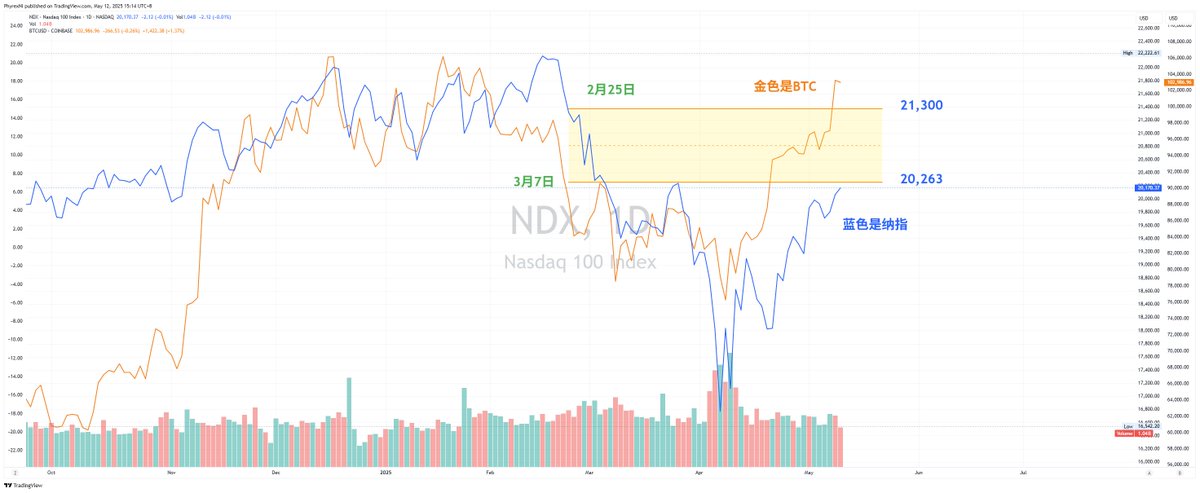

At the beginning of the month, I talked about the consistency between $BTC and the US stock market. As of now, the Nasdaq has returned to the level of March 7, and it is currently 5.1% away from the significant drop caused by tariffs on February 25. If it can rise smoothly, Bitcoin should still have room for growth.

From the beginning of the month until now, the Nasdaq has risen a maximum of 1.3%, corresponding to an increase of about 8% in BTC. Part of this is due to state strategic reserves and other factors related to BTC itself. A simple calculation suggests that about 6% of the increase is synchronized with the US stock market.

If the Nasdaq returns to the level of February 25, then BTC could potentially maintain an increase of around 3% (preemptive rise) to 10%. This space is my personal estimate and does not guarantee 100% accuracy. However, it is clear that, at least up to now, BTC and the US stock market still have a strong correlation.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。