Original Title: The Crypto Arc

Original Author: Matti

Original Translation: zhouzhou, BlockBeats

Editor's Note: This article outlines the evolution of the crypto industry from early idealism to realism, pointing out that we are at a critical turning point after disillusionment. Although most projects tend to mimic and be conservative, real opportunities still lie in the edge of "certain pessimism."

The following is the original content (reorganized for better readability):

I bring you another eclectic piece inspired by Peter Thiel. As someone who proudly calls themselves a "Thielogian," I often think about the future through the lens of his classic work, "Zero to One." Thiel's analytical framework is flexible and can be used to dissect various ideas, trends, and movements. However, sometimes it resembles Wittgenstein's ruler—its reliability heavily depends on the observer's position and does not always provide a clear and consistent perspective.

As a crypto investor, I often analyze narratives to better understand potential opportunities. At this turning point in the industry—where we are at a critical moment of narrowing arbitrage space in emerging technology markets—I am also pondering how to discover and stimulate higher-quality ideas and products.

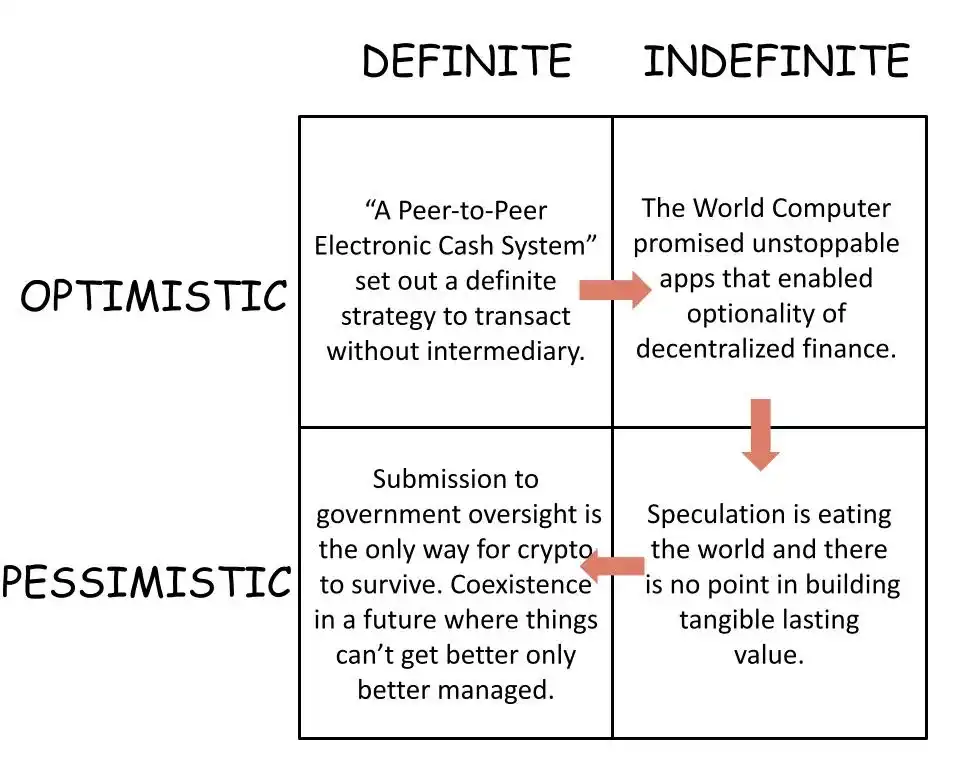

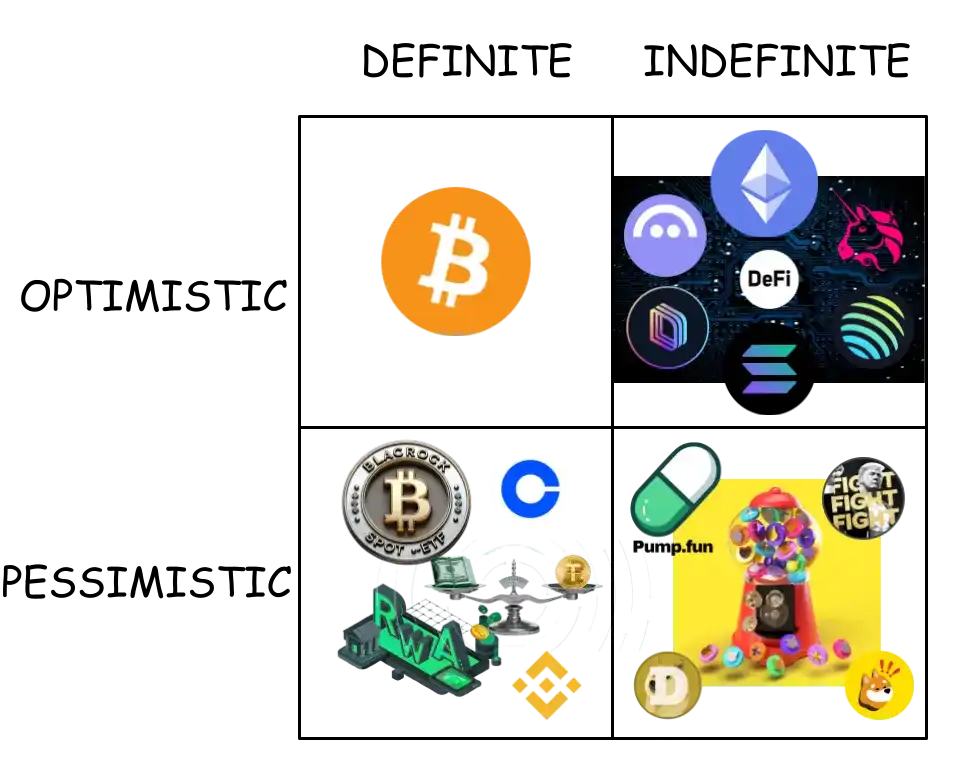

Through Thiel's lens, I see the timeline of the crypto world as an evolution: from Bitcoin's early "certain optimism," to the "uncertain optimism" under the grand vision of Web3—where finance is ultimately seen as a killer application; then to the "uncertain pessimism" of the meme coin casino era; and now, as regulation becomes clearer, we seem to be strategically embracing a form of "certain pessimism."

This is a journey that starts from cypherpunk idealism, traverses the startup craze, slides into a quagmire of despair, and ultimately moves towards standardization.

Does this trajectory exist universally across various trends? A revolutionary idea, once partially validated, often gets deified as a panacea; when it fails to deliver on those lofty expectations, it is cursed and eventually fades into the status quo. Revolutions are never truly completed, yet we continue to replay some (for some people) satisfying cycle within the closed loop of the Gartner hype cycle.

In the crypto space, this grand hype cycle is often obscured by price fluctuations. Each round of the crypto cycle—Bitcoin, ICOs promising to build the "world computer," DeFi, meme coins, and now the integration of regulation and traditional finance—appears to be a fractal of a larger pattern. Currently, we are in the "valley of disillusionment." According to the technological wave framework proposed by Carlota Perez, this is indeed a critical turning point.

Web3 promised to "on-chain" the profit model of Web2, decentralizing and tokenizing it. But Web2 or Web3 is not a place, nor is it a clearly identifiable "thing." As I mentioned a few years ago, it is more like a "user preference"; and today, this preference still belongs to a niche. If you always need to rely on the language of the old world to explain new things, then you are not truly creating something new.

The crypto industry is no longer a frontier market, but opportunities still exist at the edges of this established field. In this maturing phase, where do the biggest victories come from? Intuitively, they come from players in a growth phase or those with latecomer advantages.

It is also worth mentioning that those centralized exchanges that once held high the banner of "certain optimism" and promoted crypto adoption have now turned into pessimists, focusing more on defending their existing market share rather than promoting on-chain adoption.

In the past, exchanges and Layer 1 blockchains (L1) brought the richest returns to investors. Ironically, the places where competition is fiercest, optimism has exited, and pragmatism has entered, have birthed the biggest winners.

Does this mean we have no "secrets" left to uncover? I think not. Today's "secrets" are yesterday's lessons. Have we truly built many innovative and valuable companies or networks?

The easily reachable fruits have already been picked—most of today's projects are either imitating predecessors or slightly repackaging them, pretending to have originality. Many "solutions" chase problems that do not fundamentally exist, while others simply attempt to replicate traditional finance on-chain.

Crypto was originally a force inherently colored by revisionism but failed to complete a true revolution. Today, it is trapped by a core (perhaps a false dichotomy) question: "Do you want to do the right thing, or do you want to make money?" In other words, are you willing to "sell out" at the price the old system is willing to pay? Those revolutionaries who have cried out in the meme coin casino are increasingly accepting this deal.

Building vague products that developers think users "should want" (no, people do not really want to own their data), along with the apparent success of centralized service providers, has pushed the industry into its current stalemate. Today, there are almost no true "certain optimists" left in the crypto world. Yet it is precisely in this "almost impossible" that lies your opportunity for frontier investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。