US-UK Tariff Agreement Triggers Global Asset Rebound, Crypto Market Outperforms US Stocks, BTC Returns to $104,000

Macro Interpretation: Amid the rising expectations of a shift in the Federal Reserve's monetary policy, the implementation of the US-UK tariff agreement, and the EU's strengthening of crypto asset regulations, Bitcoin's price recently broke through the key level of $104,000, with its market cap share climbing to 64.5%, the highest level since the DeFi boom in 2021. This phenomenon not only reflects institutional investors' preference for safe-haven assets but also reveals the deep impact of the global macro situation on the crypto market.

The Federal Reserve's interest rate cut game and the rebalancing of capital flows. According to the latest data from CME's "FedWatch," the market's expectation for maintaining interest rates in June is as high as 83.5%, but the probability of a 25 basis point cut in July has risen to 60.1%. This "short-term stability, long-term easing" policy expectation is reshaping capital allocation logic: since Bitcoin broke through $85,450 on April 11, its price has risen by 16% alongside accelerated ETF inflows. Notably, data shows that the US stock market has seen an outflow of $24.8 billion in the past four weeks, reaching a two-year high, with some funds possibly migrating to crypto assets.

The geopolitical ripples of the US-UK tariff agreement: Although the newly reached trade agreement between the US and UK does not directly involve cryptocurrencies, it still has an indirect impact on the global trade landscape. The core content of the agreement includes: the elimination of tariffs on steel and aluminum products exported from the UK to the US, a reduction of the auto tariff from 27.5% to 10%, zero tariffs within agricultural product quotas, and an expansion of UK imports of US agricultural products. Paul Dales, an economist at Capital Economics, pointed out that the agreement has limited short-term stimulus for the UK economy but may accelerate the return of dollar liquidity—by reducing tariffs on industrial goods in exchange for the expansion of agricultural exports, this "manufacturing return + agricultural output" strategy may enhance the attractiveness of dollar assets. For the crypto market, adjustments in traditional asset allocation may trigger a secondary diversion of safe-haven funds, highlighting Bitcoin's reserve properties as "digital gold."

Market differentiation under regulatory storm: The EU's new anti-money laundering regulations require crypto service providers to record data on fund senders and receivers, marking the formal extension of regulatory reach into on-chain transactions. Eurogroup President Paschal Donohoe emphasized that applying traditional financial regulatory frameworks to crypto asset transfers is a "key step towards achieving transparency." The tightening of policies has triggered structural adjustments in the market: the recently launched holding ranking mechanism for TRUMP tokens has led to an increase in the concentration of whale accounts, with the top 220 addresses needing to hold at least 5,140 tokens to qualify for offline activities, objectively exacerbating the risk of chip concentration. Meanwhile, the altcoin market remains sluggish, with social media discussion heat dropping over 40% compared to last December, and the trend of funds concentrating on Bitcoin is becoming increasingly evident.

Evolution of the derivatives market and institutional strategies: The current crypto derivatives market shows a delicate balance: the funding rate for Bitcoin contracts on CEX platforms has returned to neutral (0.01% across the three major platforms), indicating a temporary equilibrium between long and short forces. However, liquidation data shows that if the price falls to $98,296, the scale of long liquidations will reach $3.487 billion, and this "cliff-like" risk exposure forces institutions to adjust their hedging strategies. The US stock market has already shown a linkage effect—crypto concept stocks like Canaan Creative and MicroStrategy have seen daily gains exceeding 5%, and Robinhood's stock price rose 8% due to a surge in crypto trading volume, as traditional financial institutions construct a "long BTC + hedge altcoin risk" strategy through derivatives tools.

The current crypto market is at a historic turning point: the liquidity expectations triggered by the Federal Reserve's policy shift, the capital flows reshaped by geopolitical trade agreements, and the rising compliance costs brought about by the improvement of regulatory frameworks together constitute the core variables affecting BTC prices. For investors, in the context of Bitcoin's market cap share continuing to rise, paying attention to the trends in CME interest rate futures, the implementation progress of the US-UK agreement, and the enforcement strength of EU regulations will become key anchor points for predicting market trends. The recovery of the altcoin market may depend on whether a new value narrative can be formed after the regulatory framework becomes clearer.

BTC Data Analysis:

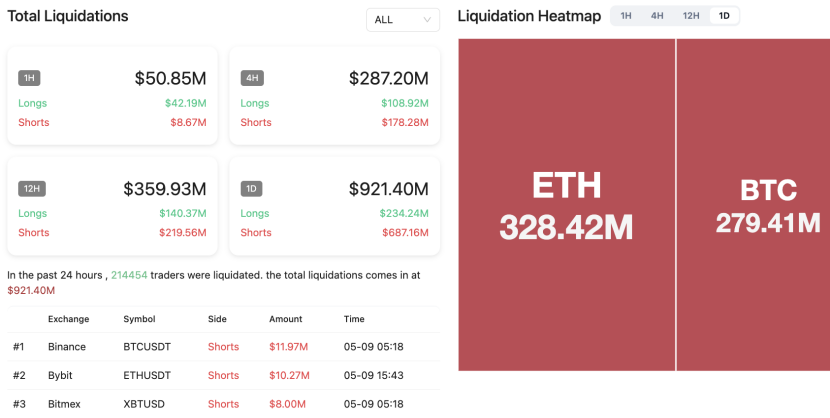

According to Coinank data, BTC has risen to over $104,000, triggering a large number of contract liquidations. In the past 24 hours, the total liquidation across the network reached $921 million, with long liquidations amounting to $234 million and short liquidations at $687 million. Among them, Bitcoin liquidations totaled $279 million, and Ethereum liquidations reached $328 million.

In the past 24 hours, short liquidations accounted for 83.8% of total liquidations, exposing the extreme vulnerability of the market's leverage structure. This round of liquidation wave stems from three mechanisms: policy expectations and market sentiment resonance: the easing of tariff negotiations between the US and various countries and the Federal Reserve's hawkish stance on pausing interest rate cuts have strengthened the narrative of Bitcoin as an "anti-inflation asset," attracting institutional funds to continue flowing in through ETFs, but high-leverage shorts failed to adjust their positions in time; imbalance in the derivatives market: Bitcoin futures open interest reached a historical peak of $12 billion, while the funding rate remained low (0.01%), indicating that market makers are suppressing volatility through Delta hedging, leading to increased liquidation pressure when prices break through key levels; liquidity layering effect: the BTC reserve on exchanges has dropped to its lowest point since 2018, insufficient market depth amplifies volatility, with approximately $1.17 billion in short liquidation thresholds concentrated around the $100,000 mark, forming a self-reinforcing upward spiral.

Short-term volatility intensifies: The buying pressure triggered by short liquidations may push prices to test the $120,000 resistance level, but the depletion of exchange reserves (2.49 million BTC) may lead to a risk of more than 5% daily drawdown;

Deepening institutionalization process: Asset management giants like BlackRock have increased their holdings by over 50,000 BTC in a single week, with the average holding cost rising to $83,000, forming a new price support;

Liquidity squeeze in the altcoin market: Bitcoin's market cap share has rebounded to 65%, with funds concentrating on leading assets, while small and mid-cap tokens may face more severe selling pressure, but the ETH/BTC exchange rate rebounding by 14.6% indicates possible local fund rotation.

The current market is at a critical juncture of transitioning from "policy-driven" to "technical breakthrough," and caution is needed regarding sudden changes in liquidity expectations following the Federal Reserve's interest rate decision, as well as potential black swan impacts in a high-leverage derivatives environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。