Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

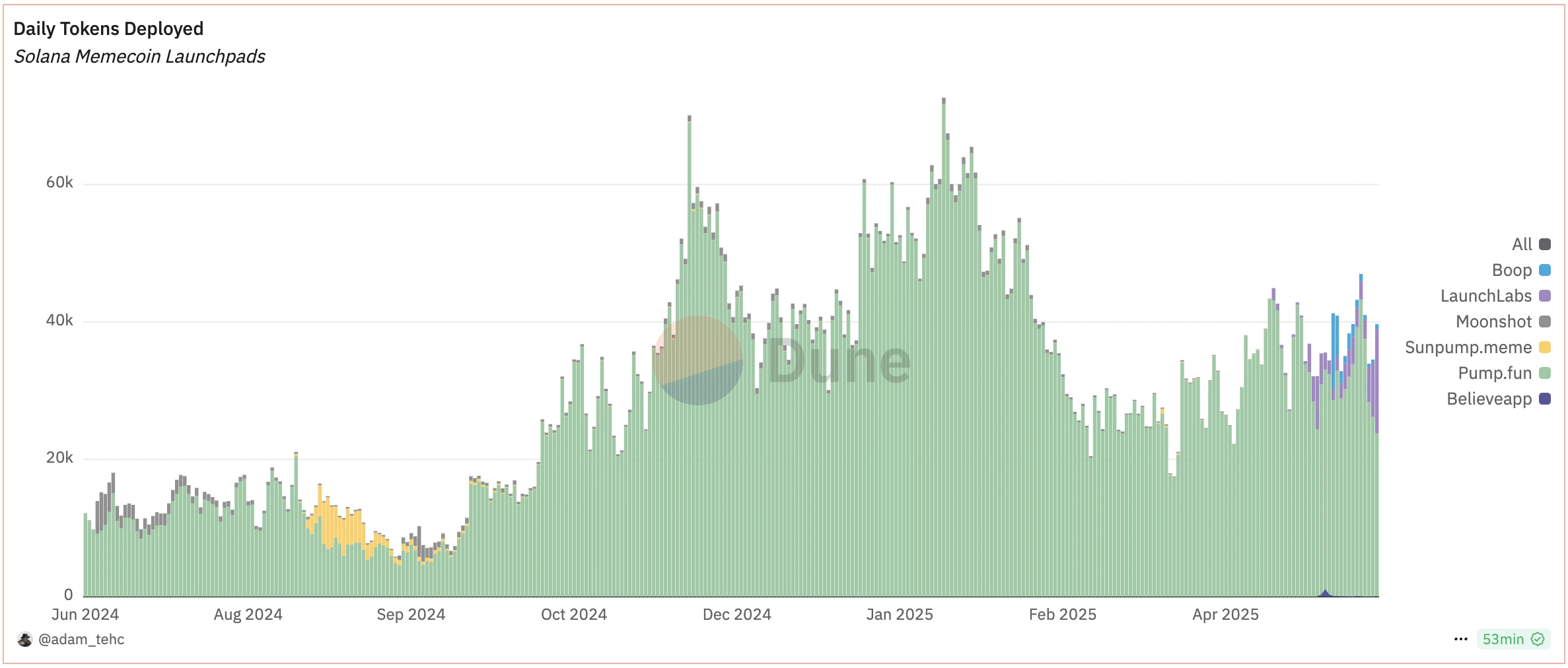

On May 13, on X, on-chain data analyst Adam posted Dune panel data showing that in the past 24 hours, the number of tokens graduated from LaunchLab, the token issuance platform under Raydium (including third-party issuance platforms based on LaunchLab such as Letsbonk.Fun), was 198, surpassing the 171 tokens graduated by Pump.fun.

Adam commented, "This is the first time in history that Pump.fun has encountered real competition."

Historical Grievances

The grievances between Pump.fun and Raydium have a long history.

In the early design of Pump.fun, token issuance required two stages: "internal market" and "external market" — after the token issuance, it would first enter the "internal market" trading phase, relying on the bonding curve of the pump.fun protocol for matching. Once the trading volume reached $69,000, it would enter the "external market" trading phase, at which point liquidity would migrate to Raydium, where a pool would be created on that DEX and trading would continue.

However, on March 21, Pump.fun announced the launch of its self-built AMM DEX product, PumpSwap. Since then, the liquidity of Pump.fun tokens will no longer migrate to Raydium when entering the "external market," but will instead direct to PumpSwap — this move directly cut off the flow path from Pump.fun to Raydium, thereby reducing the latter's trading volume and fee income.

In response, Raydium announced on April 16 that it had officially launched the token issuance platform LaunchLab, allowing users to quickly issue tokens through this platform, and automatically migrate to Raydium AMM once the token liquidity reaches a certain scale (85 SOL). Clearly, this was Raydium's direct counterattack against the aggressive Pump.fun.

- Odaily Note: For details, see “Data Analysis: How Much Does Raydium Rely on Pump.fun?” and “Raydium Strikes Back at Pump.fun, Who Will Laugh Last in the Meme Comeback Season?”.

LaunchLab's "Killer Move"

Although LaunchLab's token issuance function is quite similar to Pump.fun, its biggest feature lies not in the issuance process itself — the architecture of LaunchLab supports third-party integration, allowing external teams and platforms to create and manage their own launch environments within the LaunchLab ecosystem. In other words, third parties can rely on LaunchLab's underlying technology (with a focus on liquidity pools remaining in LaunchLab and Raydium) to launch independent token launch frontends.

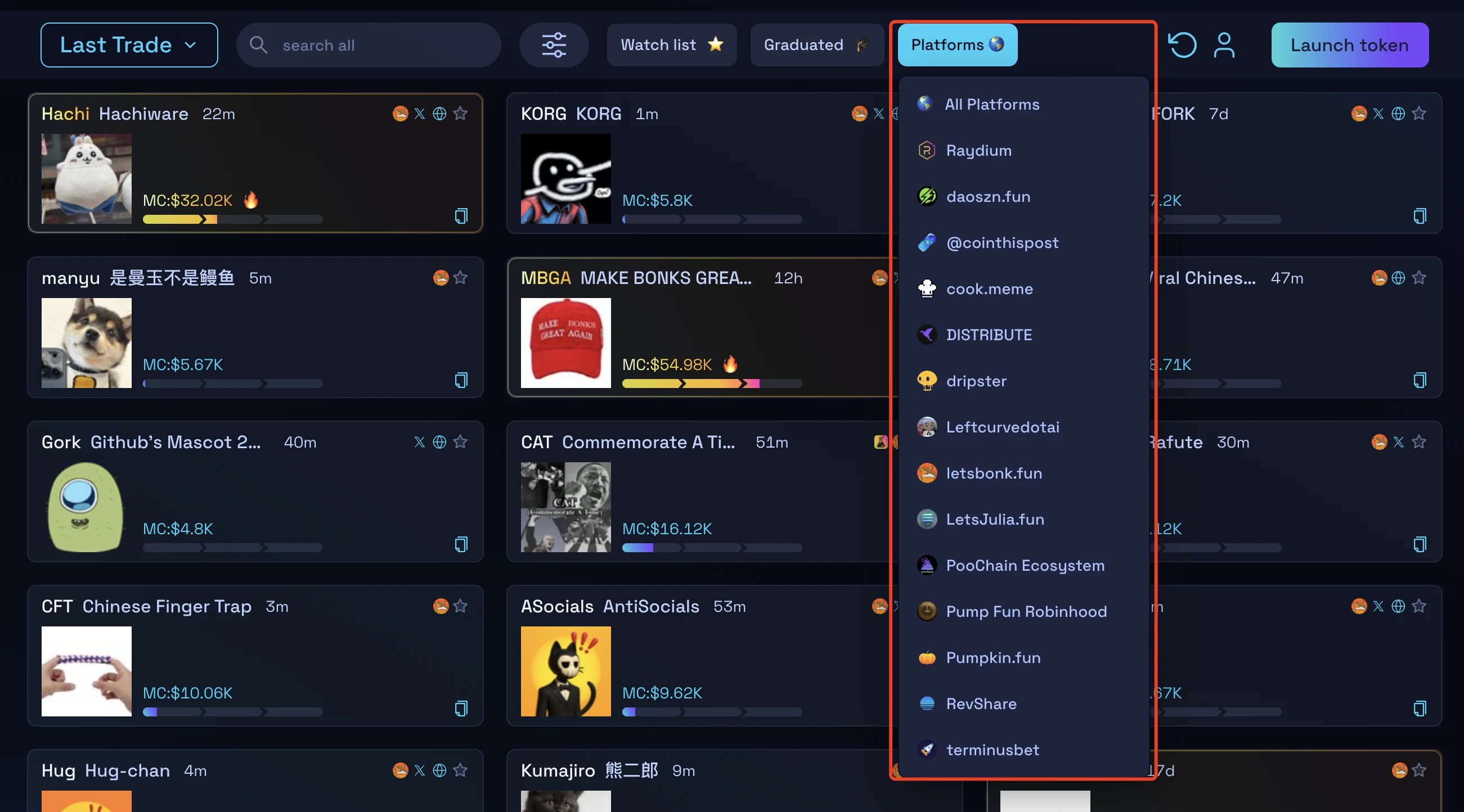

The official LaunchLab interface shows that there are currently more than ten third-party token issuance platforms built on LaunchLab, including the recently popular Bonk community token issuance platform Letsbonk.Fun — in fact, the vast majority of tokens graduated from the current LaunchLab ecosystem come from Letsbonk.Fun (see “The New Token Launch Platform Letsbonk.fun Explodes Again, IKUN Becomes the Platform's Latest Star?”).

In short, LaunchLab's strategy is to use third-party platforms like Letsbonk.Fun to launch a "wolf pack" attack on Pump.fun, and based on the current trend, this strategy has already begun to show results.

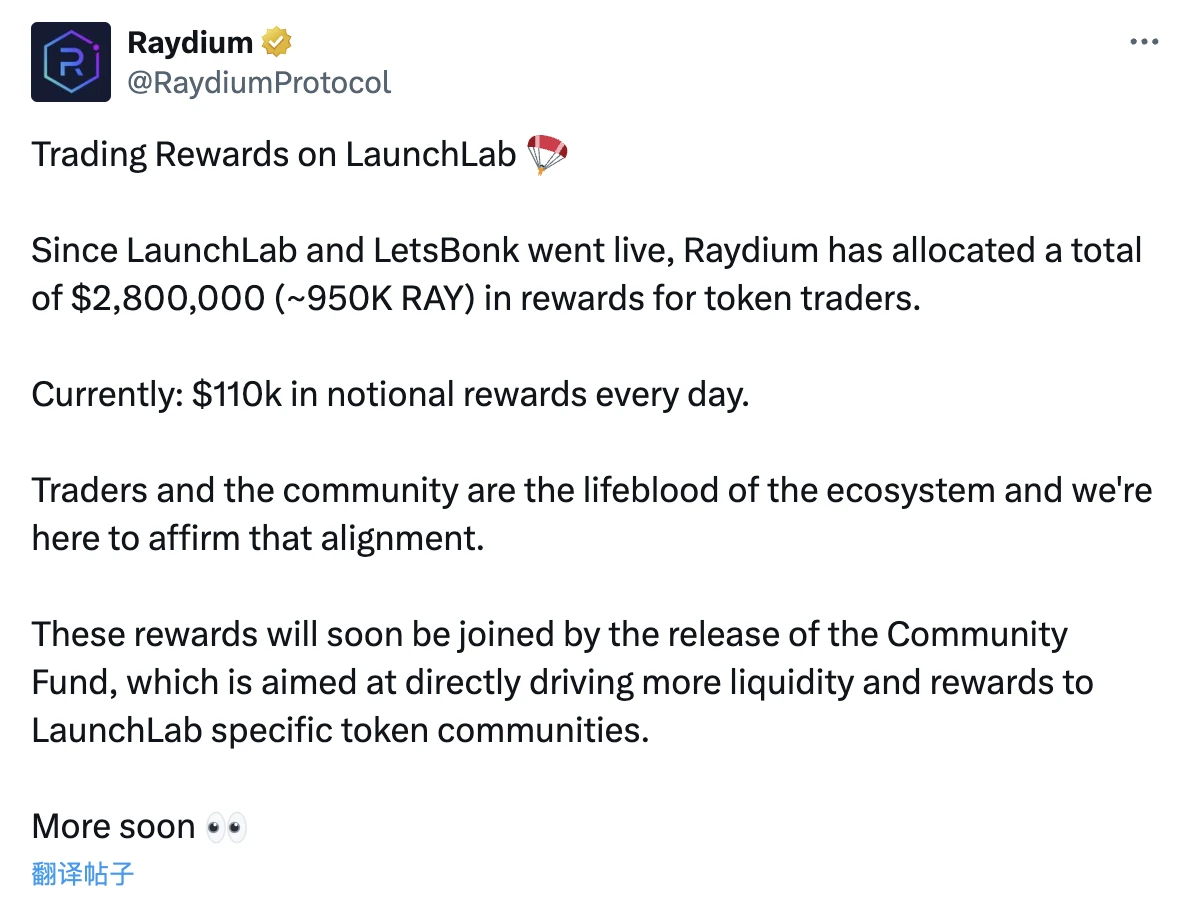

In addition, Raydium also launched an incentive program ahead of Pump.fun to provide incentives for issuance and trading activities on LaunchLab and related third-party platforms.

According to the latest official disclosure, as of today, Raydium has allocated approximately $2.8 million (about 950,000 RAY) in rewards to traders on LaunchLab and Letsbonk.Fun, with the current daily release of incentives around $110,000.

Pump.fun Forced to Respond

Perhaps feeling the aggressive approach of LaunchLab's "wolf pack," Pump.fun has finally been forced to give up part of its cake to attract more user retention — last night, Pump.fun announced the launch of a "creator revenue sharing" mechanism, allowing token creators to receive 50% of the trading revenue share from the PumpSwap platform. From now on, any user who creates a token will continuously earn income as long as that token generates trading activity. The official statement indicated that this mechanism aims to incentivize more quality projects to participate in ecosystem construction.

Meanwhile, another small incident occurred last night, where Pump.fun's X page briefly blocked Letsbonk.Fun founder Tom and some Raydium contributors, but the specifics of what happened are unclear…

Will the meme issuance track see a reshuffle?

As shown in the figure below, for most of the time since mid-2024, Pump.fun (green part) has held an almost dominant market position in meme issuance within the Solana ecosystem, until recently emerging issuance platforms like LaunchLab (purple part) and Boop (blue part) began to gradually capture a certain market share.

For any market, competition is not a bad thing for ordinary users, because more intense competition often forces vested interests to yield more profits and provide a better user experience — for example, the recent battle between JD.com and Meituan.

From the perspective of ordinary users, we should perhaps look forward to LaunchLab continuing to gain momentum and seeing more new players like LaunchLab emerge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。