Today's homework is easy to write, as the market is quite calm, just as expected, with a slight upward fluctuation. This is reflected in the data, indicating a lack of momentum for the current rise. Of course, this does not mean that a decline is certain; rather, even in a situation of very poor liquidity, there is no significant buying pressure, which shows that investors are treating the current market rationally and are not overly FOMOing. Whether the rise can be sustained still depends on the performance of the U.S. stock market on Monday.

This is not just talk. From the data of the $BTC open contracts across all exchanges, the current open contract volume is almost at its lowest point in the past year. The last time it was at this level was when Bitcoin was nearly breaking below $60,000. In this situation, whether it is the passive reduction of short positions or investors lowering their bets on both sides, it reflects the confusion of investors at this level. Those who went long are worried about a reversal, while those who went short are concerned about further increases.

Investors are waiting for clearer signals. As mentioned in the last two days, although BTC's price has risen well, the current situation resembles the rapid surge in February 2024, where most investors are waiting for lower prices, leading to missed opportunities.

In simple terms, current investors are highly cautious and unwilling to bet on a direction.

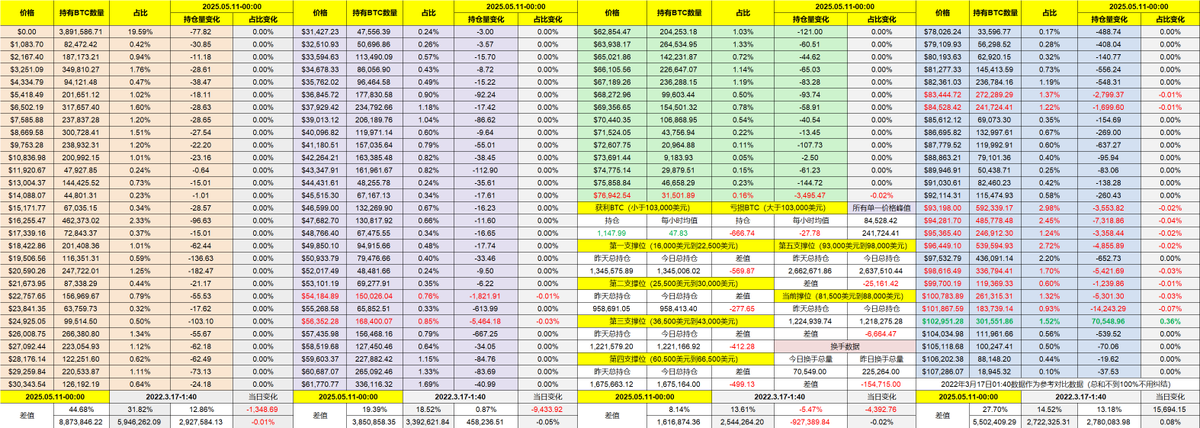

Looking back at Bitcoin's data, the turnover rate over the weekend has significantly decreased, but compared to previous Saturdays, there is still a notable increase. This indicates that many investors believe the current price will struggle to rise further and are taking the opportunity to exit at high levels. In reality, today's buying power has not significantly increased compared to previous weekends, which may also be a major reason suppressing price increases.

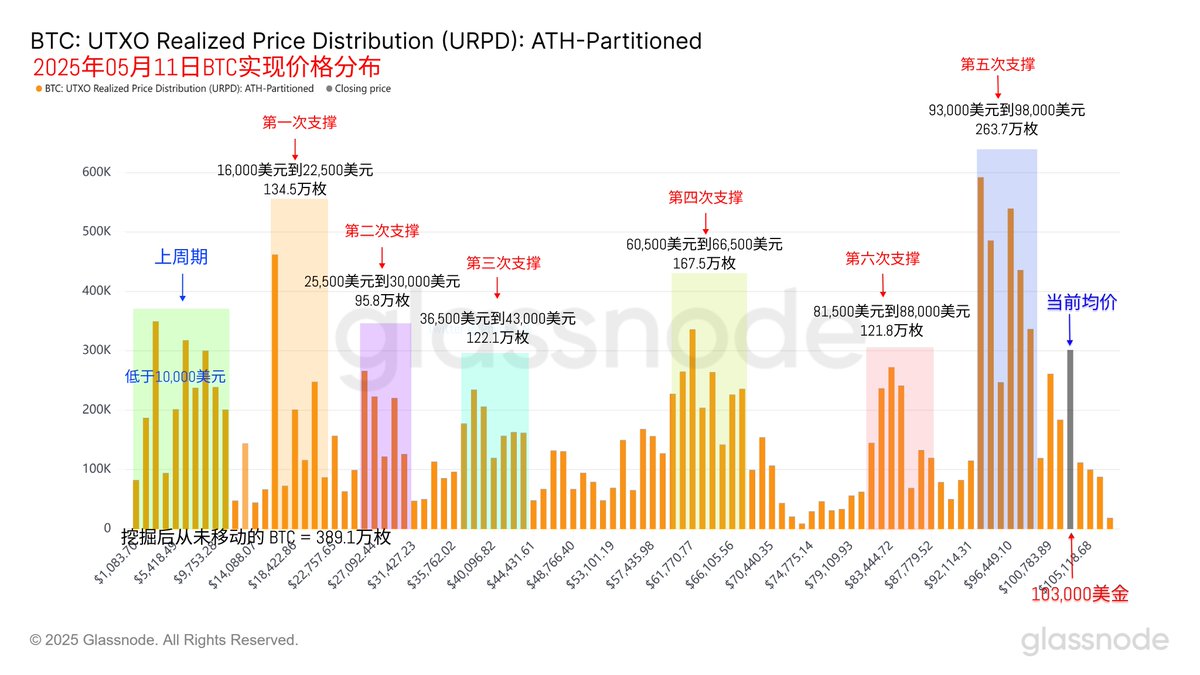

From the support data, the range of $93,000 to $98,000 remains the most stable, although there has been some reduction in holdings as prices rise, it is not severe. On the contrary, the support range around $83,000 is continuing to be broken, with a large number of profit-taking investors starting to exit this range.

To be honest, the current price does not depend on Bitcoin itself; it is more likely influenced by macroeconomic factors, politics, and economics, especially with Trump and the Federal Reserve being the most significant factors affecting the market.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。