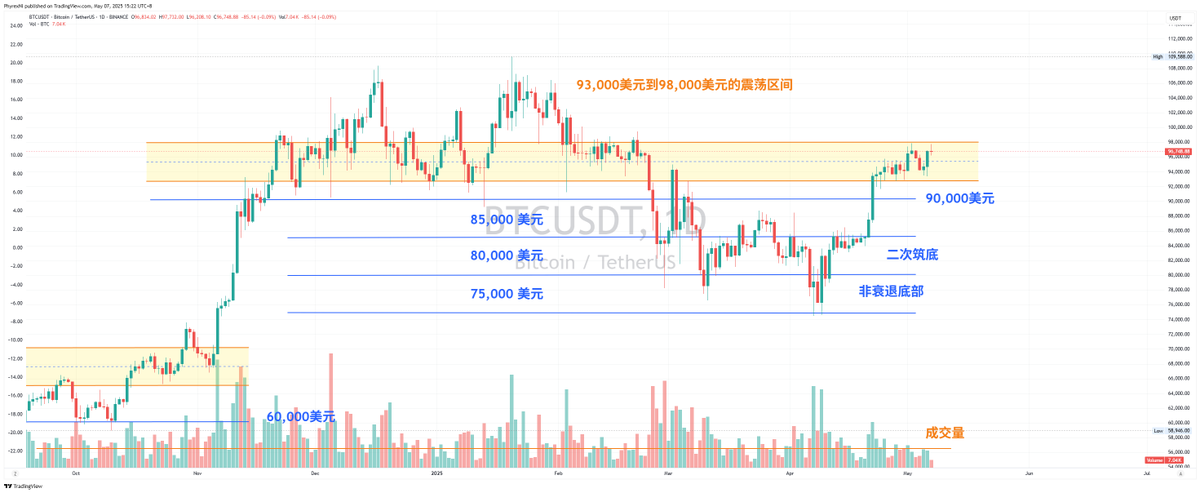

To add a bit more to Uncle Cat's perspective, from the price trend, currently, $BTC has not yet escaped the resistance zone of $98,000. We have discussed this clearly in our daily operations; although $93,000 to $98,000 is a solid support, this support has also turned into resistance, as investors are concerned about the potential for a recession in the U.S. economy.

In our tweets from a couple of days ago, we mentioned that since 1945, U.S. interest rates have exceeded 4.5% a total of seven times, and only twice did not result in an economic recession. In one instance, there was no recession, but there was still a significant economic downturn, and only once did the economy continue to grow while interest rates were high.

So, from a probability standpoint, there is a 14.5% chance that the economy will continue to grow, while there is an 85.5% chance of an economic downturn. Therefore, when the BTC price causes high-level holders to become passive long-term holders, it will indeed create pressure, especially with the risk-averse sentiment expected from the Federal Reserve's interest rate meeting tomorrow morning.

U.S. stocks have been performing well before the market opens, but we still haven't seen a return to the path prior to February 25. If U.S. stocks do not recover to the levels of February 25, the probability of BTC rising significantly on its own is not high, unless there are continuous positive factors unique to Bitcoin, such as this recent state reserve.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。