Source: Cointelegraph

Original: “16% Ambition: From Altcoin Spot to Perpetual Contracts, Gate.io's Differentiated Strategy Dominance”

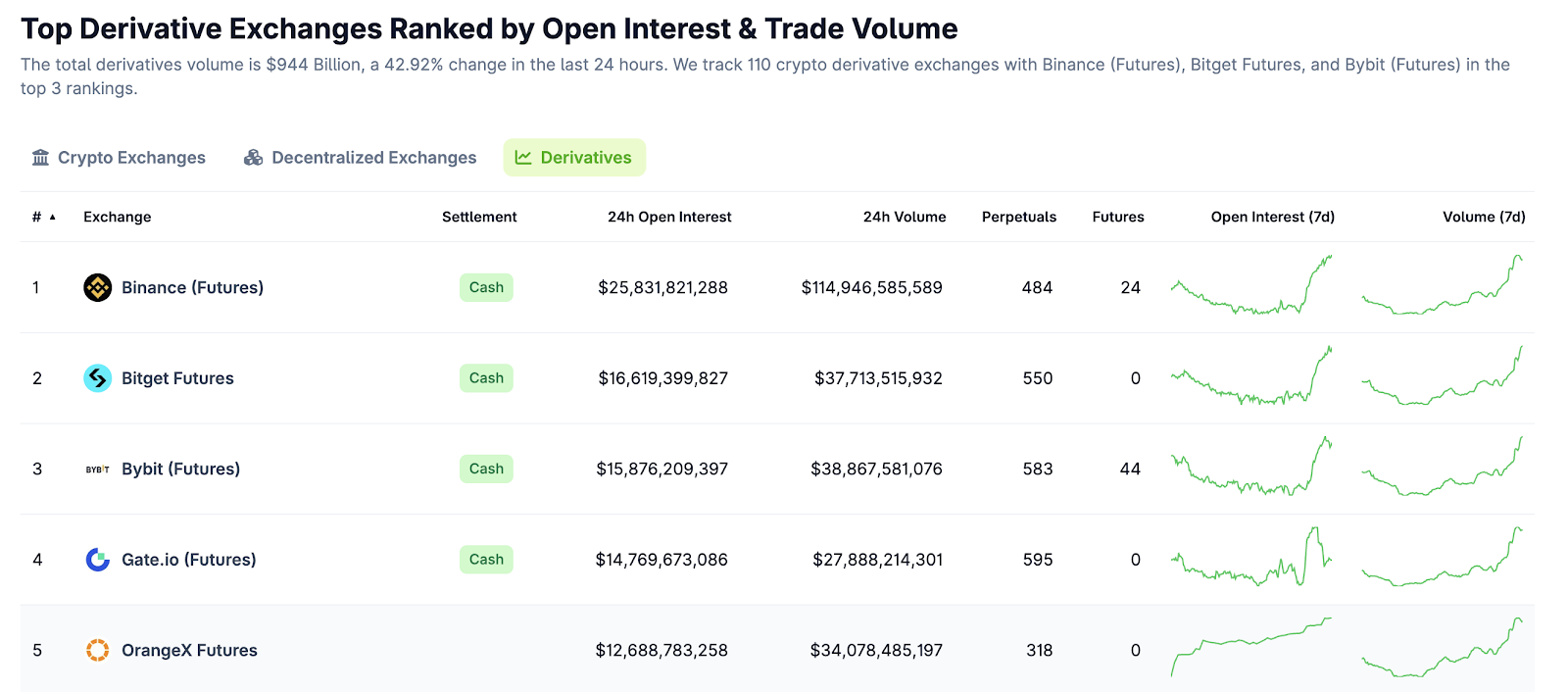

According to the latest data from CoinGecko, the cryptocurrency derivatives market landscape has undergone significant changes in the first quarter of 2025. Binance remains in the lead with a 32.4% share, followed by Bitget and Bybit in second and third place, while Gate.io has surged to fourth place with a 16% market share, becoming the platform with the strongest growth momentum among the top five. This ranking change reflects two major trends:

The loosening of the head effect: Although Binance still dominates the market, its share has significantly decreased from 60% in 2023, gradually breaking the monopoly in the derivatives market.

Intensified competition in the mid-tier: Gate.io and exchanges like MEXC are encroaching on the shares of traditional giants through differentiated strategies. For example, Gate.io's perpetual contract open interest increased from 11% in October 2024 to 16% in 2025, demonstrating sustained user stickiness and product appeal.

Gate.io's Growth Logic: From "Altcoin Supermarket" to Derivatives Dark Horse

Gate.io's market share surge is not coincidental; it is the result of multiple strategies working in synergy:

Product line expansion and leverage advantage

In May 2025, Gate.io launched perpetual contracts for ALPINE, ASR, and others, supporting up to 50x leverage and covering more emerging asset classes. This strategy accurately captures the market demand for derivatives of niche coins, creating a synergistic effect with Gate.io's long-accumulated positioning as an "altcoin supermarket."

The linkage effect between spot and derivatives

Data shows that Gate.io's spot trading volume reached $113.7 billion in April 2025, a month-on-month increase of 14.4%, with market share rising to 9%. The increase in spot liquidity has provided users and funds to the derivatives market, forming a positive cycle in the trading ecosystem.

Safety and compliance endorsement

As a well-established exchange with over 10 years of history, Gate.io has built trust through mechanisms like cold storage and the SAFU fund, becoming the only CEX to achieve double-digit growth in Q1 2025. This stability is particularly crucial against the backdrop of increased volatility in the derivatives market.

Competitive Landscape Analysis: Defense and Offense of the Top Three

Binance: Concerns under scale advantage

Although Binance still leads with over 30% market share, its dominance in derivatives is being diluted. In Q1 2025, its perpetual contract trading volume decreased by over 40% month-on-month, reflecting a trend of users migrating to diversified platforms.

Bybit and Bitget: Moats in niche areas

Bybit: Maintains professional user stickiness with high leverage (such as 100x) and low-latency trading engines, but a hacking incident in February led to a 52.4% drop in trading volume, exposing risk control shortcomings.

Bitget: Attracts novice users with copy trading as its core competitiveness, but its derivatives liquidity still relies on mainstream coins, creating a difference from Gate.io's coverage of altcoins.

The landscape is undecided; innovators win

Gate.io's comeback confirms the openness of the derivatives market: leading platforms rely on scale, while mid-tier players can break through with vertical strategies. In the future, as AI trading tools become widespread and multi-chain ecosystems expand, the competition for market share will increasingly depend on technological responsiveness and ecosystem integration capabilities. For Gate.io, whether it can maintain its fourth position and further advance depends on its ability to continue innovating within a compliance framework. This race is far from over.

Related: Goodbye to Blind Faith Era: How Gate.io Leads the Safety Revolution with Excess Reserves?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。