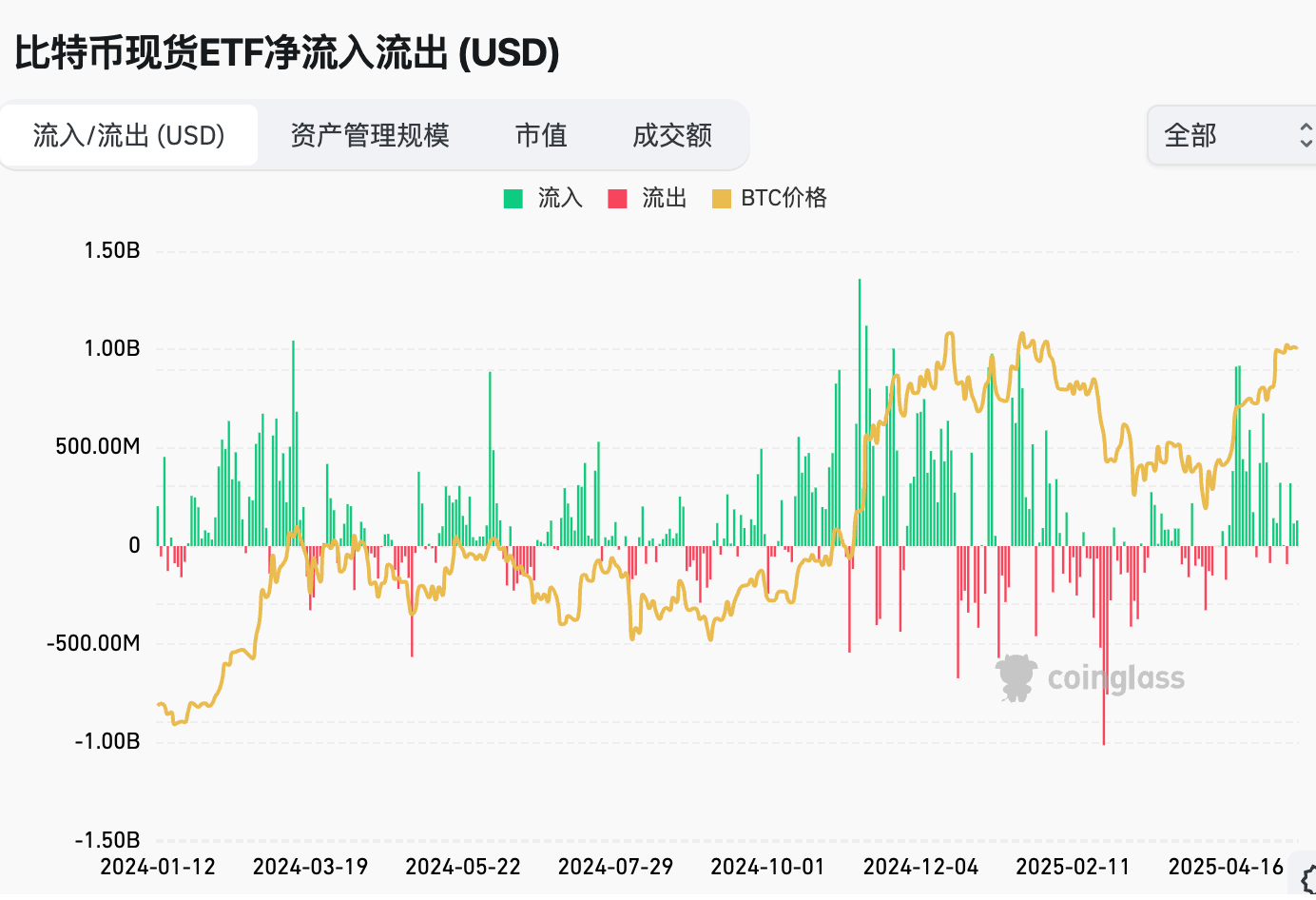

This week, the net inflow for the U.S. Bitcoin spot ETF was $607.8 million; the net inflow for the U.S. Ethereum spot ETF was $41.8 million.

On May 16, the "Fear & Greed Index" was at 69 (lower than last week), indicating a sentiment of greed over the past 7 days.

Market Forecast:

This week, stablecoins continued to see small increases, with significant inflows into the U.S. Bitcoin spot ETF and minor inflows into the Ethereum ETF. Due to the easing of global tariff conflicts, the U.S. April CPI and PPI data came in below expectations, with BTC hovering around $103,000. Some altcoins have seen slight increases, notably the new project Launchcoin, which had a 7-day increase of 2650%. There are still phase-based profit opportunities in the market, and the Hotcoin new coin list is worth paying attention to. Greed sentiment has eased compared to last week. The probability of the Federal Reserve cutting rates by 25 basis points in June is only 6.7%, lower than last week, making a June rate cut unlikely, with July being the next point of interest. Although there are positive economic fundamentals, the market still faces significant uncertainty until new liquidity enters. The outlook for the market in 2025 remains optimistic. However, liquidity shortages can occur in the summer, so partial profit-taking is recommended.

Understanding Now

Review of Major Events of the Week

On May 11, Defillama founder 0xngmi posted on X platform that hackers managed to infiltrate one address in the Lido oracle multi-signature, exposing their whereabouts after stealing 1.4 ETH. 0xngmi added that it might be worth placing some simple coins in a multi-signature wallet to act as a canary and alert when the wallet is compromised;

On May 12, the White House announced that the U.S. reached a trade agreement with China in Geneva;

On May 13, S&P Dow Jones Indices announced that cryptocurrency exchange Coinbase (COIN.O) will be included in the S&P 500 Index, replacing Discover Financial. Coinbase will become the first pure crypto company to join the S&P 500 Index, with COIN's stock price rising 9.5% in after-hours trading;

On May 13, market news reported that Trump’s company Truth Social denied rumors of issuing a meme coin;

On May 13, SEC Chairman Paul Atkins unveiled his vision for crypto regulation, indicating a more favorable approach to digital assets;

On May 13, blockchain cloud service company Nirvana Labs completed a $6 million seed extension round, led by Jump Crypto and Crucible Capital, with participation from RW3 Ventures, Castle Island, Hash3 VC, and others;

On May 14, AI agency platform Virtuals Protocol announced on social media that the VIRTUAL staking feature is now live. By locking VIRTUAL, users will receive veVIRTUAL, which is the voting escrow version of the token, representing long-term collaboration, deeper protocol utility, and future governance power;

On May 14, TheBlock reported that the U.S. SEC postponed its decision on BlackRock's iShares Bitcoin Trust's physical redemption mechanism, requesting public comments on the proposal. The current cash redemption model requires custodians to sell Bitcoin before returning cash to investors. Analysts noted that if physical redemption is approved, it would enhance ETF trading efficiency. Additionally, proposals for Grayscale's Litecoin Trust and Grayscale's Solana Trust were also postponed, while the 21Shares Dogecoin ETF entered the public comment phase;

On May 14, Robinhood's competitor, online brokerage eToro, raised approximately $310 million in its initial public offering (IPO) in the U.S.;

On May 14, the Ethereum Foundation announced the launch of a "trillion-dollar" security plan, a comprehensive initiative aimed at upgrading Ethereum's security and helping the world transition to on-chain. The plan includes "full-stack security mapping," "key area breakthroughs," and "security awareness upgrades";

On May 15, CoinMarketCap officially launched the CMC Launch platform, with the first project being the decentralized perpetual trading platform Aster ($AST);

On May 15, U.S. lawmakers stated that Trump's involvement in crypto complicates legislation, but the stablecoin and market structure bills are still expected to pass before August;

On May 16, Coinbase faced a dual blow of "SEC investigation" and "hacker stealing user data" during trading hours.

Macroeconomics

On May 13, the U.S. April unadjusted CPI year-on-year was 2.3%, expected 2.40%, previous value 2.40%;

On May 15, the U.S. April PPI year-on-year was 2.4%, expected 2.5%, previous value revised from 2.70% to 3.4%. The PPI year-on-year has declined for the third consecutive month, marking a new low since September of last year;

On May 15, market news reported that the U.S. Securities and Exchange Commission decided to postpone its resolution on the 21SHARES spot Polkadot (DOT) ETF application;

On May 16, CoinPost reported that Japanese listed company Remixpoint announced the purchase of an additional 32.83 BTC, bringing its total Bitcoin holdings to 648.82 BTC, with a current market value of approximately 9.91 billion yen;

On May 16, according to CME's "FedWatch": The probability of the Federal Reserve maintaining interest rates in June is 93.3%, while the probability of a 25 basis point cut is 6.7%.

ETF

According to statistics, from May 12 to May 16, the net inflow of the U.S. Bitcoin spot ETF was $607.8 million; as of May 16, GBTC (Grayscale) had a total outflow of $22.944 billion, currently holding $19.635 billion, while IBIT (BlackRock) currently holds $65.435 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $125.131 billion.

The net inflow of the U.S. Ethereum spot ETF was $41.8 million.

Envisioning the Future

Event Preview

Bitcoin 2025 will be held from May 27 to 29 in Las Vegas, USA;

NFT NYC 2026 will be held from June 23 to 25, 2025, in New York, USA.

Project Progress

- DeFi Development approved a 1-for-7 stock split, with shareholders set to receive an additional six shares on May 19. If approved by Nasdaq, trading will resume on May 20 after the split adjustment.

Important Events

- On May 20, the Reserve Bank of Australia will announce its interest rate decision.

Token Unlocking

Pyth Network (PYTH) will unlock 2.13 billion tokens on May 19, valued at approximately $399 million, accounting for 58.62% of the circulating supply;

Pixels (PIXEL) will unlock 89.37 million tokens on May 19, valued at approximately $4.94 million, accounting for 1.79% of the circulating supply;

Polyhedra (ZKJ) will unlock 15.5 million tokens on May 19, valued at approximately $31.9 million, accounting for 1.55% of the circulating supply;

Pyth Network (PYTH) will unlock 2.83 billion tokens on May 20, valued at approximately $472 million, accounting for 28.33% of the circulating supply;

Bittensor (TAO) will unlock 216,000 tokens on May 21, valued at approximately $95.47 million, accounting for 1.03% of the circulating supply.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We build a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and all-day market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selected" and daily news briefings of "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。