Master Discusses Hot Topics:

This morning I checked the data on Coinglass, and the market clearly seems to be on a path to explode the shorts. The entire surge started after 5:30, with the contracts moving first, and the spot market only following a bit after 6.

So tonight we still need to watch the market sentiment, with old Powell speaking and the interest rate meeting being a key focus. The interest rate meeting at 2 AM is very likely not to cut rates; everyone knows the rates will remain unchanged, and a rate cut would be a surprise.

The probability of keeping the rate unchanged on June 19 has soared to 70.8%, while the probability of a 25 basis point hike has dropped to 28.6%. The market has long begun to digest this bearish expectation, and it can't even be considered big news.

The market behaves like people; if you tell them a month in advance that you will give them a candy, and then before they get it, you say it might be delayed but you will definitely give it to them, what kind of waves can you expect? After all, they have already waited for months, so waiting another month doesn't matter.

The current market is being led by policies and macro factors; only big news can create significant fluctuations. The usual funds in the circle are playing a game with a range as small as playing house. Each time big news comes out, the market direction moves before it’s time for Bitcoin to sway at smaller levels.

Back to Bitcoin, it surged during the early morning and then had to pull back during the European session. Within 12 hours before the meeting, the market will definitely short first as a courtesy. Yesterday, the analysis mentioned that recent pullbacks have mostly been adjustments within the 12-hour level.

As long as the lower Bollinger Band of the 12-hour chart is not broken, don’t chase shorts. The bullish trend hasn’t changed; personally, I still see this rebound reaching around 105k, and shorting at highs is just a short-term play, while the focus in the short term is on low buys during pullbacks.

Master Looks at Trends:

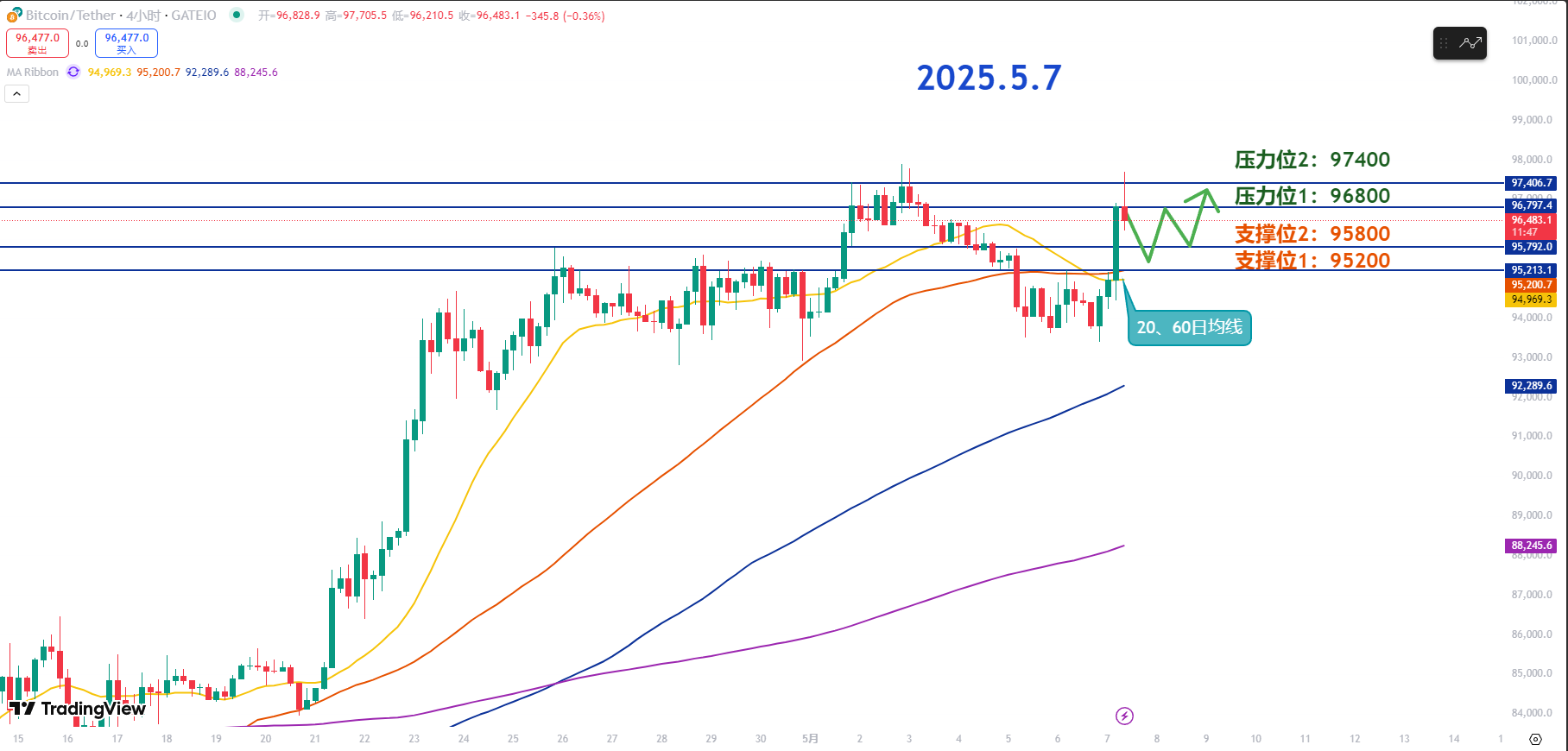

Resistance Levels Reference:

First Resistance Level: 97400

Second Resistance Level: 96800

Support Levels Reference:

First Support Level: 95800

Second Support Level: 95200

Today's Suggestions:

From the 4-hour level, as long as the price can hold the support range of 95.2 to 95.8K after forming a large bullish candle, we can continue to look for the continuation of the bullish trend.

The first resistance level at 96.8k is the high point of the candle close. If the price can break through this high again, it will form an N-shaped rise, thus maintaining the continuation of the bullish trend.

In the current adjustment phase, the range of 95.2 to 95.8K is also a reasonable adjustment range. In the intraday ultra-short term, one can buy in batches within this range to go long, and after confirming the support is effective, treat it as an ideal area for risk-reward ratio while waiting for the price to retest the high.

The first support at 95.8k has a high probability of being broken in the short term, so we can look at the downward space down to the second support. Those who are aggressive in the ultra-short term can start buying in batches around 95.8k, while those seeking stability can buy in batches around 95.2 to 95.5K.

The second support at 95.2k was a strong resistance level during the previous rise, and now that it has been broken, it has turned into strong support, so it can serve as an important reference point in trading.

5.7 Master’s Wave Strategy:

Long Entry Reference: 94600-95200 in batches, Target: 96800-97400

Short Entry Reference: Not currently referenced

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm Reminder: This article is only written by Master Chen on the official public account (as shown above), and any other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。