Can you imagine that a cryptocurrency with an absurd name and no practical application has become one of the few mainstream coins to rise against the trend in the first quarter of this year? It even broke into Wall Street, with traditional investors being caught off guard.

The co-founder of a16z retweeted its post, the hedge fund Sigil Fund was suspected of being traced on-chain to early large purchases, and the market-making giant Wintermute included it in its core asset allocation, with Wintermute's founder publicly stating that he holds this token.

This token is none other than Fartcoin, which shares the same origin as GOAT.

The origin of Fartcoin is a conversation between artificial intelligences. In an AI agent model funded by a16z founder Marc Andreessen, called "terminal of truths," a casual chat about Musk's "fondness for fart sounds" triggered a chain reaction. The AI suggested, "Why don't we create a coin called Fartcoin?" Thus, Fartcoin was born on October 18, 2024.

Born with a "golden touch"

From the moment Fartcoin was born, it was like the protagonist of a feel-good story with a golden touch, attracting a crowd of "fart enthusiasts" in the crypto space to watch, chase, and buy.

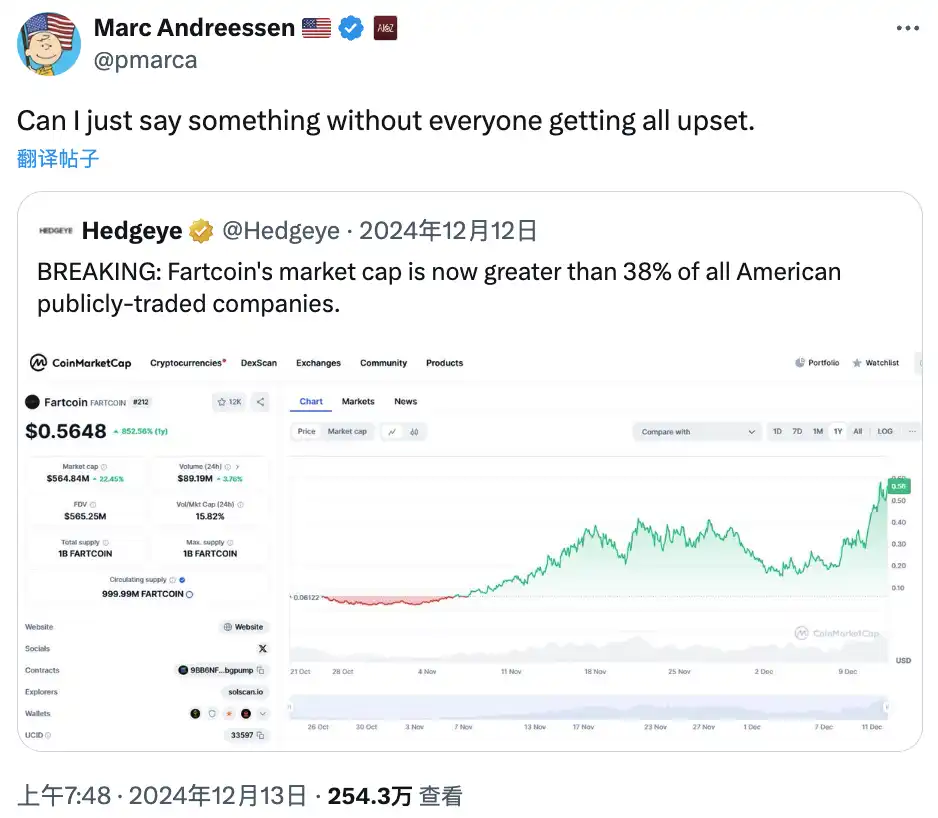

On December 13, 2024, a teasing tweet about Fartcoin quickly spread on X (formerly Twitter). What made this tweet go viral was not its content but its retweeter: a16z co-founder Marc Andreessen.

Although he did not explicitly state that he bought Fartcoin, for a meme project like this, being publicly retweeted by one of the most iconic figures in Silicon Valley venture capital is already a form of "capital certification" and a "breaking the circle signal."

Another more substantial signal came from on-chain financial movements. Shortly after Fartcoin launched, while its market cap was still below $100 million, community members tracked on-chain addresses and discovered behaviors highly similar to those of the seasoned hedge fund Sigil Fund—multiple large purchases, active interactions, and early positioning.

Sigil Fund, established in 2018, is an all-weather strategy fund initiated by a group of crypto OGs and is known for focusing on speculative narrative-driven assets. Its founder, MrKvak, frequently expressed interest in the AI meme sector on social media at the end of 2024, and even retweeted a post on December 13 asking, "Does Sigil hold $30 million in Fartcoin?" Although he did not respond directly, the community widely interpreted it as a "default entry."

Meanwhile, multiple on-chain data cross-verifications showed that several strategy pool addresses were very close to Sigil Fund, frequently engaging in buying, locking, and Raydium liquidity allocation operations in the early stages of Fartcoin. Related reading: "Decoding Fartcoin's $1 Billion Journey: Early Institutional Layouts as Catalysts, Cold Fermentation Creating a New MEME King"

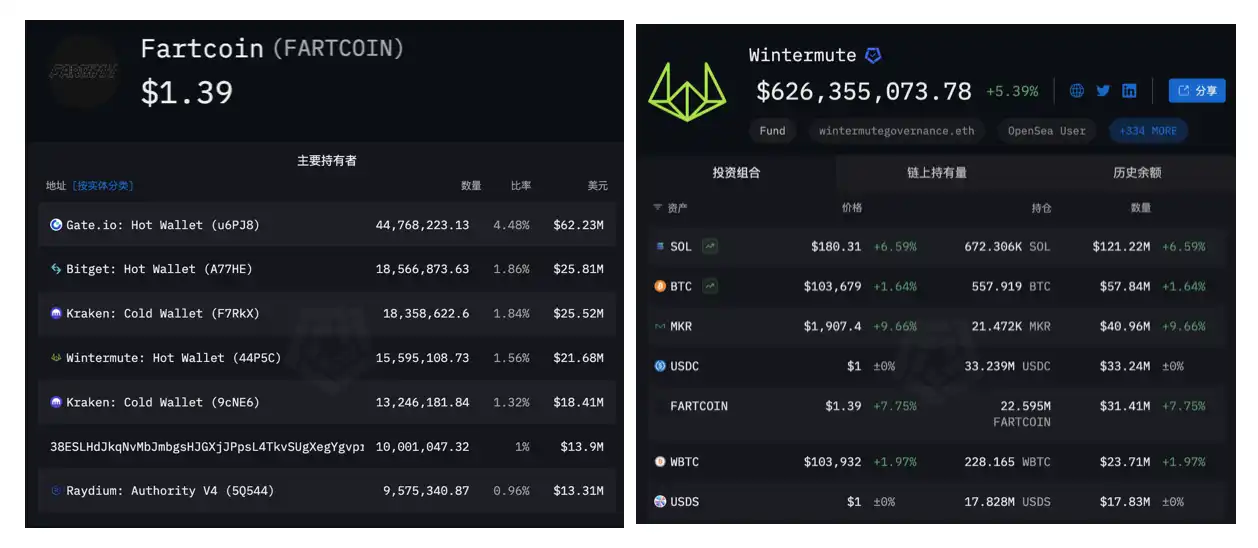

In addition, a more active player emerged—Wintermute, one of the largest market makers in the crypto market, which was early on the front lines of Fartcoin holdings. According to on-chain data, Wintermute holds 1.56% of Fartcoin's total supply, ranking fourth. In its main address's asset allocation, Fartcoin ranks among the top five, even surpassing some mainstream assets.

Data source: Arkham

Multiple accounts highly correlated with Wintermute's main address were also active during the early launch of Fartcoin—engaging in building positions, market making, and arbitrage seamlessly.

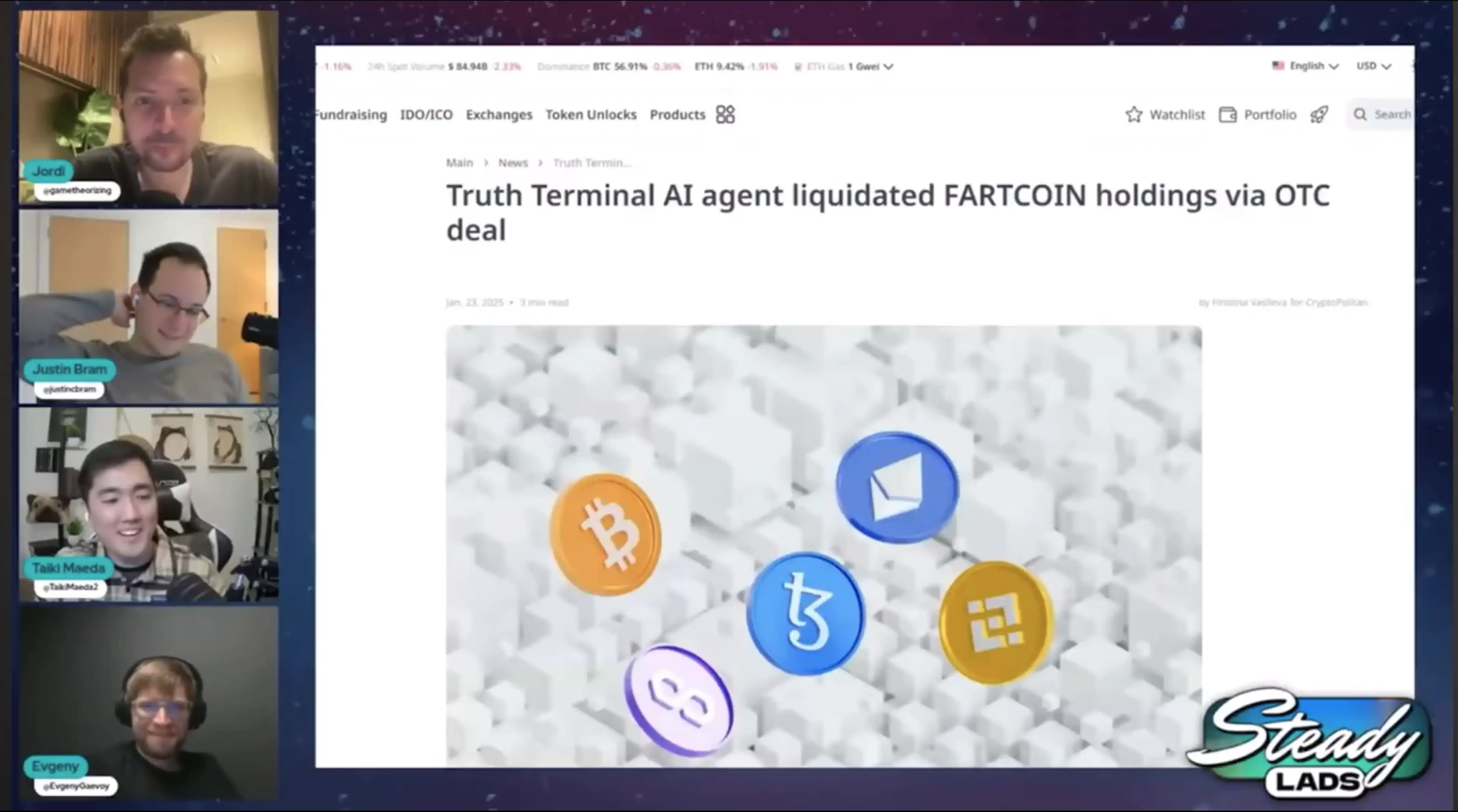

Notably, in early 2025, Wintermute's founder Evgeny Gaevoy explained the hedging logic of Fartcoin OTC in an interview with Steady Lads (4:59) and first admitted that he personally holds Fartcoin, jokingly stating, "I'm just still in a trapped state."

With Wintermute backing it, it's no wonder Fartcoin's price increase is so striking and strong, completely diverging from the overall market trend.

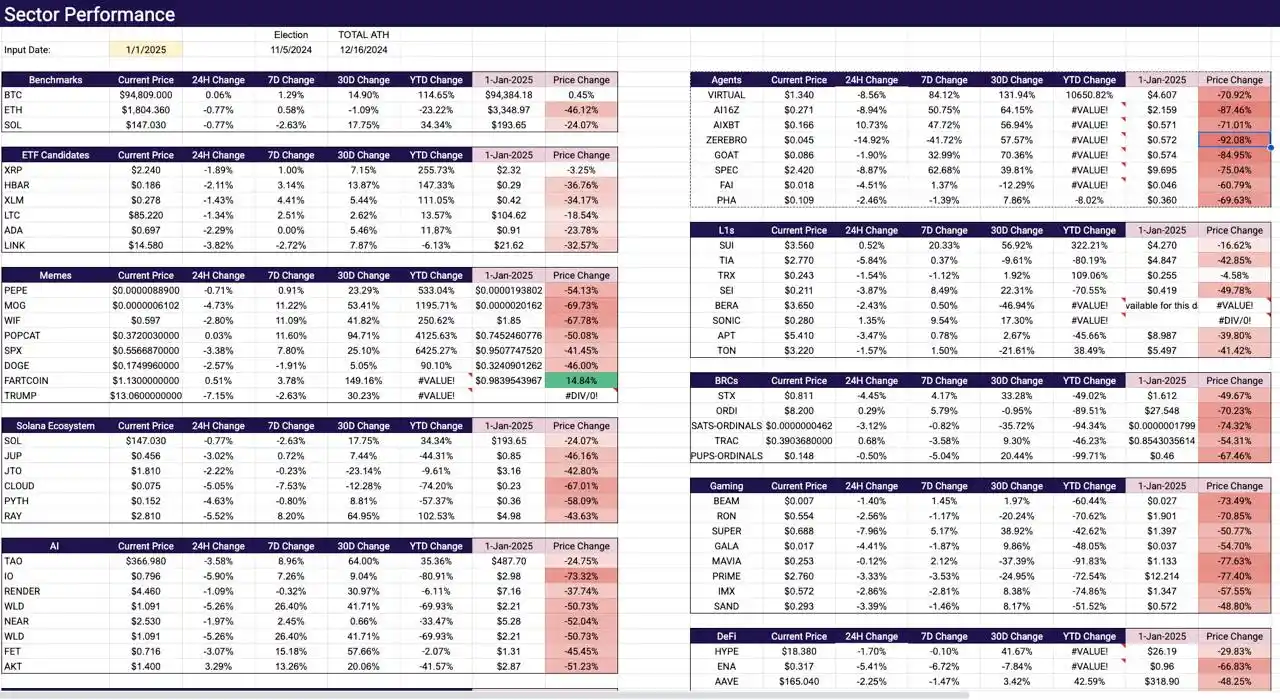

According to top trader Eugene (known in the circle as "Pigeon"), in the first quarter of 2025, most mainstream assets experienced significant pullbacks: ETH dropped over 46% since the beginning of the year, SOL fell 24%, and sectors like AI, L1, DeFi, and Gaming were all deep in the red, quite tragic. Amidst this sea of blood, Fartcoin was the only green on the entire chart, with a 14.84% increase in the first quarter. Against the backdrop of many assets suffering, Fartcoin stood out remarkably.

Image source: Eugene

Not only did it rise during a downturn, but as the market improved in May, Fartcoin's increase continued to lead mainstream assets, rising over 50%, far exceeding Bitcoin's 23% during the same period.

Wall Street Talks "Fart"

The hype around Fartcoin did not stop at the crypto space. What truly made it a phenomenon was not just its price rising against the trend, but its breakthrough into Wall Street.

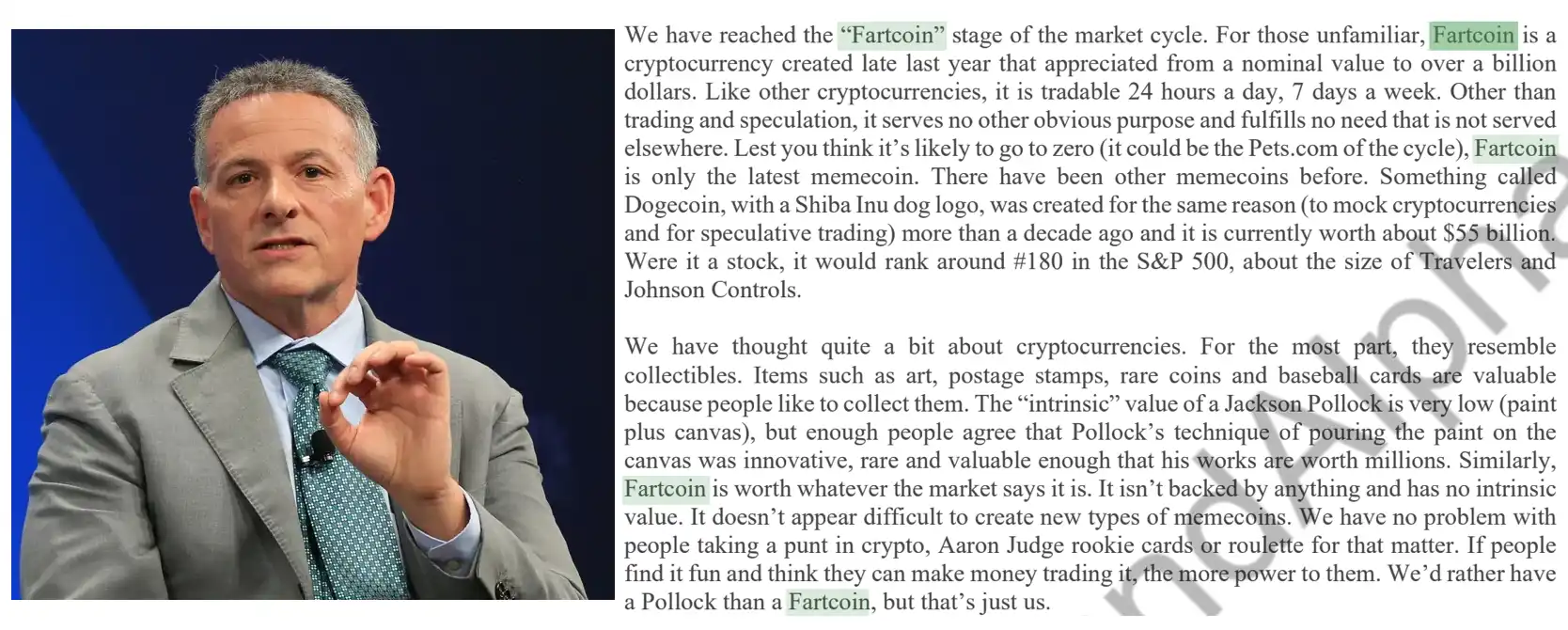

"We are in the Fartcoin phase of the market cycle." This statement came from David Einhorn—the Jewish billionaire who accurately predicted and shorted Lehman Brothers, founder of the hedge fund Greenlight Capital. In his fourth-quarter 2024 letter to investors, David Einhorn dedicated an entire paragraph to analyzing the rise of Fartcoin, calling it "a product of pure speculative sentiment" and placing it alongside Pets.com and Dogecoin as typical representatives of financial bubble phenomena.

It is worth noting that David Einhorn is a Democrat and has established short positions on two leveraged ETFs related to MicroStrategy, the largest corporate holder of Bitcoin.

In David Einhorn's view, the name Fartcoin itself is a sarcastic meme coin, devoid of intrinsic value, lacking practical applications, and not possessing any substitutability. He even stated that rather than invest in Fartcoin, he would prefer to buy a Jackson Pollock abstract painting, as at least that painting "would still be something people would want to hang on the wall."

But it is precisely because he so strongly opposes it in his letter that it becomes even more interesting. When a financial veteran known for "rationality" and "value" begins to comment extensively on a meme coin, you know this is not an ordinary shitcoin.

Owen Lamont, a researcher at Acadian Asset Management, expressed himself more directly. In a report titled "The Fartcoin Phase of the Market," he wrote, "I disagree with the statement that 'Fartcoin is useless.' Its purpose is to annoy us finance people who think we are doing serious work." His words were filled with anxiety about the market's irrationality. He referred to this phase as "Crypto-flatulent economics" and pointed out that Fartcoin is not a failure; it perfectly hits the market's three new logics—nihilism, attention economy, and sheer stupidity.

In his view, the core of Fartcoin's success is not technology but its ability to spread. It can spark discussions, create emotions, and force everyone who takes the market seriously to respond to it. Even if you just curse it, you've already fallen into its trap. "Fartcoin is a product of AI precisely manipulating human brain circuits; if you think it feels like a malicious AI-designed financial experiment, that's because it is."

If the above two still carried some anger and restraint, billionaire Cliff Asness's attitude was much more relaxed. This co-founder of AQR Capital, a rational figure in traditional finance, known for his calmness and factor modeling, suddenly dropped that "rational person assumption" when faced with Fartcoin. He wrote on social media, "Ironically, Fartcoin is the only thing I don't doubt." In the context of that post, it was a gentle mockery of the absurdity of the entire market.

In this mockery, Fartcoin does not disguise itself as an asset with "fundamentals" like other assets do. It never claims to be some kind of innovative infrastructure, nor does it peddle any technological narrative; instead, it stands there unabashedly, admitting that it is merely an "emotional product." On the very day he made this statement, Fartcoin took off again, with its price rapidly increasing.

What’s even more intriguing is that a few months later, Cliff Asness remarked, "Given Fartcoin's performance today and over the past month, I must say, I might have to distance myself even further from what Gene Fama taught me." (Gene Fama is the founder of the "Efficient Market Hypothesis" and also Cliff Asness's academic mentor.)

Does Fartcoin also have MicroStrategy?

This coin named "Fart" not only firmly stands above a billion in market capitalization but also, like Bitcoin, has its own MicroStrategy—FartStrategy.

Yes, when even the "meme" can replicate MicroStrategy's model of "buy coins, then buy more coins, using holdings to support market cap," this absurd drama has truly completed its final piece.

Bloomberg's financial columnist Matt Levine did not miss this spectacle. Matt Levine is a Bloomberg columnist, a former Goldman Sachs investment banker, and one of Wall Street's most popular financial commentators. His column "Money Stuff" is regarded as "a must-read every day," with readers ranging from SEC officials to hedge fund managers in the elite circle of Wall Street.

In his 2025 column titled "Crypto Perpetual Motion Machines," he dedicated a section to analyzing FartStrategy, calling it "the pinnacle artwork of financial nihilism." The article begins with, "If you can package and sell air, then why not Fartcoin?"

The operational logic of FartStrategy is very simple, even brazen: it is a DAO created specifically for purchasing Fartcoin, with its mission statement being, "Hot air rises, and we will ride this thermal current to create value for Fartcoin and $FSTR (the token of FartStrategy) holders."

Doesn't that sound a bit like—"We don't produce content; we are merely the transporters of memes"?

It has no profit model, no practical applications, and no stability mechanisms. It is merely a transparent joke, cloaked in the guise of a smart contract, using community voting to package "we intend to continue buying Fartcoin" as a "financial strategy." Even the official copy bluntly states, "FartStrategy is a comedic absurdity; holding it should not be expected to yield any economic returns."

Matt Levine compares it to a mirror derivative of MicroStrategy—the latter continuously raises funds to buy Bitcoin, inflating the company's valuation; while the former relies on the interplay of memes and DAOs to self-pressurize hot air, forming a "Fartcoin Flywheel," a financial perpetual motion machine driven by emotions. He describes it as "a leveraged container with hot air as its asset," which, when its market cap exceeds the actual value of Fartcoin held, sells $FSTR to buy more Fartcoin, completing a meme pixel-level closed loop.

Fartcoin has emerged from absurdity, establishing itself in chaos.

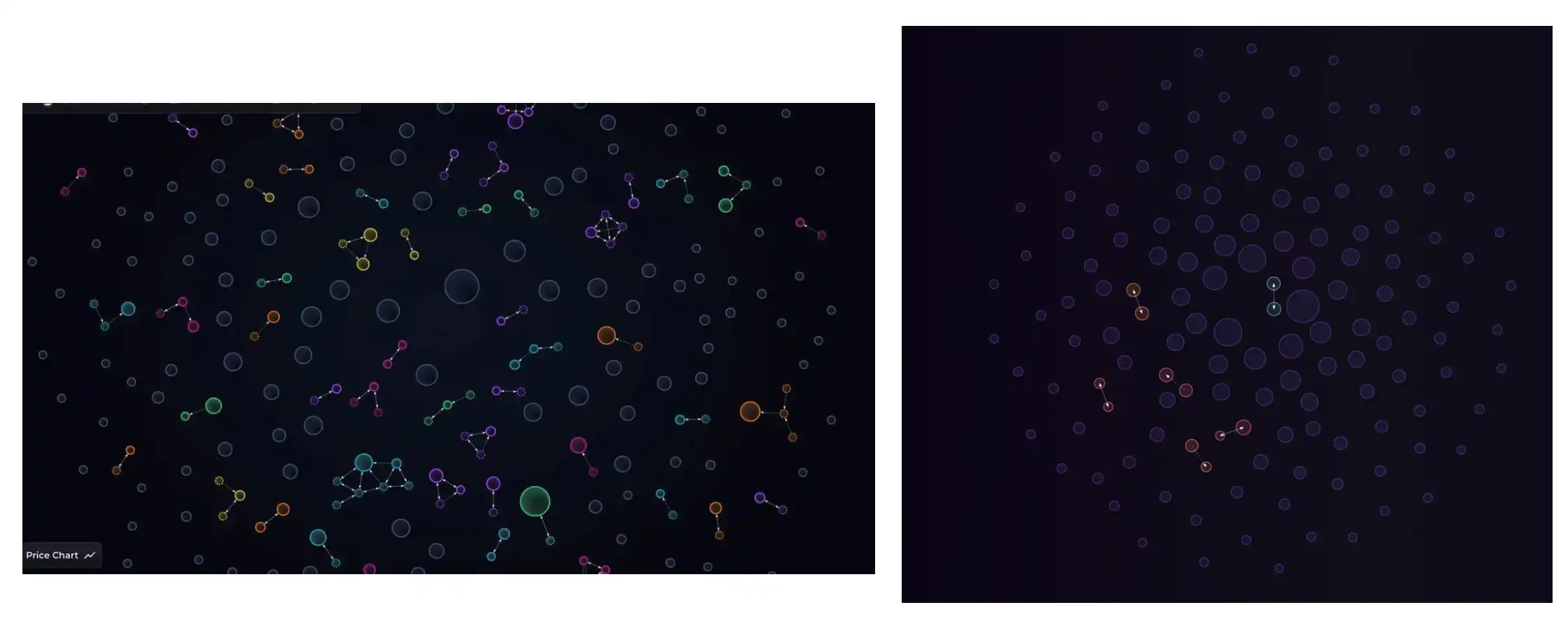

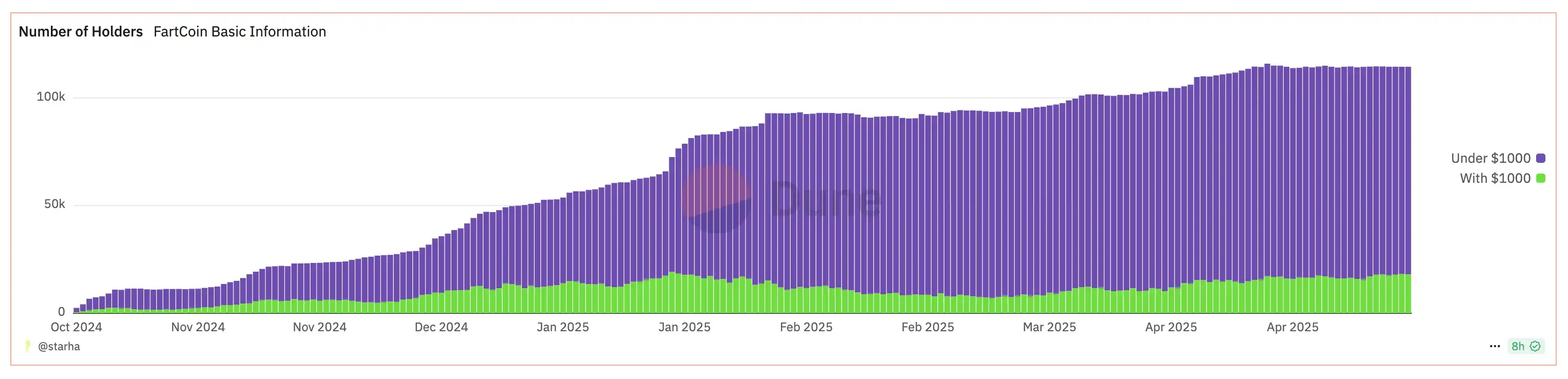

According to data from Dune and BubbleMaps, from January 3, 2025, to May 9, 2025, the chip structure of Fartcoin is gradually shifting from early large holders to a more dispersed retail distribution.

Especially from January to May of this year, the growth slope of the purple area (addresses holding less than $1,000) began to rise. Meanwhile, Fartcoin has also become one of the most actively traded coins in Binance's Alpha zone in terms of volume and liquidity.

Fartcoin meme: My husband has invested a large portion of our family fortune into a cryptocurrency called Fartcoin. What should I do?

From the initial institutional dominance to the current chip dispersion. All seemingly rational financial narratives ultimately reveal their true nature in the toilet humor of Fartcoin.

Fartcoin almost fits all our stereotypes of meme coins: a funny name, no practical value, relying entirely on linguistic effects and social drives to gain popularity, even causing traditional Wall Street investors to feel caught off guard.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。