On Thursday, U.S. time, the Senate will hold a key procedural vote on the "U.S. Stablecoin Innovation and Establishment Act" (GENIUS Act), which will determine whether stablecoin regulatory legislation moves into a substantive advancement phase. If the vote passes, the stablecoin industry will welcome its first clear federal regulatory framework.

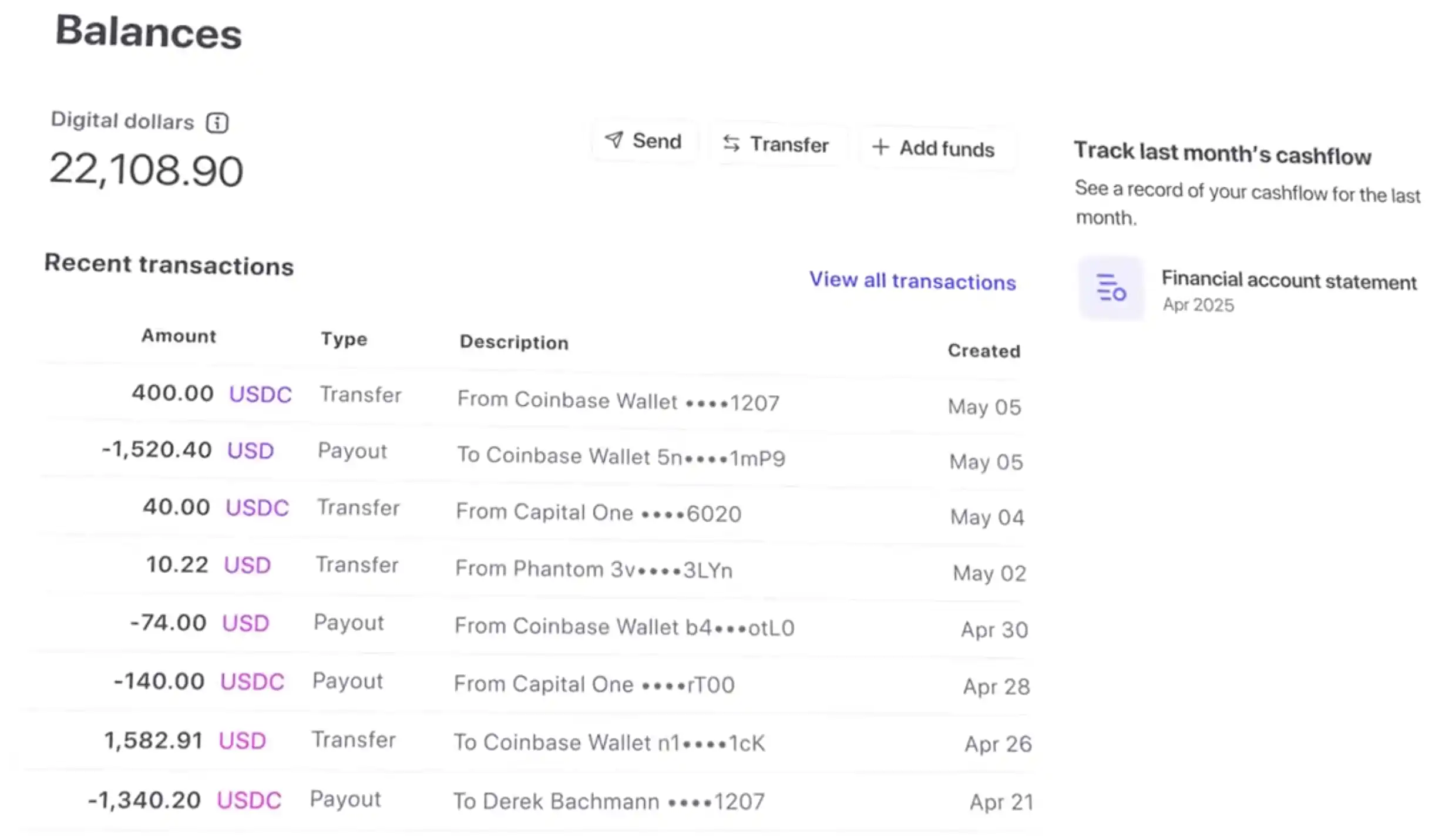

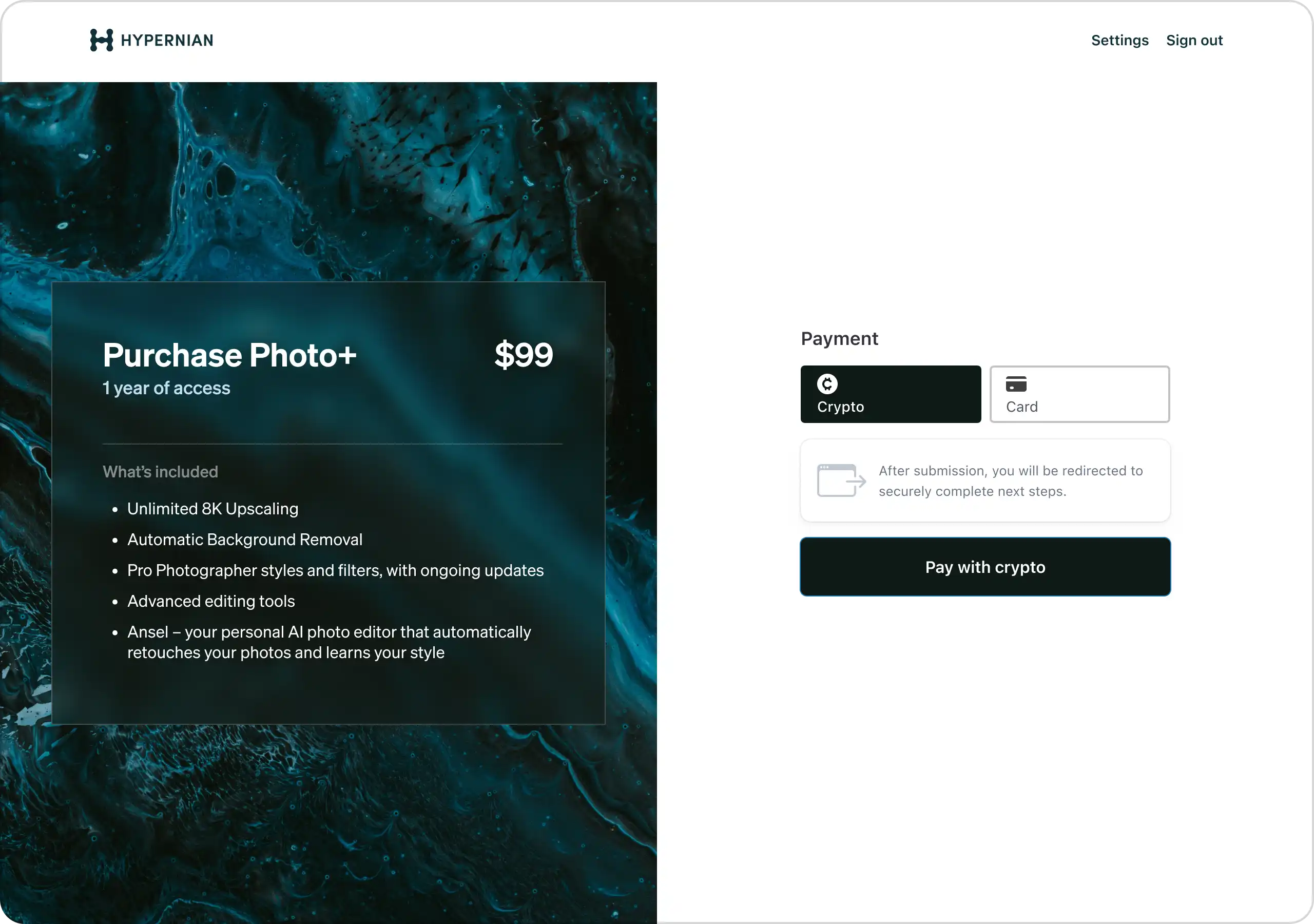

On the day before the vote, payment service provider Stripe announced the launch of Stablecoin Financial Accounts, allowing users and businesses to store stablecoin balances within Stripe, send and receive funds using fiat and cryptocurrency channels, and circulate through its extensive fiat payment network, which now covers 101 countries and regions.

The stablecoin balances in the accounts currently support two stablecoins—USDC (issued by Circle) and USDB (issued by Bridge). USDB is a closed-system stablecoin that circulates only within the Stripe platform and is not open for public trading. Both stablecoins are pegged to the U.S. dollar at a 1:1 ratio, with underlying assets including cash and short-term money market funds managed by BlackRock.

Bridge was acquired by Stripe in 2024 for $1.1 billion, marking the largest acquisition in the company's history. Bridge has complete capabilities for stablecoin issuance, custody, and clearing, having served clients such as Coinbase and SpaceX. Bridge has now been integrated into Stripe's on-chain account infrastructure system, responsible for stablecoin issuance and custody services, signifying Stripe's transformation from a "crypto payment gateway" to a "provider of on-chain financial infrastructure."

However, while Stripe claims to support registered businesses in 101 countries and regions, major financial markets such as the U.S., mainland China, Hong Kong, Singapore, and Japan are currently not on the open list.

Stripe's Journey of Exiting and Re-entering the Crypto Space

Stripe was founded in 2009 by Irish brothers Patrick and John Collison. As early as 2014, Stripe became one of the first major companies to accept Bitcoin payments, but its cryptocurrency plans ended in failure in 2018. The reason given was that Bitcoin's volatility was too high and unstable. That year, Bitcoin fell from a peak of $19,650 in December 2017 to $3,401 by the end of 2018.

After several years of silence, Stripe announced its return to the crypto business in 2022, focusing on infrastructure areas such as KYC, fraud detection, and stablecoin payments, and collaborating with crypto projects like Polygon and OpenNode.

In March 2023, Stripe completed a $6.5 billion Series I funding round at a valuation of $50 billion, with investors including a16z, Baillie Gifford, Founders Fund, General Catalyst, MSD Partners, Thrive Capital, GIC, Goldman Sachs, and Temasek.

Starting in April 2024, Stripe announced support for USDC stablecoin payments on Solana, Ethereum, and Polygon, integrating the Avalanche network and announcing a strategic partnership with Coinbase to add Base network support to its crypto product suite.

Related: "After 6 Years, Stripe Re-enters Crypto, Joining PayPal's Crypto Payment Competition?"

On October 21, 2024, Stripe announced the acquisition of the stablecoin platform Bridge for $1.1 billion, enabling it to optimize cross-border payment solutions and expand its stablecoin payment infrastructure. This is Stripe's largest acquisition to date and the largest acquisition in the history of the cryptocurrency industry.

Related: "The Largest Acquisition in Web3 History: What Exactly is Stripe's $1.1 Billion Bridge?"

In February of this year, Stripe announced the formal completion of its acquisition of Bridge, marking the official start of its significant layout in the stablecoin field.

At the end of April, Stripe stated that it was developing a new stablecoin product, supported by Bridge technology, with eligibility requirements for companies in the testing phase being headquartered outside the U.S., EU, or UK, and wishing to access dollar channels. This stablecoin product is one of the stablecoins supported by the Stablecoin Financial Accounts announced by Stripe this morning.

Notably, USDB employs a more platform-oriented incentive mechanism—Bridge returns part of its stablecoin underlying earnings to developers. This mechanism is akin to on-chain interest sharing, which is not commonly seen in traditional financial structures, perhaps indicating that Stripe is exploring revenue sources beyond stablecoin profit models.

The stablecoin payment feature launched last year focused on merchants accepting payments, emphasizing the immediacy of payments and fiat settlement, addressing efficiency issues in the payment process. Now, the launch of stablecoin accounts signifies that Stripe has completed a closed-loop construction from payment access, network support, to stablecoin issuance and custody. It resembles a comprehensive financial account, allowing users to hold and manage stablecoin balances, supporting a wider range of financial use cases (such as savings, transfers, future card payments), not limited to payment scenarios.

The Battle for Stablecoin Payments Heats Up

Unlike PayPal's publicly circulating PYUSD, Stripe has adopted a more cautious approach to stablecoins, with USDB being limited to platform use only. This "controlled closed-loop" strategy is closer to Apple's product philosophy rather than the open Web3 concept.

However, Stripe's launch of stablecoin financial accounts undoubtedly intensifies the competition in the increasingly fierce stablecoin payment arena, with more traditional financial institutions entering this field. According to the Financial Times, some of the world's largest banks and fintech companies are eager to launch their own stablecoins, aiming to capture market share in cross-border payments that they expect will be reshaped by cryptocurrencies.

Last month, Bank of America expressed its intention to issue its own stablecoin, joining established payment providers like Standard Bank, PayPal, Revolut, and Stripe, aiming to compete with businesses dominated by cryptocurrency groups like Tether and Circle. In addition to Bank of America, other major traditional financial players are also preparing for the development of stablecoins.

In the payment arena of major foreign markets, PayPal is Stripe's most important competitor, with Stripe targeting businesses of all sizes, while PayPal focuses on small businesses. In 2023, PayPal held a 42.35% market share, while Stripe held 19.44%, with Shopify Payments at 12.42% and Amazon Payments at 4.76%.

PayPal launched the dollar-pegged stablecoin PYUSD as early as 2023, and although it faced an SEC investigation, on April 30, the SEC announced it had terminated its investigation into PayPal's dollar-pegged stablecoin PYUSD without taking enforcement action.

Meanwhile, Tether is also actively laying out its stablecoin ecosystem, having strategically invested in fintech company Fizen and planning to issue a new dollar-pegged stablecoin in the U.S. this year. This move comes as Tether—previously labeled as the "preferred cryptocurrency" of criminals—repositions itself as a partner to U.S. lawmakers and law enforcement.

Additionally, JD.com has entered the "sandbox" testing phase for stablecoins in Hong Kong; in recent days, insiders have indicated that Futu Securities is conducting internal testing to support USDT and USDC deposit transactions; and last night, Visa announced an investment in stablecoin payment infrastructure startup BVNK.

As crypto researcher YettaS noted, this field is no longer a playground for new players; the core of stablecoin competition has always been channels. Whoever controls the usage scenarios of the currency holds the moat of stablecoins. Imagine if Amazon and Walmart issued their own stablecoins, mandating settlement within their internal systems—this would be a replay of Alipay's path in its early days.

From bank cards to electronic payments, and now to stablecoins, this is the third generation of the payment war, but this war has long transcended payments themselves, as it leads to the entry point of currency value and the reconstruction of coinage rights dominated by enterprises.

Breakthrough Progress Expected for U.S. Stablecoin Regulatory Bill

The reason many traditional companies are heavily entering the stablecoin space is closely related to the gradually clarifying U.S. crypto regulations and stablecoin legislation.

In February of this year, U.S. crypto-friendly Senator Cynthia Lummis stated at the first hearing of the Senate Banking Committee on Digital Assets, "We are about to establish a bipartisan legislative framework for stablecoins and market structure." At the White House's first crypto summit, Trump expressed hope to receive the stablecoin legislative bill before the August congressional recess to advance federal government regulatory reforms for cryptocurrencies and reiterated the desire for the U.S. dollar to "maintain its dominance in the long term."

U.S. Treasury Secretary Scott Bessent pledged to use digital assets to solidify the dollar's status as the global reserve currency, stating, "We will conduct in-depth thinking on the stablecoin system, as President Trump has instructed, we will maintain the U.S. as the world's dominant reserve currency, and we will use stablecoins to achieve this."

This statement highlights the U.S. government's concerns about macroeconomic and geopolitical uncertainties, which could lead to a decline in foreign investor demand for U.S. Treasury bonds, thereby pushing up Treasury yields. Over the past year, the two largest holders of U.S. Treasury bonds, Japan and China, have continuously reduced their holdings. To maintain the dollar's status as the global reserve currency, it is essential to ensure sustained demand for U.S. Treasury bonds in the international market.

By holding U.S. Treasury bonds as reserve assets, stablecoins can help lower Treasury yields while simultaneously expanding the global circulation of the U.S. dollar. Stablecoins need to maintain sufficient dollar reserves to meet investor redemption demands, and currently, Tether is one of the largest holders of three-month U.S. Treasury bonds. JPMorgan has stated that the stablecoin market is expected to grow to between $500 billion and $750 billion in the coming years. Assuming that 70% is allocated to U.S. Treasury bonds and 30% to Treasury repurchase agreements, stablecoin issuers will become the third-largest buyers of U.S. Treasury bonds.

The total market capitalization of stablecoins surged by $50 billion since Trump's election; Source: DeFiLlama

On the policy front, the U.S. has proposed two stablecoin bills—the House's "Stablecoin Transparency and Accountability Act" (STABLE Act) and the Senate's "U.S. Stablecoin Innovation and Establishment Act" (GENIUS Act), aimed at regulating stablecoin issuers through licensing requirements, risk management rules, and 1:1 reserve backing, mandating that stablecoins must be 100% backed by liquid assets such as U.S. dollars or short-term Treasury bonds.

These two bills propose different frameworks but agree on strict compliance measures. Both support privately issued, dollar-backed stablecoins and prohibit central bank digital currencies (CBDCs).

On May 7, Senate Majority Leader John Thune submitted a motion to end debate on the stablecoin "GENIUS Act," with a key procedural vote scheduled for Thursday. The bill requires 60 votes in favor, with the current Senate having 53 Republican seats and 47 Democratic seats, meaning Republicans need to secure support from at least 7 Democrats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。