On Tuesday, the data for the U.S. $BTC spot ETF showed a significant pullback, possibly due to risk aversion ahead of today's Federal Reserve interest rate meeting. After all, there was also the passing of the state Bitcoin strategic reserve on Tuesday, and the BTC price rebounded quite well. Let's take a look at Wednesday's data.

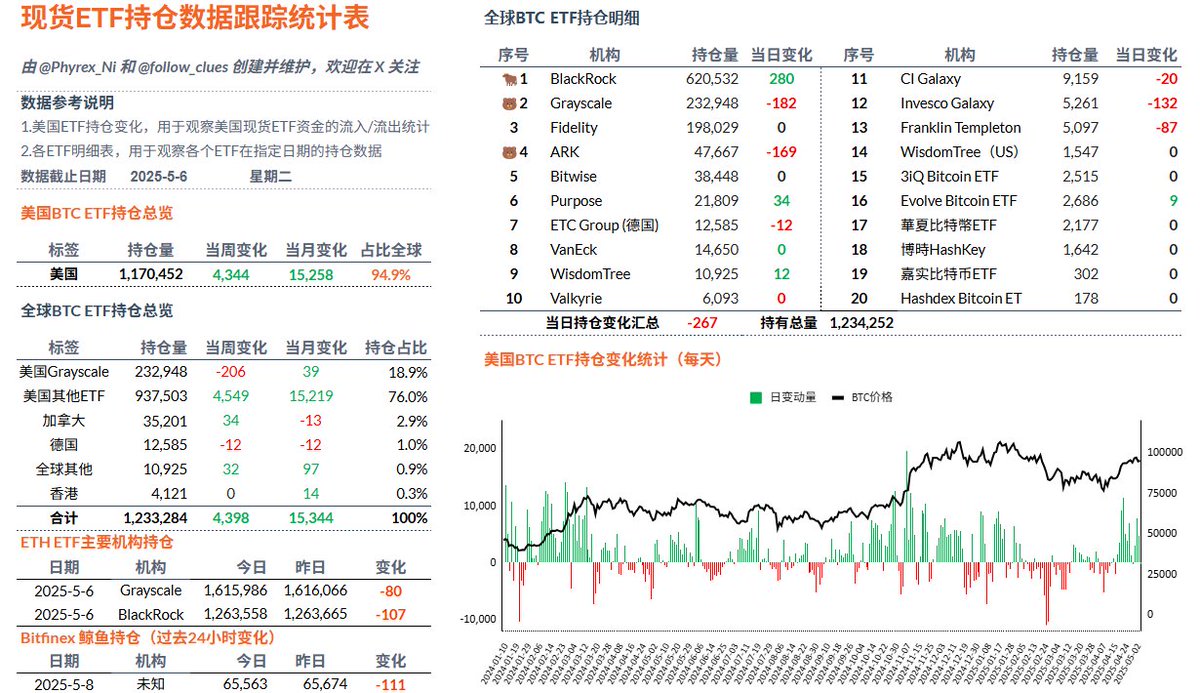

Although there was a net outflow on Tuesday, BlackRock's investors have seen a net inflow for the 16th consecutive working day, albeit with only 280 BTC flowing in. Grayscale, ARK, and Invesco were the main sellers, but the volume wasn't significant. Overall, there are no signs of panic; it's likely just risk aversion.

Today's interest rate meeting had some hawkish comments, but they were still within market expectations. The U.S. has officially begun negotiations with China on tariff issues, and Trump's preparation to abolish Biden's AI diffusion rules are both positive stimuli for the market. Let's see if U.S. stocks can return to the levels they were at before the tariff-induced drop on February 25.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。