Original Title: "A Billion-Dollar Bitcoin Buyout - These Companies Are Eager to Join"

Original Author: Luke, Mars Finance

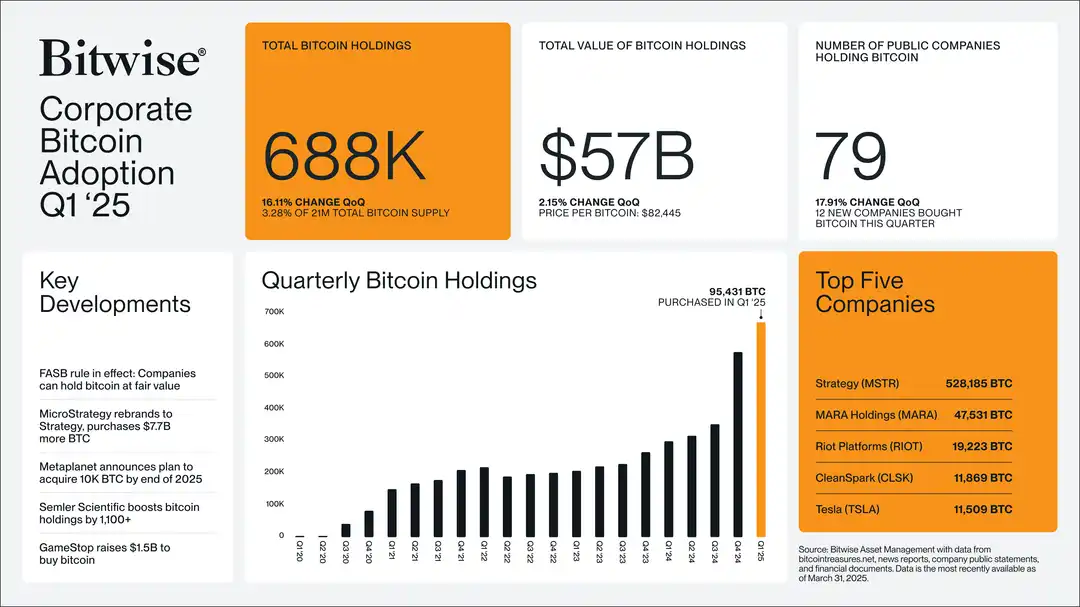

In the spring of 2025, the global financial market is quietly brewing a revolution. Bitcoin, once derided as a "geek fantasy," has now proudly ascended to the strategic core of corporate boardrooms. From Wall Street's financial giants to Silicon Valley's tech pioneers, from Tokyo's investment newcomers to British football clubs, publicly traded companies and institutions are rapidly incorporating Bitcoin into their balance sheets. This is not a speculative frenzy, but a thoughtful bet on value storage, brand reinvention, and the future of finance.

United States: Bitcoin's "Wall Street Moment"

As a beacon of global finance and technology, the United States is at the forefront of corporate Bitcoin investment. From April to May 2025, publicly traded companies embraced Bitcoin at an astonishing scale and speed, driven by both inflation concerns and a desire for brand innovation.

MicroStrategy: The Flagbearer of Digital Gold

MicroStrategy, a business intelligence software company founded in 1989, has long ceased to be a traditional tech firm. Under the leadership of founder Michael Saylor, it has transformed into the world's largest "Bitcoin investment company." In April 2025, MicroStrategy's actions were nothing short of epic: the company purchased 25,370 Bitcoins in three batches, spending approximately $2.2616 billion (April 7-13: 3,459 Bitcoins, $285.8 million; April 14-20: 6,556 Bitcoins, $555.8 million; April 21-27: 15,355 Bitcoins, $1.42 billion). By the end of April, its holdings reached 553,555 Bitcoins, with a cost basis of about $37.9 billion. Even more astonishing, the company raised a record $21 billion through an At-The-Market (ATM) equity offering, acquiring an additional 301,335 Bitcoins, effectively reshaping its asset landscape.

Saylor's logic is simple yet radical: the long-term devaluation of the dollar makes cash reserves akin to melting snow, while Bitcoin's fixed supply (21 million) positions it as "cyber gold." He has not only staked the company's fate on this but has also become a Bitcoin evangelist on social media, attracting global attention. However, what is less known is that MicroStrategy's success is bolstered by an invisible driver: in 2023, the Financial Accounting Standards Board in the U.S. allowed companies to measure Bitcoin at fair value, significantly reducing accounting complexity. This policy boon has opened Pandora's box, encouraging more companies to follow suit.

Twenty One Capital: A Super Alliance of Finance and Crypto

Twenty One Capital (abbreviated as "21 Capital") is the "supernova" of Bitcoin investment in 2025. This new company plans to go public through a SPAC merger with Cantor Equity Partners, created by a collaboration of four giants:

· Cantor Fitzgerald, a Wall Street investment bank founded in 1945, with annual revenues exceeding $2 billion, managing Tether's treasury assets.

· SoftBank, a Japanese tech investment giant managing over $200 billion in assets, with a portfolio that includes Alibaba and Uber.

· Tether, the issuer of the world's largest stablecoin USDT, with profits of approximately $13 billion in 2024.

· Bitfinex, a leading cryptocurrency exchange with daily trading volumes exceeding $1 billion.

On April 23, 2025, 21 Capital announced it would raise $360 million through a SPAC merger, initially holding 42,000 Bitcoins (approximately $3.9 billion). Funding sources included Tether's $1.5 billion (later revised to $1.6 billion), SoftBank's $900 million, Bitfinex's $600 million, and $585 million in debt and equity financing. The project is led by Cantor Fitzgerald Chairman Brandon Luthnick, with Strike founder Jack Mallers serving as CEO. 21 Capital introduced the "Bitcoin Per Share" (BPS) and "Bitcoin Return Rate" (BRR) metrics, aiming to maximize shareholders' Bitcoin exposure.

The birth of 21 Capital represents a historic handshake between traditional finance and the crypto industry. Cantor Fitzgerald's endorsement brings Bitcoin into the heart of Wall Street; SoftBank's involvement marks Masayoshi Son's strong return from his 2017 Bitcoin investment misstep; Tether and Bitfinex's financial strength injects rocket fuel into the project. This is not just an investment; it is a declaration about the future of finance. However, Tether's regulatory controversies (the 2021 U.S. settlement) may cast a shadow over the project, and the complexities of its SPAC listing add uncertainty.

Semler Scientific: The Invisible Pioneer in Healthcare

Semler Scientific, a California-based medical technology company focused on chronic disease management devices, has a market cap of only $300 million, seemingly unrelated to the cyber world of Bitcoin. However, in April 2025, this small giant demonstrated great ambition. On April 15, the company announced plans to issue $500 million in securities, explicitly stating that the funds would primarily be used to purchase Bitcoin. Shortly after, from April 25 to 29, it increased its Bitcoin holdings by 165 Bitcoins, spending approximately $15.7 million, bringing its total holdings to 3,467 Bitcoins, valued at about $326 million.

Why is Semler betting on Bitcoin? CFO Doug Murphy-Citron revealed at a shareholder meeting that Bitcoin's decentralized nature and anti-inflation properties align with the company's pursuit of long-term value. A deeper motivation comes from shareholders: some of Semler's investors are hedge funds in the cryptocurrency space, seeking to enhance returns through Bitcoin. Semler's low-key execution—neither flamboyant in promotion nor causing stock price turbulence—reflects an emerging model: small and medium-sized publicly traded companies are quietly integrating Bitcoin into their strategies, rather than merely chasing market trends.

GameStop: From Meme Stock to Bitcoin Pioneer

The story of GameStop reads like a Hollywood script. Founded in 1984, this video game retailer gained fame during the 2021 "meme stock" craze driven by retail investors. On March 27, 2025, GameStop announced the issuance of $1.3 billion in zero-coupon convertible bonds (maturing in 2030), accompanied by a $200 million over-allotment option, raising approximately $1.48 billion, with funds directed towards Bitcoin purchases. This move sent shockwaves through the market, with the retail community viewing it as the beginning of "GameStop 2.0."

Under CEO Ryan Cohen's leadership, GameStop is breaking free from its retail struggles. Bitcoin is not only a tool for asset hedging but also a weapon for brand reinvention, aimed at attracting young, tech-savvy consumers. The company also plans to launch crypto-related services, such as an NFT marketplace or Bitcoin payment systems. However, the massive $1.5 billion investment has sparked controversy: Bitcoin's volatility could turn financial statements into a rollercoaster. Supporters see this as a victory for meme culture, while critics worry the company may repeat the mistakes of aggressive expansion. Regardless, GameStop's transformation is set to be a focal point of 2025.

Tesla: The Silent Bitcoin Giant

Tesla, the global electric vehicle leader with a market cap exceeding $1 trillion, led by Elon Musk, has every move in the cryptocurrency space sending ripples through the market. In April 2025, Tesla disclosed it holds 11,509 Bitcoins, valued at approximately $951 million, unchanged from the previous quarter. Since purchasing Bitcoin in 2021, Tesla briefly accepted Bitcoin payments (later suspended due to environmental concerns) but has never sold its holdings.

Tesla's low profile is intriguing. Musk, as a "thought leader" in cryptocurrency, has repeatedly expressed support for Bitcoin, calling it a "decentralized financial experiment." However, as a clean energy giant, Tesla must balance environmental pressures with the returns from crypto investments. The energy controversies surrounding Bitcoin mining have made the company cautious, but its decision to hold shows confidence in long-term value. Tesla's silence is like the calm before the storm, hinting at greater strategic possibilities brewing.

SBC Medical Group: A Small but Beautiful Testing Ground

SBC Medical Group, a small medical company focused on beauty and health services, only listed on NASDAQ in 2024, with a market cap of less than $100 million. On April 14, 2025, it purchased 5 Bitcoins for $400,000, stating that this move is part of a strategy to "diversify assets and maintain value." Despite its small size, this action reflects the spreading interest in Bitcoin investment: even marginal players are beginning to test the waters of digital gold.

SBC's motivation may stem from the executives' belief in crypto or pressure from shareholders. Its attempt, though not prominent, is like a seed, signaling that Bitcoin may take root in more small and medium-sized enterprises. This trickle-down effect may hold more long-term significance than the big bets made by giants.

Japan: Asia's Bitcoin Testing Ground

Japan, with its open crypto policies and technological DNA, has become a fertile ground for Bitcoin investment in Asia. In April 2025, the actions of two companies ignited market enthusiasm.

Metaplanet: Japan's "Cyber Samurai"

Metaplanet, a Tokyo-listed company founded in 2004, operates in hotels, real estate, and tech investments. In 2024, it announced a "Bitcoin-first" strategy, earning the title of "Asia's MicroStrategy." In April 2025, Metaplanet increased its Bitcoin holdings, reaching a total of 4,525 Bitcoins (approximately $384 million), more than ten times the 400 Bitcoins it held in September 2024. The company's goal is to hold 10,000 Bitcoins by the end of 2025 and to rename its hotels as "Bitcoin Hotels," attempting to attract the global crypto community.

Metaplanet CEO Simon Geraci stated that Bitcoin is a "nuclear weapon" against the depreciation of the yen (which fell to a 34-year low in 2024) and global economic uncertainty. Japan's 2024 tax reform (exempting unrealized gains tax on corporate holdings of crypto assets) paved the way for this strategy. More notably, Metaplanet's attempt to integrate Bitcoin with the real economy—the "Bitcoin Hotel"—is not just a marketing gimmick but also plans to accept Bitcoin payments. This brand innovation could inspire more Asian companies to follow suit.

SoftBank (through 21 Capital): A Global Bitcoin Gamble

SoftBank, the tech investment giant from Japan, invested $900 million in the 21 Capital project, accounting for 25% of the total investment. Founder Masayoshi Son is known for his bold investments, from Alibaba to WeWork, always aiming for the future. In 2017, he personally lost $130 million on Bitcoin, becoming a subject of ridicule. However, by 2025, SoftBank has become more seasoned, partnering with Cantor Fitzgerald and Tether to diversify risks. SoftBank not only provides funding but also promotes institutional adoption of Bitcoin through its global investment network. Its involvement indicates that Asian tech giants are viewing Bitcoin as a new language of global capital through multinational cooperation.

Other Regions: The Global Ripple of Bitcoin

While the U.S. and Japan are the main battlegrounds, actions in other regions are also noteworthy.

Real Bedford F.C. (UK): A Bitcoin Experiment in Sports

Real Bedford F.C., a non-professional football club in the UK, announced on April 30, 2025, that it would adopt Bitcoin as its primary reserve asset, with holdings estimated at 50-100 Bitcoins (approximately $470,000 to $940,000). Club chairman Peter McCormack, a well-known crypto podcast host, drove this strategy. He believes Bitcoin can break geographical barriers in sports and attract global fans. The club is exploring a "Bitcoin + brand" model through innovations like Bitcoin sponsorships and ticket payments. Despite its small size, this experiment could provide a template for small and medium-sized enterprises.

Decoding the Motivation: Why Are Big Companies Betting on Bitcoin?

The motivations behind large companies purchasing Bitcoin intertwine rationality and foresight:

1. Inflation Hedge: The depreciation of fiat currencies like the dollar and yen (with the U.S. CPI reaching 3.5% in 2024 and the yen falling to 160:1) makes Bitcoin's fixed supply an attractive safe-haven asset.

2. Asset Diversification: The low-interest-rate environment (with the U.S. 10-year Treasury yield at 2.5% in 2024) diminishes the appeal of cash reserves, while Bitcoin offers high-risk, high-reward options.

3. Brand Innovation: Companies like GameStop and Metaplanet are attracting younger consumers and reinventing their brands through Bitcoin.

4. Policy Dividends: New U.S. FASB regulations, Japanese tax reforms, and pro-crypto policies from Trump have lowered investment barriers.

5. Shareholder Pressure: The influence of crypto hedge funds and high-net-worth investors is driving companies like Semler and SBC to take action.

Potential Buy Orders: A Frenzy for Digital Gold?

Disclosed Buy Orders

The total scale of Bitcoin purchase plans from April to May 2025:

· MicroStrategy: $2.2616 billion (25,370 Bitcoins) + $21 billion (301,335 Bitcoins) = $23.2616 billion (326,705 Bitcoins).

· GameStop: $1.48 billion (approximately 15,745 Bitcoins).

· Semler Scientific: $500 million (planned) + $15.7 million (165 Bitcoins) = $515.7 million (approximately 5,485 Bitcoins).

· SBC Medical: $400,000 (5 Bitcoins). 21 Capital: $3.6 billion (42,000 Bitcoins).

· Metaplanet: Approximately 5,475 additional Bitcoins (about $515 million).

Total: Approximately $29.3723 billion (about 395,435 Bitcoins, accounting for 1.88% of total supply).

Potential Buy Order Forecast

· Undisclosed Public Companies: MicroStrategy's success may inspire 100-200 public companies (with market caps over $1 billion) to each invest $100 million to $500 million, totaling $10 billion to $50 billion (approximately 106,380 to 531,900 Bitcoins).

· Institutional ETFs: BlackRock's iShares Bitcoin Trust (IBIT) is attracting institutional funds; if more funds join, new buy orders could reach $5 billion to $10 billion (approximately 53,190 to 106,380 Bitcoins).

· National Reserves: If the U.S. converts 1% of its foreign exchange reserves (approximately $60 billion) into Bitcoin, it would amount to 638,300 Bitcoins. Potential policies from countries like China and Russia could contribute $20 billion to $30 billion.

· Crypto Industry: Companies like Tether may increase their holdings by $2 billion to $3 billion (approximately 21,280 to 31,920 Bitcoins).

Short-term Forecast (Q2-Q3 2025): Disclosed buy orders ($29.3723 billion) + undisclosed companies ($5 billion) + ETF inflows ($2 billion) = approximately $36.3723 billion (about 387,025 Bitcoins, accounting for 1.84% of total supply).

Mid-term Forecast (Q4 2025 - Q1 2026): If national reserve policies are implemented, buy orders could reach $80 billion to $120 billion (approximately 850,000 to 1,275,000 Bitcoins, accounting for 4.05% to 6.07% of total supply).

Price Impact: With a circulating supply of about 19.7 million Bitcoins, a 1% increase in demand could push prices up by 15% to 30%, with prices potentially reaching $115,000 to $130,000 by the end of 2025.

Conclusion: Revolution or Frenzy?

In 2025, Bitcoin has transitioned from a cyber utopia to corporate reality. MicroStrategy's bold bets, GameStop's transformation, Semler's low-key attempts, 21 Capital's multinational alliance, and Metaplanet's brand innovation collectively paint a picture of a "digital gold" revolution. This is a struggle against inflation and fiat currencies, as well as a strategic bet on the future. However, undercurrents of turmoil lurk in the storm: price volatility, regulatory shadows, and market frenzy could steer this revolution off course.

For us, this is a window into the future. Will Bitcoin become a "cyber vault" for enterprises, or will it be another tulip mania? The answer may lie in the next earnings report, the next board meeting, or the next wave of market trends. Regardless of the outcome, this revolution has already rewritten the rules of finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。