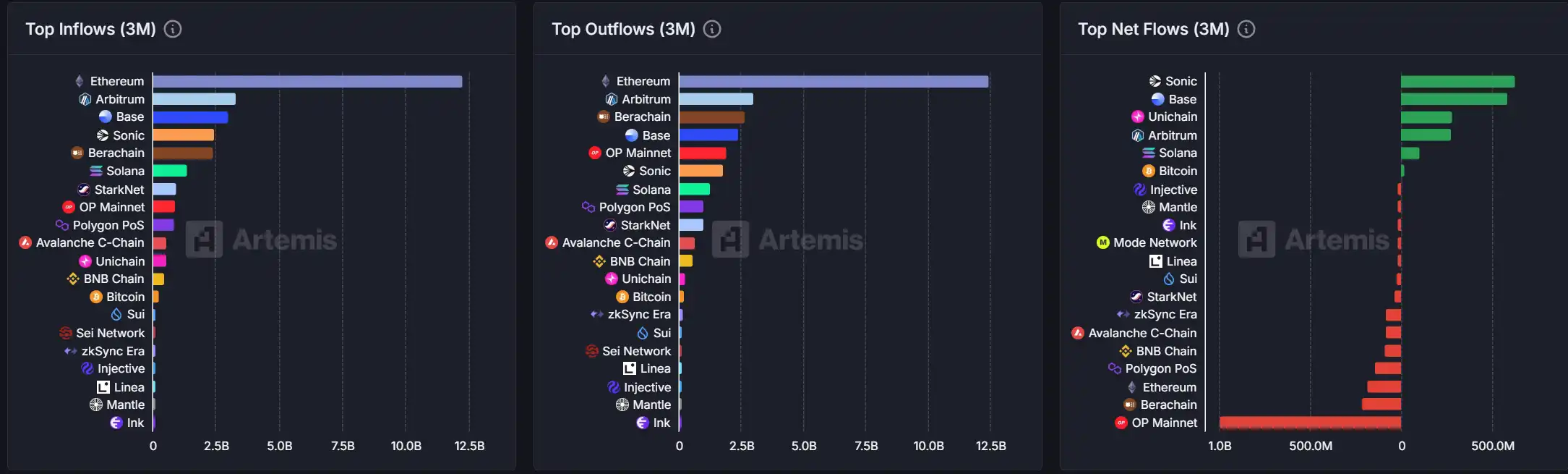

On-chain funds: $12.2B flowed into Ethereum today; $12.4B flowed out of Polygon.

Largest price fluctuations: $Alpaca Finance, $Polymath.

Top news: RWA sector TVL rises to $11.886 billion, BlackRock BUIDL increases over 48.8% in the past month.

Selected News

RWA sector TVL rises to $11.886 billion, BlackRock BUIDL increases over 48.8% in the past month.

Ethereum ICO whale deposits 2,500 ETH worth $4.59 million into Kraken.

South Korean presidential candidate Lee Jae-myung promises to push for approval of crypto spot ETFs.

“$1,800 shorting ETH whale” repays and closes position, losing $430,000.

Due to "Binance adding monitoring tags," MOVE, ALPHA, PORTAL, REI drop over 10%.

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito.

BOOPFUN: BOOP is gaining attention today due to its airdrop event and launch on the Binance Alpha platform. The project is distributing airdrop rewards to Kaito NFT holders and staking users, with high returns surprising many users and becoming a hot topic in the community. BOOP's unique tokenomics design (including sharing transaction fees with users through staking) is seen as a core differentiator from competitors like pumpfun. The community is actively discussing the project's potential to challenge existing platforms and its potential impact on the crypto ecosystem.

BNB: Today's discussions around BNB mainly focus on VanEck's submission of a spot BNB ETF application, which has attracted significant market attention and is seen as a potential catalyst for attracting institutional investment. Additionally, Binance founder CZ's proposal for Kyrgyzstan to include BNB and Bitcoin in its national crypto reserves has sparked heated discussions. The launch of the Space and Time (SXT) project on Binance Launchpool, allowing users to mine SXT tokens by staking BNB, has also become a key topic. These developments collectively position BNB as a focal point in the cryptocurrency space today.

XRP: The rise in attention for XRP today is primarily due to two major events: Ripple's commitment of $25 million to support U.S. educators for its RLUSD stablecoin, which has received widespread praise on Twitter; and the news of Ripple's failed acquisition of Circle, sparking market discussions about its strategic positioning. The combination of charitable actions and business movements has made XRP an important topic in the crypto community today.

USDE: The USDE stablecoin is gaining attention due to its integration with HyperliquidX exchange and HyperEVM, providing daily rewards for HyperCore users. The USDE launched by Ethena Labs is seen as a strategic move aimed at creating scalable yield-generating dollar assets within the Hyperliquid ecosystem. However, there are concerns about its centralized backing model and potential competition with Hyperliquid. The rapid adoption and high total value locked (TVL) of this stablecoin in the Pendle liquidity pool have been impressive, and its role in enhancing stablecoin diversity on HyperEVM is also being discussed.

MIOTA: The excitement around MIOTA today stems from the official launch of the IOTA Rebased mainnet, which introduces significant improvements such as Move smart contract functionality, proof-of-stake mechanisms, and decentralized validator node groups. The new mainnet promises faster transaction speeds, stronger security, and better developer tools, significantly enhancing IOTA's competitiveness in the Layer-1 space. The community is celebrating this milestone event, emphasizing the network's application potential in real-world scenarios such as trade, logistics, and finance. The mainnet launch has sparked widespread discussions about IOTA's future development and its ability to attract developers and institutional adoption.

Selected Articles

Recently, there has been a lot of buzz online regarding the proposal to lift the OPRETURN restriction—this proposal was put forward by Bitcoin Core OG developer Peter Todd. (It is worth mentioning that HBO identified Peter Todd as Satoshi Nakamoto in the widely publicized documentary "Money Electric: The Mystery of Bitcoin," which led to Todd receiving numerous funding requests and threats, causing him to go into hiding.) Although there are many doubts within the community regarding this OPRETURN change, according to an announcement by Bitcoin developer and Blockstream core contributor Greg Sanders (nickname "instagibbs") on May 5 on GitHub: in the next network upgrade, Bitcoin Core will no longer impose any byte or quantity restrictions on OP_RETURN.

Unto Labs, a crypto project led by former Jump Crypto employees, is quietly building the next-generation "performance monster" blockchain. On April 29, the project completed a $14.4 million funding round, achieving a valuation of $140 million, led by top firms Framework Ventures and Electric Capital. Core developer Heeger is building a "self-developed engine" for this new chain—a virtual machine called ThruVM based on RISC-V architecture, aiming to make it easy for Web2 engineers to go on-chain, with a development experience no longer limited by EVM and BPF.

On-chain Data

On-chain fund flow situation on May 7

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。