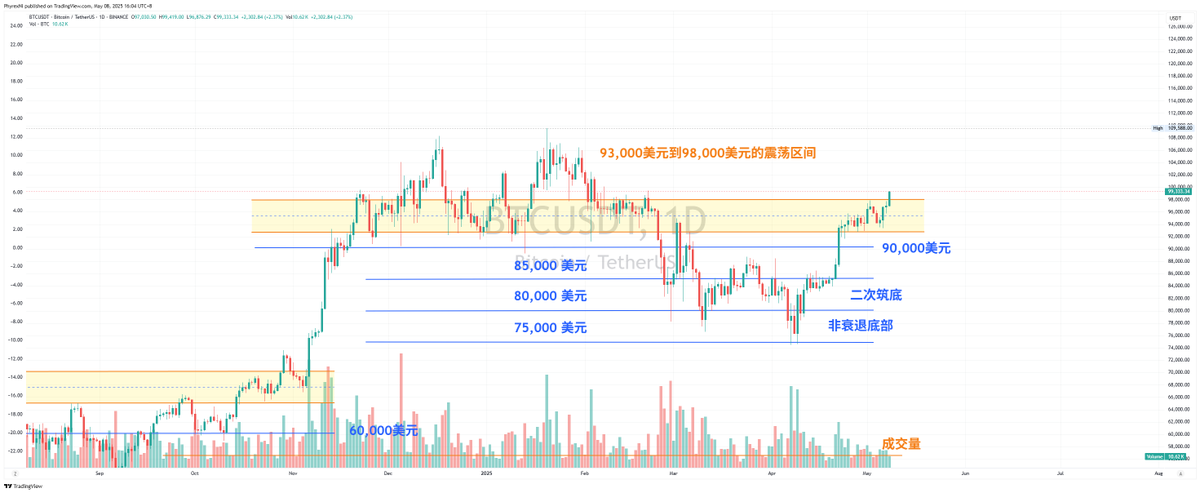

For two consecutive working days, the market has started to rally around 6 AM. Yesterday, it was mentioned that there was a high probability of oscillation between $93,000 and $98,000. Although it has currently broken through, I personally still maintain a "cautiously optimistic" stance. Last night, I impulsively opened a short position at $97,500, and now it’s a bit painful; I’m still considering whether to cut my losses.

This rise should still be event-driven. On one hand, the U.S. is unbinding AI chips and has made some progress on tariffs. On the other hand, after the first state of New Hampshire passed it, two more states have successively passed strategic reserves related to cryptocurrency, namely:

Oregon SB167 has been signed into law, updating the state's Uniform Commercial Code and providing much-needed clarity on how to handle digital assets (for example, legally recognized as collateral).

Arizona HB749 has been signed into law. Although it does not allow direct investment, it transfers unclaimed assets, airdrops, and staking rewards into reserves.

Arizona SB1373 is on the governor's desk. After passing HB749, it seems Governor Hobbs is willing to enact legislation supporting cryptocurrency. SB1373 is also a strategic reserve, just not utilizing pension funds.

I really think it shouldn't be a time to short the market; I am just a foolish example. It’s difficult to predict what events might occur, and recently, Trump’s outbursts have decreased somewhat, which may also reduce negative impacts.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。