Tonight (May 15, 2025). According to Jinshi Data, at 20:30 Beijing time, the United States will release the retail sales data and Producer Price Index (PPI) for April. Following that, at 20:40, Federal Reserve Chairman Jerome Powell will give a speech. The market will closely monitor these events to gauge the direction of the Federal Reserve's monetary policy. Bitcoin's recent price has fluctuated between $102,000 and $105,000, with the cryptocurrency market sentiment influenced by both macroeconomic conditions and policy expectations.

U.S. Economic Data: A Barometer for Consumption and Inflation

The April retail sales data is a key indicator of U.S. consumer momentum. The market expects a month-on-month increase of 0.4% in April retail sales, with core retail (excluding automobiles and fuel) expected to grow by 0.3%. If the data falls short of expectations, it may intensify concerns about economic slowdown and increase the probability of interest rate cuts; if the data is strong, it may further lower expectations for rate cuts this year. The PPI data reflects upstream inflationary pressures, with expectations for the April PPI year-on-year rate to rise from 2.1% in March to 2.3%. If the PPI rises more than expected, it could trigger concerns about an inflation rebound, prompting the Federal Reserve to maintain a hawkish stance.

The April CPI data released yesterday unexpectedly cooled, with the year-on-year rate dropping to 2.3%, while the core CPI year-on-year rate remained steady at 2.8%. This data briefly raised expectations for interest rate cuts, with federal funds futures indicating that the market expects the Federal Reserve to cut rates by about 56 basis points by December, down from 75 basis points last week. Tonight's retail sales and PPI data will provide further guidance on the direction of rate cut expectations.

Powell's Speech: Caution or Signal?

Powell's speech tonight is highly anticipated. The market expects him to signal a rate cut, but analysts believe Powell is more likely to focus on assessing the Federal Reserve's monetary policy framework rather than directly addressing rate cut expectations. Recently, Powell has repeatedly emphasized data dependency, pointing out that the Federal Reserve will seek a balance between inflation, economic growth, and employment. Given that inflation is not yet fully under control and the labor market remains robust, Powell may maintain a cautious tone to avoid excessive market optimism regarding rate cuts.

The market's pricing of hawkish expectations has already been reflected in asset prices. If gold prices cannot break through the resistance at $3168-$3170, they may test $3100. Risk assets like Bitcoin are also under pressure, with market risk appetite suppressed by the uncertainty of Federal Reserve policy.

Bitcoin and the Crypto Market: Resilience Under Macro Pressure

According to the latest data from AiCoin, as of May 15, 2025, the price of Bitcoin is approximately $102,000, down about 3.7% from the April high of $106,000. The total market capitalization of the cryptocurrency market is about $2.8 trillion, down 18.6% from the early-year high of $3.8 trillion, but still above the $2.06 trillion at the beginning of 2024. Bitcoin's market dominance has risen to 59.1%, while altcoins generally show weak performance, with funds concentrated in mainstream assets like Bitcoin and Ethereum.

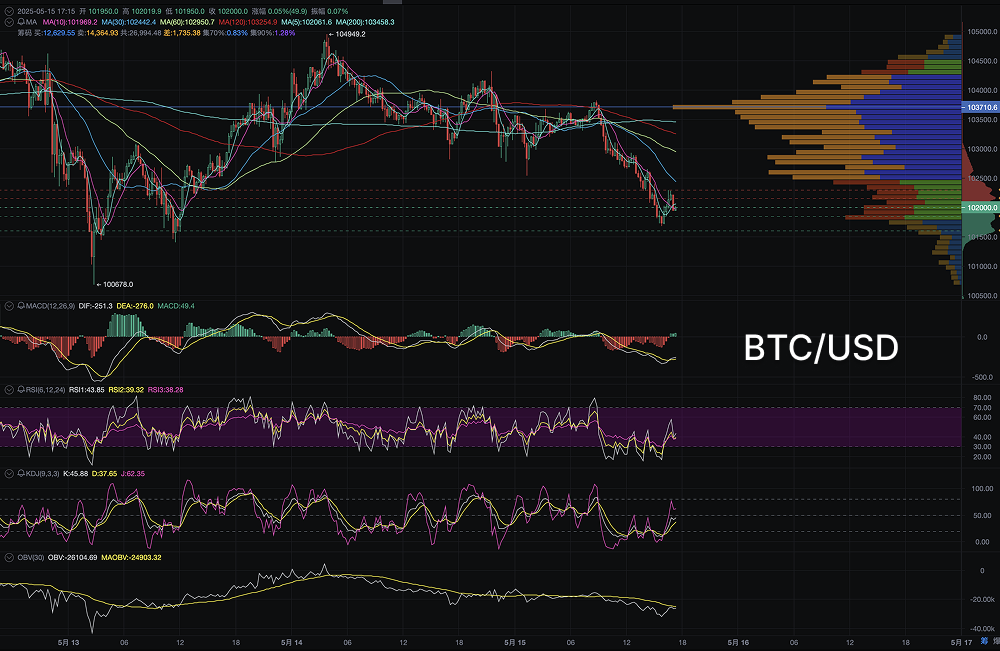

From a technical perspective, Bitcoin is currently in a narrow trading range of $102,000 to $105,000. The key support level is at $100,000; if it falls below this, it may test $95,000. The resistance above is at $105,000, and a breakout could challenge the year-to-date high of $109,100. On-chain data from CryptoQuant shows that the outflow of Bitcoin from exchanges has increased recently, indicating that institutions and long-term holders prefer to accumulate rather than sell. Meanwhile, the activity of large transfers has decreased, reflecting that institutional investors are waiting for clearer macro signals.

Market Outlook: Short-Term Volatility and Long-Term Opportunities

Tonight's retail sales and PPI data, along with Powell's speech, will set the tone for the market's short-term direction. If the data is weak and Powell signals a dovish stance, expectations for rate cuts may rise, benefiting risk assets like Bitcoin, which could break through the $105,000 resistance in the short term; if the data is strong and Powell maintains a hawkish stance, the crypto market may face downward pressure, testing the $100,000 support. In the long term, the pro-crypto policies of the Trump administration, the continued inflow into Bitcoin ETFs (with a net inflow of $3.6 billion in the first quarter of 2025), and increased institutional adoption provide structural support for the market.

This article represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。