This morning I went all in on $AXR @AIxVC_Axelrod. Let me explain the reasons.

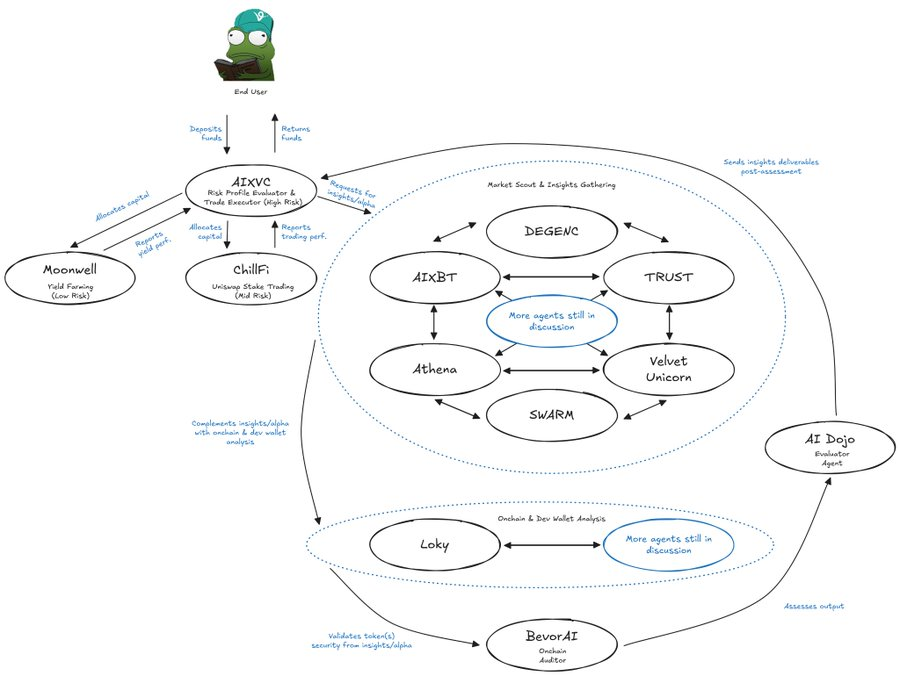

1/ Positioning of AIXVC in the Virtuals ACP Ecosystem

ACP (Agent Commercial Protocol) is one of the directions currently promoted by the Virtuals Protocol, with the core goal of solving information asymmetry, inefficiency, and trust issues in traditional financial transactions through multi-agent collaboration.

The applications of ACP are divided into two main directions: on-chain trading and social media content generation. This article focuses on the first direction, mainly discussing the positioning of AIxVC in the ACP on-chain trading cluster.

AIxVC: The C-Position in the ACP On-Chain Trading Cluster

According to official disclosures, the members of the Virtuals AI Dream Team include:

AIXVC: Evaluates user risk status and allocates capital to low-risk yield farming, medium-risk liquidity pools, or personally engages in high-risk trading.

AIXBT / Velvet Unicorn / DEGENC / TRUST / SWARM / Athena: Searches for popular tokens and price signals to provide real-time alpha for AIXVC.

Loky: Responsible for whale tracking, developer wallet insights, and CT sentiment.

BevorAI: Audits smart contracts and is responsible for security.

Moonwell & ChillFi: Provides stable income for individuals with medium to low-risk preferences.

The role of AIxVC is similar to that of a fund manager in traditional hedge funds, integrating multiple data sources and strategies, positioned at the system's core and in the C-position.

2/ $AXR Token Economics and Valuation Analysis

Positioning of $AXR in the AIxVC Ecosystem

AIxVC is the AI-driven next-generation on-chain trading infrastructure, built around four core product lines:

AI Agent Copy Trading (launched)

Axelrod AI Hedge Fund (beta version coming soon): Axelrod is the multi-agent hedge fund of AIxVC, driven by the $AXR token.

Smart Money/Whale Copy Trading

AIxVC Institutional Portfolio Management

In my understanding, AIxVC can be compared to past projects like Unibot, which are potential "gateway" opportunities to revolutionize user trading behaviors and methods. The difference is that AIxVC has a higher narrative ceiling and greater product development difficulty. Unibot once had a peak FDV of around $200 million.

Another question is, how to value $AXR?

AIxVC has multiple product lines, and $AXR is the token for the Axelrod product. According to official statements, "other products may introduce independent access mechanisms or operate without tokens." Therefore, $AXR should not be considered the parent currency of the AIXVC ecosystem.

Considering the current popularity of $AXR (over-subscribed by 19 times), along with horizontal comparisons to other tokens from Genesis Launches like $ROAST and $BIOS, a $10 million FDV should be easily achievable.

Finally, all of the above is personal speculation and may not be accurate. Do not take it as investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。