Original Title: "Two Years After Launch, How Did Sui Become the Strongest New Public Chain in This Round?"

Original Author: Alex Liu, Foresight News

On May 3, 2023, the Sui mainnet officially launched, marking two years since its inception. Many may remember that when Sui first launched, the situation was not as optimistic as it is now—investor FTX collapsed, and the foundation was forced to "buy back tokens"; during the bear market, the token price plummeted from $1.7 to $0.4; there were no regular token airdrops, but rather lottery-style token purchase quotas, leading the community to flood social media with "No airdrop, No community," and even calling it a "scam."

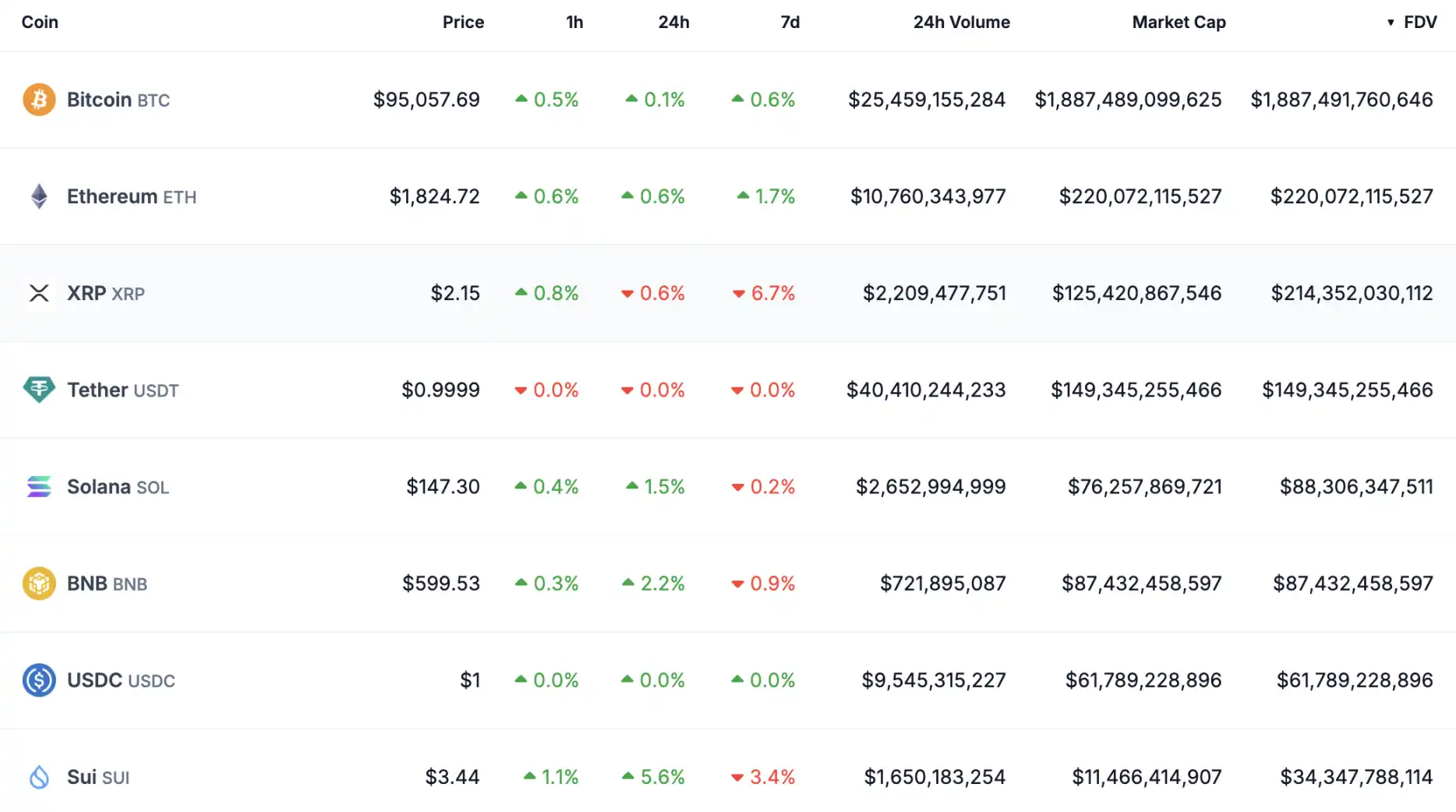

In just two years, everything has changed. In this cycle, where Bitcoin bottomed at $16,000 and eventually broke through $100,000, Sui has undoubtedly become the main character among new public chains. Looking across the entire public chain landscape, it is only slightly behind Solana, which has "rebirthed" in this round. In fact, the FDV (Fully Diluted Valuation) of Sui's governance token SUI is now second only to BTC, ETH, XRP, SOL, and BNB among non-stablecoins, making it the sixth-largest crypto asset in the industry.

Cryptocurrency FDV Rankings, Data: CoinGecko

How did Sui achieve such impressive results? What did it do right, and where did its competitors fall short? Taking advantage of Sui's second anniversary, I, as a deeply involved participant in the ecosystem, will attempt to uncover the growth secrets behind Sui's various data through personal experiences and subjective feelings.

DeFi Ecosystem

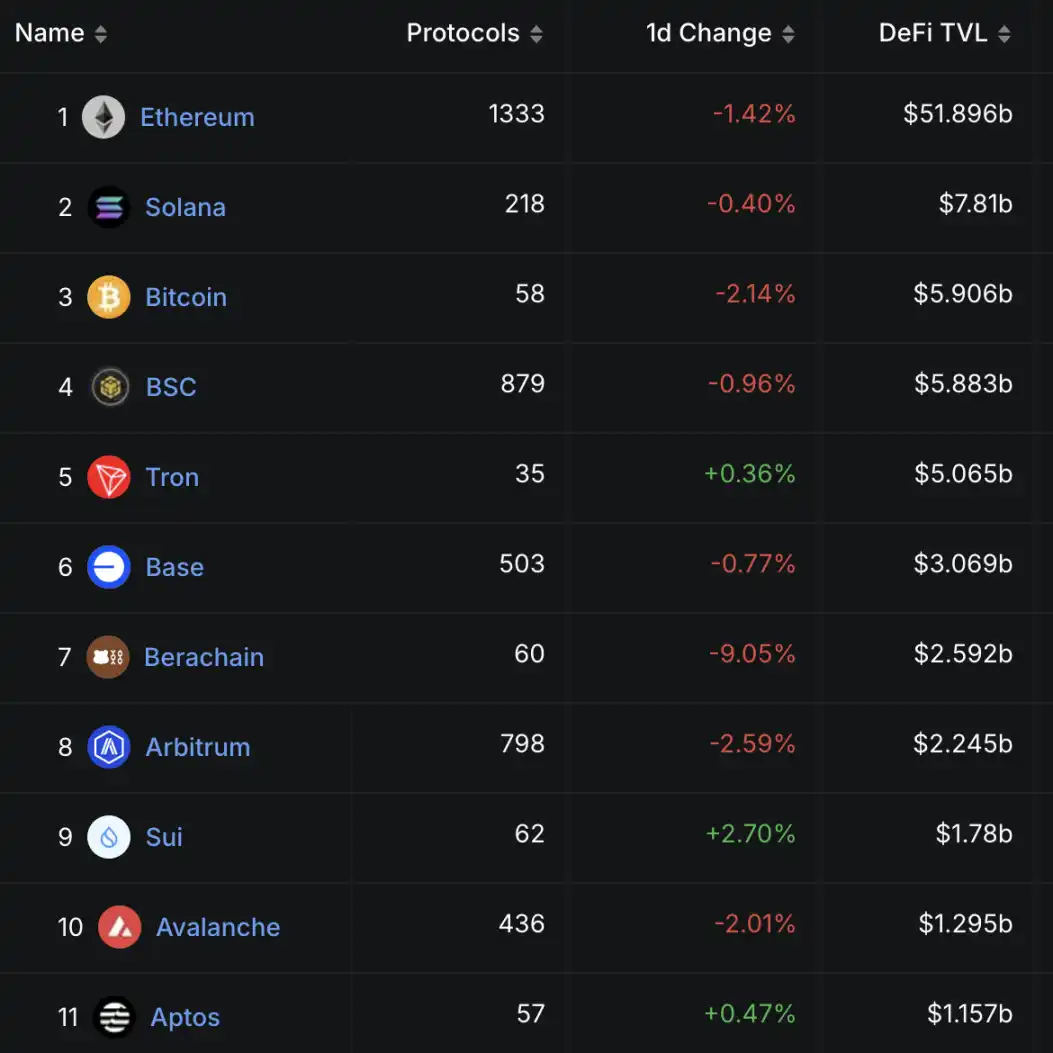

Sui currently ranks 9th among all public chains with a DeFi TVL (Total Value Locked) of $1.78 billion, surpassing established public chains like Avalanche and Aptos, which launched its mainnet a year earlier with the Move language. However, the construction of Sui's DeFi ecosystem was not completed overnight.

Public Chain DeFi TVL Rankings, Data: DeFiLlama

Like most "VC coins," Sui's mainnet activity data was not impressive right after the token launch; the DeFi lacked users and could not operate. How did Sui turn this situation around?

Quests "Airdrop Tokens," Attracting the First Wave of Traffic

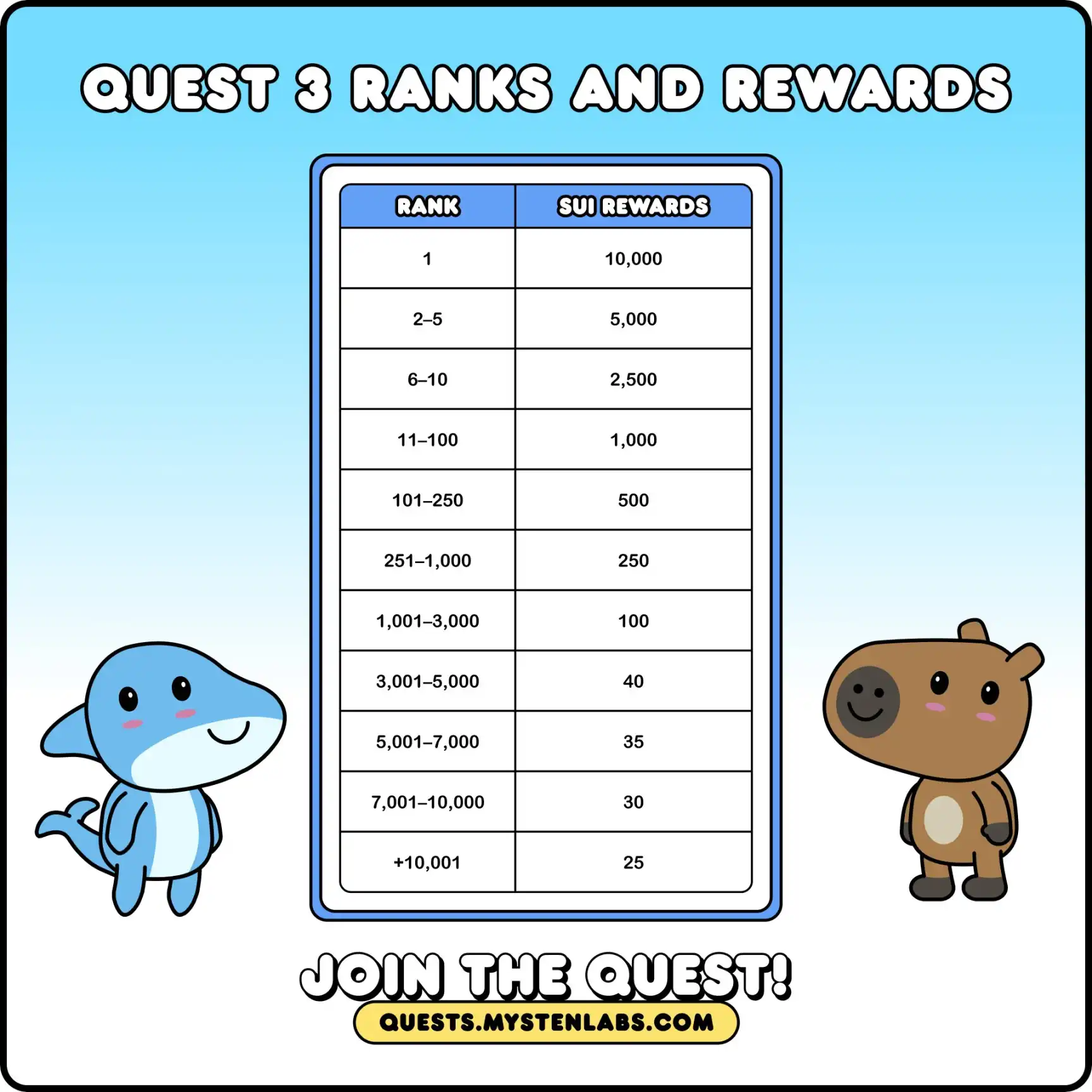

Starting in July 2023, Mysten Labs (the developer of Sui) launched three rounds of Bullshark Quests in less than half a year, where users could complete tasks to receive SUI token airdrops, with 5 million tokens per round, totaling 15 million tokens distributed.

It is worth noting that Sui's early task incentive model leaned towards "sunshine distribution," rewarding based on the number of participants rather than capital allocation. While those ranked higher could receive a large number of tokens, ordinary retail investors ranked lower also had decent earnings.

During this phase, a large number of retail investors and airdrop studios flocked to the Sui ecosystem, helping to establish an objective early user base for Sui. The official rewards also left an impression of being "non-competitive" and "retail-friendly" in the airdrop space. I was also attracted by the Quest at the end of 2023 and began to engage with the Sui ecosystem.

Token amounts for different ranking tiers in Quest 3

Token Incentives, Strong Price Relief from Selling Pressure

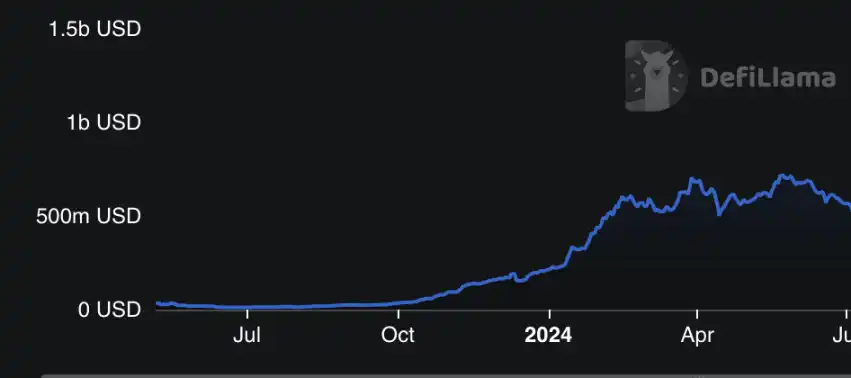

Early TVL trends under token subsidies for Sui

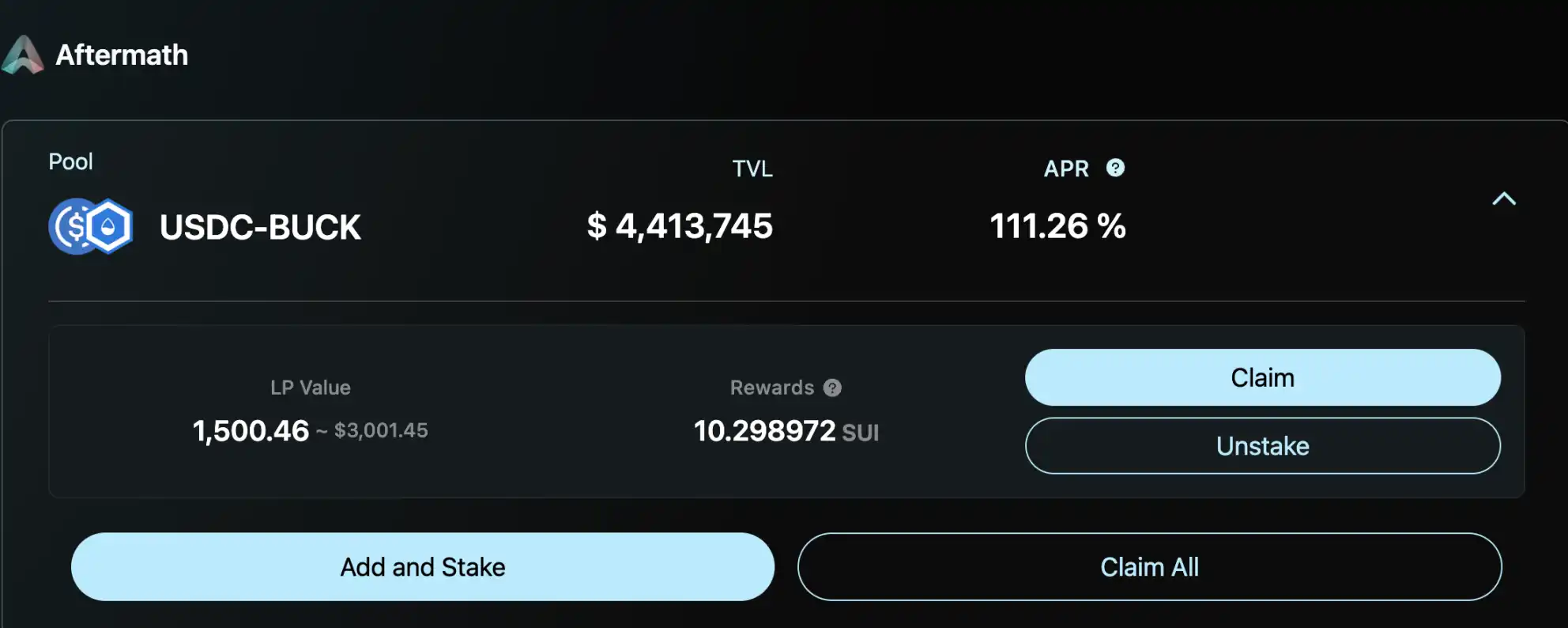

Sui was the first new public chain in this cycle to provide interest subsidies for DeFi protocols using tokens. Early relatively niche protocols could even achieve over 100% annualized returns through stablecoins. I participated in many DeFi mining activities, and lured by high interest rates, I increased my capital deployment on Sui during this phase.

Early staking of stablecoin LP on Aftermath had interest rates as high as 110%

Subsequently, public chains like Aptos, Starknet, Sei, and ZKsync imitated Sui's extensive subsidies for the DeFi ecosystem, but their ecosystems did not achieve the same prosperity as Sui. Where does the difference lie? DeFi interest rates attracted mining whales, but as mentioned earlier, the token price trends were relatively weak. Large holders had to "mine, withdraw, and sell" to lock in profits, causing continuous selling pressure on the tokens, leading to further price declines. To maintain the same interest rates, more tokens needed to be subsidized, creating a vicious cycle.

In contrast, SUI's substantial token subsidies were distributed at low price levels, and subsequently, the price steadily increased. The willingness of whales to hold SUI tokens strengthened, reducing selling pressure, and the number of tokens needed to maintain the same interest rates also decreased, creating a positive spiral of price growth and TVL growth.

Considering the current SUI price, the actual annualized return of the DeFi protocol that previously offered 100% annualized returns could be over 300%, making "mining, withdrawing, and selling" counterproductive.

Chinese Developers, Highly Efficient

Due to the Taiwanese origin of Evan Cheng, the founder of Sui developer Mysten Labs, there is a particularly high number of Taiwanese teams in the Sui ecosystem. The lending protocol Scallop, options protocol Typus, stablecoin protocol Bucket, and others are all backed by Taiwanese teams. The advantage of having many Chinese developers is high development efficiency and guaranteed code quality. In comparison, European and American teams tend to be more "laid-back."

Mysten Labs Co-founder and CEO Evan Cheng

Wealth Effect

The success of an ecosystem is closely related to its ability to create wealth for ordinary users and whether it possesses a wealth effect. If we look back from a god's perspective at the time when Solana started to rise, aside from its dominance in the Meme sector, the wealth effect generated by Jito and the subsequent Jupiter airdrop attracted countless retail investors to invest in Solana's unlaunched token projects, driving the development of DeFi, which was an indispensable part.

At the end of 2023 and the beginning of 2024, the leading lending protocols on Sui, Scallop and Navi, also began to adopt Solana's approach by launching point systems and subsequently issuing tokens. A significant amount of capital that overflowed from Solana (undeniably Solana was still the first choice at that time) participated in these two projects.

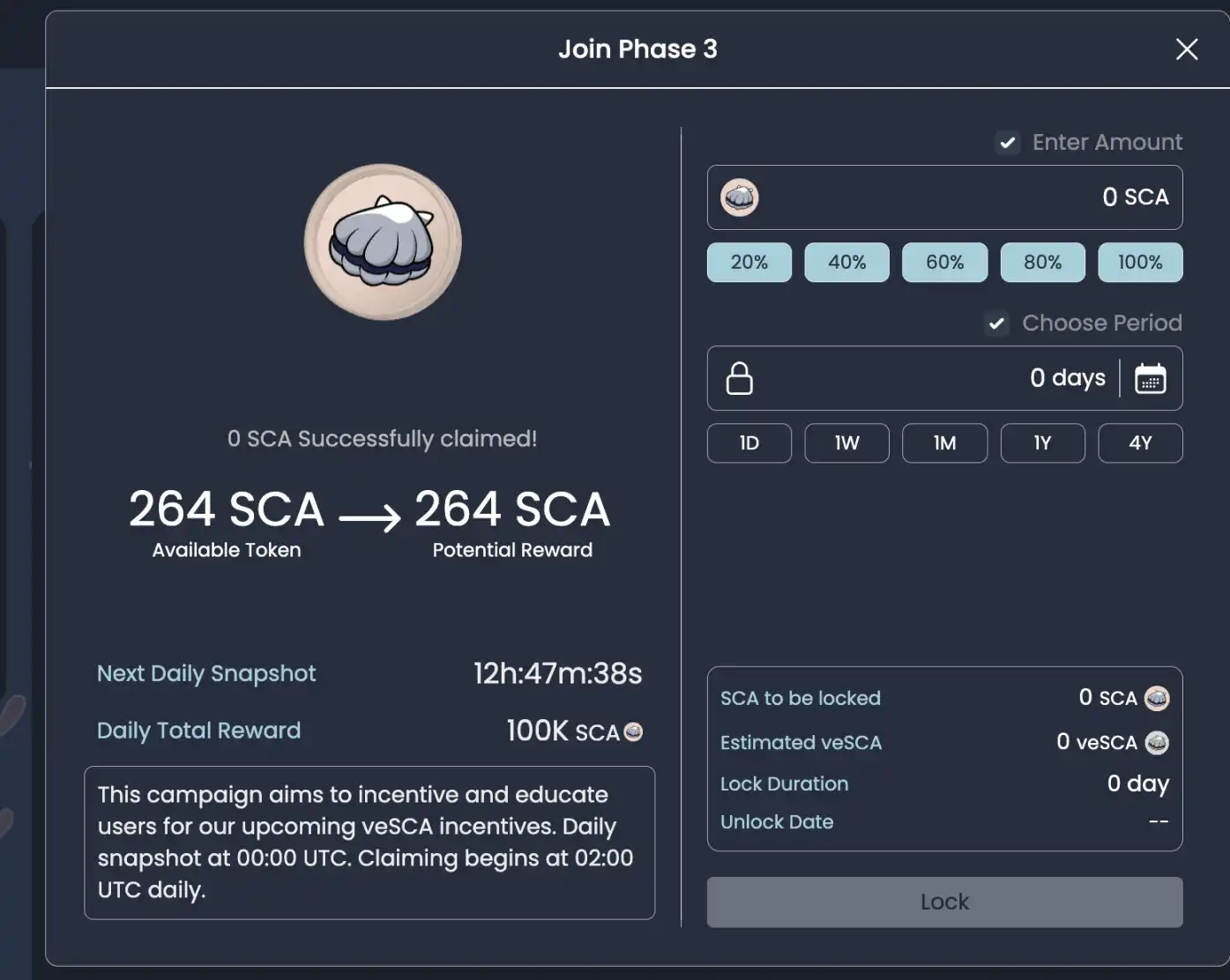

I participated in the last chance of the Scallop airdrop with $10,000 and received a hot pot meal as an airdrop

However, at this time (and even now), Sui's native projects could not support a high valuation. After experiencing airdrops worth hundreds or thousands of dollars on Solana, users received SCA tokens worth only tens, hundreds, or even just a few dollars, leading to complaints about the lack of wealth effect for users.

Unexpectedly, SCA turned out to be the "most generous" airdrop in the Sui ecosystem for quite some time. Meanwhile, Navi, which had been issuing tokens for over a year, "forgot" about the airdrop users and used the points leaderboard to manipulate users for over a year.

Official Intervention, Creating Wealth Effect

The wealth effect issue is not unique; public chains like Aptos, Starknet, Sei, and ZKsync have not achieved success in this area, or rather, public chains with wealth effects are few.

But when there is a problem, Mysten Labs has a solution.

Mysten Labs is almost unique in that it develops projects itself and then issues tokens to the projects within its ecosystem for airdrops. The valuations that Sui's native projects cannot support can be met by Mysten Labs. Including the Sui mainnet (valued at tens of billions), Mysten Labs has accumulated the incubation of three unicorn-level (over $1 billion) protocols and platforms, all centered around Sui.

Deepbook

Deepbook is positioned as the liquidity center on Sui, serving as a CLOB (Central Limit Order Book) trading platform at the protocol level. Since its launch, its FDV has exceeded $3 billion at its peak and currently hovers around $1.8 billion.

On October 14, 2024, DEEP will officially TGE, with 10% of the total token supply allocated for user airdrops, potentially worth up to $300 million, with a total of 101,968 Sui addresses eligible to claim.

Sui Name Service

Sui Name Service is the domain protocol on Sui, which not only maps addresses on the Sui chain in the .sui format but is also deeply integrated with other Mysten Labs projects like Walrus. To have a custom domain for a website deployed on Walrus, one needs to purchase SuiNS. For example, the official website for staking WAL is stake-wal.wal.app, which is a relatively cumbersome URL, rather than stake.wal.app or staking.wal.app. The reason is that both SuiNS domains stake.sui and staking.sui have been purchased by unofficial parties.

On November 14, 2024, NS will open for airdrop claims, with 10% of the total token supply allocated for community airdrops, valued at a peak of $30 million.

Walrus

Walrus is a decentralized storage and data availability protocol based on Sui. Ideally, using Walrus will create deflationary pressure on the SUI token. Walrus has raised $140 million in separate funding.

On March 27, 2025, the WAL token will have its TGE, with 4% airdropped to active users in the Sui and Walrus ecosystems and testnet participants, valued at approximately $120 million, and an additional 6% reserved for future airdrops after the mainnet launch. Over 120,000 Sui addresses will receive WAL airdrops.

In contrast, during the same period, the liquidity staking project Amnis on Aptos only airdropped to the top 10,000 on the leaderboard, with the AMI token's circulating market value around $5 million. Comparatively, the wealth effect on Sui is striking.

Ecosystem Airdrops

From the outcry of "No Airdrop, No Community" to the paradigm shift of "No Community, No Airdrop," although Sui did not conduct user airdrops at the launch of its mainnet, it has excelled in utilizing airdrop marketing and community building afterward.

Referring to the screenshots in the articles "The Conference is Coming, Whispers are Rising, Is a New Round of Airdrop Season Coming to the Sui Ecosystem?" and "Gold Mining Handbook | How to Layout the 300 Million WAL Phase II Airdrop?", Sui's co-founders subtly hinted at "airdrop" opportunities to users, using airdrops as bait to guide users to interact with the ecosystem and join the community, and those who followed through indeed received airdrop rewards. This is the "airdrop marketing" that users are eager to see, and the reputation of the Sui chain having a wealth effect has been established.

I received an NS token airdrop based on Adeniyi's hint to interact with SuiNS.

Excellent Control of Supply + Market Value Management

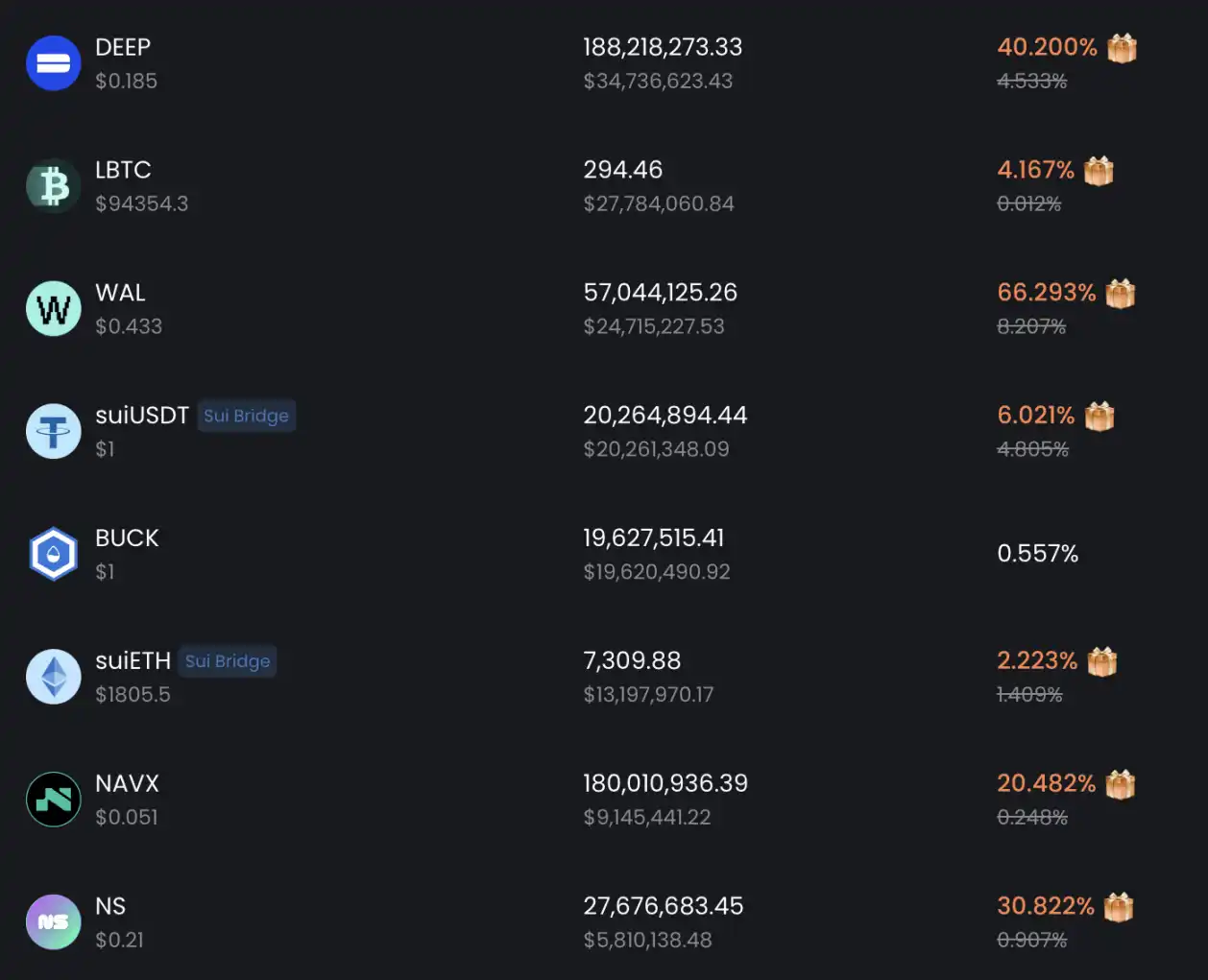

Interestingly, aside from the SUI native token, the ecosystem tokens from the above airdrops have not been listed on Binance (no chips handed over), and their initial circulating supply is relatively low. The DeFi protocols in the Sui ecosystem provide extremely high deposit rates for these tokens, further locking them up and reducing circulation.

The lower token circulation makes it easier for Mysten Labs to manage "market value" and create a "wealth effect."

Learning from Solana

As two of the most dazzling public chains in this cycle, Solana and Sui share many similarities in their strategies. Chronologically, it seems that Sui is learning from Solana. What kind of strategy is the champion of this cycle?

Token Price is the Best Marketing

Observing the rise of Solana and Sui, a common point is that the token price rises ahead of the fundamentals, with various data catching up afterward.

The token price itself is the best marketing; a strong token price attracts attention, mindshare, and capital, which in turn fills in the "fundamental" data and provides reasons for further increases. For instance, the growth of TVL is often driven by the rise of the public chain's native token.

If you focus on driving the price up, there will be great scholars to "debate" for you.

Hardware, Airdrops, You Have, I Have

Sui gaming console SuiPlay0X1

Solana launched the Web3 phone Saga and Seeker, aiming to bridge Web2 and Web3 and bring Web2 traffic into crypto. However, the result shows that most buyers of these Web3 phones are native Web3 users, motivated by the potential airdrops of ecosystem project tokens.

Sui also learned from Solana and focused on Web3 hardware. On September 2, 2024, Mysten Labs, in collaboration with gaming handheld operating system developer Playtron, launched the pre-sale of the Web3 gaming handheld SuiPlay0X1 (details: priced at $599, is the SuiPlay gaming handheld worth buying?). Currently, the pre-sale of 10,000 units has sold out and will be shipped this summer.

We have the hardware, and I can't be lacking in airdrops! Since its launch, SuiPlay has accumulated over 10 airdrops or airdrop commitments from ecosystem projects.

News: SuiPlay gaming console received an airdrop.

Community Building

The unity of the community affects the overall atmosphere of the ecosystem and the external perception of it. The current Sui community is undoubtedly one of the stickiest communities in Web3.

Exclusive Agreements for Developers

According to relevant news, the Sui Foundation signs exclusive agreements with project parties, requiring them to build only on the Sui chain as a prerequisite for receiving foundation grants (for user incentives, etc.). This seemingly "closed" restriction effectively prevents developers from being fickle. Developers on the Sui chain tend to be more focused, unlike some developers on EVM chains who frequently jump around.

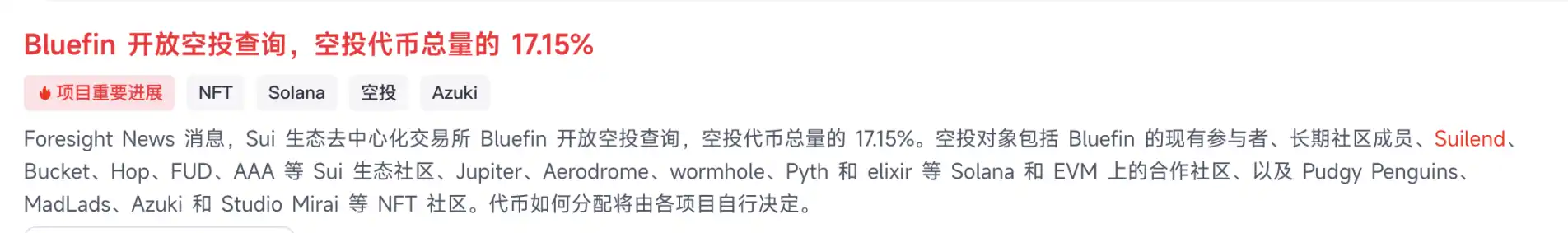

Ecosystem Unity and Mutual Assistance, Interest Binding

Sui ecosystem projects are relatively united, often engaging in "mutual airdrops." I ranked in the top 50 on the Navi leaderboard, and although I did not receive a single NAVX token airdrop, I received several airdrops sent to Navi users from various ecosystem projects.

Bluefin airdropped to Sui ecosystem projects.

Conclusion

Building a robust DeFi ecosystem, creating a significant wealth effect, and establishing a community culture are all challenging tasks. The achievements of Sui, just two years after its launch, are certainly not coincidental. Even with such a substantial project, there must be a Cabal operating behind the scenes, but the excellence of the Sui team itself is undeniable.

In this cycle, Sui is still a follower of Solana, but if the momentum continues, it may soon become a challenger.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。