This Week's Preview (5.12-5.18), TRUMP Dinner Qualification Will Be Locked; If BTC Drops, Long Position Liquidation Intensity Will Reach $15 Billion?

Table of Contents:

- This Week's Large Token Unlock Data;

- Overview of the Crypto Market, Quick Read on Weekly Hot Coins' Rise/Fall and Sector Fund Flows;

- Bitcoin Spot ETF Dynamics;

- BTC Liquidation Map Data Interpretation;

- Key Macroeconomic Events and Crypto Market Highlights and Interpretations This Week.

1. This Week's Large Token Unlock Data;

Coinank data shows that this week, various tokens such as APT, ARB, and AVAX will undergo one-time unlocks. The following are sorted by unlock value in UTC+8 time:

Aptos (APT) will unlock approximately 11.31 million tokens at 2 AM on May 13, accounting for 1.82% of the current circulation, valued at about $67.5 million.

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9 PM on May 16, accounting for 1.95% of the current circulation, valued at about $42.7 million.

Avalanche (AVAX) will unlock approximately 1.67 million tokens at 8 AM on May 17, accounting for 0.4% of the current circulation, valued at about $41.3 million.

Starknet (STRK) will unlock approximately 12.7 million tokens at 8 AM on May 15, accounting for 4.09% of the current circulation, valued at about $23 million.

Immutable (IMX) will unlock approximately 24.52 million tokens at 8 AM on May 16, accounting for 1.35% of the current circulation, valued at about $17.9 million.

Sei (SEI) will unlock approximately 55.56 million tokens at 8 PM on May 15, accounting for 1.09% of the current circulation, valued at about $14.5 million.

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8 AM on May 18, accounting for 6.63% of the current circulation, valued at about $10.4 million.

ApeCoin (APE) will unlock approximately 15.6 million tokens at 8:30 PM on May 17, accounting for 1.95% of the current circulation, valued at about $10.3 million.

We believe that the concentrated unlock of multiple project tokens this week may have a significant impact on market supply and demand and price fluctuations. Key points are as follows:

APT has the largest unlock scale but lower circulation dilution. Although the unlock amount for Aptos (APT) reaches $67.5 million, it only accounts for 1.82% of the circulation, resulting in limited dilution effects compared to other projects. Historical data shows that the APT team tends to release positive information before unlocks to hedge against selling pressure, which may alleviate short-term price downside risks. However, its long-term unlock plan still raises concerns, and attention should be paid to subsequent market absorption capacity.

STRK and MELANIA have prominent high ratio unlock risks. The unlocks for Starknet (STRK) and MELANIA account for 4.09% and 6.63% of the circulation, significantly higher than other projects. STRK's unlock in August 2024 previously led to a 12% price drop in a single week, and similar volatility should be watched this time. As a meme coin, MELANIA has strong community speculation attributes, and a high ratio unlock may exacerbate price fluctuations.

Market strategies are diversifying to cope with selling pressure. Low ratio projects like AVAX (0.4% circulation) and ARB (1.95%) have relatively controllable market impacts. However, historical data for ARB shows an average decline of 8% within 30 days after unlocks. Some projects may mitigate selling pressure through over-the-counter (OTC) trading or leverage ecosystem progress to hedge against liquidity shocks.

Overall, large unlocks pose a challenge to short-term market liquidity, but the market capitalization management strategies of project parties and market sentiment will dominate the actual impact. We need to pay attention to on-chain data changes and project dynamics before and after the unlocks to assess real risk exposure.

2. Overview of the Crypto Market, Quick Read on Weekly Hot Coins' Rise/Fall and Sector Fund Flows

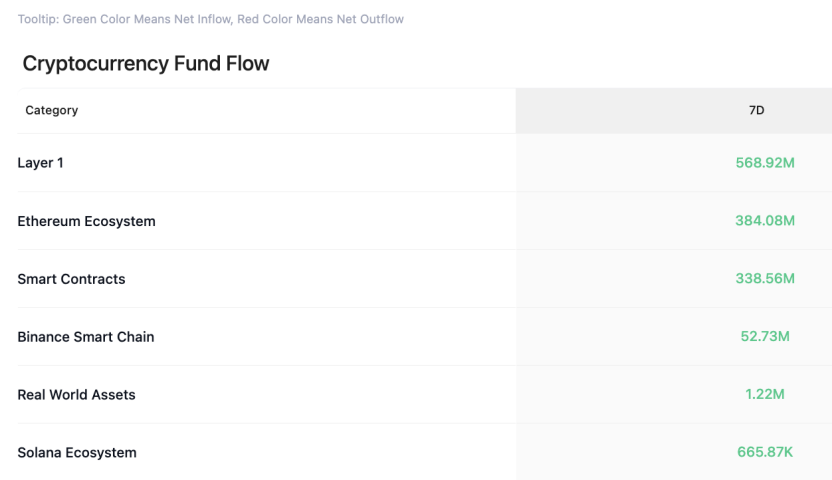

CoinAnk data shows that in the past week, the crypto market, categorized by concept sectors, saw net inflows in sectors such as Layer 1, Ethereum ecosystem, smart contracts, Binance Smart Chain, Real World Assets, and Solana ecosystem.

In the past 7 days, the following tokens have seen significant price increases (selected from the top 500 by market capitalization): MOODENG, GOAT, PNUT, PI, and WIF are among the top gainers, and strong coins should continue to be prioritized for trading opportunities this week.

3. Bitcoin Spot ETF Fund Dynamics.

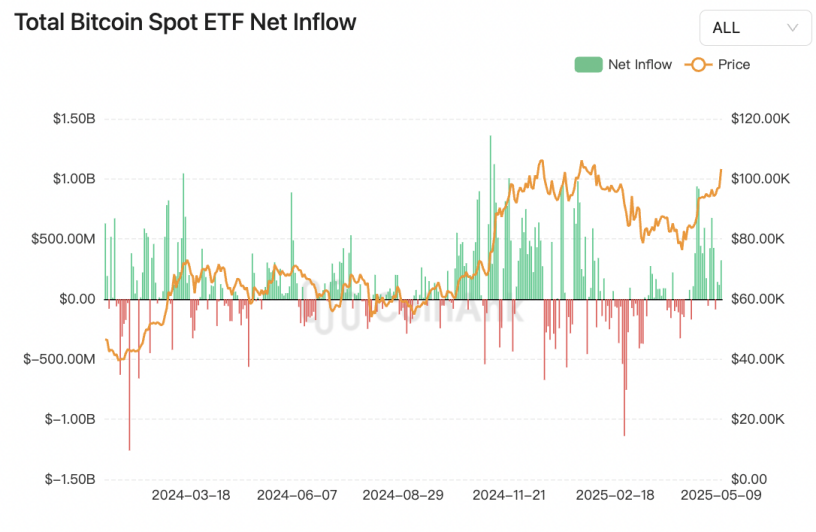

CoinAnk data shows that last week, the total net inflow in the Bitcoin ETF market reached $920.9 million. Among them, BlackRock (IBIT) had the highest net inflow, reaching $1.0303 billion; Fidelity (FBTC) and Ark (ARKB) had net inflows of $62.4 million and $45.6 million, respectively; Grayscale (GBTC), Bitwise (BITB), Franklin (EZBC), and VanEck (HODL) had net outflows of $171.5 million, $26.8 million, $11 million, and $8.1 million, respectively.

Last week, the Ethereum ETF market saw a total net outflow of $38.2 million. Among them, BlackRock (ETHA) had a net outflow of $4.2 million; Fidelity (FETH) had a net outflow of $37.2 million; Grayscale Mini (ETH) had a net inflow of $3.2 million.

We believe that last week, the cryptocurrency ETF market exhibited significant structural differentiation. The Bitcoin spot ETF maintained overall net inflows (+$920.9 million), but there were notable differences among institutions: BlackRock IBIT attracted $1.03 billion in a single week, continuing its leading position in the industry, while Grayscale GBTC faced a net outflow of $171.5 million, possibly related to the 1.5% high management fee leading to a migration of funds to lower-cost products. It is worth noting that although Fidelity FBTC has historically shown multiple instances of weekly outflows, it still achieved a net inflow of $62.4 million this time, reflecting a dynamic adjustment in institutional investors' trust in leading issuers.

In contrast, the Ethereum spot ETF saw an overall net outflow of $38.2 million, indicating a cautious short-term attitude towards ETH assets in the market. BlackRock ETHA and Fidelity FETH saw outflows of $4.2 million and $37.2 million, respectively, possibly due to regulatory uncertainties surrounding Ethereum ETF approvals, while Grayscale Mini ETH products saw a contrary inflow of $3.2 million, suggesting some funds are seeking arbitrage opportunities at a discount. This differentiation indicates that investors are more inclined to anchor their crypto asset allocations to Bitcoin's "digital gold" narrative, while their risk appetite for smart contract platform tokens is relatively conservative.

A deeper observation reveals that the fund flows in Bitcoin ETFs are highly correlated with market cycles. For example, when macro risk aversion sentiment rises, BlackRock IBIT has repeatedly become the only product maintaining net inflows, highlighting its core position as an institutional allocation channel. The continued weakness of Ethereum ETFs may reflect long-term concerns in the market regarding the liquidity and regulatory classification of POS mechanism assets, necessitating attention to the SEC's policy direction's catalytic effect on fund sentiment.

4. BTC Liquidation Map Data.

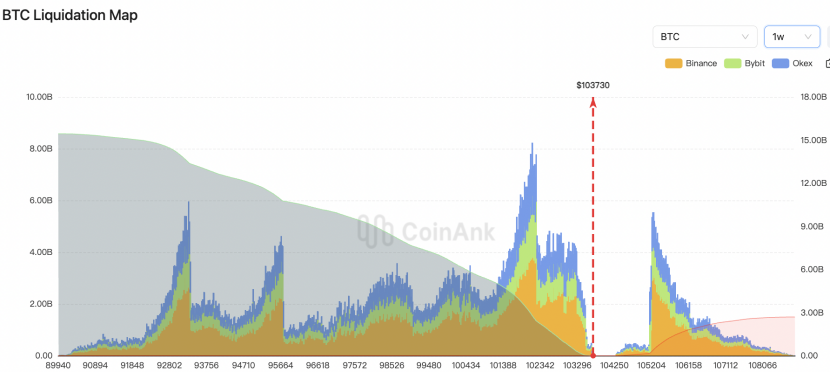

CoinAnk liquidation map data shows that if BTC breaks through $108,880, the cumulative short position liquidation intensity on mainstream CEXs will reach $2.693 billion. Conversely, if Bitcoin falls below $92,000, the cumulative long position liquidation intensity on mainstream CEXs will reach $15 billion.

We believe that the current Bitcoin market has significant long and short position risk near key price thresholds ($108,880 and $92,000). The liquidation data reflects the correlation between the concentrated distribution of market leverage positions and liquidity risks.

Specifically, when Bitcoin breaks through key resistance levels (such as $108,880), a large number of short stop-loss orders will be triggered, creating a "short squeeze" effect. This process may trigger a liquidity wave, accelerating price increases and attracting chasing funds, forming a positive feedback loop. Conversely, if the price falls below support levels (such as $92,000), the concentrated liquidation of long leveraged positions will lead to increased selling pressure, further lowering prices and potentially triggering panic selling. It is important to note that the "intensity" in the liquidation map is not an absolute value but reflects the relative importance of different price level liquidation clusters on the market; higher liquidation bars indicate a more intense market reaction when prices reach that area.

Current data highlights two risk characteristics: first, both long and short positions are highly concentrated near key thresholds, leading to extreme polarization in market sentiment; second, the long position liquidation intensity is far higher than that of short positions, indicating that if prices decline, the chain reaction the market may endure could be more severe. This pattern suggests that investors should be wary of liquidity exhaustion risks in high volatility scenarios and pay attention to the market sentiment transmission path after price breaks through thresholds. For trading strategies, it is necessary to dynamically assess the potential price inertia triggered by liquidation based on position distribution while strengthening risk management to cope with extreme volatility.

5. Key Macroeconomic Events and Crypto Market Highlights and Interpretations This Week.

CoinAnk data shows that the key macroeconomic events and crypto market highlights this week are as follows:

May 12: TRUMP dinner qualification ranking will be locked;

The U.S. SEC announces it will hold the fourth crypto roundtable meeting, with the SEC Chairman and Nasdaq attending;

May 13: The U.S. will release April CPI data on May 13 at 8:30 PM;

May 14: Vaulta: EOS tokens are proposed to be exchanged for A tokens at a 1:1 ratio;

May 15: Obol will have TGE;

May 16: Galaxy plans to list on Nasdaq;

May 17: Terra: The deadline for submitting loss claims to the Terraform liquidation trust fund is May 17;

Others (specific times not yet determined): The U.S. Treasury will hold multiple crypto industry roundtable meetings this week.

This week, the crypto market faces the intertwined effects of multiple macro and industry events. First, the SEC's fourth crypto roundtable meeting on May 12 focuses on "asset tokenization," with deep participation from traditional financial institutions like BlackRock and Fidelity potentially promoting the refinement of regulatory frameworks, but it may also strengthen compliance constraints on the DeFi sector, leading to short-term market concerns about policy uncertainty. Second, if the U.S. April CPI data released on May 13 continues the cooling trend from March, it may solidify market expectations for a Federal Reserve rate cut, enhancing the attractiveness of risk assets. However, if the data rebounds beyond expectations, it may lead to simultaneous pressure on the crypto market and U.S. stocks.

On the industry side, the EOS token exchange for A tokens (May 14) may trigger short-term price fluctuations, but Vaulta's token economics design implies inflation traps and potential selling pressure, which may weaken investor confidence in the long term. Meanwhile, Galaxy's listing on Nasdaq (May 16) marks traditional capital's recognition of crypto infrastructure, potentially boosting market sentiment. Additionally, the TRUMP dinner qualification linked to the TRUMP token indicates political forces' outreach to the crypto community, which may push the industry's regulatory stance towards a more lenient direction.

In summary, the interplay of regulatory dynamics and economic data will be the dominant factor this week. If CPI data is mild and the SEC meeting releases positive signals, the crypto market may continue its recent upward trend; however, structural risks from events like the EOS exchange still need to be monitored, and market volatility may further amplify.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。