Introduction: Why Are We So Obsessed with "Points" and "Alpha"?

At some point, it seems we have become particularly sensitive to "points" and "Alpha."

The first thing we do when we open an exchange or DEX is no longer to look for the next coin that can double, but to check if there have been any changes in the points leaderboard or if there are new updates on Alpha airdrop rules.

We have started to carefully maintain our on-chain behavior records— even if we do not really understand what points can ultimately be exchanged for, and we are not sure how Alpha airdrops are distributed. Yet, we still enjoy "grinding points" and "interacting," because we feel that one day they will bring unexpected surprises.

Gradually, we realize that the so-called "points" are no longer just trading incentives, but a strategic lever for platforms to allocate assets and control user attention; and "Alpha" is no longer just a vague qualification for airdrops, but is becoming the strongest emotional driver in an ecological governance mechanism.

In the past five years, from CEXs like Binance, OKX, and Bybit to DEXs like Uniswap, Curve, and zkSync, the gameplay of points and Alpha has continuously evolved: from the initial trading rebates to today's ecological mechanisms centered around community governance, resource regulation, and traffic filtering.

This seemingly "user growth game" composed of Alpha and points is actually reshaping the relationship between users, platforms, and ecosystems, and each of us has long been part of this game.

1. The Essential Evolution of the Points Mechanism—From Rebate Tool to Ecological Scheduling System

In the early crypto ecosystem, whether CEX or DEX, points played a very simple role: to increase user trading volume.

The initial trading points were very straightforward, with exchanges represented by Bitstamp and Bitfinex offering different levels of rebates or fee discounts based on trading volume. This design, similar to "points," was intuitive and effective, allowing users to clearly see the direct economic benefits corresponding to each transaction. However, its flaws were also evident: it could not retain long-term users, nor could it form real community stickiness; users were more like profit-seeking traffic rather than co-builders.

At this stage, Alpha was almost non-existent, or merely a vague "early investment opportunity," failing to truly become a driving force for user growth.

1. From "Trading Rebates" to "Early Investment Tickets"

After 2017, with the emergence of Binance Launchpad, CEXs first linked points with "opportunities": users earned points through staking or holding positions, which could be exchanged for the qualification to participate in high-quality project IDOs.

This design changed the rules of the game: points were no longer just used to reduce fees, but became a stepping stone to access Alpha projects— you had to lock in assets and remain active to earn the next potential ticket for a surge.

Subsequent platforms like OKX Jumpstart and Bybit Launchpad replicated this mechanism. The points gameplay thus entered the "opportunity-binding phase": it was no longer about "giving rewards," but about "filtering people."

2. From "Filtering People" to "Empowerment Governance"

The DEX ecosystem, developing in parallel, reshaped the meaning of points in a more radical way. Uniswap's UNI airdrop in 2020 was a true breakthrough in the concept of points and Alpha. It was not a simple rebate, but an active "incentive + governance" mechanism based on past on-chain behavior. Users were no longer just receiving short-term rewards, but directly became participants in protocol governance, with points representing governance and decision-making power within the on-chain community.

This shift clarified the strategic connotation of points: from purely transaction-driven to being a core lever for ecological governance and community participation.

After 2021, this trend further deepened. The veToken points model introduced by Curve clearly made points directly determine governance rights and ecological benefit distribution; while the new generation of DEX represented by Raydium embedded points into the core processes of project launches and ecological initiations. At this point, points were no longer "accessories" of the platform, but foundational tools for project initiation, community governance, and resource allocation in the Web3 ecosystem.

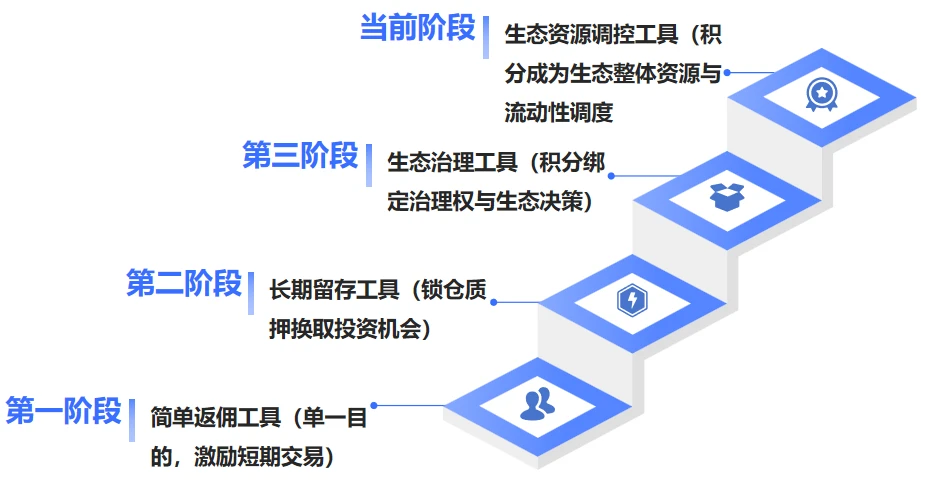

When we review the development history of the points mechanism, we can clearly see its core evolution path:

Image Source: Nomos Lab, compiled from public information

Today, whether CEX or DEX, they are strategically designing points rules to regulate user attention, asset flow direction, and even the overall development trend of the ecosystem. The competition of points mechanisms is no longer a simple game of discounts, but a real ecological war.

From simple "trading incentives" to deeper "ecological strategic weapons," the evolution path of points showcases the profound changes in Web3 user growth strategies. This change is both a result of user demand and a necessary outcome of the continuous escalation of competition and games among platforms.

2. The Alienation and Collaborative Evolution of the Alpha Mechanism—From Vague Expectations to Ecological Driver

If points are the "rule order" set by the platform, then Alpha is the "emotional fuel" for user participation.

Points often have clear acquisition methods and redemption paths, while Alpha drives user engagement in the ecosystem through a vague but strong expectation, even if there are no clearly stated "rewards."

It is not always tied to the points mechanism; sometimes it even exists outside the entire incentive system, but it often generates the strongest desire to participate, becoming the most core "non-institutional force" in platform growth.

1. The Psychological Essence of Alpha: Ambiguity Creates Participation Enthusiasm

The charm of Alpha lies in "uncertainty."

Because users do not know whether Alpha airdrops exist, when they will come, or how they will be distributed, they are more likely to actively participate, interact, and keep their assets active under the expectation of "maybe there will be." This is a typical psychological game: vague hope is more attractive than clear rules.

Blur is the most typical case. Its early airdrop points mechanism had a leaderboard, but no clear redemption rules, yet users were still willing to place orders, interact, and generate trading volume—because they believed: as long as I am active, I might be rewarded.

This emotional drive constitutes the underlying power of Alpha.

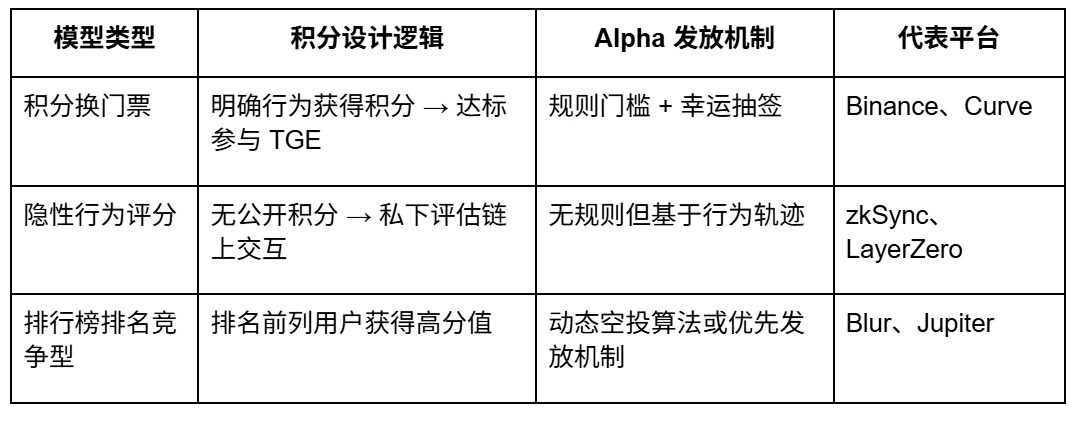

2. Three Main Alpha Models and Evolution Logic

(1) Narrative-Driven Alpha: Driving Participation through Emotional Consensus

Representative Projects: zkSync, StarkNet, Scroll

Mechanism Characteristics: No points system, relies solely on rumors of "possible airdrops" to stimulate user on-chain interaction

User Behavior: Interacts across the entire ecosystem, registers for all projects, behavior is highly dispersed but has high sustainability

(2) Points-Linked Alpha: Binding Expectations with Rules

Representative Projects: Binance Alpha Points, Curve veCRV

Mechanism Characteristics: Alpha is clearly linked to points, redeemable for TGE quotas or airdrop qualifications through points consumption

User Behavior: Actions revolve around points tasks, with high concentration of assets and behaviors, and intense competition

(3) Behavior-Capturing Alpha: No Rules but Highly Effective

Representative Projects: LayerZero, Blur

Mechanism Characteristics: No formal points system, but user behavior data is secretly recorded and affects airdrop qualifications

User Behavior: Designs behavior trajectories around interactions, but cannot determine input-output ratios

3. The Risks of Alpha Games: Over-Stimulation and Behavioral Alienation

The ambiguity of Alpha, while capable of stimulating enthusiasm, can also easily lead to issues like short-term arbitrage and ineffective volume brushing.

The early order brushing issues with Blur, a large number of low-quality interactions with zkSync, and LayerZero being overly guided towards "interaction farming," all expose a core problem:

When Alpha is no longer scarce and becomes the norm of "as long as you interact, you will have it," it loses its filtering value and instead pollutes the ecosystem.

Therefore, platforms have begun to experiment with a combination mechanism of "points + Alpha" for more refined control.

4. Alpha and Points: A Collaborative Evolution of Hybrid Mechanisms

A single mechanism is no longer sufficient to meet ecological management needs. Thus, platforms have begun to explore "dual-track driving":

Mechanism Advantages Risks Best Action Method Points Clear rules, easy to layer incentives Easy to brush volume, form internal competition As a basic structure and filtering threshold Alpha Stimulates enthusiasm, strengthens user participation expectations Unstable, induces excessive interaction As an additional reward and emotional driver

The goal of the hybrid mechanism is:

To use points to "regulate behavior paths," avoiding systemic abuse;

To use Alpha to "create vague expectations," stimulating long-term participation enthusiasm.

The Binance Alpha Points model adopts this strategy:

Sets rules for points acquisition and consumption thresholds (institutional control);

Introduces lucky mechanisms and special conditions (emotional selection);

Controls the release rhythm and difficulty in each Alpha project, achieving dual goals of traffic management and user filtering.

5. The New Function of Alpha: Becoming the "Token of Identity" in On-Chain Narratives and Ecological Identity

The evolution path of Alpha is gradually shifting from "rewards" to "symbols of identity."

In ecosystems like zkSync and LayerZero, users are not just interacting for short-term airdrops, but hope to be recognized as "ecological co-builders" or "long-term participants." Alpha is beginning to serve as an indirect proof of on-chain reputation and governance rights.

After the Blur airdrop, a points consumption mechanism was introduced: encouraging long-term activity rather than one-time ranking.

Binance Alpha sets thresholds for points retention and random conditions: filtering loyal users rather than arbitrageurs.

LayerZero begins to recognize "real interaction paths" and sets up behavior anti-cheat systems.

These changes collectively point to a trend:

Alpha is becoming the most differentiated and symbolic "value distribution logic" in on-chain ecosystems.

3. Points × Alpha—A User Control System Under Dual-Track Driving

The growth mechanism in the Web3 world is entering a "dual-track driving" phase: institutional points systems and ambiguous Alpha rewards are beginning to be consciously combined, forming a strategic tool that spans user acquisition, behavior guidance, asset retention, and rhythm management.

In the past, points and Alpha were two parallel worlds: one was a clear, quantifiable participation structure; the other was driven by vague and uncertain expectations that engaged users' subjective imaginations. But today, they are no longer separate; instead, they leverage each other to build a brand new user behavior operating system.

The first to realize this was Binance. In its Alpha Points mechanism, the rules for acquiring points are designed with great precision: users earn points through trading, holding positions, and participating in activities; at the same time, the system sets different levels of qualification thresholds for redeeming priority subscription rights or airdrop qualifications for specific TGE projects. However, what truly drives users to frantically "grind points" is not the direct utility of these points, but the suspenseful Alpha behind them—meaning that if you accumulate enough points, you might receive an airdrop, but you might also miss out.

This design of ambiguous boundaries greatly stimulates user participation enthusiasm. For example, in the DOOD airdrop, users with over 168 points directly qualify, while those with 129 to 167 points must rely on a UID tail number lottery. This subtle "ambiguous range" encourages a large number of users to actively increase their interactions and scores to avoid falling into the risk zone of being "marginalized."

The core of this mechanism is: points provide structure, Alpha provides suspense; points represent "what I have done," Alpha represents "there might be a result"; points are bound by rules, Alpha engages psychology. When the two are combined, the platform gains multiple control capabilities over user attention, time, behavior, and asset flow paths.

Image Source: Nomos Lab, compiled from public information

This structure not only optimizes the logic of user stratification and selection but also significantly enhances the platform's ability to control the rhythm within the ecosystem. Taking Blur as an example, it initially did not provide any points redemption rules, but successfully created an emotional guide of "effort will be recognized" through points leaderboards and behavior-linked scoring systems, thereby promoting users to participate continuously, frequently, and at high costs.

This approach, which uses "ambiguous Alpha" as the core incentive, is actually a deep utilization of user psychology: when reward rules are opaque, users tend to invest more because everyone believes "maybe I will be chosen." The existence of points creates a positive feedback framework for this ambiguity:

Points control behavior paths: clear incentive rules guide users to lock assets and participate long-term;

Alpha provides emotional drive: creates uncertainty, stimulates users to grind points, and increases stickiness;

Fusion point: utilizes the combination of "points snapshot + Alpha airdrop + consumption mechanism" to regulate rhythm and ecological load.

Ultimately, user behavior also transforms. They no longer act solely to "exchange rewards," but participate to "leave traces" and be recognized by the system. They build "points identities" on the platform while betting on the realization of some future Alpha. This "participation as a candidate" mechanism transforms users from short-term actors into long-term asset co-builders.

What the platform hopes for is precisely this silent binding.

4. The Blurred Boundaries of Integration—The Interpenetration and Competitive Reconstruction of CEX and DEX Mechanisms

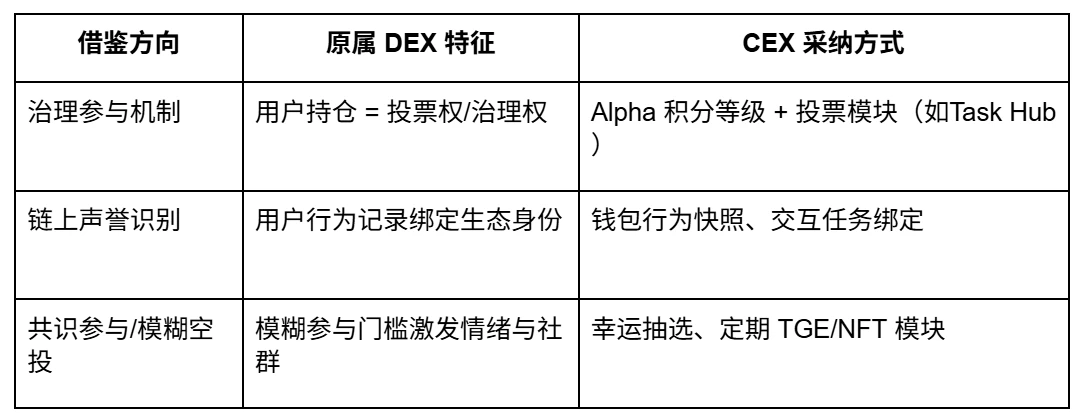

As the dual-track mechanism of Alpha × points matures, another essential trend begins to surface: the boundaries between CEX and DEX mechanisms are rapidly blurring, as they learn from and borrow from each other, gradually merging. In the past, we viewed the two as opposing paradigms of "centralization vs. decentralization," but now they are both moving toward the same goal—building a more stable user participation system and ecological collaboration mechanism.

First, CEXs are leaning toward DEX governance concepts. Platforms like Binance, OKX, and Gate are no longer satisfied with traditional task-centered + rebate point designs; they are beginning to introduce concepts such as on-chain behavior snapshots, on-chain wallet binding, and task structure stratification, and are building user levels and points growth paths through these on-chain interaction traces. For example, Binance's introduction of "Web3 wallet binding + on-chain task participation" rules in Alpha Points essentially identifies "trusted users" through on-chain behavior, creating a DEX-style "reputation distribution."

At the same time, these platforms are gradually incorporating light governance modules, such as user voting for listing (like Gate Startup) and activity voting (like OKX voting leaderboard), beginning to construct a path of "user consensus → behavior monetization," effectively borrowing the governance participation structure of DEXs.

Image Source: Nomos Lab, compiled from public information

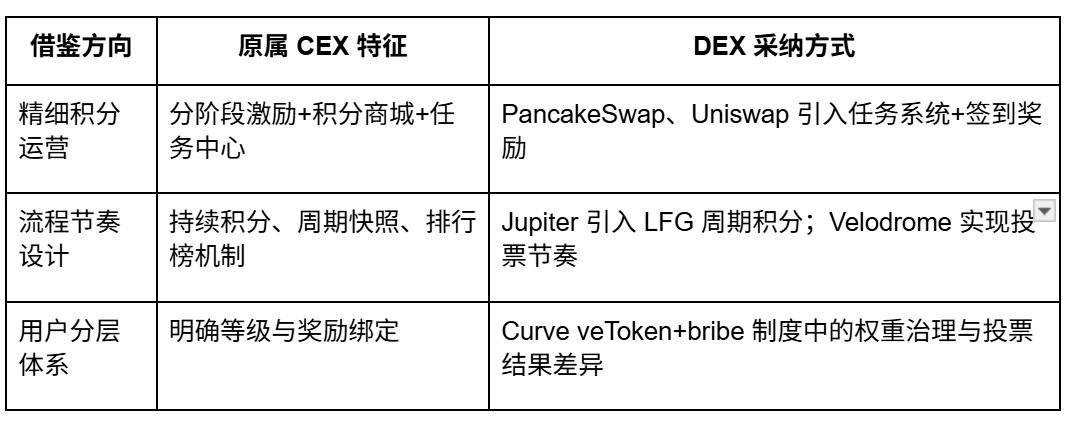

Meanwhile, DEXs are quietly moving closer to CEXs. New-generation DEXs like Uniswap, PancakeSwap, Jupiter, and Velodrome are beginning to introduce institutionalized operational modules such as points systems, task structures, phased airdrops, ranking mechanisms, and periodic settlements.

Jupiter's LFG system is a typical "leaderboard + points reset + periodic cycle" CEX operational model, while Velodrome combines governance voting and incentive distribution through veNFT and bribe mechanisms, creating a "user behavior + governance incentive" programmable points path. Uniswap is advancing a cross-protocol structure of "on-chain identity + multi-chain points," continuously evolving in operational precision.

Image Source: Nomos Lab, compiled from public information

More importantly, user behavior is also changing in the integration of the two types of platforms.

They no longer simply "choose platforms," but "choose mechanisms": whether there are reasonable points rules, whether they provide vague but real Alpha rewards, and whether there are identifiable identity trajectories. The unit of competition for platforms is no longer "user numbers," but "mechanism design capability"—who can build a smoother incentive structure and solidify higher-quality user paths will have a better chance of winning future ecological dominance.

Points and Alpha are becoming the "mechanism language" in this competition.

The past battle for traffic is transforming into a battle for mechanism design, while platform governance, community control, and user stickiness are moving toward the next stage of deep structuring through this integration.

Chapter 5: After Points, the Battle of Mechanisms Has Just Begun

We once thought that points were a promotional tool, giving users some benefits, attracting new users, and stabilizing trading volume, completing tasks. But looking back now, this understanding is too shallow.

In today's Web3 world, the gameplay of points and Alpha is no longer a superficial incentive structure; it has become a battleground for cognition and power between platforms and users.

On one hand, platforms finely set user behavior trajectories through points systems—what is worth doing, when to do it, and how much is considered "qualified"; on the other hand, they create the expectation of "maybe there will be" through vague Alpha mechanisms, continuously stimulating your emotional engagement.

This set of mechanisms is very clever because it does not require you to know what you will get at the moment; it only requires you to believe: it is worth staying.

And just as this narrative logic gradually solidifies, new changes are beginning to brew.

We are standing at a crossroads of "mechanism integration → mechanism leap." The next round of this game will no longer be just "what you have done," but what traces you have left in whose system.

Future points may no longer be as simple as "trading volume × weight," but will be composed of multiple variables:

In which chains have you interacted?

How many ecosystems have you participated in governance?

Do you have a complete and coherent on-chain behavior trajectory?

Are you completing ranking tasks, or are you genuinely participating?

In other words, points are not just "evidence of behavior," but have become a way for the ecosystem to understand your value.

And this understanding will no longer be limited to a single platform.

We can already see some signs:

zkSync's airdrop introduced "average asset retention time" when calculating interactions; LayerZero's points system has long secretly recorded the chains you participated in and their depth; on-chain identity protocols like Sismo and Gitcoin Passport are beginning to be adopted across multiple platforms, becoming your identification as "a real user."

Perhaps in the near future, points from different platforms will no longer compete with each other but will form a cross-ecosystem mutual recognition "trust network": if you have interacted on LayerZero, zkSync might lower your threshold; if you have participated in the governance of a certain DAO, Blur might be willing to directly give you a whitelist.

At that time, we will not be facing "how many points to get," but "how does the entire Web3 see me."

On the other hand, platforms are also starting to feel anxious.

While ambiguity brings high participation, regulatory uncertainties are also beginning to loom:

Do points belong to assets? Does Alpha constitute disguised financing? If the purpose of a points system is ultimately to airdrop tokens to users, does it need to publicly disclose the distribution logic? Does it involve compliance risks?

Thus, you will see more and more platforms becoming "ambiguous and restrained": not giving you too clear formulas, not directly telling you "what points can be exchanged for," everything is just "for reference," and everything must "be subject to official subsequent notifications."

It seems to be "maintaining mystery," but in reality, it is "avoiding responsibility."

And the endpoint of this ambiguity war may very well be: users are becoming smarter, and platforms are becoming more cautious.

Therefore, truly effective mechanisms will no longer be about "stimulating interaction," but about designing a structure that makes users willing to stay and worthy of being recognized. It is not about making people grind points, but about fostering a willingness to co-build.

This mechanism is not just an operational means, but the ecological order itself.

In Conclusion: You Are Not Just Grinding Points, But Defining Who You Are

Points may seem like rewards, but they are records of "your participation."

Alpha may seem like an airdrop, but it is a signal of "you being seen."

Looking back at the entire evolutionary process, from Bitfinex's rebate system to Binance's Launchpad, from Uniswap's UNI airdrop to Curve's veToken decision-making rights, and then to LayerZero, Jupiter, and zkSync's user recognition algorithms, we see clearly:

Users are not retained by incentives, but by recognition of the mechanisms.

And we have already evolved from "benefit seekers" to "candidates."

We engage in interactions not for short-term gains, but to build an identity, an image that can be seen by the ecosystem.

What we are grinding is not just points, but the kind of person we are willing to become. What we are betting on is not just Alpha, but our belief that a certain mechanism is worth participating in and co-building.

The battlefield between platforms has shifted from "who gives more airdrops" to "whose system can retain users."

From a competition for traffic to a competition for structure.

From incentive games to identity construction.

From points games to order design.

In the end, we will forget how many points we have and what Alpha has given us.

But we will remember: which platform truly saw me.

References

CoinMarketCap. (2024). The evolution of decentralized exchanges.

GlobeNewswire. (2024, September 17). Bybit Web3 makes WSOT debut: DEX Wave featuring over 100 DeFi partners in Web3’s first idol competition.

NFTEvening. (2025, April). Understanding Binance Alpha Points: A guide to earning rewards.

ODaily. (2025, February). DEX points incentives: Opportunities and challenges in Web3.

ODaily. (2025, March). Web3 points wars: Trends and user engagement strategies.

ODaily. (2025, April). Binance Alpha ecosystem: TGEs and points-driven growth.

Panews. (2024, October). Bybit WSOT DEX Wave: Voting mechanisms and liquidity boost.

Panews. (2024, December). OKX Jumpstart: Staking mechanisms and accessibility challenges.

Panews. (2025, January). Gate.io Startup and task center: Points for new users.

Panews. (2025, March). Web3 points wars: A comparative analysis of major platforms.

Panews. (2025, April). Binance Alpha Points: Mechanics and market impact.

TheBlockBeats. (2024, November). Uniswap’s multi-chain points plan: Scaling DeFi incentives.

TheBlockBeats. (2025, February). PancakeSwap’s voting points: Governance and resource allocation.

TheBlockBeats. (2025, April). Binance TGE airdrops: Attracting investors in 2025.

Thirdweb. (2024). Web3 loyalty programs: NFTs and points interoperability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。