BTC Market Share Hits Four-Year High! How Will the Triple Storm of Federal Reserve Policy, Political Maneuvering, and Geopolitical Conflicts Reshape the Crypto Landscape?

Macro Interpretation: At 2 AM tomorrow, the Federal Reserve's upcoming interest rate decision will become the focus of global capital markets. According to the latest data from CME's "FedWatch," market expectations for a rate cut in May have plummeted, with only a 3.1% probability supporting the last glimmer of hope. In this policy fog, the Bitcoin market is exhibiting a unique tug-of-war between bulls and bears—its market cap share has surpassed 65%, reaching a four-year high, contrasting sharply with the continuously compressed volatility, akin to the calm before a storm. Meanwhile, the regulatory storm surrounding cryptocurrencies in U.S. politics is escalating, compounded by the sudden military conflict at the India-Pakistan border, weaving a risk network that stirs market nerves.

On the monetary policy front, forward-looking analyses from top Wall Street investment banks reveal a significant divergence between market expectations and institutional forecasts. Goldman Sachs has pushed back its first rate cut to July, while JPMorgan believes the threshold for action in June has significantly increased, and Metzler Capital boldly predicts that a rate cut cycle may not begin until 2026. The core of this divergence stems from the remarkable resilience displayed by the U.S. labor market—April's non-farm payrolls remained stable at around 300,000, and the unemployment rate continues to hold at historical lows, providing the Federal Reserve with ample justification to maintain a "higher for longer" interest rate policy. Notably, the current pricing in the money market for three rate cuts in 2025 subtly misaligns with the two cuts anticipated by major institutions, and this expectation gap may become a significant catalyst for future market volatility.

The market's sensitivity to policy signals has already begun to show in the U.S. stock market. The Nasdaq index has fallen for three consecutive trading days, with tech giants like Tesla and Meta facing widespread pressure. This price correction in risk assets starkly contrasts with the continued rise in Bitcoin's market cap share. At a recent summit, Bridgewater Capital pointed out that institutional investors are viewing Bitcoin as "digital gold," especially against the backdrop of negative funding rates in perpetual contracts, with some hedge funds beginning to position long, betting on a potential volatility explosion following the FOMC meeting. K33's technical analysis indicates that Bitcoin's price has compressed near the middle band of the Bollinger Bands, a technical formation that often signals an impending breakout.

The political maneuvering in Washington adds new uncertainty variables to the crypto market. The Senate Democrats' investigation into Trump-related cryptocurrency projects is intensifying, with the operational models of WLFI and TRUMP tokens facing congressional scrutiny. This bipartisan political struggle coincides with the critical voting window for the "GENIUS Stablecoin Act," where the controversies surrounding the 100% reserve requirement and anti-money laundering provisions expose deep-seated contradictions in the construction of the regulatory framework. There are also warnings in the market that the ambiguous relationship between politicians and cryptocurrencies could trigger regulatory backtracking, especially after Trump Media announced a payment partnership with Cryptocom, leading to a noticeable increase in market pricing for policy risks.

The sudden escalation of geopolitical risks injects new variables into the crypto market. The unexpected "Sindhural" military operation at the India-Pakistan border has led to a wartime state in the Kashmir region, pushing gold prices up by 1.2% in the short term, while Bitcoin's status as an emerging safe-haven asset is once again being tested. Historical data shows that during the 2019 India-Pakistan air conflict, Bitcoin experienced an 8% surge in safe-haven buying in a single day; a similar safe-haven logic may be reactivated in the current market environment. However, analysts caution that if the scale of the conflict expands and leads to a contraction in dollar liquidity, the crypto market may face short-term selling pressure.

In this market upheaval intertwined with multiple factors, the strategy divergence among institutional investors is becoming increasingly apparent. Some quantitative funds are beginning to increase their positions in Bitcoin volatility derivatives, betting on directional breakouts following the Federal Reserve meeting; meanwhile, traditional asset management giants are more inclined to lock in downside risks through options combinations. A noteworthy signal from the secondary market is that Bitcoin mining stocks have recently outperformed spot prices significantly, a divergence that often indicates an improvement in the industry's fundamentals. As the June Bitcoin futures expiration date approaches, the market may enter a new phase of bullish and bearish confrontation.

When we weave these clues into a complete logical chain, it becomes clear that the crypto market is facing uncertainties from Federal Reserve policies, the restructuring of the regulatory framework, and the safe-haven demand arising from geopolitical conflicts. The resonance effect of these three forces may give rise to historic market movements. For astute traders, the current market offers not only risks but also opportunities—against the backdrop of extremely compressed volatility, any unexpected event could trigger a dramatic price reassessment. While Wall Street debates whether the BTC narrative can continue, the market itself may be writing a new answer.

BTC Data Analysis:

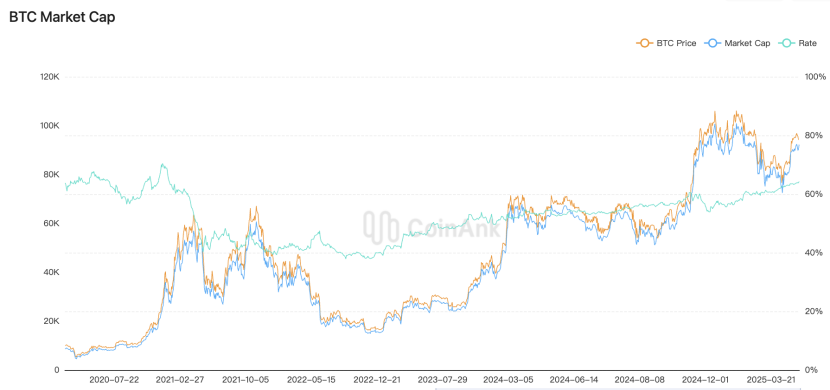

According to CoinAnk data, Bitcoin's market share has climbed to 64.86% today, briefly surpassing the 65% mark, reaching a new high not seen in over four years, the highest since early 2021. This phenomenon reflects that the current crypto market is in a phase of structural differentiation: mainstream capital continues to concentrate on Bitcoin, while the altcoin market is exhibiting signs of liquidity contraction. Observing historical cycles, Bitcoin's market share exceeding 70% in 2019 and 2021 both triggered a broad rally in crypto assets, and when the market share reached 60% in November 2021, it also sparked a mini bull market for altcoins. This "Bitcoin leading breakout - capital spilling over to altcoins" rotation pattern essentially reflects a gradual shift in investor sentiment from risk-averse allocation to risk preference.

The current market exhibits three notable characteristics: first, the continuous inflow of institutional investors through compliant channels like ETFs reinforces Bitcoin's "digital gold" attribute; second, macroeconomic fluctuations are prompting capital to concentrate on high liquidity assets, with altcoins facing greater selling pressure due to low liquidity and high volatility; third, the regulatory expectations for classified management of crypto assets are granting Bitcoin, which has clear commodity attributes, more compliance premium. If we refer to historical capital transmission paths, if Bitcoin's market share can gently retreat after consolidating at a high level, it may trigger a three-phase recovery in the altcoin market: initially flowing into high-consensus assets like ETH and SOL, then spreading to meme coins and AI concept sectors in the mid-term, ultimately leading to a reevaluation of the DeFi ecosystem's value. It is worth noting that signs of a softening regulatory stance from the U.S. SEC may inject new variables into the market, but the overall recovery of altcoins still requires signals of liquidity spillover after Bitcoin breaks through key resistance levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。