Original Title: Bull Case for MKR/SKY - Q2 Update

Original Author: Taiki Maeda

Original Translation: Shenchao TechFlow

In the MKR/SKY report a few months ago, I proposed that the restart of buybacks would allow it to outperform most crypto assets on a risk-adjusted basis. Since the buyback announcement on February 20:

· MKR has risen 46% compared to BTC,

· MKR has risen 70% compared to ETH,

· MKR has become one of the few cryptocurrencies with a price increase year-to-date (YTD): +24%.

In this update, I will discuss three reasons why I believe this trend will continue:

Launch of the SKY staking mechanism

Mandatory migration of SKY tokens (over 10% of the supply will be burned)

SPK token mining plan

Introduction of the SKY Staking Mechanism

Currently, MKR/SKY is a token that uses all protocol revenues for token buybacks. At the current buyback rate, the protocol buys back approximately $15 million per month (about $500,000 daily), which is about 1% of the circulating supply per month (the highest among all crypto projects).

On April 30, Rune posted a proposal in the forum to launch the SKY staking mechanism. According to the proposal, 50% of the protocol's revenue will be allocated to SKY stakers, paid in USDS. This means that about $250,000 will be used for buybacks daily, and $250,000 will be allocated to stakers.

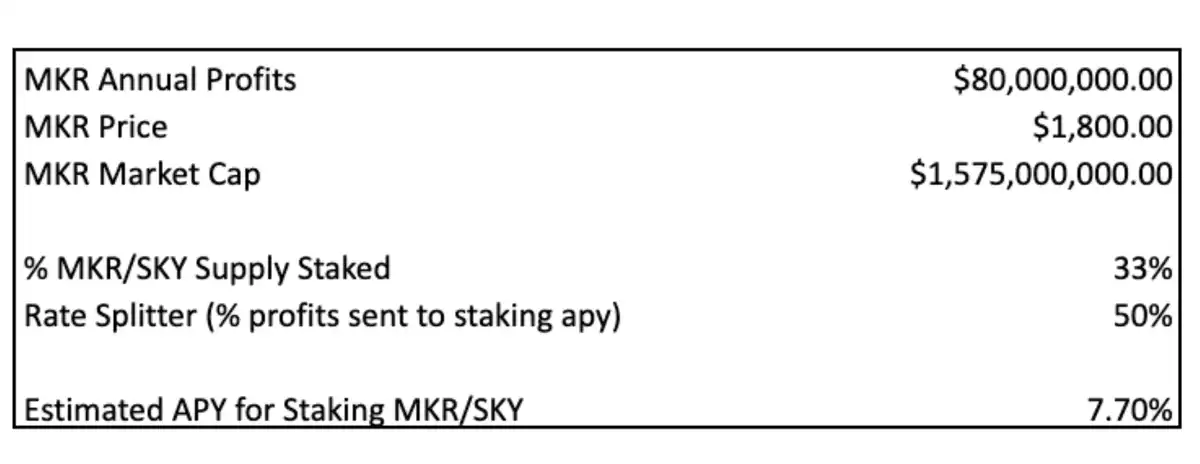

Assuming 33% of the SKY supply is staked, stakers are expected to receive a staking yield of 7-8%.

Mandatory Migration of SKY Tokens

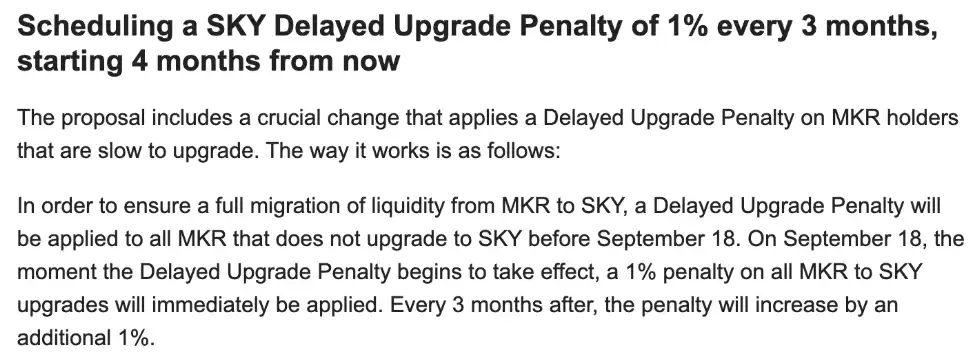

In the same update, it was also mentioned that there will be a mandatory migration from MKR to SKY:

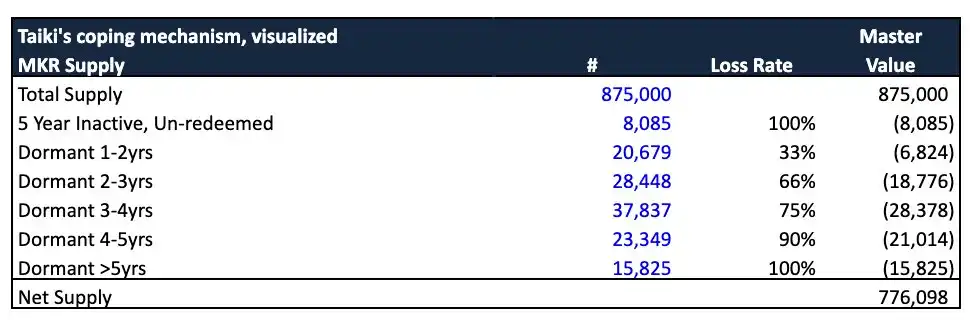

Since MKR is one of the earliest ERC20 tokens (launched in 2017), there are inevitably some permanently lost tokens. This could be due to lost private keys, lost wallets, or the death of holders. Through on-chain data analysis, I have identified some "dormant MKR tokens" that will inevitably be destroyed from the supply.

Based on reasonable assumptions, for example: "If there are 23,349 MKR tokens that have not been transferred in the past 4-5 years, I can assume that about 90% of them have been permanently lost, which means they will be destroyed." Based on these assumptions, I expect that about 100,000 MKR will be destroyed due to the migration (approximately 11.4% of the circulating supply). By referencing other cases of lost tokens (such as Aragon DAO), I believe this is a conservative estimate.

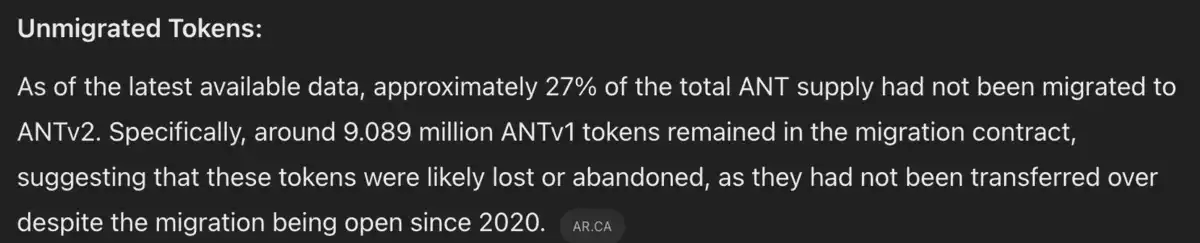

For example, in 2023, the Aragon DAO token ($ANT) was trading below its treasury value. "Treasury raiders" or RFVooors bought tokens at prices below net asset value (NAV) and demanded redemption of the treasury for profit. This action was successful, and the process of migrating ANT tokens to a new token was initiated to redeem the treasury value. During this process, about 27% of the tokens were not migrated, which can be inferred that these tokens are permanently lost.

Therefore, I expect that in the coming months or years, 10-20% of MKR will be destroyed, which will support the token price. Additionally, this mandatory migration may encourage more centralized exchanges (CEX) to list SKY, which will bring additional benefits.

Launch of SPK Token

Spark is a project that combines lending markets with on-chain asset management, achieving $40 million in revenue in the first quarter of 2023 with almost no incentives. They are able to borrow stablecoins at subsidized rates for SKY, thereby allocating capital on-chain.

SPK will be a "fair launch/mining" token, which users can only mine by staking USDS or SKY (specific economic models can be referenced in related documents). In the first two years of the token issuance, 50% of $SPK incentives will be allocated. If we assume a fully diluted valuation (FDV) of $500 million, then $250 million of value will be allocated to SKY/USDS stakers. This not only provides staking rewards for the native token but also promotes the growth of USDS, and the growth of USDS will further drive more buybacks in the future.

Additionally, other sub DAOs or "star" projects are set to launch (such as Solana Star, RWA Star, etc.), and the launch of these new projects will further support the buyback plan.

Stablecoin Bill

The "Stablecoin Bill" (GENIUS ACT) is expected to be signed by Trump in July or August. Although this bill mainly targets centralized stablecoin issuers (thus having little impact on decentralized issuers), this policy narrative may bring positive market momentum for MKR/SKY. Industry experts predict that the bill is likely to pass in July or August.

Conclusion

Stablecoins are the future and are one of the most profitable projects in the crypto space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。